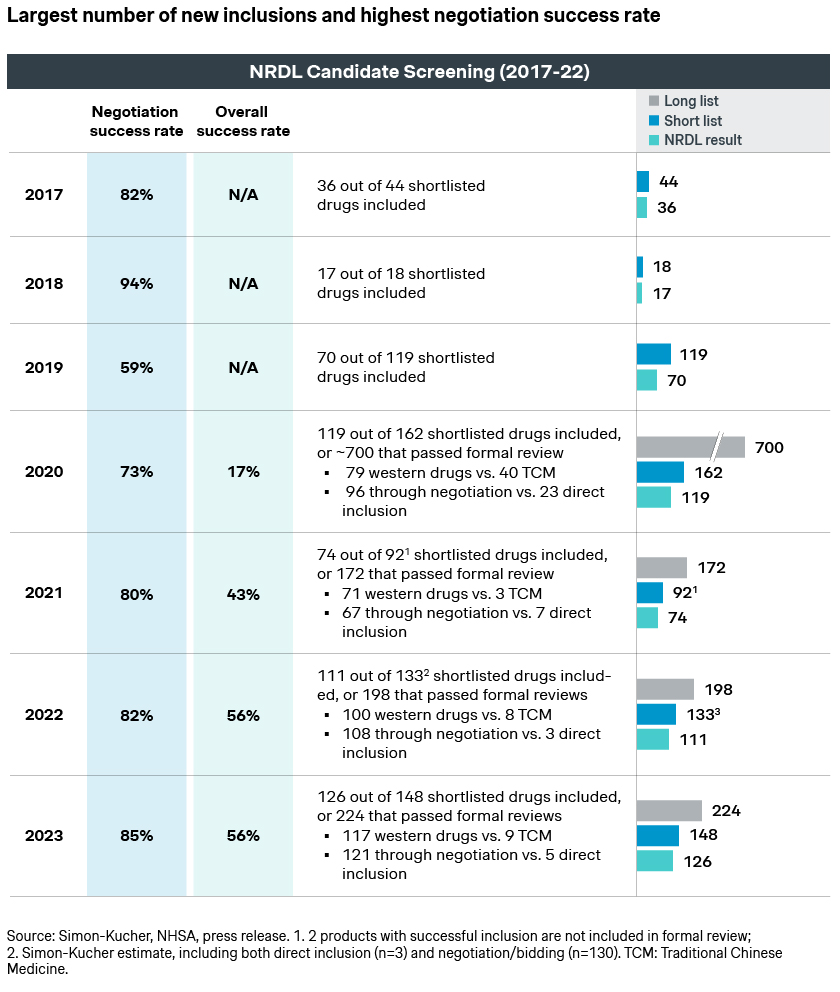

The NRDL 2023 appears to be a rather uneventful one, with the process kicked off in July and wrapped up in early December as planned. The official results were announced in mid-December, just in time for all to plan ahead for the new year regardless of the outcome. Here’s our full readout for the China NRDL 2023.

Notably, the 2023 NRDL features a long list of 224 candidates and 126 new inclusions. This breaks a record for the largest round of formulary expansion in the NRDL’s seven-year history.

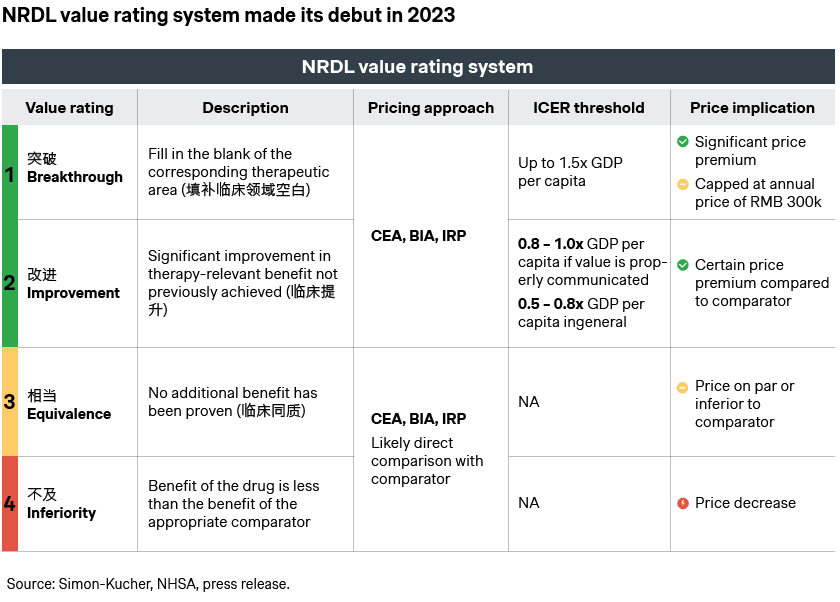

NRDL new value rating system

Like earlier NRDLs, the candidates consist of a good mix of newly launched innovative drugs, a significant number of me-toos and me-betters, as well as candidates who failed in previous years but made another attempt this year. Unlike earlier NRDLs, each were assigned to one of the four classes per this year’s brand-new value rating system:

- Breakthroughs refer to candidates that are truly innovative, and are the first to address the clear unmet needs in the clinical setting

- Improvements afford significant advantages over current standard of care

- Equivalents show no major improvement, or have not yet proven this clinically

- Inferiors is probably not the most politically correct label, but does foretell the dim prospect for the class

More importantly, each class would have a different likelihood of being shortlisted, as well as a different evaluation approach and ICER threshold. This results in distinct listing possibilities and pricing outcomes. In fact, a Simon-Kucher analysis indicates around 72% listing success for the breakthroughs and 64% for improvements versus 30% for equivalents. This is a strong indication of the new rating system in motion, as well as NRDL’s preference for innovations.

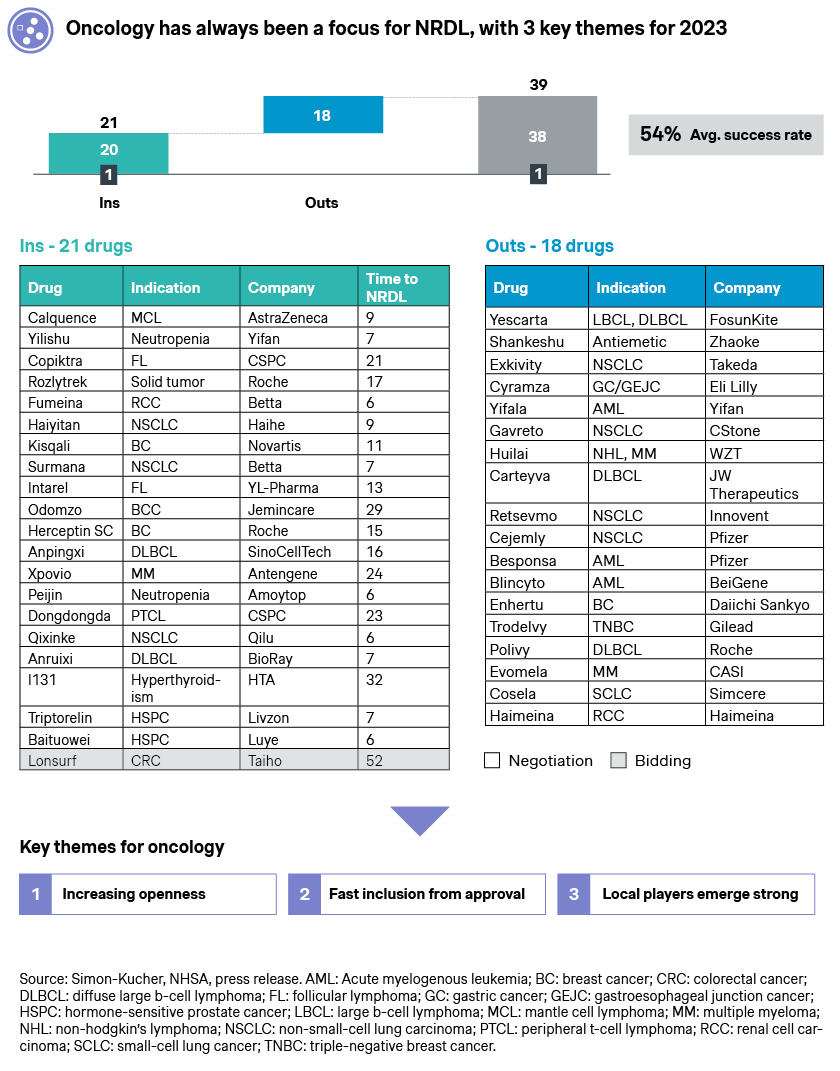

Oncology comes out as top TA in the NRDL 2023, with both notable wins and misses.

Oncology continues to be the most contested field with 39 candidates and 21 wins, among them a number of innovative breakthroughs like the new generation BTK inhibitor Calquence, precision medicine Rozlytrek indicated for NTRK and ROS gene fusions, and the new CDK4/6 inhibitor Kisqali for HR+/HER2- breast cancer. Notably, over half of the new oncology inclusions made it into the NRDL within 12 months of their launches, underscoring the strong motivation for fast NRDL listing from the candidates.

At the same time, there are still price ceiling constraints and budget impact considerations at play, which led to some high-profile misses.

- Enhertu was considered a hotshot by many given its stellar clinical profiles across different indications, but did not make it to the shortlisting stage despite the high expectation, representing the biggest surprise in this year’s NRDL process

- None of the other three ADCs Trodelvy, Polivy, or Besponsa had better luck. While this was the first try for the first two, it was another renewed attempt for Besponsa, which came better prepared with adjustments in its value dossier including China real-world evidence, yet still to no avail this time around

- CAR-T therapies Yescarta and Carteyva might have been wishing the charm as they go in the process for the third time, but were stumped again given the still significant gap in price expectations

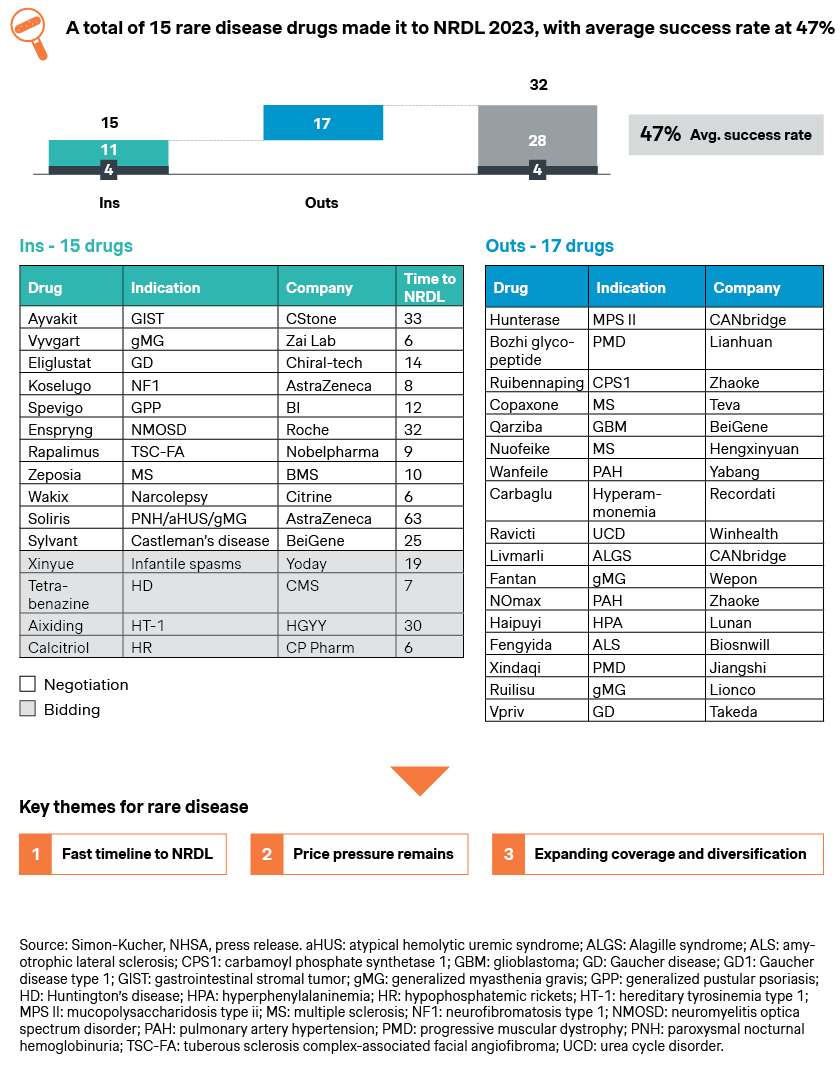

The rare disease category saw some encouraging breakthroughs, with 15 new drugs emerging triumphant.

- Myasthenia gravis represents one the more notable rare diseases with large unmet needs and disease burden, and the inclusions of Vyvgart and Soliris brought new hopes for the 250,000 patients across China

- Gaucher’s disease features much fewer patients but significant burden to patients and caregivers alike, and the NRDL inclusion of a local product eliglustat could bring much-welcomed changes to the whitespace

- Paroxysmal nocturnal hemoglobinuria (PNH), atypical hemolytic uremic syndrome (aHUS), TSC-FA, GPP, NF1, GIST, narcolepsy, and Castleman’s disease are also among the whitespaces welcoming their first NRDL-listed therapies. Some were approved just hours before the NRDL submission deadline, indicating a shared sense of urgency among the regulatory authorities, payers and industry players

- Multiple sclerosis is one of the rare indications with 6 incumbents already listed in NRDL, but still has outstanding unmet needs which Zeposia strives to address. By driving home its differentiated value propositions, Zeposia succeeded with eventual listing, and affords physicians and patients another option with advantages in cognitive function protection

- It is interesting to note that four new rare disease drugs have been included via the NRDL bidding mechanism, with local players winning the races with more cost-effective therapies to infantile spasms, Huntington’s disease, HT-1, and hypophosphatemic rickets (HR) patients, and capitalizing on the new pathway for NRDL listing

NRDL has come a long way over the past 7 years, now with over 3,000 drugs in its formulary.

At the same time, it is still evolving with recurring themes and new twists. The new four-class value rating system represents one of the latest developments of the NRDL, largely mirroring the G-BA additional benefit rating system in Germany and the ASMR rating in France. Going forward, we are likely to see further tweaking and ongoing optimizations, and hopefully more breakthroughs in the near future.

Reach out to our authors for more information!

Additional Contributors: