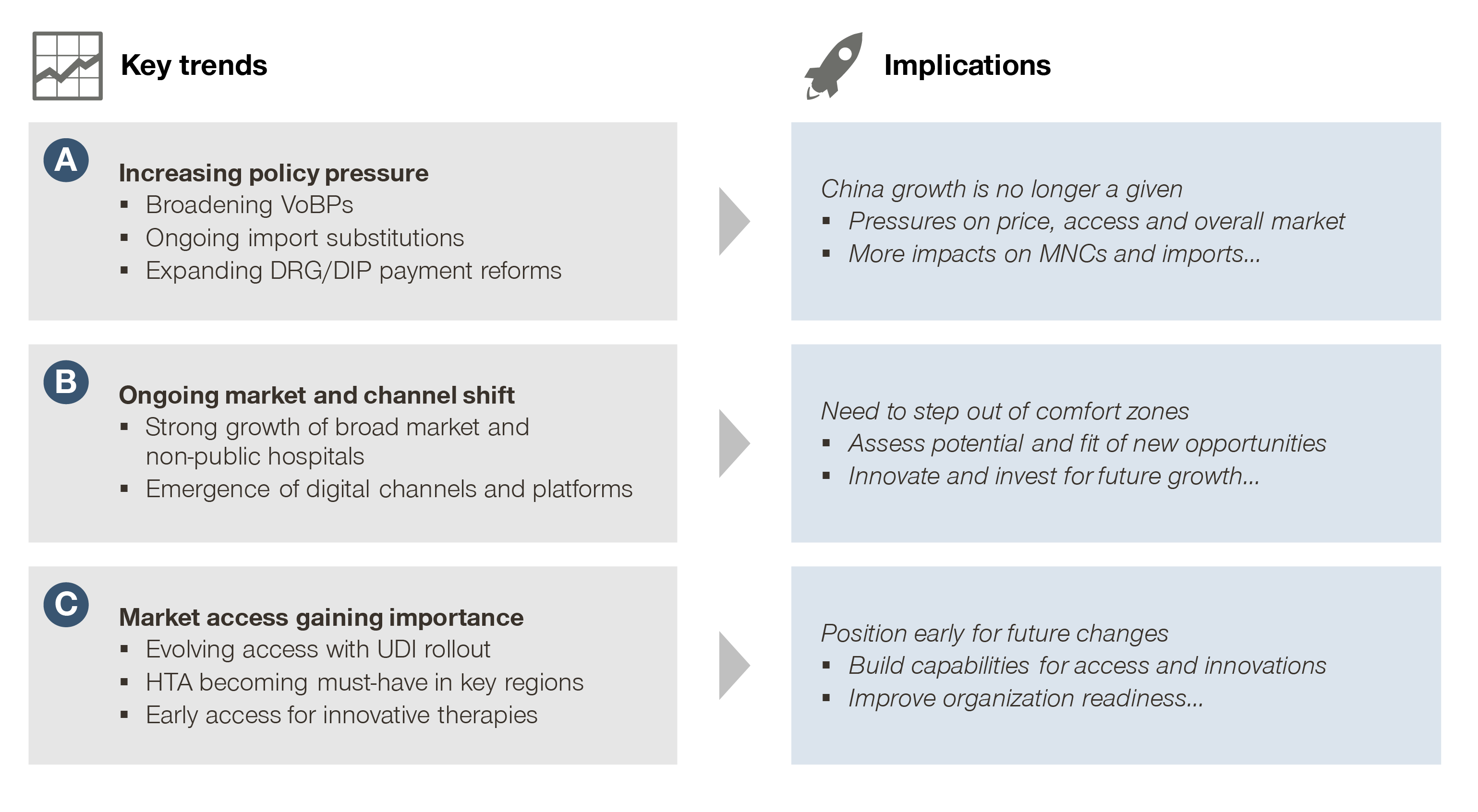

We recently released our annual China Medtech Outlook for this year, and highlighted three key trends for the industry. Industry players will need to better assess the trends and implications, proactively adapt to changes, and continue to innovate on multiple dimensions to survive and thrive.

Building on ongoing dialogues and in-depth discussions with leaders of the MedTech industry, our China Medtech Outlook is now out. In comparison to the results from last year, there are a few key themes emerging with important implications to the industry.

Increasing policy pressure

Volume-based procurement (VoBP), import substitution, and payment reform are the major policy thrusts in 2021, bringing price pressure and growth challenges to the industry.

Among them, VoBP has the largest near-term impact on the high-value consumables industry:

- In the first round of national VoBP last year, the average price cut of 93 percent for coronary stents sent shockwaves across the industry

- In the second round of national VoBP this year, the average price cut of 82 percent for artificial joint products appears milder in comparison, but the signal of broadening scope and accelerating pace for VoBP is unequivocal

- VoBPs at provincial level are rolling out in parallel, and the categories involved are also expanding, covering more categories – including trauma, spine, and IVD

At the same time, import substitution has become more salient in 2021. In part, as a result of a burdened global supply chain and tense geopolitical situation, bringing additional challenges to multinational companies and imported products.

Payment reform has seen faster rollout than expected and will bring far-reaching impacts to the MedTech industry:

- The Diagnosis Related Group classification system (DRG) was viewed with skepticism by the industry in 2020, but has been piloted in 30 cities across China in 2021

- In parallel, the Big Data Diagnosis-Intervention Packet (DIP) – a home developed DRG tailored to regional differences in China – has seen pilots across 71 cities in 2021

- The shift from the fee for service model to prospective payment models, like DRG and DIP, will fundamentally change how MedTech and consumables will be procured and used. In turn, bringing price and volume pressures to the industry as a whole

Ongoing market and channel shift

While the traditional strongholds for MedTech consumables are increasingly under pressure, new segments like non-public hospitals, broad market, and digital platforms are becoming increasingly important.

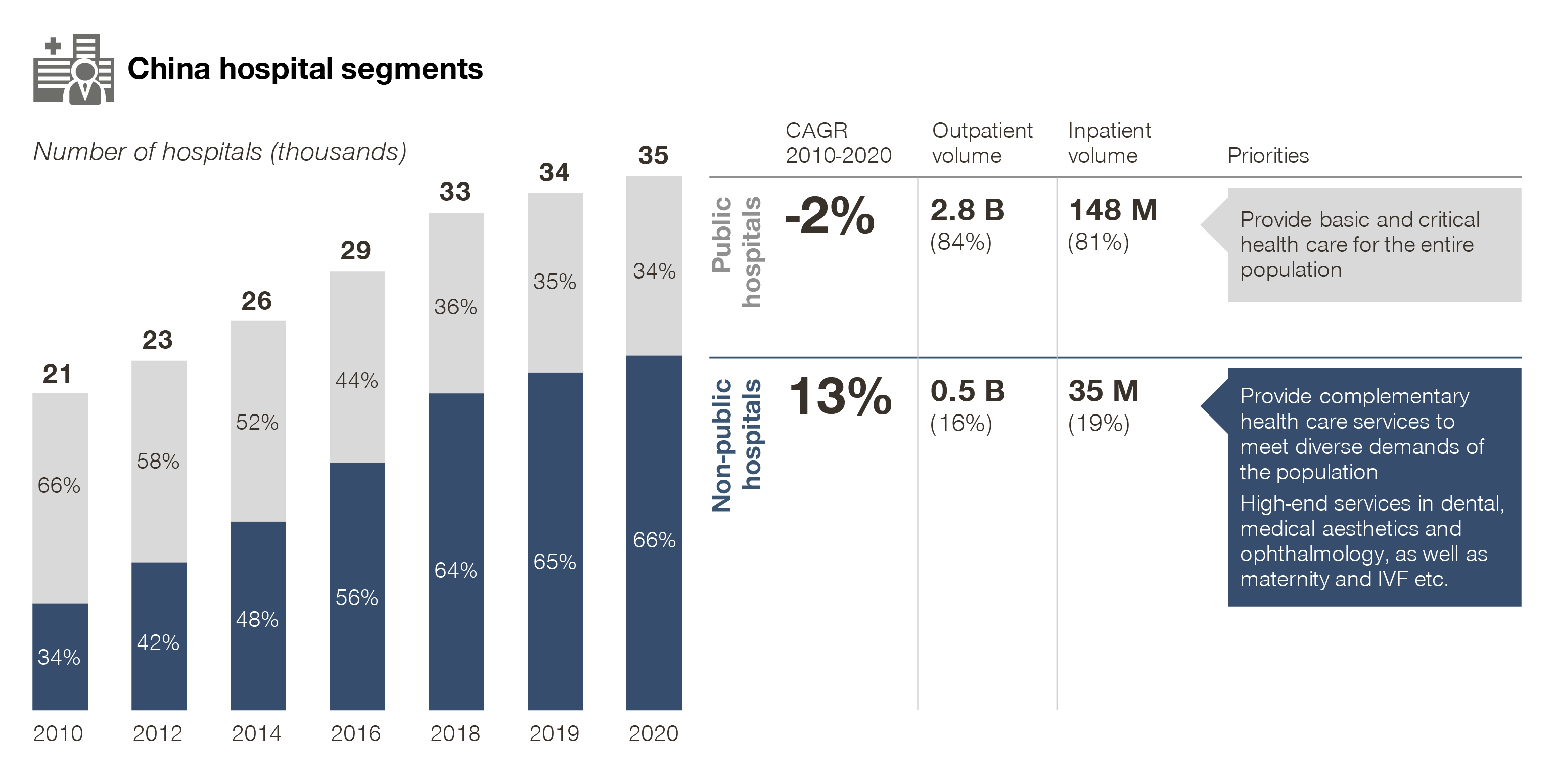

1. Non-public hospitals

In particular, non-public hospitals have shown rapid growth over the past decade, now accounting for two-thirds of total hospitals in number.

At the same time, this segment now accounts for 16 percent of outpatient volume and 19 percent of inpatient volume. It is seeing double digit growth and strong momentum compared with public ones.

More importantly, non-public hospitals have successfully carved up niches in certain specialties, especially in high value sectors, such as:

- Dental

- Ophthalmology

- Medical aesthetics

- As well as fertility, maternity and pediatrics – making it an increasingly important market for related MedTech and consumables

2. Broad market

Broad market has long been a priority for MedTech and consumable majors, but capturing growth from the segment has not been as straightforward as many expected.

To fully tap into the opportunities from this segment requires knowledge of the unmet needs of hospitals and healthcare providers (HCPs) in the broad market, as well as understanding how to reconfigure and tailor products and services to that end.

More importantly, enabling hospitals and HCPs is key to improving their capabilities in diagnosis, treatment, and surgical practices, and requires ongoing investments and long-term broad market commitments.

With the wave of digitalization, MedTech and consumables companies are also proactive in exploring online and digital platforms, which are reshaping the value chain to be more efficient, as well as economy of scale and scope.

Market access gaining importance

Market access is becoming key to winning in the Chinese MedTech market, with Unique Device Identifier (UDI), Health Technology Assessment (HTA), and Real World Evidence (RWE) as some of the major catalysts.

- UDI

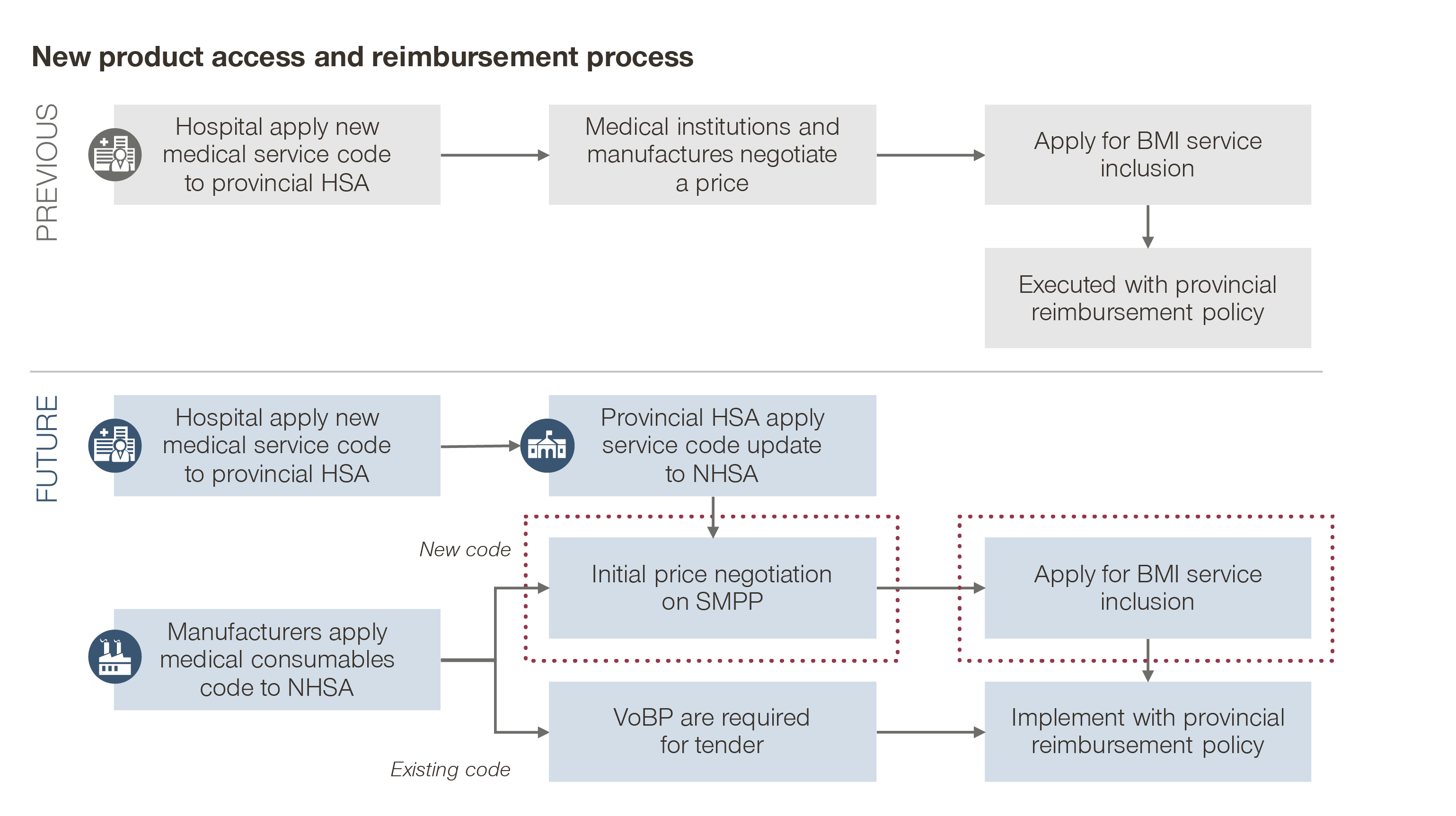

The first batch of UDI was implemented in the National BMI Consumable Catalog in January 2021. The second batch will be implemented by June 2022, aiming to standardize the coding and nomenclature of MedTech and consumables. This will have major implications on the access and reimbursement for the entire industry.

![graph]()

- HTA

HTA has gained increasing importance over recent years for MedTech access.

A few regions like Jiangsu, Guangdong, and Shanghai have made HTA a prerequisite for initial access and subsequent reimbursements. Going forward, the roles of evidence generation and health economics assessment will become increasingly important for differentiating value propositions and accelerating access.

- RWE

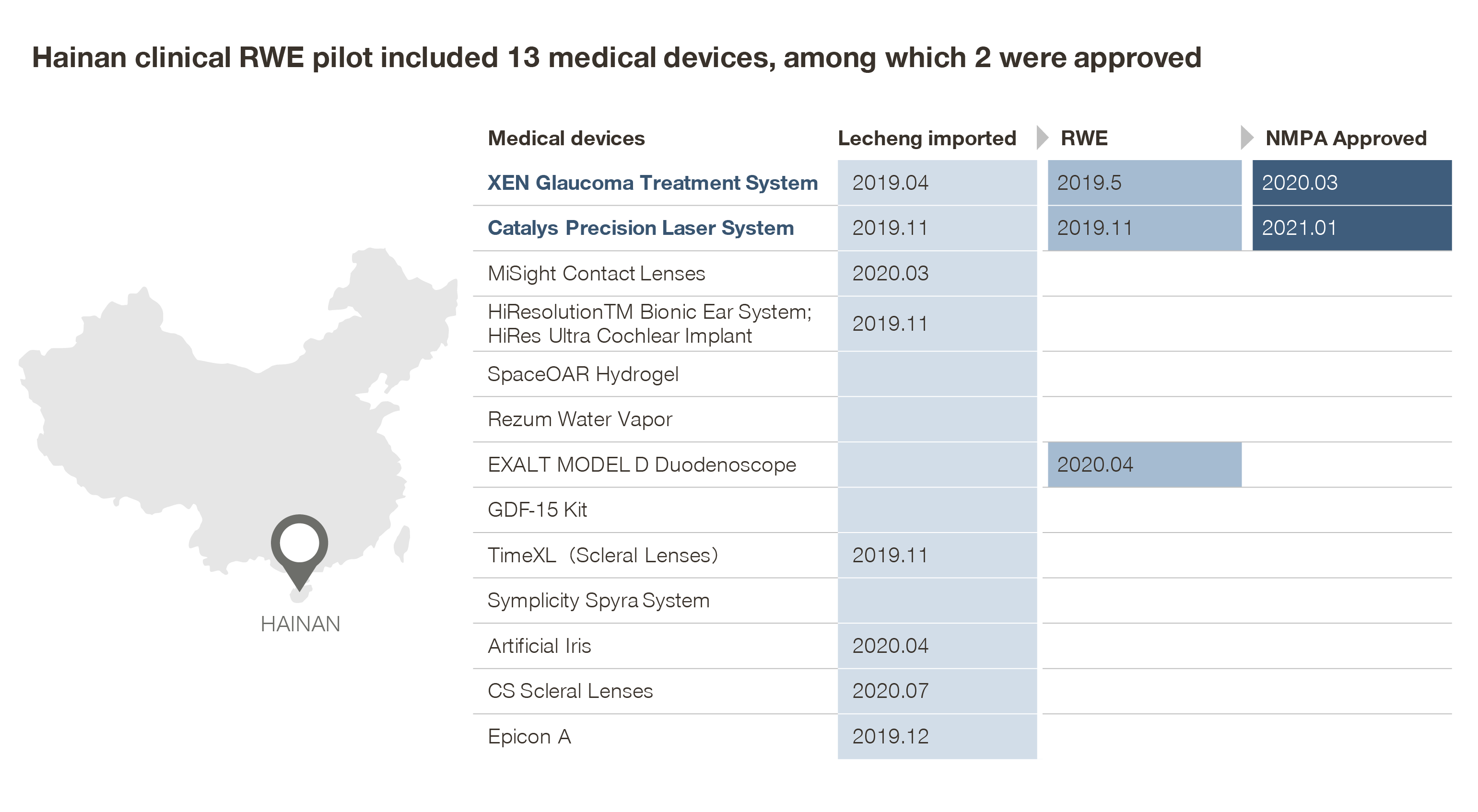

Meanwhile, RWE affords new opportunities for early access and accelerated approvals for innovative therapies.

With Hainan and the Greater Bay Area as pilot zones, a number of innovative therapies and devices approved overseas have landed in China for early access before their formal National Medical Products Administration (NMPA) approvals.

RWE studies conducted in parallel to early access would help accelerate regulatory processes and eventual NMPA approval – as seen in the cases of Xen and Catalys.

- Xen, a gel stent implant for open-angle glaucoma surgery, in particular, received conditional approval from NMPA four months after it started its RWE study, paving the way for many to follow

Winning in China’s MedTech industry

With both the headwinds and tailwinds in China’s dynamic environment, MedTech players will need to adapt and innovate more than ever.

To better adapt, MedTech and consumables companies would first need to have an in-depth understanding of the key trends and future outlooks, an objective assessment of the implications, and proactively adjust their strategic priorities and operational imperatives accordingly.

More importantly, innovation has been an important theme in the industry, and operates across multiple dimensions.

At product and portfolio level, there have been ongoing thrusts for China-fit R&D to better address China’s specific needs, while, at the same time, mitigating import substation risk.

In addition, customization goes a long way towards mitigating VoBP impact, as seen in the case of AK Medical. The company differentiates its offerings, taking advantage of 3D printing.

Philips, on the other hand, brings its teeth whitening offering directly to the consumer market through partnerships with non-public dental clinics. In so doing, it carved out a high value niche that is not subject to the cost containment pressure from DRG and DIP etc.

At access and GTM level, leading companies are striving to differentiate with their product and service offerings, and bring:

- Better workflow solutions to customers

- Cloud-based digital platforms for remote diagnosis and surgery

- As well as big data, AI, and machine learning for better clinical decision support – spearheading many IVD, surgical consumables, and imaging majors

At the business model level, MedTech majors are stepping out of their comfort zones with cross sector partnerships with peers, pharmaceutical companies, providers, and payers alike for disease and health solutions.

Radiometer, for example, recently entered into a partnership with AstraZeneca towards total care for chronic kidney diseases patients. Illumina joined force with Sanofi to better identify, diagnose, and treat rare diseases patients in China.

On the commercial payer front, J&J explored partnerships with MediTrust and Taiping Insurance for breast prosthesis for breast cancer patients.

Innovation will always be the name of the game for the industry and will create true value by addressing unmet needs for customers and patients alike. In that regard, it will be the ultimate source for growth for the industry and bodes well for the ones with courage and determination to step out of their comfort zones, reinventing themselves and the industry in the process.

For full report, please contact: Shanghai_LS@simon-kucher.com