Liquid biopsies are emerging as a transformative diagnostic tool, offering a less invasive, faster, and more scalable alternative to traditional tissue biopsies. As molecular testing becomes central to precision medicine, will the diagnostic and payer ecosystem drive – or delay – broader adoption?

What are liquid biopsies?

Liquid biopsies are diagnostic tests that detect tumor-derived biomarkers such as circulating tumor DNA (ctDNA), RNA fragments, or exosomes through a simple blood draw. Compared to traditional tissue biopsies, they are minimally invasive, easier on patients, and less risky – especially for those with inaccessible or fragile tumors. They also provide a more comprehensive view of tumor heterogeneity by capturing molecular information from multiple tumor sites simultaneously.

The benefits extend across the patient journey and provider workflow. In early-stage diseases, research from John Hopkins in the US shows that liquid biopsies can detect cancer before clinical diagnosis. During treatment for rapidly evolving diseases, where multiple procedures are required to take biopsies across different sites, liquid biopsies allow clinicians to monitor response and resistance with faster repeat blood draws.

Current market landscape: Expanding indications, accelerating adoption

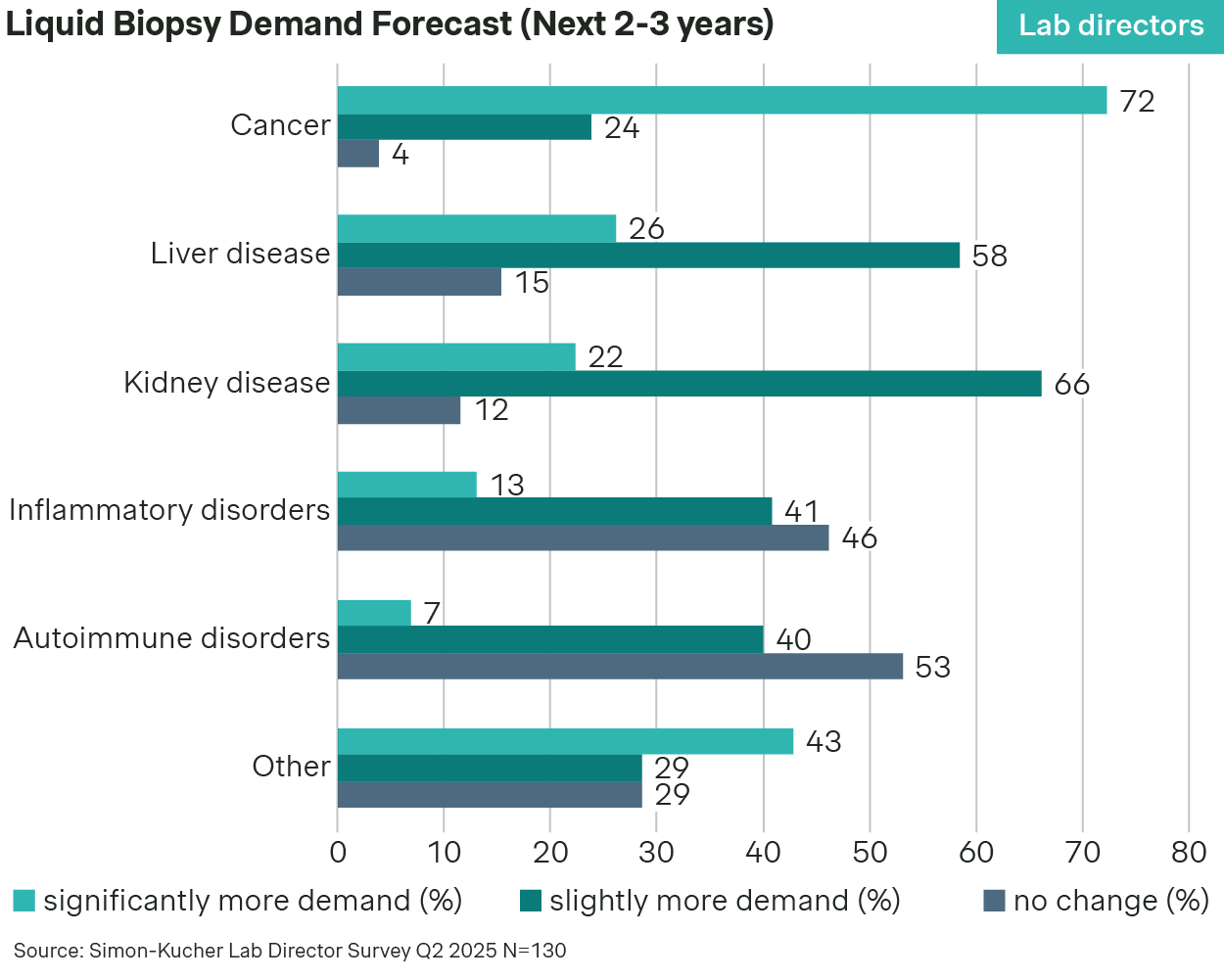

While originally focused on advanced cancer mutation profiling, liquid biopsies are quickly expanding into adjacent use cases. Lab directors agree that demand for liquid biopsies will remain strongest in cancer over the next two to three years, but other indications like liver and kidney disease are also emerging.

Previously, laboratory-developed tests (LDTs) were the primary means for screening actionable mutations with liquid biopsy, but their inconsistency across labs limited their reliability and scalability.

Today, large players like Guardant Health and Foundation Medicine lead mature liquid biopsy uses, including therapy selection, resistance monitoring, and residual disease tracking. At the same time, innovators like GRAIL and Exact Sciences are commercializing multi-cancer early detection (MCED) tests to identify cancer before symptoms appear, expanding liquid biopsy’s clinical impact. Earlier-stage companies like Freenome and Delfi Diagnostics are also exploring new frontiers, from additional cancer and disease types to novel biomarkers.

This wave of innovation is backed by growing clinical validation and increasing interest from providers and payers. Regulators are also fueling momentum. In the US, for example, the FDA provided Quest Diagnostics with Breakthrough Device Designation for its new liquid biopsy. As technology matures and applications broaden, liquid biopsy adoption is gaining critical momentum.

Catalysts for growth

Momentum for liquid biopsies is being driven by a confluence of scientific, clinical, and commercial tailwinds.

First, accuracy and reliability have improved dramatically. Advances in assay sensitivity, multi-omic analysis, and machine learning have closed the performance gap between liquid and tissue biopsies, especially for mutation detection in advanced cancers.

Second, the number of clinically relevant use cases continues to expand. Liquid biopsies are no longer limited to identifying targetable mutations for precision medicine – they are being used to monitor treatment response, detect minimal residual disease (MRD), and guide sequencing decisions across lines of therapy. Their noninvasive nature makes them well-suited for serial testing, a key enabler of personalized and adaptive treatment strategies.

Third, liquid biopsies significantly reduce the care burden on both patients and healthcare systems. Diseases like non-small cell lung cancer see growing demand for tissue samples to test for biomarkers in order to select the most relevant therapy, making liquid biopsy’s less invasive and more scalable approach increasingly attractive. By replacing invasive tissue biopsies with simple blood draws, they reduce procedure volumes, shorten recovery times, and free up physician time for other tasks.

Case Study: ESR1 mutation testing in HR+ breast cancer

The shift from tissue to liquid biopsy is visible in hormone receptor-positive (HR+) breast cancer, where ESR1 mutations are a known mechanism of treatment acquired resistance to aromatase inhibitors. Providers across key markets increasingly expect ESR1 testing before initiating second-line endocrine therapy, with liquid biopsy emerging as the preferred method. Publications support their use due to higher sensitivity.

This shift is already reflected in the National Comprehensive Cancer Network clinical guidelines, which recommend liquid biopsy for ESR1 testing at disease recurrence or progression. As this becomes the clinical norm, it offers a glimpse of how liquid biopsies could be more broadly embedded in guidelines and workflows.

The barriers slowing adoption

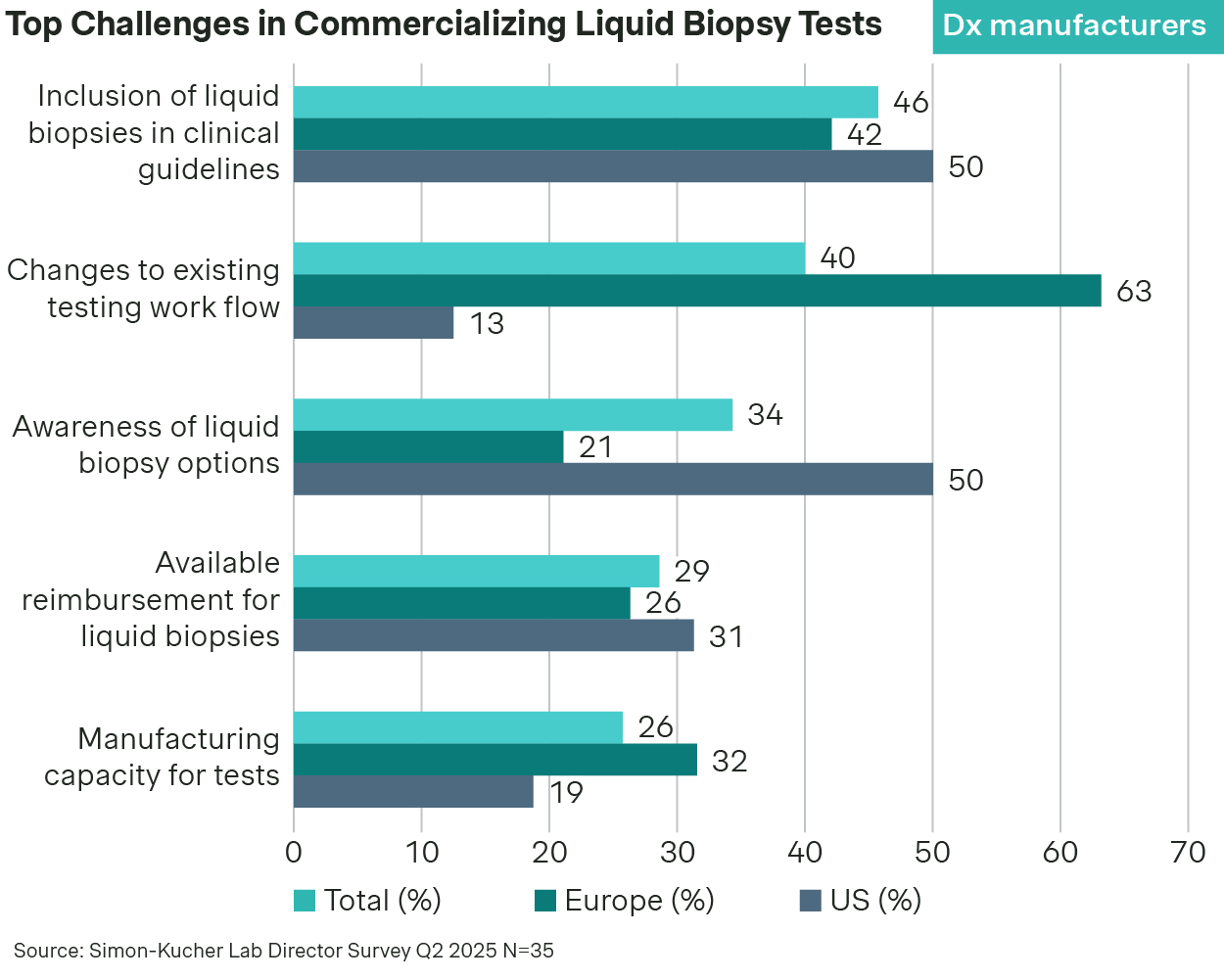

Despite strong clinical momentum, widespread adoption of liquid biopsies is constrained by structural barriers, particularly guideline/reimbursement inclusion and the need to redesign testing workflows.

Payer coverage remains highly fragmented, particularly outside of late-line therapy selection in advanced cancers. Use cases like MRD monitoring or pan-cancer early detection often lack the long-term outcome data payers require for broad reimbursement. While inclusion in clinical guidelines and positive health technology assessments (HTA) help, reimbursement decisions remain cautious and slow.

Current lab infrastructure is still designed around tissue testing. Adapting to liquid biopsy workflows – whether through sample handling, automation, or reporting – requires new equipment, updated protocols, and staff training. In low-volume settings, the case has to be made that the transition and change management is offset by improvements in patient care and financial performance.

Additionally, in markets where pathology infrastructure is deeply entrenched, attempts to introduce liquid biopsies often face organizational resistance. Healthcare providers can have a financial incentive to continue with tissue biopsy since surgical procedures to collect tissue samples bring high margins for their organizations today.

Strategies to overcome barriers and unlock growth

For liquid biopsies to gain broader adoption, diagnostic manufacturers need to work closely with both payers and healthcare providers. With payers, this means developing evidence plans and value dossiers that meet payer access expectations, and engaging strategically to achieve reimbursement policies reflecting the unique value of liquid biopsy. With providers, diagnostic manufacturers need a commercial plan that both raises awareness and ensures providers have the support to integrate liquid biopsy into clinical workflows.

At Simon-Kucher, we help diagnostics companies unlock the full potential of their liquid biopsy innovations. We offer end-to-end support for diagnostic companies, specifically in evidence development planning, early value differentiation/communication, access-rationalized evidence generation strategy, reimbursement targeting, and innovative patient access programs.

Whether you need to navigate payer and clinical guideline hurdles, or optimize your commercial activities and services provided to labs, our team provides data-driven strategies to accelerate growth and maximize impact.

To explore how we can support your liquid biopsy strategy, reach out to our experts today:

Michael Keller, Chris Barr, Mark Engelhardt, and Tyler Perez.

Thanks to contributions from Finn Johnson!