The UK has produced some of the world’s most successful neobanks, but domestic growth tells a more nuanced story. New results from our Neobanking Study reveal why high adoption has not yet translated into product depth and business model maturity, and what this means for the next phase of competition.

The UK’s place in a global neobanking shift

Globally, neobanks have moved beyond challenger status. Digital-first banks have gained ground in national banking systems, reshaping customer expectations, pricing models, and product delivery across both mature and high-growth markets.

The UK has been an early leader in this shift, achieving broad uptake domestically and producing several globally scaled neobanks, despite having one of the world’s strongest traditional banking systems.

At the same time, neobanks’ rapid growth has outpaced their broader banking maturity. Lending, in particular, continues to lag behind, as traditional players remain dominant.

Our proprietary Neobanking Study, based on a global consumer survey across 16 markets, provides a rare, data-backed look into this transition. The results highlight the unique strengths and challenges that digital banks face, as well as the need for traditional banks to continuously adapt in a rapidly transforming banking environment.

Reshaping expectations in a digital-first market

The UK banking market is seeing a clear recalibration of customer expectations, driven by the growing role of neobanks and traditional players racing to keep up.

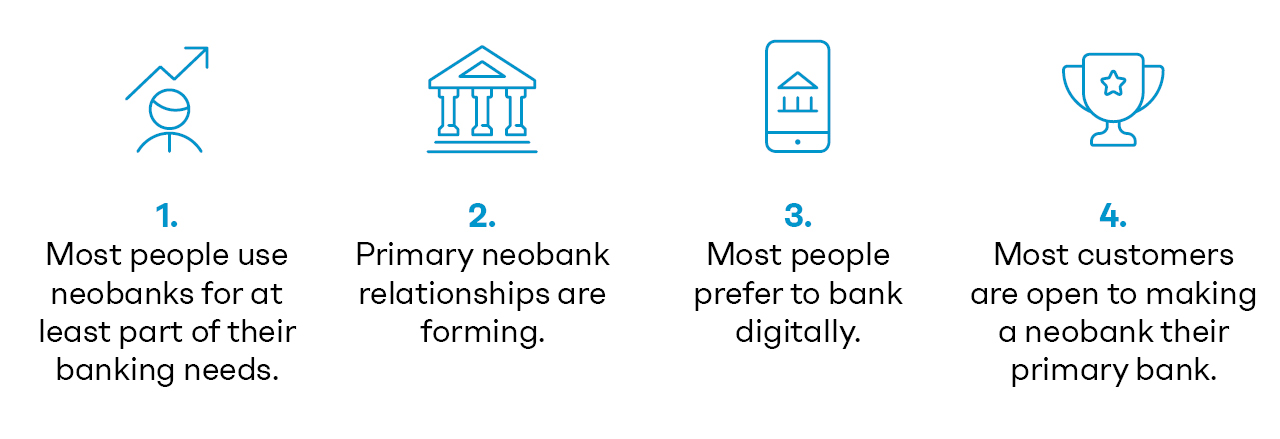

Four key results illustrate this shift:

Neobanks are now firmly embedded in everyday financial behavior in the UK, with nearly two-thirds of respondents (64%) using neobanks for some or all of their banking needs.

Primary digital banking relationships are emerging. One in five UK customers (20%) already considers a neobank their primary banking provider - rising to over one quarter among customers aged 35-44.

The behavioral shift is unmistakable. 60% of respondents prefer digital channels, while only 22% favor physical banking, signaling a structural shift toward convenience, accessibility, and app-led experiences.

Customers are open to further change. 32% consider themselves “very likely” to start a new banking relationship in the next 12 months, with 57% considering themselves “likely/very likely” to make a neobank their primary banking provider in the next three years.

Redefining the customer lifecycle

Traditional banks have long benefited from a tried-and-tested product lifecycle, where customer relationships begin with a current account and expand into savings and credit over time as customers’ needs develop.

Neobanks have rewritten this model. Product innovation and intentionally disruptive strategies have successfully drawn new customers to multiple alternative entry points - from FX to budgeting tools, cards, or single-purpose savings products.

The benefits are clear: flexible onboarding pathways mean innovation can be rewarded. In our global study, 25% of neobank customers hold an alternative investment (e.g. cryptocurrency) product, compared to 14% of customers at incumbents.

This unique dynamic creates a structural trade-off – lowering barriers to adoption and driving use-case-led engagement, while also making it harder to establish a traditional full current-account relationship early on.

Unique challenges on the road to maturity

Two clear consequences of this dynamic are:

- Product adoption is shallow

High headline adoption has not translated into depth of product use. Only 30% of neobank customers have a current account with a digital-only provider, well behind the 93% holding current accounts at incumbent banks. A smaller gap appears in term savings, where 18% hold accounts with neobanks and 26% with high street banks. However, the pattern points to a clear cross-sell challenge: many customers use neobanks as a solution for a specific need, rather than as a one-stop shop. - Lending remains immature

Limited product depth has direct implications for neobank balance sheets, as many UK neobanks remain weighted toward transactional and fee-based income. Even fully-licensed banks such as Starling and Monzo operate with loan-to-deposit ratios below 40%, well short of the 80%+ range typical of more traditional incumbents. Lending product adoption is also shallower among survey respondents, as 65% of customers at traditional banks hold a credit card or lending product, while only 34% of neobank customers do so.

The future of digital banking success

While innovation has flourished, disruption has been more tempered. Competitive pressures have raised standards across the industry, and incumbents have upped their game in an attempt to keep pace with challengers. The result is a market where digital capability is no longer a differentiator, but a baseline.

At a micro level, consumer behavior reinforces this dynamic. UK customers have shown a willingness to adopt neobanks for targeted use cases, while continuing to rely more on established banks for current accounts, credit, and long-term savings. Multi-banking has become the norm, allowing consumers to enjoy the benefits of innovative offerings without abandoning traditional banks. For neobanks, this has meant strong customer acquisition and engagement, but slower progress toward balance-sheet depth and lifetime value.

Neobanks have established a meaningful customer foothold. Now, the challenge is no longer proving demand for digital banking, or re-creating the traditional customer lifecycle, but converting usage and engagement into greater product depth and more robust, lending-driven monetization.

The UK is an example of what neobanking looks like once the disruption phase has passed. As the market settles, the real test is whether trust, capability, and scale can be converted into deeper, longer-lasting customer relationships. In this way, the UK shifts the question from whether neobanks can win against incumbents, to what winning actually means in a world where digital banking is already the norm.

At Simon-Kucher, we partner with digital banks and traditional institutions as they navigate this shift. Our work helps digital-first players convert early momentum into lasting value and supports incumbent banks to adapt to a market where customers expect digital excellence by default.

If you're interested in further discussion, reach out to us today.

This UK view is part of a wider global analysis, with full findings from our latest Global Neobanking Study coming soon.