Although last quarter showed slight economic growth in the Netherlands, the economic outlook continues to be uncertain and B2B companies must prepare today to meet tomorrow’s challenges. As inflation remains high, costs remain volatile, and skilled-labor forces remain scarce — commercial levers are the best option left to push up margins.

The economic climate continues to be uncertain, and the threat of a recession dropping market volumes is not gone. At the same time, CAPEX investments are becoming harder to capitalize as interest rates continue to rise yet overall consumer confidence and demand is down, lowering capital asset utilization. These factors disproportionately impact B2B companies which need to already prepare today to defend future margins of tomorrow.

Three years after the start of the pandemic, cost-cutting opportunities have largely been expended and are often not enough in today’s economic climate. Energy, raw materials, and transport costs remain volatile – and the Netherlands is currently experiencing one of the sharpest labor shortages on record, rendering further downsizing exercises unwise.

Commercial strategy levers are the best option for B2B companies looking to prepare for these uncertain times ahead.

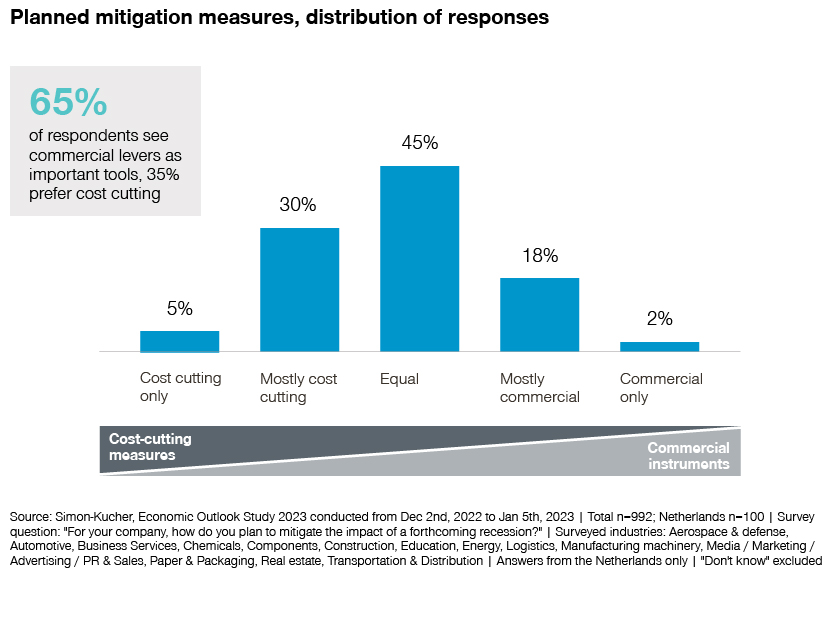

Our recent study of 992 companies – including 100 businesses from the Netherlands – captured a global snapshot of attitudes regarding the future commercial reality across B2B sectors. It revealed that B2B companies in the Netherlands show a growing preparedness for potential storms ahead but are cautiously optimistic on the economic outlook.

In fact, three quarters of firms in the Netherlands expect stable or increasing profits even in the face of economic uncertainty. On top of that, more than 50% say they feel well-prepared to tackle potential recessions mainly through commercial levers.

In this article, we take a closer look at the top actionable insights for building resilience – and how B2B companies can strategically prioritize commercial levers to unlock sustainable growth, even in these uncertain times.

Key Trend

Our study clearly identified the trend within B2B companies to focus on commercial, as opposed to traditional cost cutting strategic levers. In fact, for the first time in this survey’s history, commercial levers became the plurality of respondents’ priorities.

● 45% of respondents said cost-cutting and commercial levers were equally important.

● 20% of industrial leaders are either mostly or only focused on commercial levers.

So, what are the best practices for B2B companies – when addressing the commercial challenges of an uncertain economic outlook.

1. Focus Resources

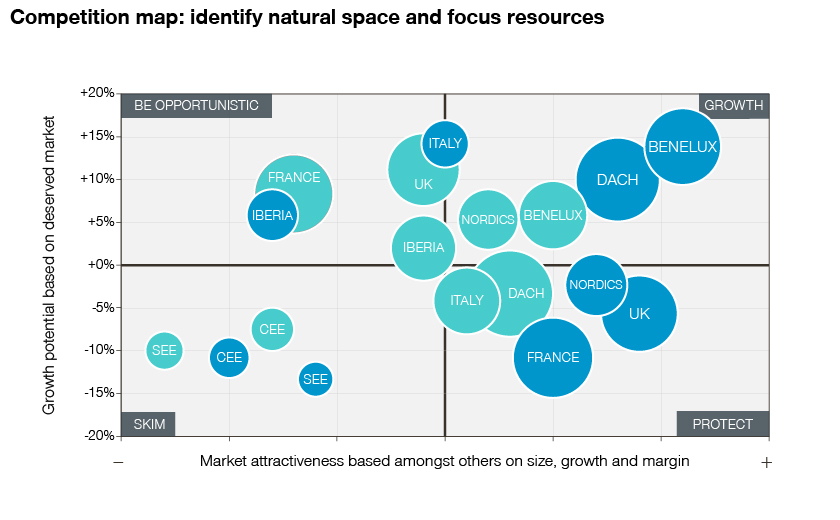

Focus is key for any organization but is especially crucial when preparing for economic uncertainty. The important decision is where to put that focus. Hard choices about what, or what not, to do must be made. It is critical that business leaders fully understand their market positions and are competently able to determine the most attractive market segments and align them with their own competitive advantage.

The truth is, even in a world of ‘big data’, many organizations still work on leadership’s intuition and gut-feelings – lacking the fact-based insights needed to drive a commercial strategy. Without this, there’s no solid base for discussion or decision-making.

As a result, an often-seen knee-jerk reaction to recession is to chase volume in current markets. But what if the market is stagnant, and competition has a similar volume ambition? B2B companies will end up fighting for customers through a price war. However, smart companies understand which markets are most attractive – and where they have a competitive edge, which can lead to better margins and potential growth.

For example, one of our clients – an automotive supplier – was attacked in its home market where it was market leader and made strong margins. The main competitor saw this attractive market and placed a low-priced attack. A first reaction could have been to aggressively follow with a price decrease to defend the market – lowering everybody’s margins. However, they understood their own – and their competitors’ – position and introduced a similarly low-priced attack on one of the competitor’s key home markets. This was incentive enough for the competition to back off. A well-implemented strategic reaction that wouldn’t have been possible without knowing the competition’s market positions.

This shows the importance of a fact-based market picture; one which leverages internal and external market insights. Even in a B2B niche market with a lack of market reports, it’s important to ensure a foundation, even if it is not 100% accurate. Transactional data, customer insights, sales team insights, and industry experts can all provide input for building a market picture; functioning as a starting point for essential decisions. B2B business leaders need to know where to focus the sales force, and which geographies, markets or customers they no longer serve. At the same time, they need to know where to invest for innovation, and which products to rationalize.

2. Differentiate Pricing

Inflation will remain high compared to last decade and the leading companies all understand that pricing is a whole organization effort, with many departments playing a role. Current high inflation has made price increases an important commercial enabler. But, just like with muscles, the mechanisms and processes for increasing prices will atrophy over time if not exercised properly in the past low inflation years. Pricing should be the first commercial lever; protecting your margins by passing on increased costs. However, getting this right is no easy feat and organizations need to be smart to avoid hurting their brand, and damaging customer relationships.

Price increase campaigns are about differentiation. It starts with the understanding that there’s no ‘one price increase fits all’. B2B companies need to drill down to analyze the price elasticity and willingness-to-pay, per market and per customer. Business leaders need to organize their team accordingly, getting different departments together and approaching price increases holistically.

This involves getting Finance and Procurement to understand that cost increases need to be passed on. At the same time, Sales must understand the story, the arguments, and practice. For that to happen, it has to be a C-level priority to give this topic the true organizational attention that it requires. If it’s not grounded at C-level, Sales are less likely to focus on the price increase, and continue as before, hunting volume at the expense of margin. Done right, it can have a powerful organizational and financial impact.

Take this example from one of our clients: They reallocated their Procurement department from being an Operations function to sitting under the Chief Commercial Officer. In doing so, they made it part of their commercial go-to-market. The benefits were immediate. With the commercial organization closely aligned with Procurement, the company’s commercial agility increased and helped to keep prices up to date against market volatility. It also enabled much more accurate forecasting – helping moderate the volatility of prices towards the customers.

There was also an unexpected and positive impact on the competitiveness of cost prices. Why? Because Procurement had much greater transparency over which part of the product portfolio really mattered to Sales, they focused harder on fighting down costs in those products. In these uncertain times, it pays off to invest in commercial pricing capabilities because successful price increase campaigns require the full organization to work together.

3. Embrace Digital Transformation

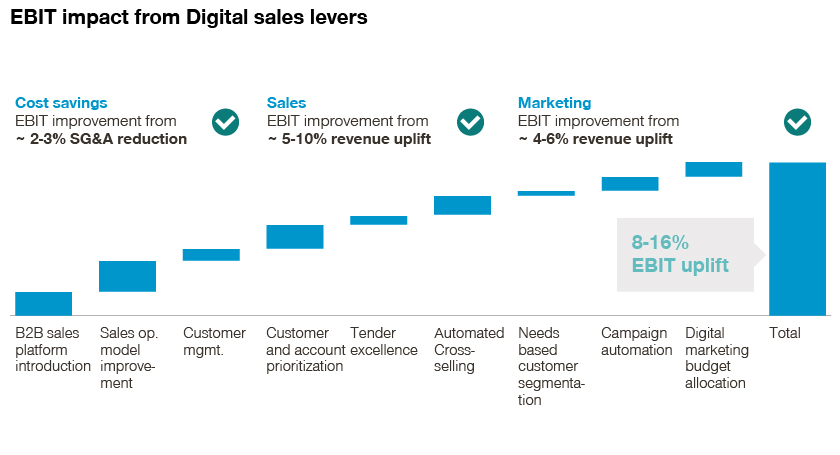

When it comes to digital tools, B2B companies often lag behind the more transactional and data rich B2C sectors. However, it’s important to recognize that digital investments are a survival factor in these uncertain times – especially considering the imminent shortage of technical salespeople, which will only worsen as veteran employees continue to retire without sufficient replacements.

What business leaders need to do is focus on the most valuable deals. This begins with getting sales to optimize their time and doing what they do best – convincing customers and closing deals. Other factors can also make a significant difference, such as reducing admin, answering non-technical queries, travelling, and focusing on added-value contacts.

At the same time, the customer journey has moved significantly into the digital space. It’s increasingly digital, measurable, and trackable – enhancing the opportunities to build ongoing and more profitable customer relationships, and focusing on customer lifetime value rather than one-off transactions.

We are currently taking one client through a complete revamp of their go-to-market, moving from one-size-fits-all today to a segment-driven approach to Sales, Market, Pricing, Assortment, and Services. This is a journey over years. However, once at the other end, the customer-journey will be front and center.

This transformation will dramatically change how the client interacts with their customers, with each able to contribute and tailor their approach to the specific customer. This enables the company to optimize the value extracted from each customer segment. Something made possible because they have been making digital capability investments for many years previously.

Many forward-thinking B2B companies also leverage webshops, either building their own, working with partners, or going through established platforms like Amazon. This creates opportunities for dynamic pricing.

4. Invest In Dynamic Pricing

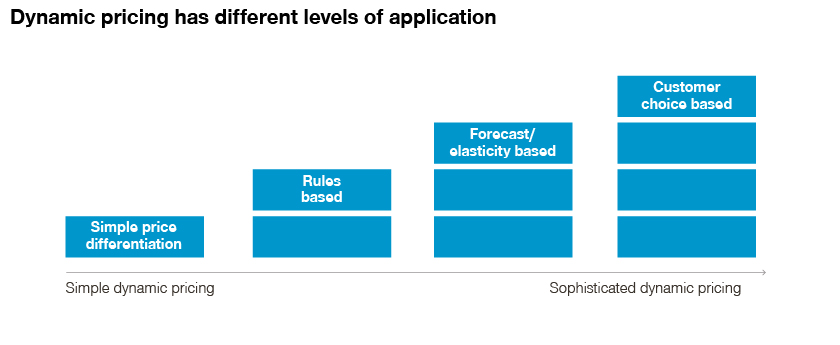

Dynamic pricing is another digital solution for weathering future economic storms, and intelligently responding to changes in demand. But as our study shows, it’s not yet seen as a priority by business leaders.

B2B companies are typically more preoccupied with technical, and operational excellence instead of extracting full value from pricing. Static price models are put in the market and only reviewed once a year. This is too infrequent to keep up with market fluctuations. The world is digitizing, and market dynamics are changing at an increasingly faster pace – especially with today’s volatile markets. It is easy to see why investment in the midterm might feel counterintuitive at a time when downsizing is being considered; however, experience shows that dynamic pricing creates differentiating capabilities and considerable value for B2B companies.

Extracting full willingness to pay out of the market is the most impactful way to improve profit. Though it’s an investment with a midterm pay-off time, this is a skill that companies need to develop. Due to the complexity of the topic and systems required, a full solution can take up to 2 years to build and roll-out. It is precisely because investments in dynamic pricing and other advanced commercial capabilities today will take years to create impact at scale, that it is imperative to start early to be ahead of the next economic downturn. If we learned anything about the B2B sector during the pandemic, it’s that the most agile organizations can successfully navigate rapidly deteriorating markets.

Forward-thinking B2B companies view dynamic pricing as a strategic differentiator which will enable them to better ride-out the next economic downtown. In the current ‘cautiously optimistic’ outlook, it becomes a moral imperative to invest today against the uncertainty of tomorrow. Looking at it another way, if we knew there would be an impending economic downturn 5-years from now, and history would tell us that recessions are long-term periodic trends, would dynamic pricing still be seen as a distant priority?

5. Leverage Sustainability

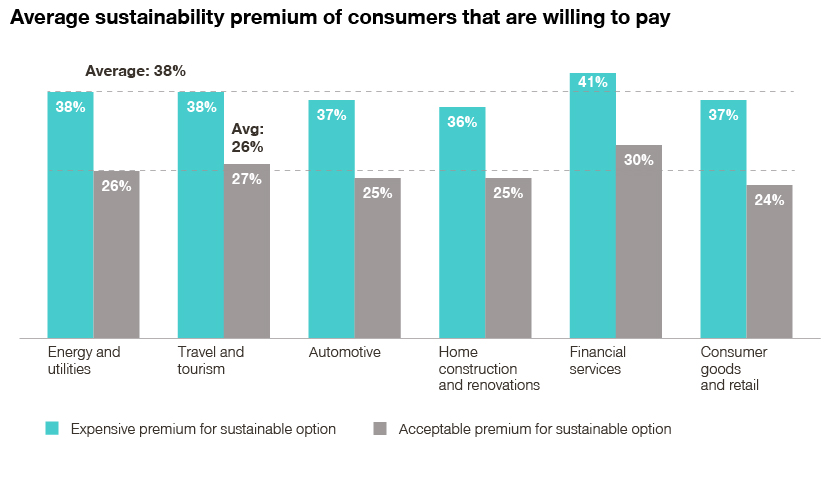

B2B companies have woken up to society’s demand for sustainability. While sustainability has been driven by a regulatory push, it’s increasingly powered by client needs with sustainable products being now commonly seen as a default requirement by consumers.

However, they say that necessity is the mother of all invention. Rather than viewing sustainability as a burden, B2B businesses can seize the opportunity to re-imagine their product portfolios in light of the increased cost of resources and raw materials. Consumers see the value in sustainability first, but that value is now slowly moving upstream to B2B companies. Whilst sustainability is a somewhat novel concept, particularly for B2B companies early in the value chain, and is often poorly priced – it represents a near-term source of top-line growth.

In fact, best-practice sustainability is not just an add-on, but rather an integrated part of the main business. Sustainability is everywhere, and business leaders need to see where their company plays it part. In our portfolio we’ve worked with both alternative meat producers as well as food ingredients producers—the value of a soybean is worth way more to a meatless burger producer than to an animal feed producer. B2C companies understood this already and now B2B companies, up-and-down the value chain, are starting to capture the value of sustainability as well.

Final Thoughts

Our research shows that when it comes to cost-cutting and the use of commercial levers in B2B business, there’s been a noticeable shift towards commercial actions. Business leaders in the B2B sector see cost-cutting is no longer the most viable or beneficial approach for dealing with economic uncertainty. Key actions business leaders can take now to unlock this commercial opportunity are:

1. Know where to focus resources

2. Zero-in on margin management

3. Get started with dynamic pricing

4. Invest in digitalization

5. Align operations on sustainability and make it commercially successful

We at Simon-Kucher encourage all business leaders to be forward-thinking and prepare today, to realize better growth tomorrow.

Do you have everything in place to brace the financial storm? Find out how Simon-Kucher can help you press the right commercial levers. Contact us. Also for the full study results.

Seminar

To help business-oriented companies succeed in their quest for more sustainable growth in these challenging times, we organize a seminar with a dedicated business-to-business program. During this event, FD economist Mathijs Bouman, industry leaders and our growth experts will share their perspectives on how to drive profitable growth in times of economic uncertainty. On top of this, Laurent Pasqualini (CEO of Caldic Europe) will share his firsthand experience on how to accelerate growth and build an uncertainty-resilient team. Furthermore, we will discuss new B2B insights on effectively shifting from price increases to margin management and how to best organize and align your commercial teams in a digital age

Please be aware the seats are limited and therefore it is recommended to quickly register via this form.