AI is no longer a future concept – it’s here now and will soon start to reshape the way financial advice is delivered and consumed. This article explores what that shift means for UK firms, where the biggest risks and opportunities lie, and how different players, from IFAs to D2C platforms, can adapt and stay competitive.

The UK’s wealth management sector is worth £9.1 trillion, and growing. But despite this scale, millions are shut out from advice. When the Retail Distribution Review came into effect at the end of 2012 it changed the way financial advice was paid for. Fees became much more transparent and were levied at the time of advice. Customers baulked at these up-front costs, and banks largely withdrew from the market.

The result is a persistent, well-documented advice gap, where demand and supply are both under strain. In a market this large and underserved, something has to shift.

We believe that AI will be the catalyst.

What do financial advisors do?

Financial advice has two core elements:

- Investment advice – what financial instruments to buy, when, and in what quantities.

- Financial planning – how to plan for life events and navigate the tax system.

In both cases advisors are strictly regulated. There are rules on what they can and cannot advise customers to do, and they work from a playbook. When you strip it all back, financial advice is simply the process by which trained professionals provide consumers with access to a suitability and tax optimization playbook; in other words, it’s an algorithm.

They then layer on top the hyper-important element of trust, which may come in either the form of a recognized brand or a local high-street presence.

AI: The great enabler (and disruptor)

If there’s one thing that AI can do brilliantly, it’s to solve algorithmic problems at scale. We’re going to see intelligent systems democratizing complex, tailored, and compliant financial planning. AI has the potential to do for advice what self-service did for banking – reduce friction, lower costs, and broaden access – conditions that facilitate new entrants.

With natural language processing and data use, AI can personalize advice in a way that’s fast, scalable, and responsive. Clients benefit from 24/7 access and better insights, whilst advisors gain operational leverage; what once took hours to deliver now takes minutes. Crucially, AI can deliver much of this advice at a dramatically lower cost, sometimes even for free, making quality guidance accessible to far more people. For advisors this offers the potential to free up capacity for more complex, high-value interactions.

Advisors who embrace AI will thrive. Those who don’t may not survive.

Mapping the battlefield: Who’s ready for AI?

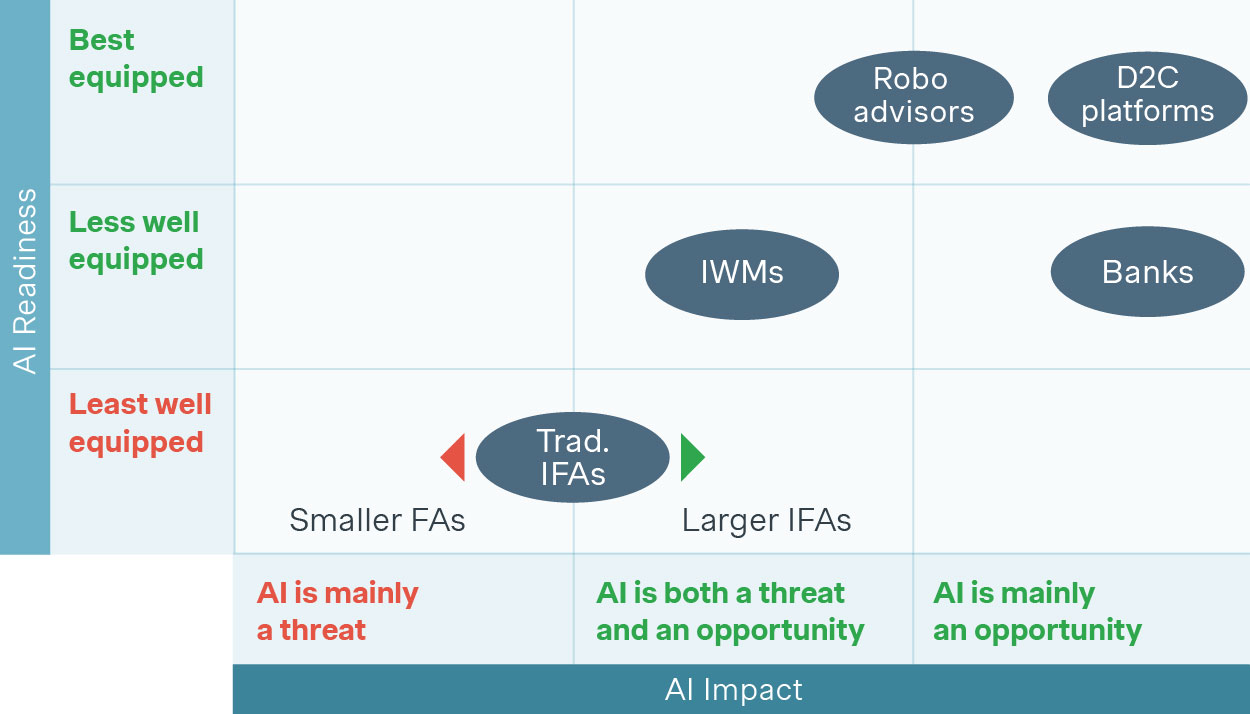

AI doesn’t disrupt evenly. Its impact depends on two factors:

- The actual exposure and readiness of each provider type – who’s genuinely at risk, and who’s positioned to benefit, and

- How well-equipped they are to respond.

Below is a strategic positioning matrix showing where key players currently sit:

Traditional IFAs: Mostly threatened, but also some clear opportunities

Independent Financial Advisors (IFAs) are in the danger zone. AI is automating much of what they do on a day-to-day basis, particularly at the mass-affluent end of the spectrum, at significantly lower costs. With limited tech infrastructure and smaller scale, some IFAs are poorly positioned to defend their niche.

But the greater threat may be price compression. New entrants – lean, digital, and AI-native – can offer much of the value at a fraction of the cost, creating pressure on traditional pricing models. Unless IFAs pivot toward hybrid advice, adopt scalable tech, and clearly articulate the value of human-led services, many may find themselves in danger of being priced out of the market.

However, by embracing AI to increase operational efficiency and widen their client base through new offerings, forward-thinking IFAs can protect their business. We expect to see a split between struggling independents and successful tech-savvy national players, and the continuation of the trend of private equity rapidly buying up and consolidating independent IFAs.

IWMs: Moderately equipped, dual-edged exposure

Integrated Wealth Managers (IWMs) benefit from legacy brand trust and diversified income streams, but they’re not immune to the shifting economics of advice. AI doesn’t just change how services are delivered, it changes what people are willing to pay for them. As new entrants drive down the cost of advice, IWMs will also face mounting price pressure, especially on the financial advice/planning side, where fees have recently been more resilient than Investment Management fees.

Their traditional model, where advice was bundled with asset management, now looks increasingly vulnerable.

To stay competitive, IWMs must:

- Modernize their service mix

- Reconsider how they price financial advice and investment management

- Boost operating efficiencies through AI

Those who embrace AI will hold their ground. Those who cling to legacy models risk erosion.

Banks: Ready to reclaim the market?

Post-RDR, banks pulled back from financial advice. Now, AI gives them a cost-effective and scalable path back in.

High Street Banks are sitting on a goldmine of customer data and distribution power. AI-powered planning tools allow them to deliver advice at scale to mass-market consumers. This will allow them to regain their natural status as the first port of call for financial advice for many of their customers.

The biggest challenge for the banks is internal; organizational inertia. With direct and regular access to millions of customers and their data, they “just” need to show up with the right product at the right price.

D2C platforms: Agile and on the rise

Direct-to-consumer (D2C) platforms are typically the most agile players in this market, but under the surface, it’s a more nuanced picture.

While some new entrants are building strong tech stacks and experimenting with AI, many incumbents still grapple with legacy infrastructure and limited flexibility. Personalisation at scale remains more ambition than reality, limited by both outdated systems and tight regulatory boundaries.

That said, the direction of travel is clear. As technology matures and regulations adapt, D2C platforms are well-positioned to capture greater share of the advice market, particularly for mass-affluent and digitally native segments. AI allows them to simplify access, lowering costs of delivering advice, and enhance their offering through both hybrid and traditional advice models.

For those growing their wealth, AI can democratize planning and reduce the advice gap. For those in the decumulation phase, AI can improve retention at a time when many look for advice on more complex financial planning matters.

The opportunity is there, but execution will separate the leaders from the late adopters.

Robo-advisors: The originals face a strategic choice

Robo-advisors were built to deliver automated investment guidance/advice at scale. Their current proposition (by design) lags traditional advice in terms of richness. Advances in AI will help bridge that gap without adding significant costs. But as AI drives down the cost of delivering advice, the core USP of robo-advisors – low-cost, digital-first advice – risks being commoditized.

The strategic question now: can robo-advisors build on their head start, or will they be overtaken? They face two major threats: being squeezed out by those with larger customer bases and more established brands, and being leapfrogged by the next generation of innovators.

What comes next?

This is not a slow transformation; it’s an inflection point. Every provider now stands at a strategic crossroads:

- Traditional IFAs must take a long hard look at what the future holds for them. Do they double down and focus on the decreasing pool of people willing to pay for traditional advice, or do they lean into the AI future and transform the way they operate?

- IWMs need to modernize their offering, their pricing, and drive operational efficiencies. However, with a more holistic solution set there are as many opportunities as threats.

- Banks must re-enter the market boldly and with urgency.

- D2C platforms have a great opportunity to introduce advice and guidance into their customer journeys. Advice has a key role to play in both customer acquisition and retention.

- Robo-advisors have a unique opportunity to lead a rapidly-evolving market. However, AI provides an opportunity for others to step in and leapfrog their offering. They will need to innovate to survive.

This is not a drill

This is not a tech upgrade. It’s a systemic reshuffling of a £9-trillion industry. The question is no longer whether AI will transform financial advice.

The only question: Who’s ready?

How we can help

Simon Kucher is the world's leading commercial advisor. Our experts are at the forefront of thinking about how organizations need to adapt their commercial models in the face of technological change.

Get in touch today to explore how we can support you through the transition.