Pricing is unique among value creation levers. Unlike a full operational turnaround, it goes straight to the bottom line, materializes quickly, and carries lower execution risk. In many ways, it’s the cleanest lever in the private equity toolkit. Drawing on the results of our Industrials and Business Services Value Creation Study 2025, this article discusses why pricing forms the backbone of today’s equity stories in industrials, standing out as the lever that consistently delivers speed, certainty, and bankable impact.

Private equity investors are operating in one of the most uncertain environments in years. Inflation, rising rates, and shifting trade policies have created volatility that makes it harder than ever to underwrite growth stories with confidence. Our Industrial and Business Services Value Creation Study confirms this reality: 46% of PE executives cite economic downturn as a top challenge, followed closely by tariffs (41%) and geopolitical risks (41%). Investors are looking for levers they can trust.

Pricing provides exactly that: a disciplined way to protect margins, pass through cost shocks, and create credible growth stories that buyers will reward at exit. It allows investors to protect profitability and build credibility in equity stories when other levers feel less dependable.

The reality is no one knows where tariffs will ultimately land. What we do know is that firms need to stay agile, execution-focused, and on top of developments. Tariffs create cost volatility, but they also create an opportunity for disciplined pricing action, either to pass through costs or to use relative cost positions as a competitive tool. It reinforces why pricing excellence isn’t just a margin lever, it’s a resilience tool in a volatile environment.

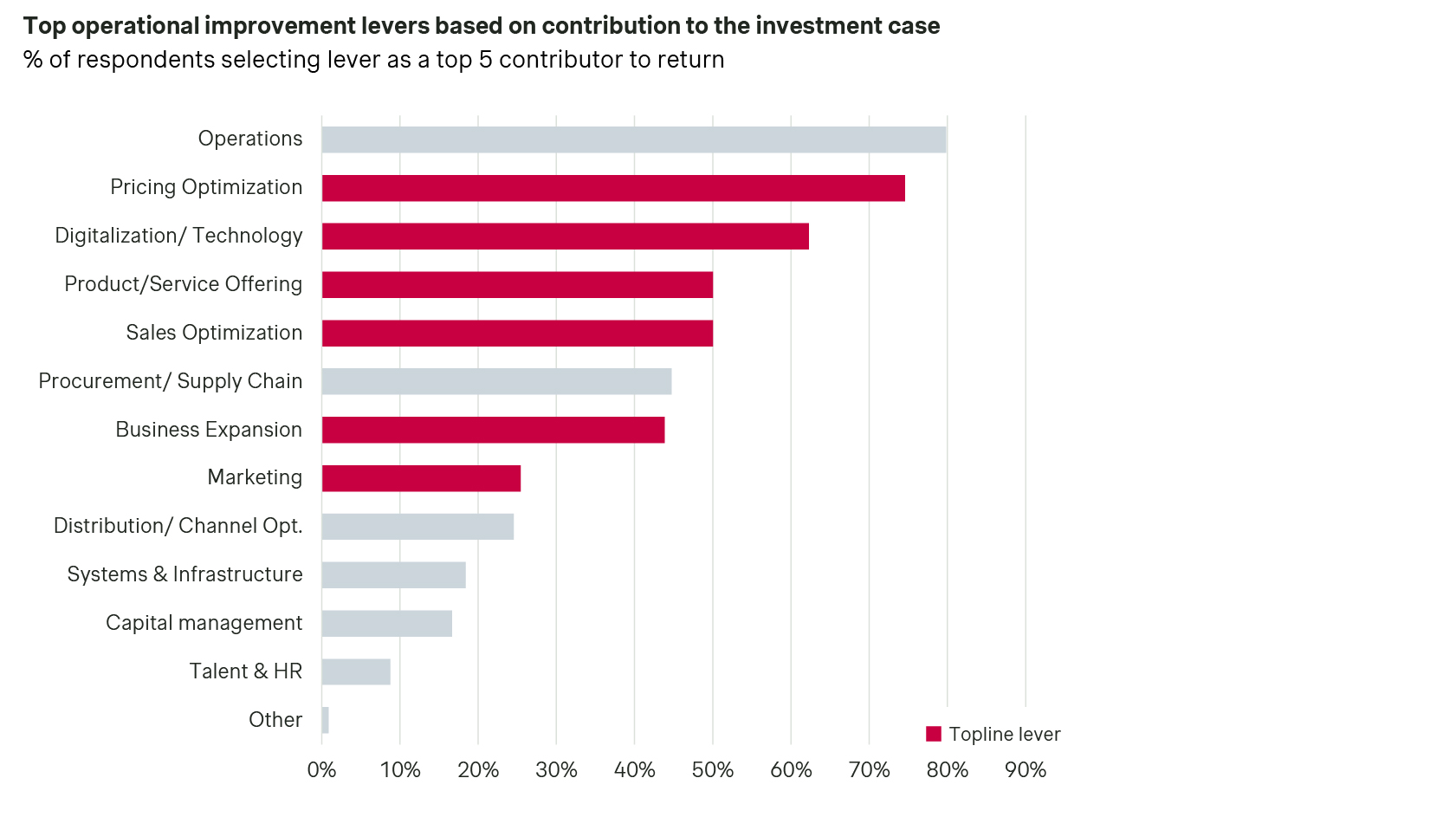

Today’s deal teams and operating partners agree

Latest Industrial and Business Services Value Creation Study reveals that Operations (80%) and Pricing (75%) are the top two contributors to the investment case, well ahead of digital, product, or sales optimization.

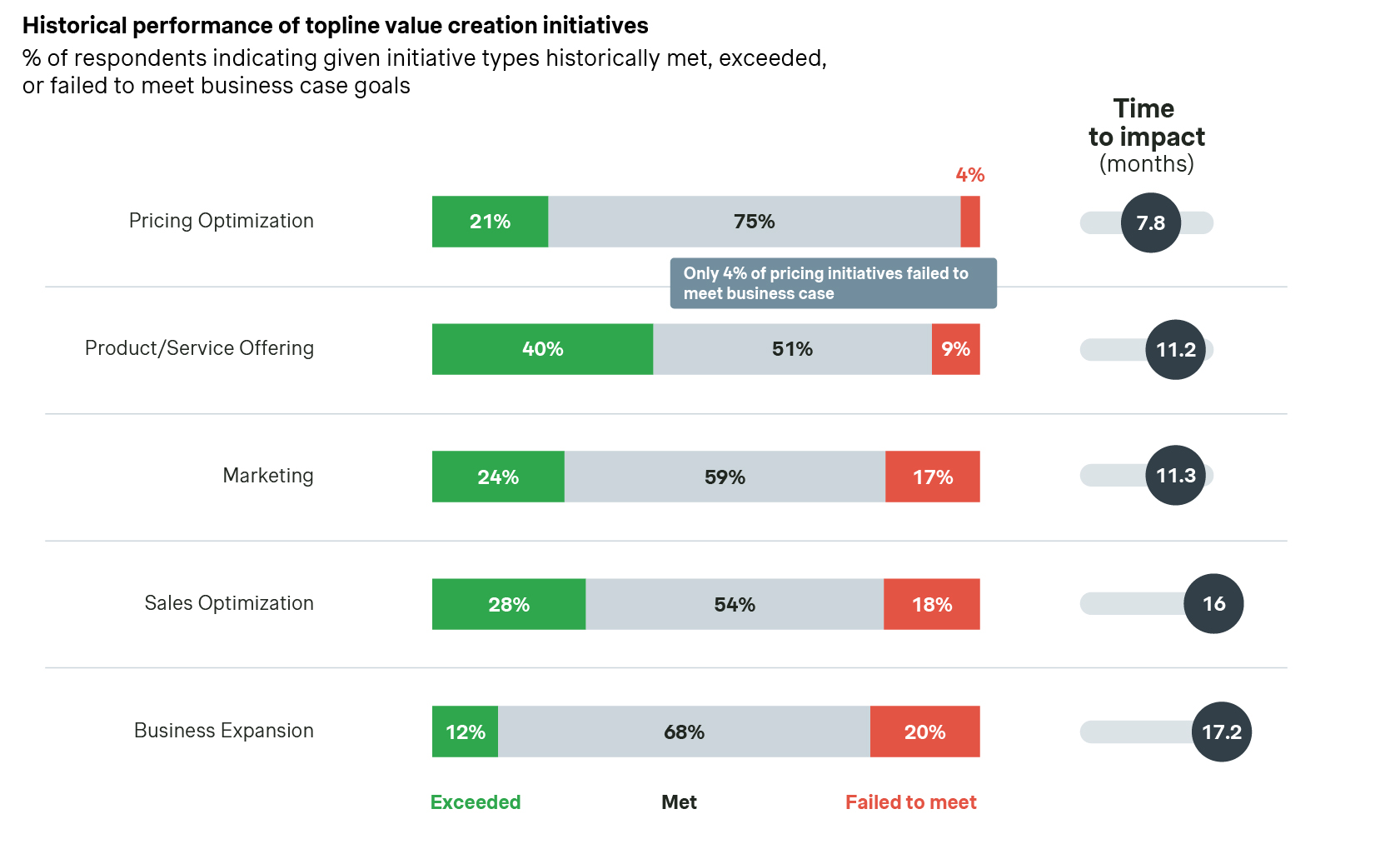

Meanwhile, only 4% of pricing initiatives fail to meet business case expectations, dramatically lower than product/service innovation (9%), marketing (17%), sales optimization (18%), or business expansion (20%).

If that weren’t convincing enough, pricing also has the shortest time to impact at just 7.8 months, compared to 11–17 months for the other levers. That’s gold. Because unlike a five-year digital transformation, pricing actions can be taken in the first 100 days. They show up in EBITDA almost immediately. And when you’re holding an asset for four or five years, speed matters. The earlier you capture the uplift, the more years of compounding you enjoy, and the more credible it looks to the next buyer.

Eight months: That’s still too long

If pricing is this fast and this reliable, why does it still take nearly eight months post-close to realize impact? Eight months might not sound like much, but in a typical four-to-five-year hold, that’s a huge amount of lost value creation time.

You’re giving up not just eight months of EBITDA impact, but also the compounding effect of having that uplift show up in multiple reporting periods and in your exit story.

That’s where Simon-Kucher’s pricing due diligence comes in

When you assess pricing during diligence, you shorten the cycle and bring that impact forward into the first 100 days, turning a proven lever into an even more powerful one.

At Simon-Kucher, we go beyond high-level margin checks to provide a deep, evidence-backed view of a company’s true pricing dynamics. Instead of waiting the industry-average eight months post-close to realize pricing impact, we enable investors to bring results forward, compounding EBITDA earlier and strengthening the equity story at exit.

Pricing is the fastest lever, but only if you start early enough. If you wait until post-close to even begin, you’ve already slowed yourself down. Simon-Kucher’s pricing due diligence bridges that gap by giving deal teams a day-one roadmap for pricing improvements.

Starting early is only half the battle

Capturing pricing impact depends on disciplined execution. Pricing is a capability, not a project. It’s a discrete function and needs a clear owner to drive.

Strong KPIs are essential, with leading firms using dashboards that not only track high-level margin impact but also drill down to customer and product level opportunities, linking directly to sales activities that close gaps in real time.

Value selling training is equally critical: teams must know how to articulate the value proposition, prove ROI, and handle objections. The best companies equip salesforces with ROI calculators, battlecards, and structured trainings at least annually.

Finally, tying sales compensation to pricing objectives ensures alignment, creating win-win behaviors and reinforcing the change. Without these enablers, even the best pricing strategy risks falling short in practice.

Execution is the differentiator

Our study shows that when initiatives fail, most of the reasons are controllable. In fact, 67% of failures come from execution gaps, not external shocks.

Poor implementation is the number one driver, cited by 53% of respondents, reflecting failures in planning, resourcing, or management.

PortCo resistance is another major cause, flagged by 35%, where lack of alignment or buy-in stalls momentum.

These numbers underscore why ownership, KPIs, value selling training, and aligned incentives are so critical: they directly address the execution risks that matter most. With these enablers in place, pricing moves from being just the fastest lever to being the most reliable one as well.

Interested in our 2025 Value Creation Study results in more detail?

Form placeholder. This will only show within the editor