As precision medicine advances, the success of biomarker strategies depends on both scientific innovation and overcoming market-specific funding and access barriers. There are steps pharma and diagnostics companies can take to navigate reimbursement frameworks, leverage laboratory-developed tests, and use temporary funding solutions to ensure timely and sustainable patient access.

Precision medicine has grown significantly as an area of interest and development for pharma and diagnostics companies over the past ten years, as evidenced by the number of FDA approvals for biomarkers tests as companion diagnostics (CDx). Before 2015, only 10 unique biomarkers were approved as companion diagnostics. Now, there are 38 approved biomarkers, primarily in oncological indications (e.g., HER2, BRCA1, ROS1, ESR1).

Pharma and diagnostics companies are continuing to invest in research and development of novel precision medicines that utilize a corresponding diagnostic to identify qualified patients. As treatments paired with new biomarker testing are being developed, how can pharma and diagnostics companies ensure sufficient funding and seamless access for biomarker testing?

The answer is multi-faceted and differs based on the market of interest. In all cases, addressing the question above is crucial to ensure timely uptake and ROI of the accompanying treatment.

First, it is important to establish the funding archetype for the market(s) of interest: tariff-based or budget-based.

- Tariff-based funding includes markets such as the US, France, Germany, Japan, and Italy. These markets allocate a specific reimbursement amount to a code that corresponds to the diagnostic test. The codes may be generic or tied to a specific indication/test-type, and in some instances (especially in the US), restrictions related to timing, prior authorization status, testing sequence, and more may be in place.

- In budget-based markets, such as the UK or Spain, there is no specific funding amount per test. Instead, budgets for testing are allocated to labs, and labs are responsible for distributing budget to diagnostic testing or applying for additional funds.

In some cases, a new diagnostic may already be covered under the existing codes or budget. For tariff-based markets, many standard testing modalities are associated with an established generic code and can immediately be applied by labs to bill for testing if no further restrictions exist. In the US, Germany, and France, for instance, established generic codes exist that cover all IHC and NGS-based testing, regardless of biomarker. In these instances, assuming regulatory approval of the prospective diagnostic, labs can immediately adopt and bill for the test.

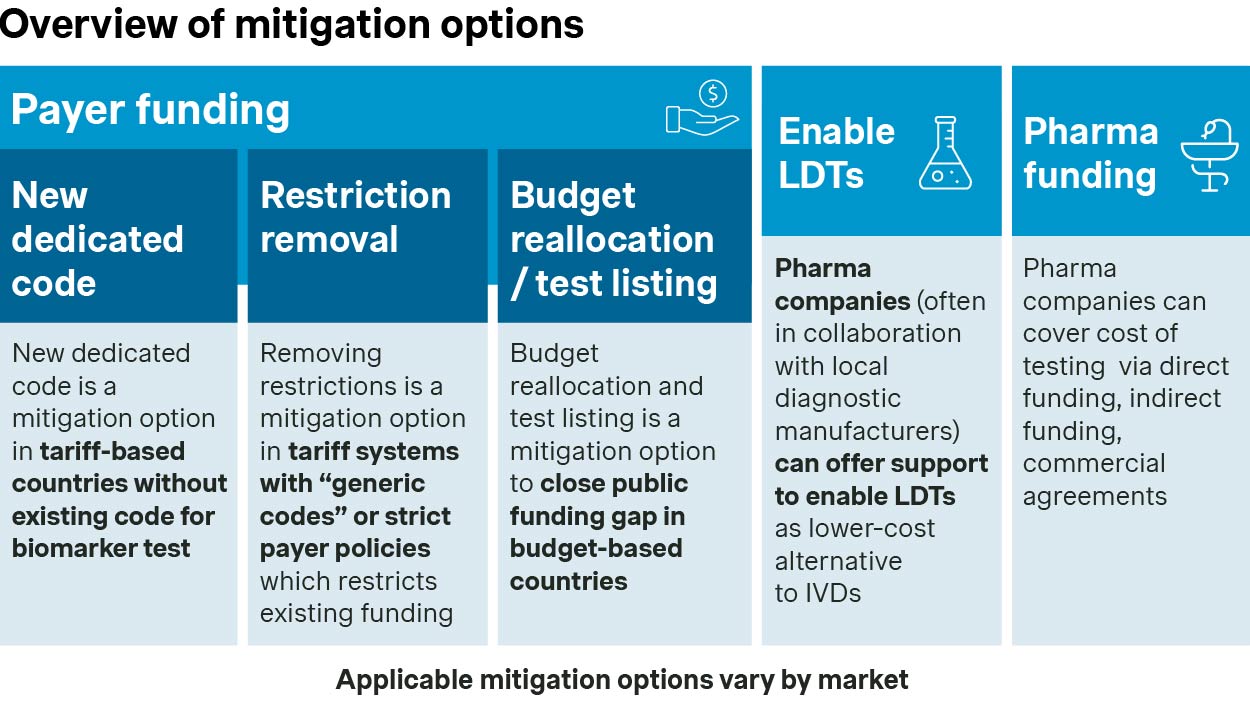

Given this, there are three key approaches to address funding gaps and access challenges:

Addressing challenges within a market’s existing funding framework

1. Tariff-based markets: Leveraging existing funding

For tariff-based markets, challenges largely lie with whether there are codes that currently apply to the new biomarker test. As an example, in the US, PCR-related codes are indication or biomarker-specific. In these cases, applying for a new code/reimbursement rate is required by the diagnostic manufacturer (the pharmaceutical company and scientific societies play an indirect role in code application process). This also applies to instances where the generic code reimbursement is not sufficient.

Novel code creation, though, may not be straightforward, especially in markets such as Germany where new codes are only possible in exceptional cases. A recent example of the creation of a new code for a companion diagnostic occurred in Germany in 2021, with the introduction of coding for MSI-H/dMMR testing to support the use of Keytruda and Jemperli.

2. Budget-based markets: Reprioritization of budgets

For budget-based markets, guidance and influence is required to nudge labs to reprioritize budgets for the diagnostic. Certain drivers support prioritization, including high demand for the treatment for which the diagnostic accompanies, national/sub-national guideline inclusion, and test directory inclusion.

An example of successful budget allocation may be found with BRCA testing and AstraZeneca’s Lynparza in Spain. In 2022, high physician demand and guideline inclusion successfully motivated labs in select regions to adjust their budget to cover the test.

LDT support to promote wide-spread uptake

Laboratory-developed tests (LDTs) are diagnostic tests that are designed, manufactured, and used within a single laboratory. These tests are used to some degree across markets, are less expensive than commercial assays, and offer a higher degree of flexibility to be modified.

With that said, initial development of these tests requires a high level of expertise and investments, and in the US and the EU, LDT use is undergoing an increasing number of restrictions. Even with the increasing restrictions however, labs will continue to have financial motivation to utilize LDTs over commercial IVDs.

An example of an LDT success case is Merck’s Keytruda requiring testing with PD-L1 IHC 22C3 pharmDx from Dako. The low funding level and small footprint of Dako’s associated platform at the time necessitated alternate forms of testing, such as LDTs. To support this, Merck sponsored a concordance study that established protocols for cross-platform testing of the assay. The study showed high concordance between different platforms, providing strong argument for cross-platform use.

Pharma funding as a bridge option

In some instances, pharma funding is required to bridge the gap to sufficient funding (i.e., while applying for a new code or increased funding amount). The emphasis here is on ‘bridge,’ meaning that manufacturers need to carefully plan the timeline, including exit strategy, for this funding route. Otherwise, there is a chance markets could start to rely on pharma funding as a long-term solution to access.

AstraZeneca covered plasma-based EGFR T790M testing in the UK as a companion test for Tagrisso until this modality of testing was broadly established. In the US, Novartis partnered with Qiagen and Neogenomics Laboratories to identify patients eligible for Piqray by tumor tissue or plasma PIK3CA mutation PCR test until sufficient reimbursement was established for the majority of the patient population.

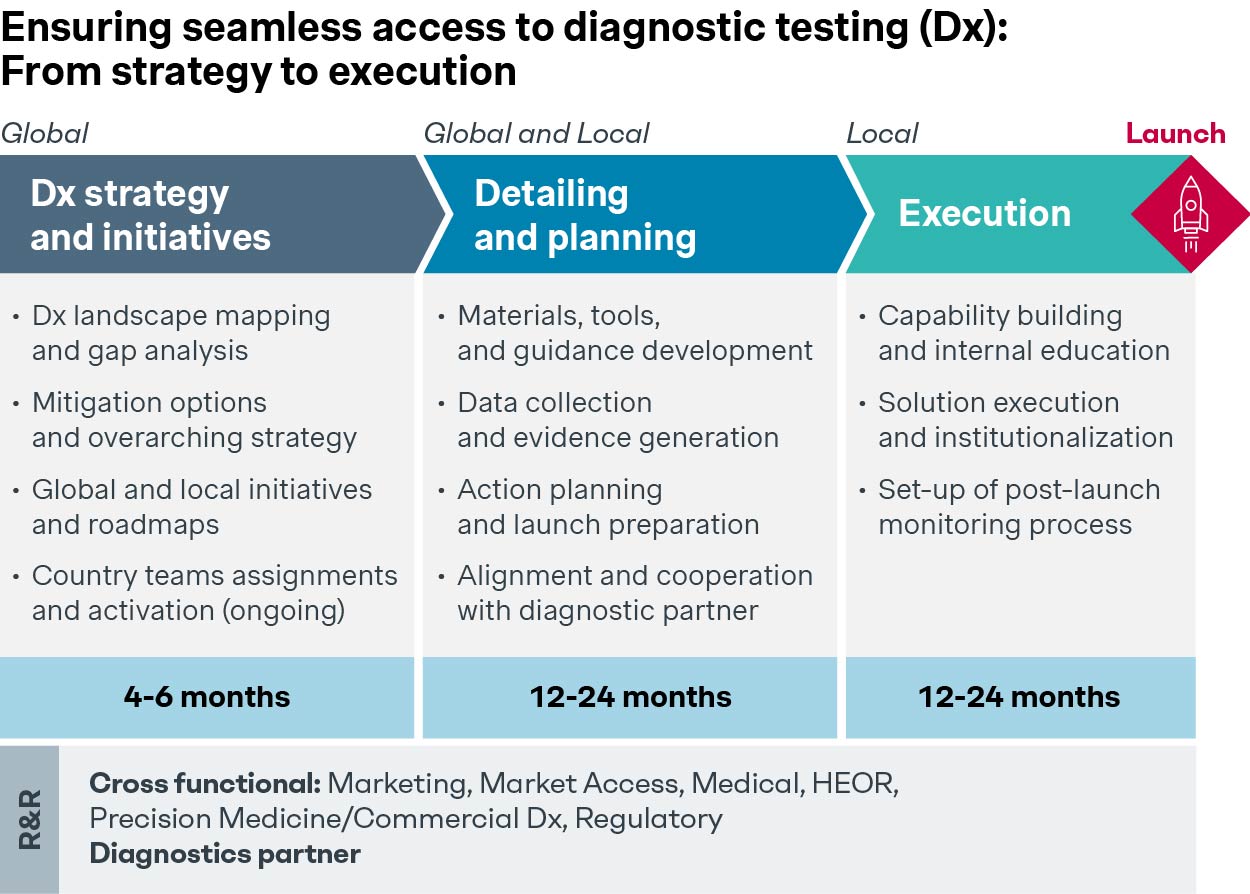

Ensuring seamless access and funding for biomarker testing is possible with proper planning

There are many challenges to account for when developing an access strategy for a precision medicine-associated diagnostic, which can vary based on funding system (budget vs. tariff), type of testing, and formal linkages between the diagnostic and Rx. Biomarker testing strategies define how to address access challenges, which can include pharma companies funding tests or promoting LDTs as either short or long-term solutions.

Early planning and preparation are essential during the pre-pivotal phase, and global/local team involvement is key to building a robust biomarker access strategy that will not hinder the Rx’s potential usage.

Finally, a winning biomarker access strategy requires clearly defined roles and responsibilities split between the pharma company and diagnostic manufacturers.

If your team is interested in formulating a winning precision medicine biomarker testing access and funding strategy, Simon-Kucher can help! Please reach out to our dedicated team of experts to learn more about how we can support.