As a SaaS leader, your job has gotten tougher since the start of the year. Acquisition especially, has become more challenging in the last few months. Potential customers are cutting costs and are poised to slash their new technology budgets and delay buying decisions. To maintain their edges, SaaS companies should shift gears. Instead of focusing too much on acquiring new clients, they should focus on proactively retaining and monetizing existing customers more effectively.

We’re moving into the second quarter of 2023, and the economic outlook for most industries is uncertain, at best. Silicon Valley bank collapsed, interest rates keep increasing, and inflation is at a record high. As a result, tech companies have taken a big step back from their hyper growth ambitions, and SaaS valuations in the space have become conservative in comparison to the outlandish numbers that appeared in headlines just a year ago.

With all of these factors in play, what growth looks like in SaaS is also changing. Net Dollar Retention is more important than ever. Today, SaaS leaders need to focus on longevity, prioritizing growth measures that are equal parts profitable and sustainable. We call this “Better Growth”.

But what does that look like in practice? It is key to shift gears, focus on your existing customer base and prioritize retention and monetization strategies going forward.

An increased focus on monetization and retention

Monetizing existing customers is a revenue model that’s often overlooked. The best performing SaaS companies use a land-and-expand approach where they scale with their customer over time. Here, customer success teams play a pivotal role in evangelizing new features and functionalities, helping their customers become more successful and identifying potential expansion opportunities.

“The best SaaS companies grow over 30% in revenue from their customer base alone.”

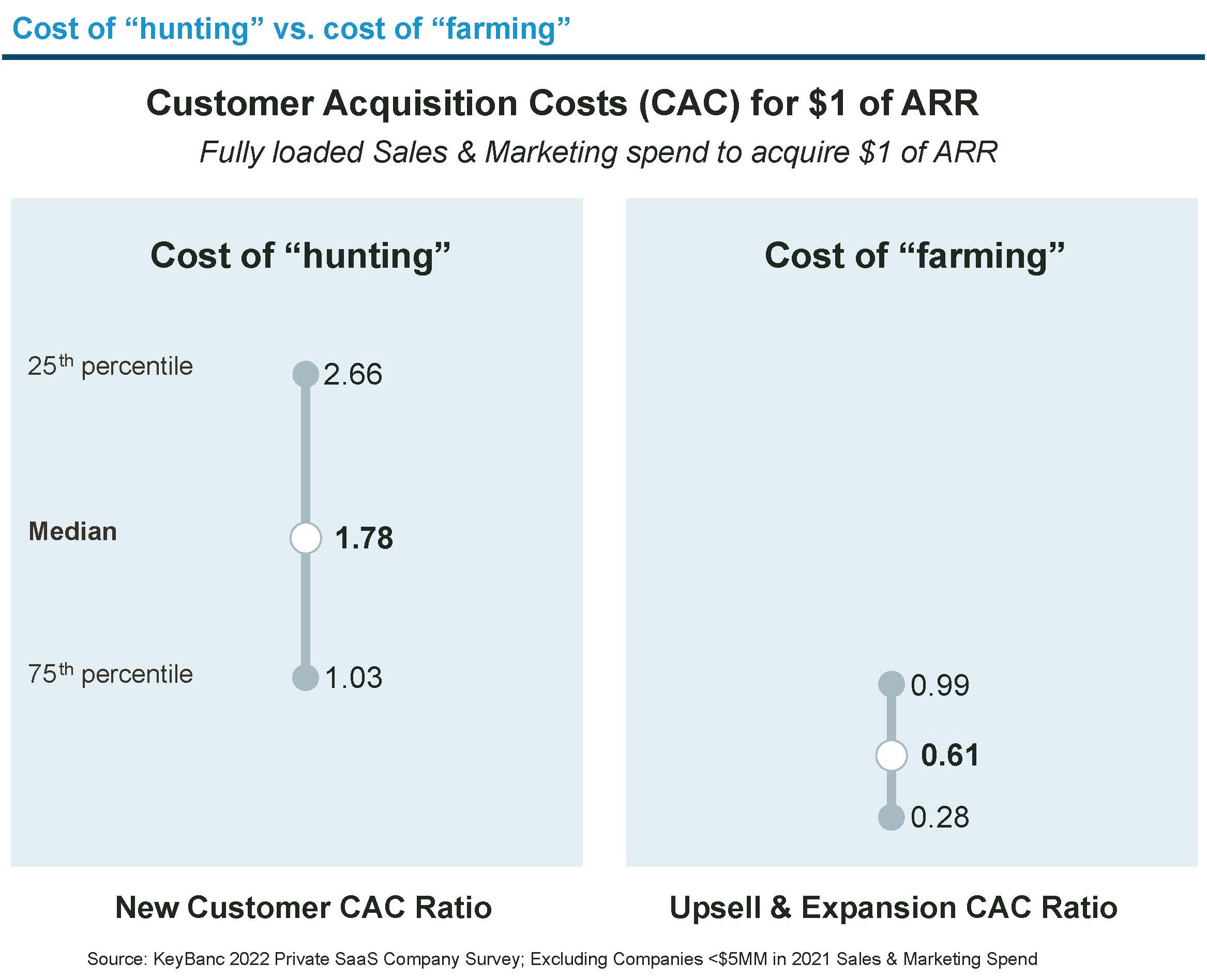

Meanwhile, retention is an important strategy for avoiding churn and the challenges it presents. A high churn rate lowers ARR and also limits the opportunity for expansion with existing customers. Plus, trying to acquire a new customer is harder and more expensive than selling to customers with which you already have a relationship. Instead, by focusing on retention, you can better position your customers to become advocates. As research from KeyBanc clearly shows, the cost of “hunting” (acquisition) is significantly higher than the cost of “farming” (expansion).

Figure 1: Cost of “hunting” vs. cost of “farming” - Ensure fact-based insight into your cost of acquisition and expansion

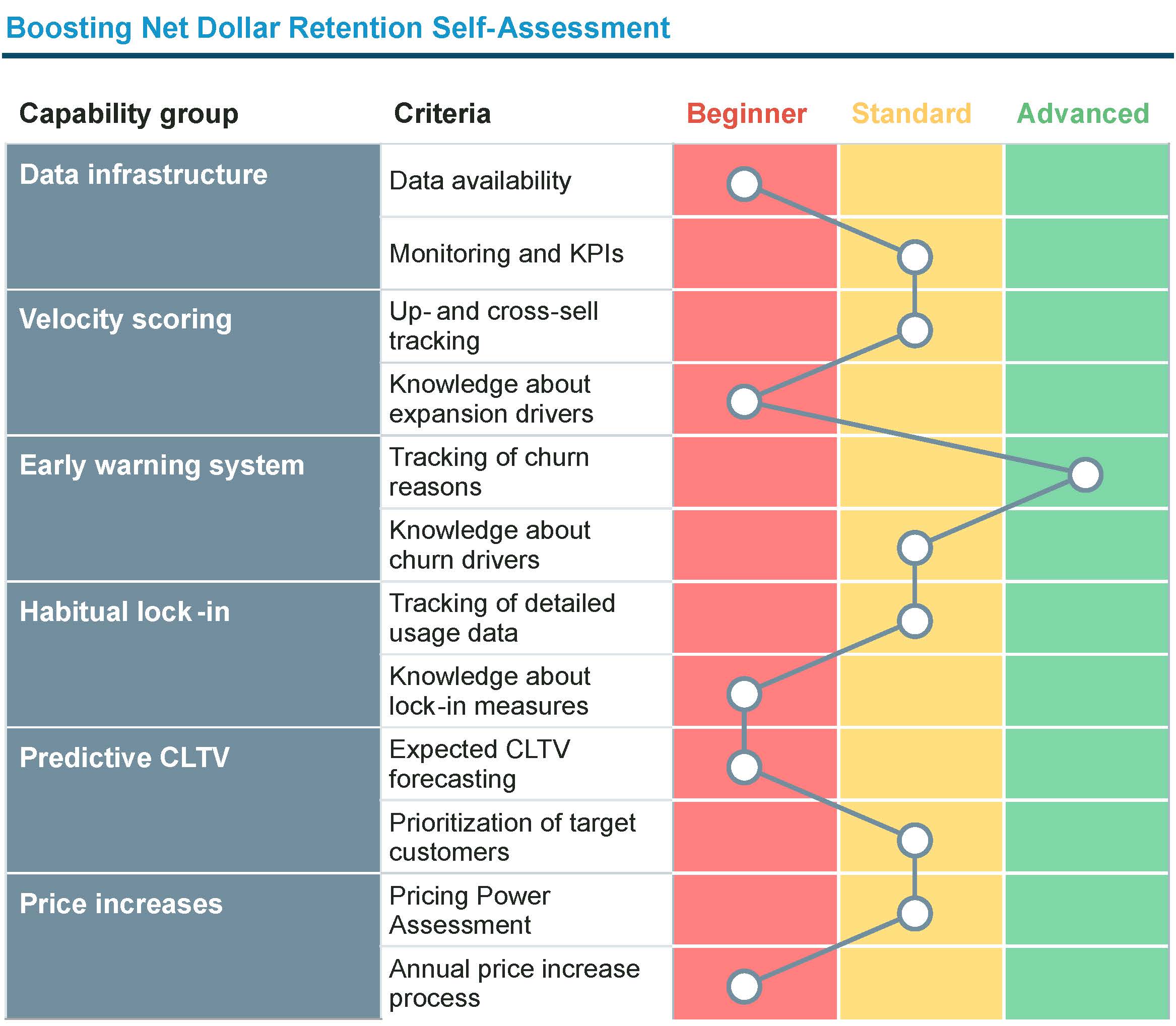

The SaaS companies employing monetization and retention methods effectively can grow over 30% (NDR 130%) in revenue from their customer base alone. Best-in-class SaaS companies perform well across the entire Customer Base Management spectrum of the Net Dollar Retention Self-Assessment.

Figure 2: Net Dollar Retention Self-Assessment - Determine your NDR maturity to pinpoint improvement potential in monetization and retention efforts

Get the data right to empower your customer success team

Whether your aim is to double down on retention or find ways to upsell to high-velocity accounts, profitability relies on finding the ability to truly connect with customers. As such, customer success teams play an important role in mapping out opportunities for expansion and renewals. They are a crucial piece of the monetization puzzle.

“To determine which customers are ready for up-sell, you need to distill the factors that truly drive differences across your customer segments.”

A software company that has truly shown the value of a strong customer success organization is Salesforce. In the early 2000s, Salesforce experienced significant growth and the company’s market cap rose from half a billion dollars to two billion dollars. Despite this growth, they still faced a monthly customer churn rate of 8%. Their solution? The company pivoted their focus to retaining and growing the customer base. As a result, they built one of the industry’s best performing customer success teams.

A key pillar of Salesforce’s approach was to segment their customer base and prioritize customer success interactions to maximize their impact. By leveraging usage patterns to identify customers that were likely to churn, they were able to make customer success managers more targeted in their retention efforts – which ultimately reduced their churn rate.

Customer success teams that are empowered with data and core insights are better equipped to keep customers engaged. Ultimately, to determine which customers are ready for up-sell, you need to distill the factors that truly drive differences across your customer segments. Think about data points such as number of active users, log-in frequency, number of integrations, feature adoption, usage patterns, and time-to-value.

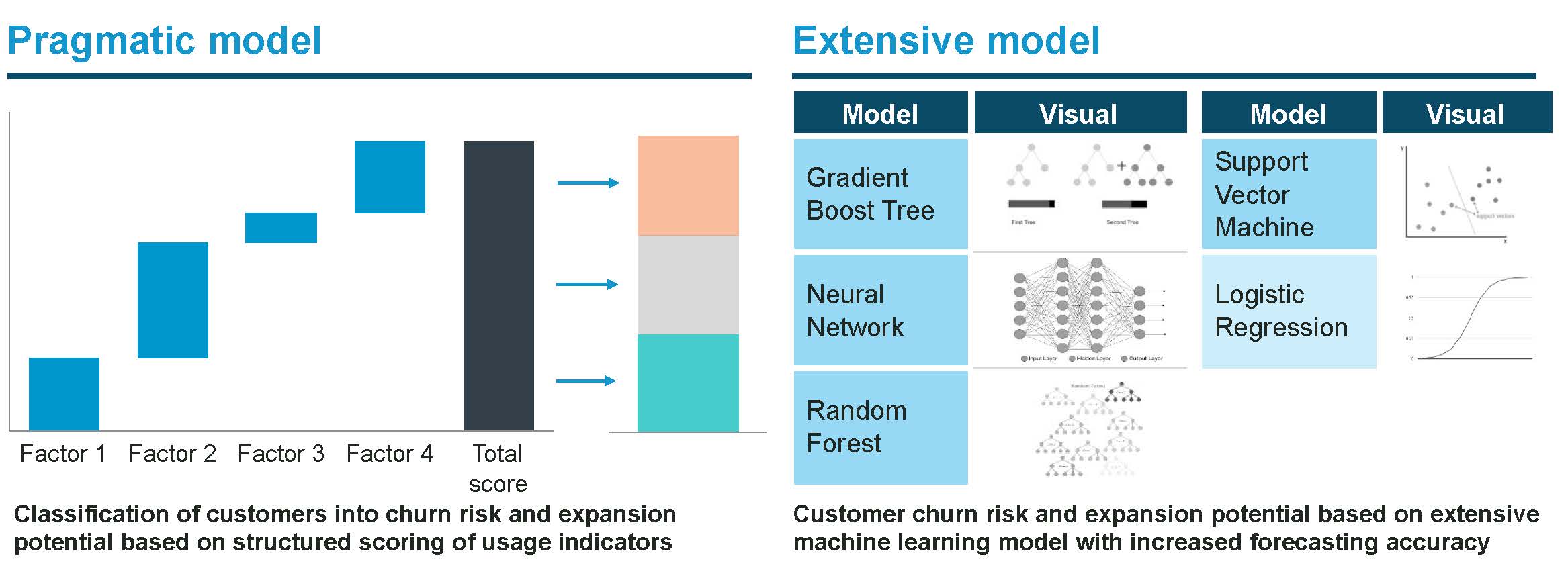

Prediction models for churn risks or expansion opportunities can be as simple or as complex as needed. For smaller, early stage companies, this can look like a straightforward opportunity/risk assessment model. Meanwhile, larger organizations with above-average data capabilities can work with complex machine learning algorithms that facilitate decision making.

Ultimately, effective customer success can pay dividends. And, when combined with data and insight, you have a recipe for sustainable growth and lasting success.

Figure 3: Risk and opportunity forecasting models - Introduce pragmatic or extensive modeling depending on data availability and maturity to predict churn risk and expansion potential

Install four proven customer base management (CBM) initiatives

To truly capitalize on the insights from a risk/opportunity scoring model and continually grow NRR, there are four initiatives that every customer success team can introduce.

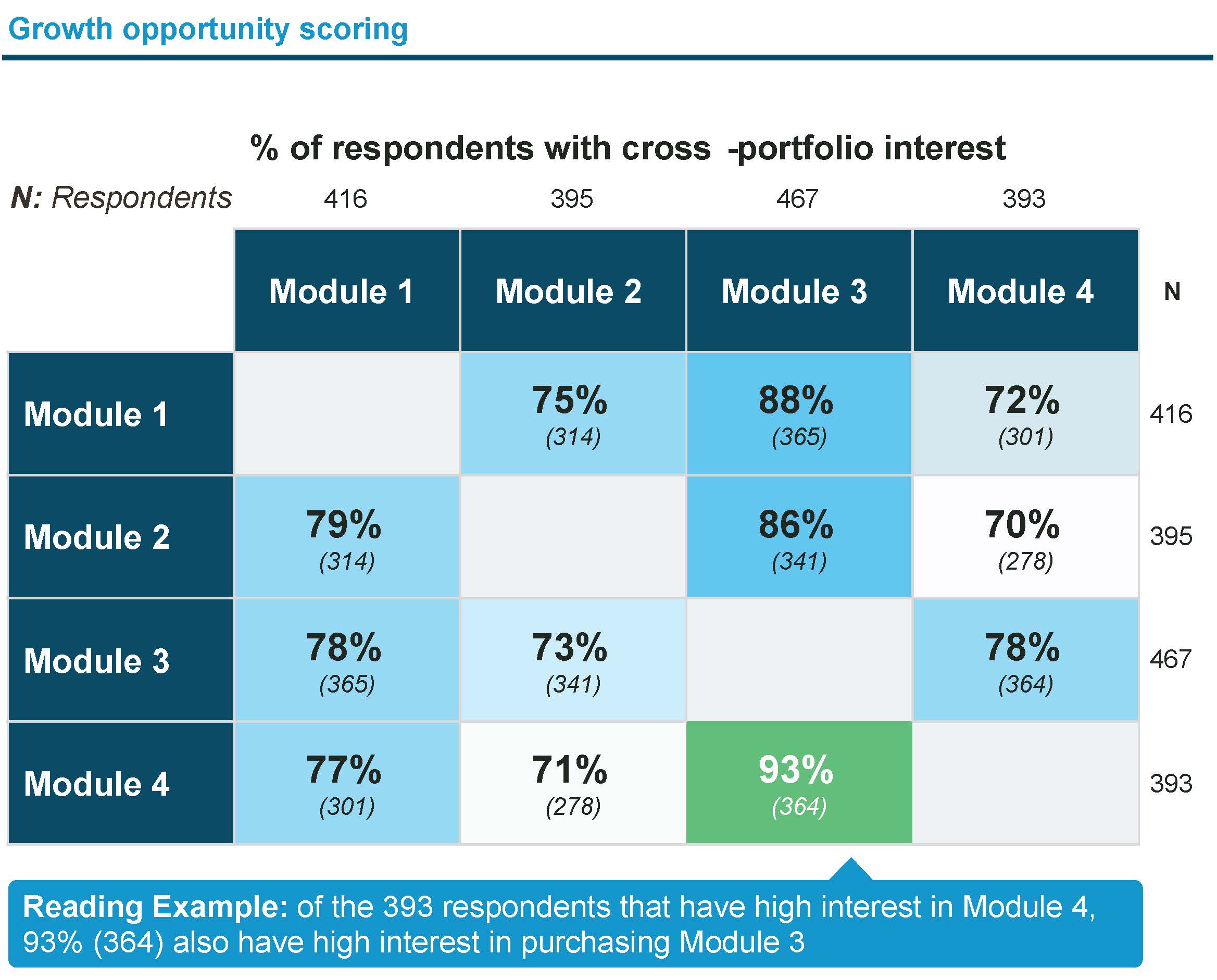

- Velocity scoring: Systematically identify cross-sell and up-sell opportunities for high-velocity, low-risk accounts by determining what usage patterns lead to expansion.

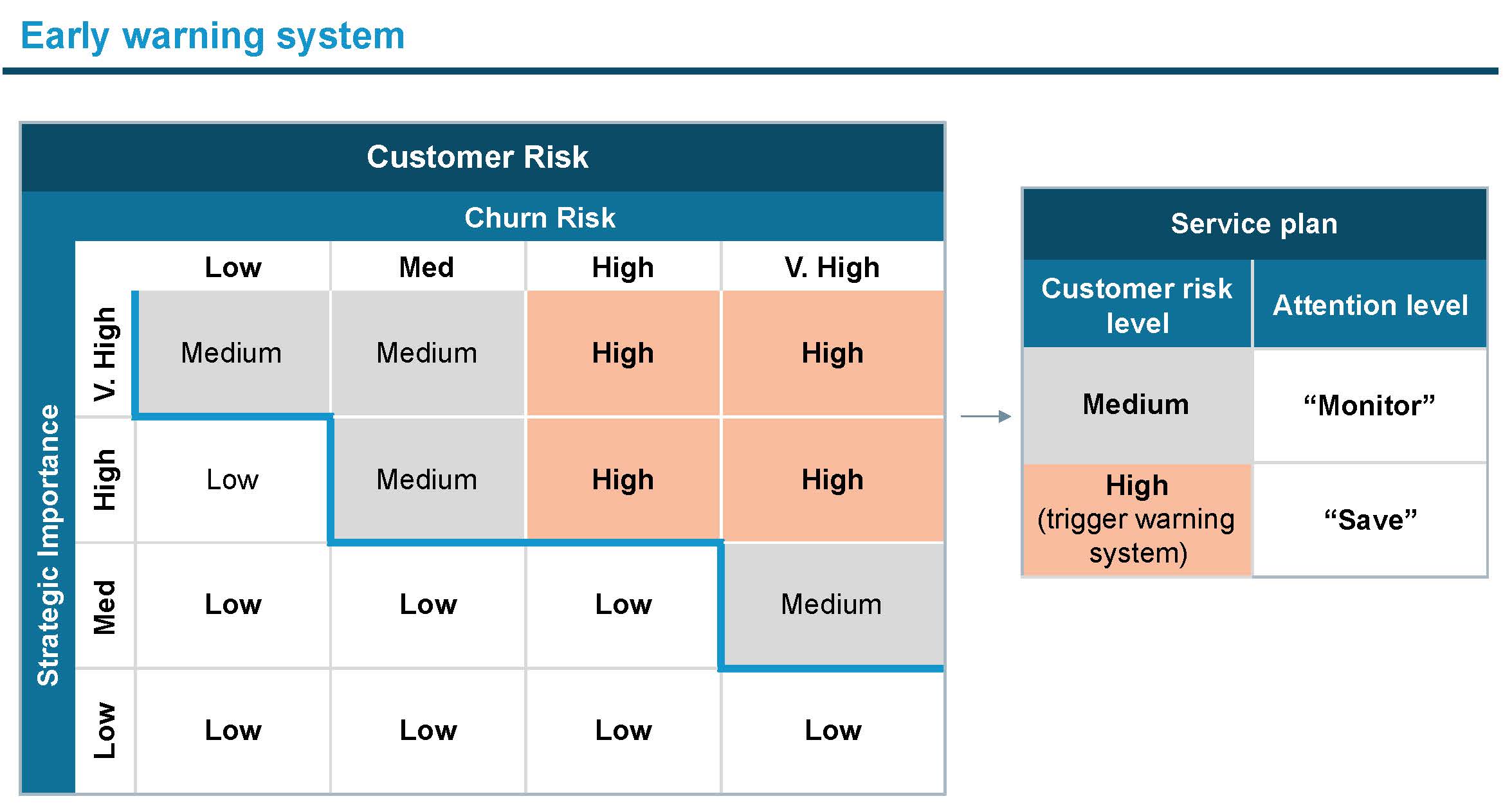

- Early warning system: Get insight into customer-level churn risk factors to inform what counteracting measures you can take and prepare you to launch save campaigns and win-back initiatives.

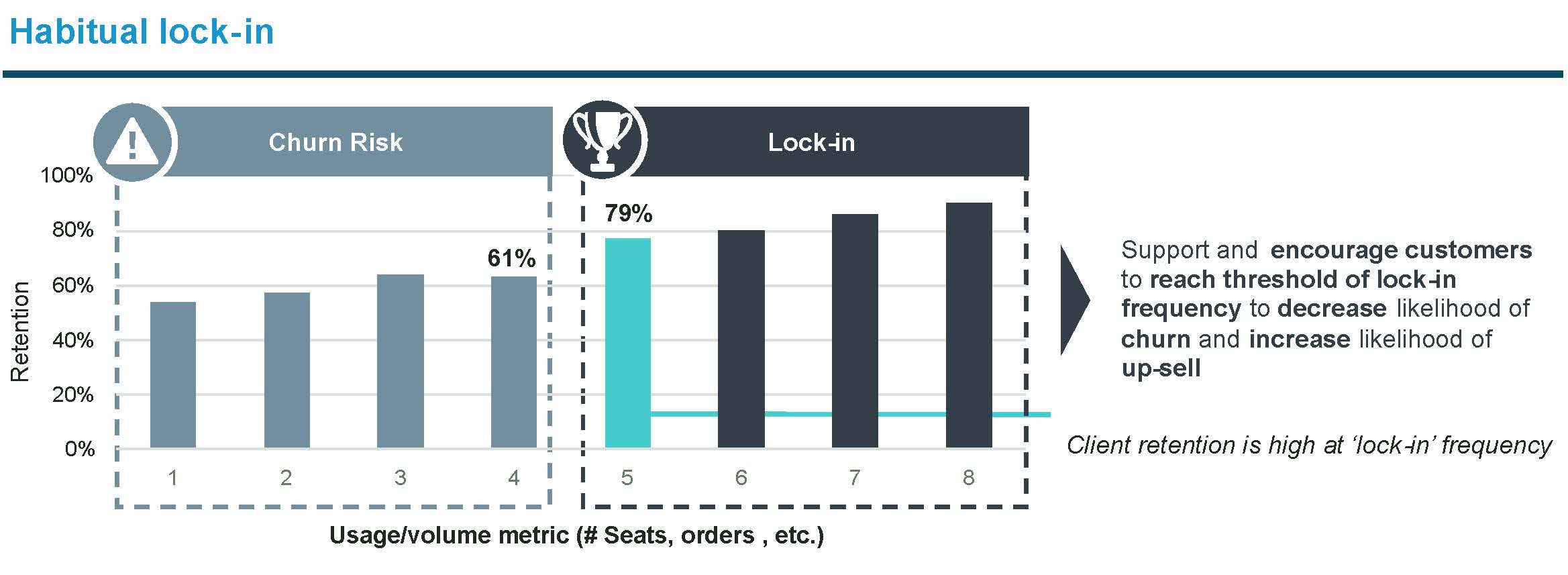

- Habitual stickiness: Explore the relationship between usage patterns and retention rates to promote usage or consumption at key inflection points that create “stickiness.”

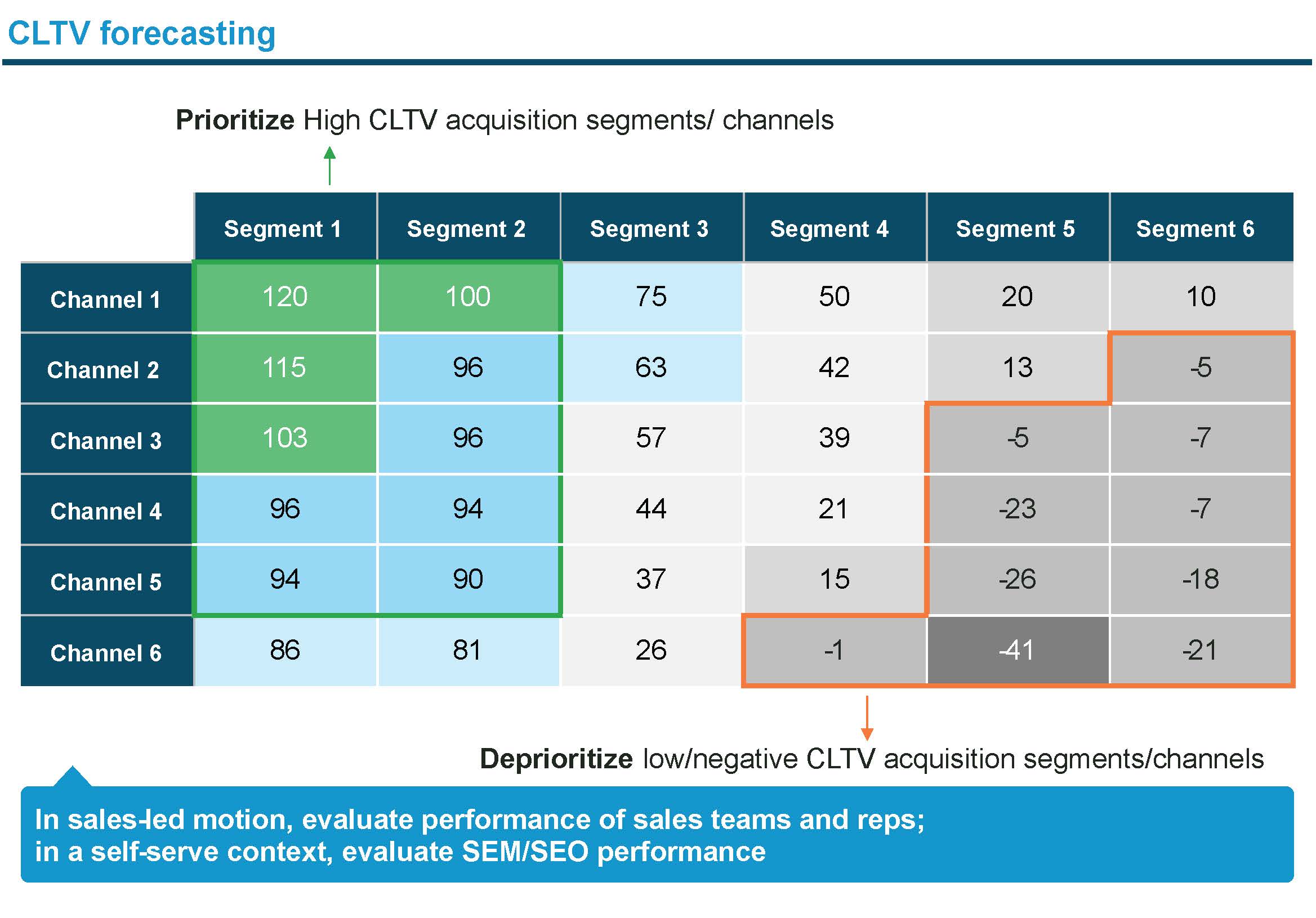

- Predictive customer lifetime value (CLTV) for acquisition: Inform acquisition activities with retention forecasts so that you can proactively acquire long-tenure customers with above average willingness to pay.

Figure 4: Velocity Scoring - Perform usage correlation analysis to identify theoretical cross-sell paths and prioritize ones that have the best growth potential

Figure 5: Early warning systems - Identify and prioritize accounts for which preemptive action should be taken by quantifying account importance and churn risk

It is important to not underestimate the third and fourth actions in this list. When it comes to stickiness, SaaS companies can take action to increase the “stickiness” of their product. The more your product becomes part of your customer’s processes, the less likely they are to leave. As such, it’s key to understand where the inflection points are in terms of number of users, number of integrations, feature adoption, and usage patterns.

Figure 6: Habitual Stickiness - Build incentive structures and train the CS organization to encourage the behaviors that increases stickiness and lowers churn

Informed by usage analytics, CLTV forecasting for acquisition will help develop or confirm your ideal customer profile (ICP). As such, implementing effective CBM tools will also help you acquire more effectively and efficiently, resulting in faster scaling.

Figure 7: CLTV forecasting - Introduce a Predictive CLTV Model to allow for more effective targeting of high value segments and better financial forecasts

Strengthen your teams’ pricing “muscle”

Lastly, in the current economic climate with interest rates that keep increasing and soaring inflation across global markets, it’s important for your organization to have an effective annual price increase process in place. Besides preventing churn and upselling; you should also retrain your ‘price increase muscle’, in order to improve your bottom line.

Needless to say, this is probably the least favorite part of the job for your CS managers, but it’s an important one. When executed diligently, it’s the most effective lever for a software company to safeguard profitability, especially when inflation keeps soaring.

“If ever there was an urgency — and also an opportunity — to increase prices, the time is now.”

The problem with most SaaS companies today is that they’ve lost the “muscle” to follow through on increasing prices. Price increases haven’t kept pace with wage increases, and rising costs and inflation are now putting additional pressure on margins. If ever there was an urgency — and also an opportunity — to increase prices, the time is now.

A winning price increase process consists of three steps:

- Configure the levels: Differentiate price increase targets on customer-level and develop account plans for your most important customers

- Get prepared: Develop communication materials, clear escalation rules, and a compelling incentive system for your commercial organization

- Monitor success: Provide sufficient management attention, monitor key metrics and be prepared to steer when required

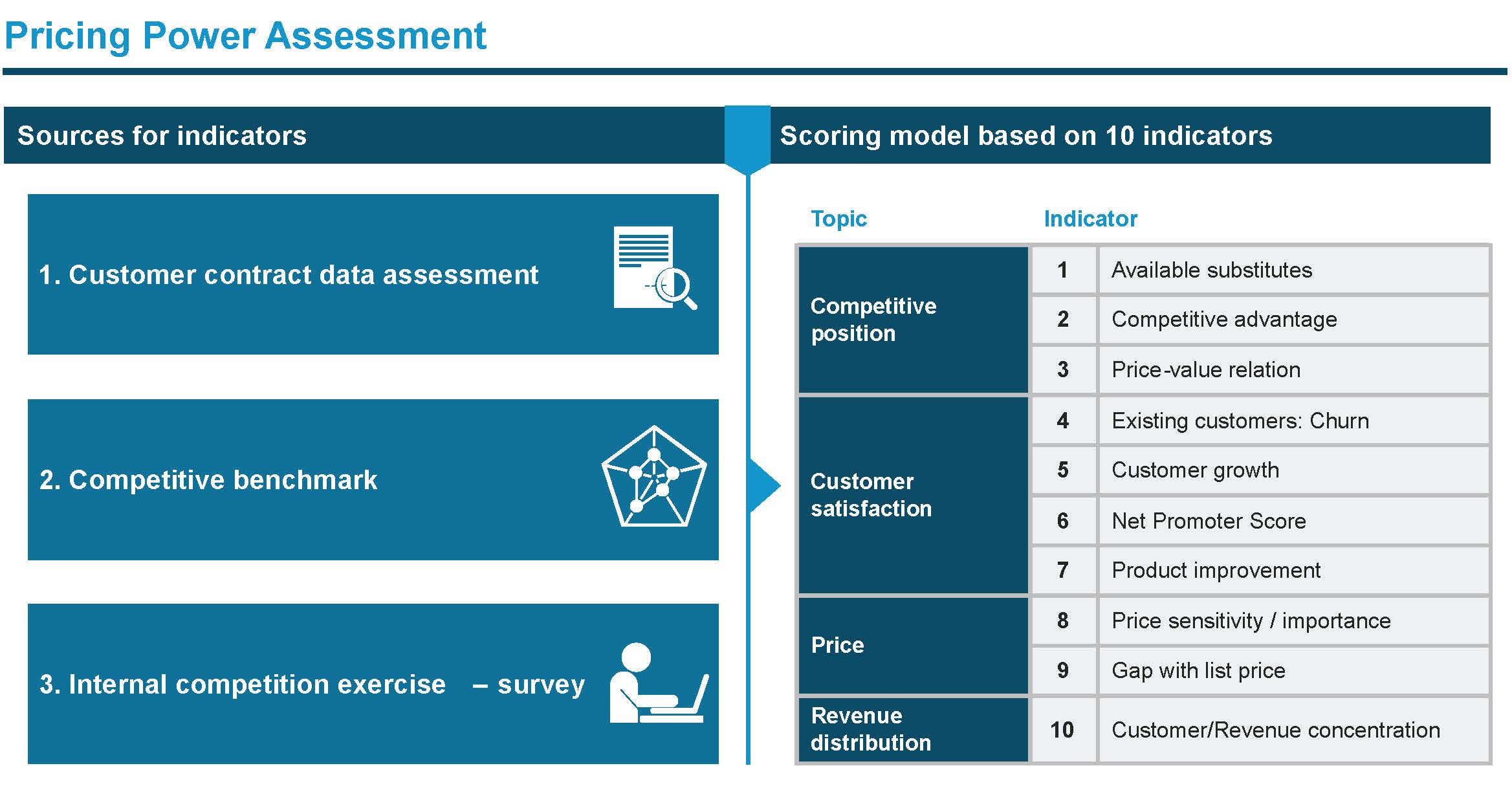

The starting point is to differentiate price increase targets on customer-level. When you’re in a more transactional SMB environment you will need a rule-based approach based on indicators of price increase potential. When you’re dealing with fewer larger customers in an enterprise environment, you will need account plans with a clearly outlined negotiation strategy including going-in / target / walk-away prices. To determine the pricing headroom, you can leverage a structured assessment of pricing power based on selected indicators.

Figure 8: - Pricing Power Assessment: - Leverage a structured assessment to determine price increase potential per customer

Once you’ve established the targets, the next steps to get prepared. The key is in developing a compelling value story that clearly outlines the necessity and justification for the price changes. Best-in-class SaaS companies develop a narrative that centers around value and their competitive advantages. Any price increase effort will only fly if Sales and CS are well-prepared for the challenges ahead.

Finally, you will need structural KPI monitoring. Especially in the enterprise segment, customer-facing teams need to prepare concessions in advance to avoid price erosion and run effective negotiations. As part of this process, it is key to capture learnings for next price increase rounds to ensure a learning curve and strengthen your teams’ pricing “muscle” over time.

Staying on course

SaaS leaders are facing many challenges and changes, and it can be difficult to stay on course. Leaders that want to keep their company on a path to sustained growth need to support their acquisition efforts with additional revenue streams — and their existing customer base has a lot to offer in that regard.

Shifting your focus to customer base monetization measures through more focus, better insight in expansion opportunities and churn risk, combined with an effective price increase process, will enable sustainable growth even in more challenging economic times.

Ready to transition to ‘better growth’? Interested in a quick scan of customer base management initiatives for your company? Contact us to discuss monetization and retention strategies.

Tech Summit

Next, to help SaaS leaders achieve sustainable growth in these challenging times, we organize our 7th Tech Summit Spring Edition (more information). This Tech Summit is dedicated to business leaders from SaaS companies and takes place on the 25th of May in Amsterdam. You can register here.