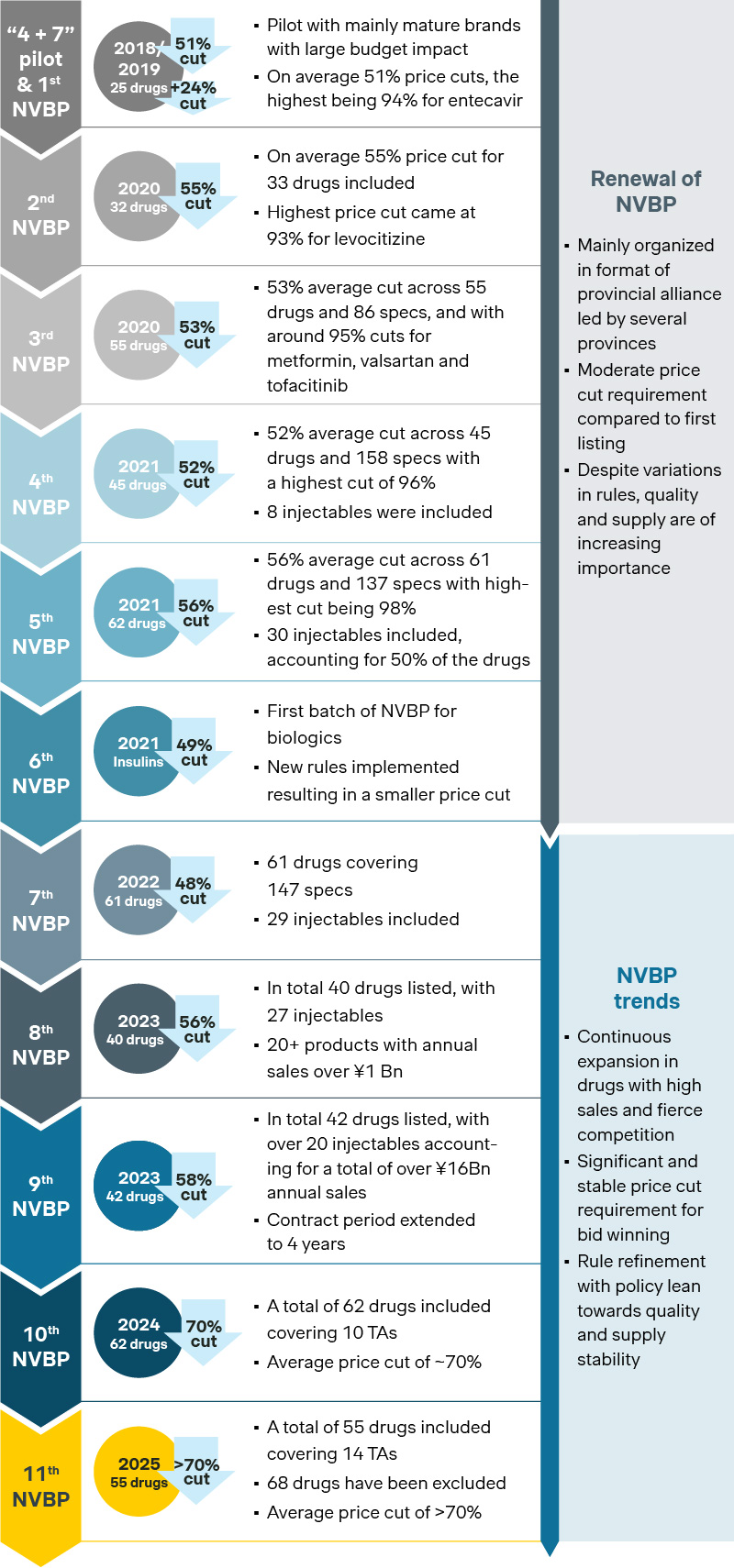

Competition has been intensifying at the latest round of national VoBP (national volume-based procurement), with many upping the ante one way or another. Strategic foresight and agility are key to navigating the changes and overcoming challenges.

The policies for the 11th round VoBP feature some major departures from earlier rounds, with unprecedented transparency on inclusion and exclusion criteria, and new emphasis on quality and allocation.

Source: Simon-Kucher insights

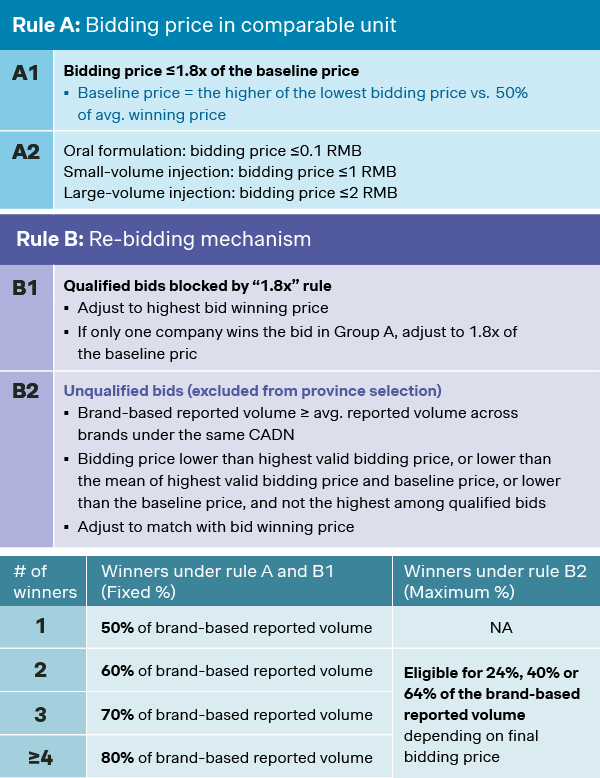

- The baseline price calculation has been refined. In previous rounds, the baseline price has always been set as the lowest bidding price. The new baseline price from 11th national VoBP is now set as the higher price of the lowest bid or 50% of the average bids, hence rendering the possibilities of higher baseline price for bidders. In fact, among the 55 drugs included in the 11th national VoBP, 8 of them adopted the new baseline which could be 150% higher than otherwise, and bidders for eltrombopag, sodium bicarbonate, avatrombopag, and salbutamol have been the ones benefiting from the new rule.

- Revival mechanism has been introduced for bids that failed the first time around, affording them another chance to get back in the game, while still qualifying under the “1.8x” rule per Rule B1. For those that missed the first two rounds, there’s also Rule B2 as minimum winning criteria, with less committed volume but still kept alive as valid bid.

- Updated volume allocation rule has been established where all winners are eligible to the committed volumes by their own brands, hence protecting the leading players from being unreasonably undercut by lowest price bidders.

Heightened competition

Despite the goodwill signals from the new policies and tender rules, the results of the 11th national VoBP indicated heightened competitions. Only 453 out of a total of 794 bids were successful, with the average price cut at a historical high of over 70%.

Source: Simon-Kucher insights

Not surprisingly, the most intense competition come from products with the highest number of generic players, including ceftizoxime, diprophylline, and famotidine, all of which saw over 40 manufacturers submitting bids. Blockbusters like dapagliflozin, olaparib, and roxadustat also saw remarkable competition from generic players, including many of the usual suspects but also new entrants like Hetero Labs and Cipla from India.

Source: Simon-Kucher insights

Local majors such as SJZ No.4 Pharma and Kelun came out as major winners, each securing 12 bids. With strengths in manufacturing prowess, supply chain efficiency, as well as economy of scale and scope, they will continue to be at the forefront.

Not surprisingly, most originator products chose to opt out and preserve their premium prices, with Viatris and B. Braun as the only exceptions with winning bids for nicergoline and multiple electrolytes respectively.

A life post VoBP

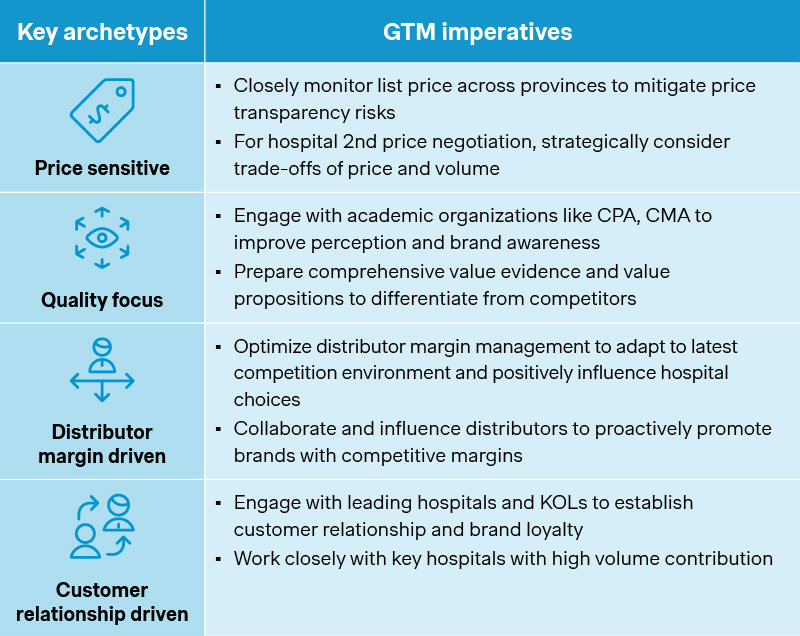

For the many originators opting out of the volume-based procurements, it doesn’t have to be the end of the story. In fact, many players have been planning ahead with a strategic framework to navigate the changes and mitigate the impacts.

There is no one-size-fits-all answer though. Given the distinct characteristics across different customer archetypes, sales channels, and relevant stakeholders, companies would need to assess, prioritize, and tailor the go-to-market levers accordingly.

Source: Simon-Kucher insights

For the all-important hospital channel, maintaining listing status at key accounts is crucial, while aiming for the remainder 20-40% of hospital volume not covered by the winning bids. That is what an originator hypercholesterolemia drug did after opting out of national VoBP, by entering new partnership with a leading distributor to capture the volume from the less price-sensitive and more brand-conscious customers. After an initial dip in its revenue, it has seen a steady recovery by focusing on the higher value customer segments and tailoring its go-to-market model accordingly.

In parallel, many have been doubling down on retail and online spaces, where channel push and customer pull can turn out to be a powerful combination. An immunology brand collaborated with direct-to-patient pharmacies to improve patient accessibility ahead of time and leveraged online platforms like JD Health and Ali Health for patient education. The impact of eventual national VoBP came much subdued as a result. More importantly, it was able to build on the big data and real-time consumer insights for better disease management and patient engagements, positioning itself for sustained growth amidst changes and uncertainties.

When a door closes, some windows may open. That is particularly true with VoBP.

Thanks to contributions from Wolfgang Liang and Jiuzhou Zhao!