Power costs, capacity tightness, and grid constraints are reshaping how industrial and utility leaders protect margins and plan growth. This article lays out a practical way to treat electrical energy as a managed portfolio, sharpen contracts and pricing, monetize flexibility, and use data to steer profitability.

Three key takeaways

Electricity is now a C-suite risk variable, not a background cost.

Reliability and capacity are being repriced, wholesale volatility is back, and grid bottlenecks can constrain growth.

Winners manage electricity as a portfolio and execute three commercial master moves.

Leading teams shift from annual procurement to a portfolio approach that spans sourcing, hedging, flexibility, and contract or tariff structures.

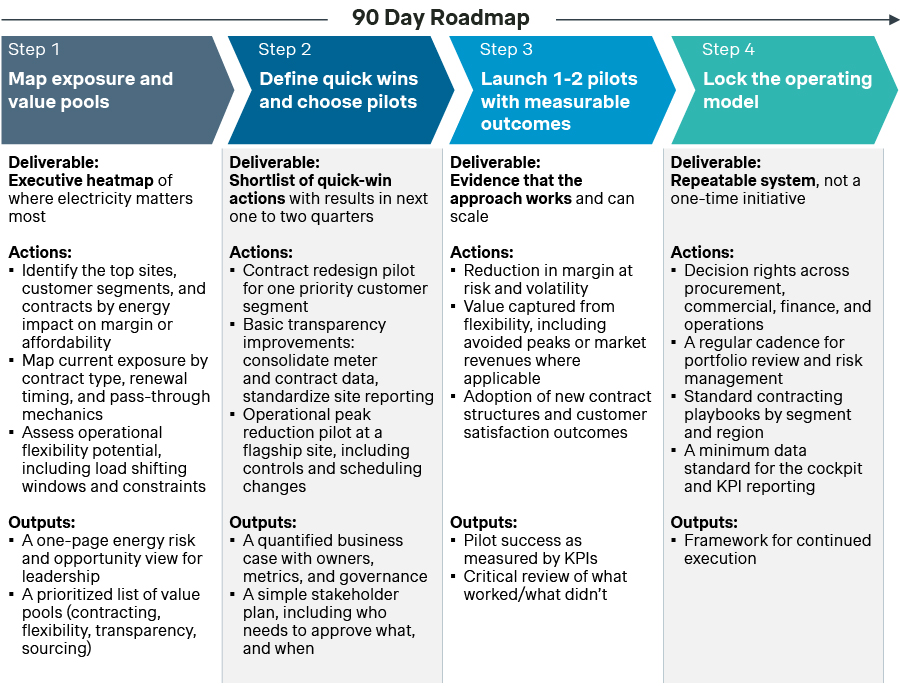

A focused first 90 days can create momentum without perfect data.

Start by mapping exposure and priority value pools, pick one or two pilots, and lock a cross-functional operating model with clear KPIs.

Below, we provide a pragmatic playbook for industrial and utility leaders navigating a tighter power system. It connects the market forces behind rising volatility and reliability costs to the concrete levers leaders can pull - from portfolio and tariff choices to flexibility and data transparency. By the end, readers will have a clear set of actions to start in the next 90 days and a structure to scale what works.

Why electrical energy is suddenly a C-level topic

1. Reliability and capacity costs are moving into the spotlight

Across several markets, the cost of reliability is rising and becoming more visible. A clear recent signal is PJM's capacity market. In December 2025, PJM announced that its latest capacity auction cleared at the Federal Energy Regulatory Commission (FERC) approved cap of $333.44/MW-day, with total procured capacity and a bill impact that is material at the system level. Independent coverage further notes PJM procured capacity below its reserve margin target, underscoring how tight conditions can translate into higher costs and heightened stakeholder attention.

For C-suites, the takeaway is that electricity costs can rise quickly through components that are outside traditional energy procurement levers, including network charges, capacity, and congestion. These costs have direct consequences for profitability and customer affordability, and they are increasingly debated in public forums.

Implications for stakeholders

- Industrials: Reliability-related cost escalation can break margin assumptions embedded in long-term contracts, especially where power is a meaningful input to cost to serve.

- Utilities: Cost recovery becomes harder when major bill components (such as capacity charges, network or transmission charges, congestion costs, and fuel-related energy supply costs) spike, especially under affordability pressure.

2. Wholesale volatility is back, and it affects planning behavior

After a period of stabilization in parts of the market, 2025 brought a renewed reminder that power prices can move sharply. The International Energy Agency (IEA) reports that average wholesale electricity prices in the EU and the US rose about 30-40% year-on-year in the first half of 2025, linked to higher gas prices, while still remaining below 2023 annual levels.

This matters because volatility changes organizational behavior. When leaders cannot confidently forecast delivered electricity cost, they hesitate on electrification capex, re-evaluate site footprints, and demand different risk allocation in commercial contracts.

Implications for stakeholders

- Industrials: The economic case for electrification and new production lines becomes more sensitive to region and contract structure.

- Utilities: A higher volatility increases the importance of risk under management (e.g., hedging), sourcing strategy, and tariff design, while also increasing political and regulatory scrutiny.

3. Demand is rising, while the grid is constrained by real delivery bottlenecks

North American Electric Reliability Corporation's (NERC) 2025 long-term assessment emphasizes that the grid faces intensifying reliability risks as demand growth, including from data centers and AI, threatens to outpace resource additions. This is reinforced by broader reporting on heightened outage risk linked to rising demand and infrastructure constraints.

At the same time, grid expansion and modernization are limited by supply chain and labor realities. President's National Infrastructure Advisory Council (NIAC) reports that transformer lead times have stretched to multi-year horizons, and large transformer lead times can extend beyond three years in some cases. This is particularly important because transformer availability can gate both new connections and upgrades, even when funding is in place.

Implications for stakeholders

- Industrials: Site expansion and new connections can be delayed, turning electricity into a hard constraint on growth.

- Utilities: Grid constraints raise both reliability risk and customer bill pressure. That elevates the importance of a clear hedging and sourcing posture, paired with tariff mechanisms that enable timely, auditable cost recovery.

From commodity to strategic lever: How leaders rethink electrical energy

Leading organizations are moving from procurement to portfolio plus commercial strategy. Three shifts stand out for both industrials and utilities.

1. Move from annual buying to a portfolio approach

Instead of buying power year by year, leaders build a portfolio across instruments, tenors, and risk types. The portfolio often combines:

- Market purchasing and hedging

- Long-term supply arrangements, including Power Purchase Agreement's (PPAs) where relevant

- On-site generation and firming solutions where economics and regulation support them

- Flexibility options, demand response participation, interruptible arrangements, and operational load shaping

- Storage and controls to reshape exposure and capture value

For industrials, the goal is not to win every year versus a benchmark. It is to build an energy position that matches the organization's risk tolerance and supports strategic goals, including growth and decarbonization. For utilities, the shift is from least-cost procurement to portfolio optimization that balances risk, customer bill stability, and defensible cost recovery, while monetizing flexibility as a system resource.

2. Embed energy into commercial and operational decisions

Electricity becomes strategic when it is connected to decisions that move enterprise value.

For industrials:

- Pricing and contracting: Protect margins and allocate risk transparently

- Product mix and scheduling: Run energy-intensive processes when costs and constraints are favorable

- Footprint and site strategy: Treat delivered cost and availability as a location variable, not an afterthought

- Capex prioritization: Invest in flexibility and controls as much as physical assets when they improve resilience and economics

For utilities:

- Tariff and program design: Modernize rate structures to reflect system costs and incentivize flexibility

- System planning and operations: Integrate load growth, distributed resources, and reliability needs into actionable investment and operating decisions

- Cost recovery and stakeholder narrative: Create transparent linkages between investments, reliability outcomes, and customer bill impacts

- Portfolio and contracting choices: Align hedging, PPAs, and capacity strategies with regulatory expectations and customer affordability

This shift often requires governance changes. Best-in-class organizations create joint accountability across commercial, operations, finance, and energy functions.

3. Segment by customer and asset archetype

A single playbook rarely works. Leaders differentiate by archetype.

For industrials:

- Energy-intensive assets versus less energy-intensive assets

- Single-site critical loads versus multi-site portfolios

- Customers who want price stability versus customers willing to accept index-linked economics for lower expected costs

- Regions with tight grids versus regions with more headroom

For utilities:

- Customer segments with different load shapes and flexibility potential (residential, commercial, industrial, large loads)

- Areas with tight constraints versus areas with more capacity headroom

- Customers with high reliability requirements versus customers willing to participate in managed programs

- Rate classes where bill stability is the priority versus classes where price signals can drive meaningful load shaping

This segmentation enables a more precise approach to contracting, investments, tariff design, and flexibility program design.

Implications for stakeholders

- Industrials: Winning strategies move beyond annual procurement to an energy portfolio and a commercial model that makes energy risk visible, managed, and appropriately shared with customers and sites.

- Utilities: Winning strategies shift from least-cost procurement to portfolio risk management that supports bill stability and defensible cost recovery, while integrating flexibility into planning and operations.

Three commercial master moves to create value

Master move 1: Smarter contracting and pricing

The problem: Many commercial and regulatory structures were built for a world where electricity volatility was episodic. In 2025, wholesale price moves, congestion, and reliability-related charges materially affected affordability, margins, and investment decisions.

What leaders do: Shift from simplistic fixed-price assumptions to structured risk allocation and transparency.

For industrials, this means:

- Align procurement and hedging with margin stability and earnings-risk goals, not only least-cost outcomes, and make the risk posture explicit and governed.

- Establish indexation to agreed market references where pricing can support it.

- Set caps and floors that share tail risk with customers or internal business units.

- Use transparent pass-through mechanisms tied to auditable inputs for energy-driven surcharges.

- Employ hybrid structures that combine partial fixing with partial indexation to balance stability and competitiveness.

For utilities, this means:

- Align procurement and hedging with bill-stability goals, not only least-cost outcomes, and make the risk posture explicit and governed.

- Design tariffs and riders that enable timely, auditable cost recovery for major cost drivers, while avoiding avoidable bill shocks.

- Use rate design and programs to incentivize customer flexibility through price signals and performance expectations, especially for large loads.

- Increase transparency on bill drivers such as energy, capacity, network charges, and congestion, so the cost narrative is defensible with regulators and stakeholders.

Why this matters now: 2025 signaled how multiple cost components can move meaningfully, including wholesale prices and capacity. The IEA documents a 30-40% year-on-year increase in average wholesale prices in H1 2025 in the EU and US. PJM's capacity auction outcome in late 2025 illustrates how reliability costs can spike and become a leadership issue.

Stakeholder lens

- Industrials: Build a customer contract menu aligned to risk appetite, avoid silent margin leakage, and protect investment cases for electrification.

- Utilities: Align procurement and hedging with bill-stability goals, and design tariffs and riders that enable timely, auditable cost recovery while incentivizing customer flexibility.

Value created

- Reduced earnings volatility

- Better customer trust through transparent mechanisms

- Improved ability to commit to capex and long-term commitments with less downside exposure

Master move 2: Monetize flexibility and build new services

The problem: Many organizations treat flexibility only as a defensive hedge. In a tighter system, flexibility can also be monetized.

What leaders do: Treat flexibility as an asset that creates value through multiple channels:

- Internal value: Load shifting, peak avoidance, storage dispatch, and operational scheduling tied to price signals

- External value: Participation in demand response and ancillary services where available, and bilateral flexibility arrangements

- Customer value: Energy-as-a-service and performance-based offerings tied to measurable outcomes such as energy intensity, availability, and carbon footprint

Why this matters now: NERC's 2025 outlook highlights intensifying reliability risks as demand growth threatens to outpace resource additions, which raises the value of resources that reduce peaks and improve adequacy. When capacity and congestion tighten, flexibility becomes a high-value system attribute rather than a nice to have.

Stakeholder lens

- Industrials: Flexibility can become a margin lever, not only a cost hedge. It can also support customer promises on delivery, uptime, and sustainability.

- Utilities: Flexible demand and distributed resources can be procured as reliability resources, often cheaper and faster than traditional build, depending on local conditions.

Value created

- New revenue or cost offsets

- Improved resilience during constrained periods

- Differentiated customer offerings, especially for B2B segments that value uptime and sustainability

Master move 3: Use data and transparency to steer profitability

The problem: Many organizations see energy costs too late, at too high a level of aggregation. This limits action and causes inconsistent decisions between commercial and operations teams.

What leaders do: Build an energy cockpit and a governance system that links consumption, cost, and margins.

Core elements:

- Unified data model across sites, contracts, and tariffs

- Granular reporting by site and major processes, then by product and customer where feasible

- DKPIs that drive behavior, such as energy-adjusted margin, peak exposure, and flexibility value capture

- Transfer pricing principles that make energy-smart decisions consistent across functions

Why this matters now: When prices and constraints move quickly, leaders need near-real-time visibility to steer. Last year’s market signals show that both wholesale prices and reliability components can be repriced materially.

Stakeholder lens

- Industrials: Connect energy to pricing, contract selection, scheduling, and capex choices.

- Utilities: Use granular data to identify peak and congestion drivers, validate DER/DR (Demand Response/ Distributed Energy Resource) performance, and defend procurement and grid investments in regulatory proceedings.

Value created

- Faster identification of margin leakage and optimization opportunities

- Better governance and accountability

- Credible reporting for executives, boards, and investors

A pragmatic first 90-day roadmap

This roadmap is designed to produce momentum without waiting for perfect data.

How Simon-Kucher can help

Simon-Kucher supports industrials and utilities in turning electricity from a volatile cost to a managed, value-creating lever, with a focus on commercial impact and execution.

Typical support for industrials includes:

- Pricing & contracting: Risk-sharing contract menus, pass-through logic, and margin protection (including indexation/caps/floors where appropriate)

- Flexibility monetization: Load shifting, storage/controls, demand response participation, and performance-based offerings

- Decision enablement: Energy cockpit, energy-adjusted KPIs, and governance to align commercial, ops, finance, and procurement

Typical support for utilities includes:

- Bill stability & cost recovery: Procurement/hedging strategy aligned to customer bill outcomes, auditable cost drivers, and defensible recovery mechanisms

- Tariff & program design: Rate structures and flexibility programs (DR/DER/managed charging) that balance affordability, reliability, and incentives

- System value capture: Identifying peak/congestion drivers, validating program performance, and building evidence for regulatory narratives

Specifically for heavy emitters, Simon-Kucher recently surveyed stakeholders on how energy availability and procurement influence their strategy and site selection. Our experts are always happy to discuss solutions to your most pressing issues. Reach out, and we’ll connect you with a member of our team.

Explore all the insights from our B2B Masterclass

Unlock practical strategies in B2B pricing, sales, and marketing