Defining a robust pricing and market access (P&MA) strategy is indispensable for companies aiming for a successful launch in Europe. France and Germany stand out as key European markets demanding strategic attention due to their significant market size, stringent Health Technology Assessment (HTA) requirements, economic impact, and integral role in international price referencing.

Understanding their healthcare models and converging P&MA developments is a key agenda item for the global summit of pharmaceutical stakeholders. As recent healthcare reforms shape the landscapes of France and Germany, we answer the question: Are the French and German P&MA systems heading toward the same destination? We explore the parallels in their current healthcare models, observe evolving dynamics, and dissect the future course of pharmaceutical success in these influential European markets.

HTA evaluation outcomes: Do France and Germany value therapeutic innovations in a similar manner?

France and Germany have comparable HTA and pricing approaches. In contrast to markets like the UK and Sweden, which focus more heavily on cost-effectiveness, France and Germany are driven by clinical evidence standards. Both countries employ a distinct two-tier system that mainly relies on clinical evaluations and price negotiations.

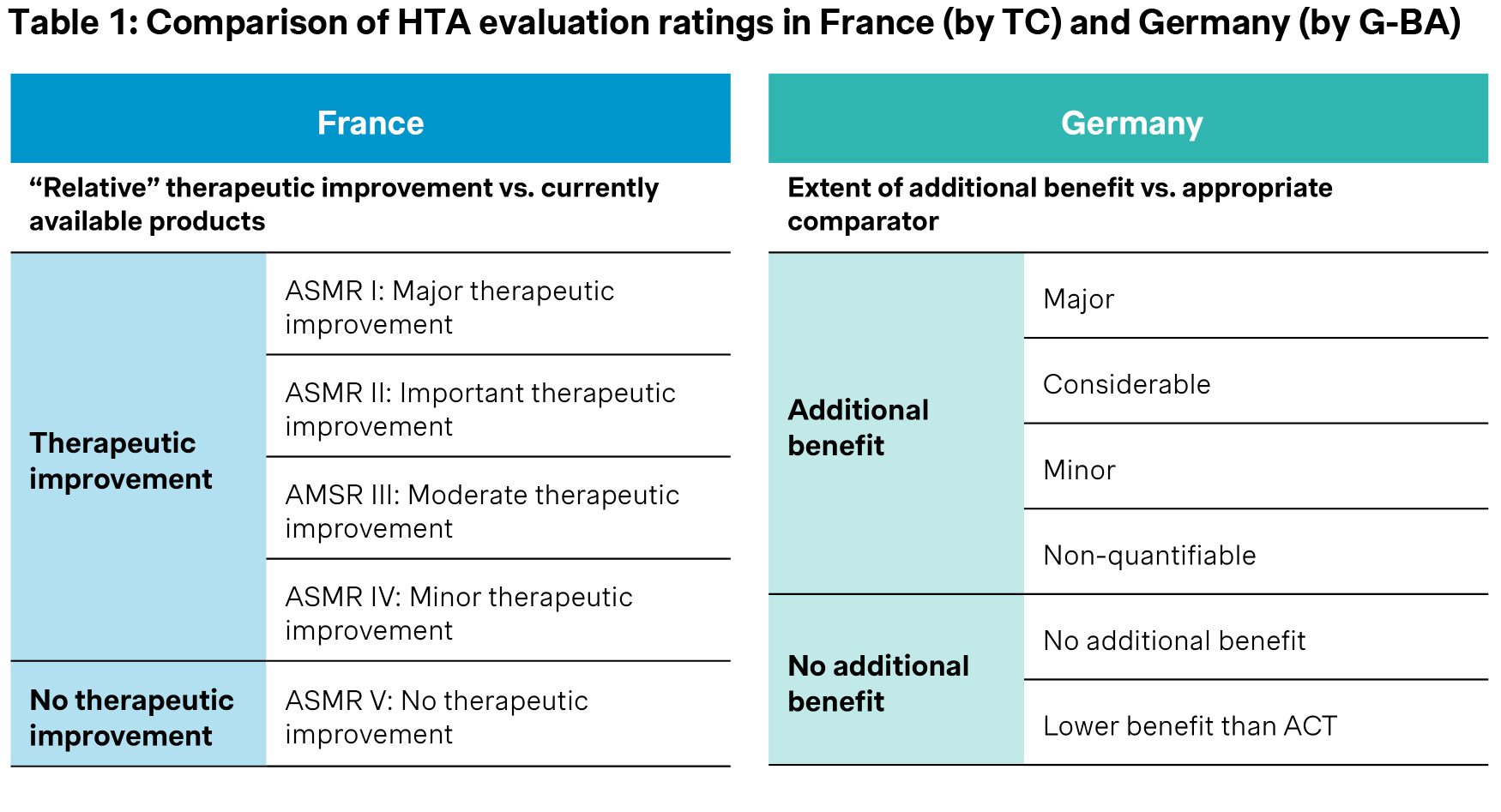

The French HTA system has been a clear role model for the development of the German regulation for pricing and reimbursement of pharmaceuticals. The introduction of the “AMNOG reform - Arzneimittelmarktneuordnungsgesetz” in 2011, as part of a comprehensive healthcare reform, brought a substantial change to the reimbursement of new drugs in Germany, adopting a HTA process akin to that of France. This process requires manufacturers to submit a dossier, triggering a systematic and formal evaluation of the relative therapeutic improvement of a new drug compared to the standard of care and therefore negotiate a reimbursement price reflective of the drug’s therapeutic value. Both France and Germany assess this relative therapeutic improvement, with France employing an ASMR scale system and Germany using an added benefit scale but with different implications for pricing (see Table 1: Comparison of HTA evaluation rating scales in France (by TC) and Germany (by G-BA)).

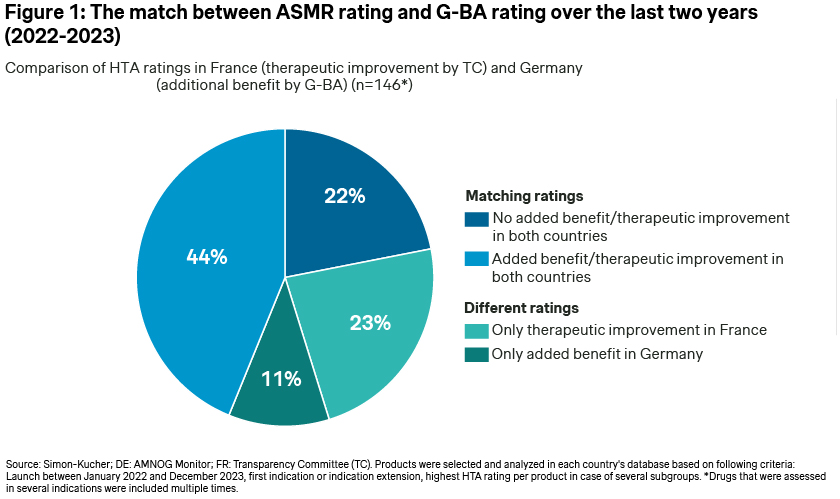

We, at Simon-Kucher, compared the HTA ratings of a total of 146 drugs launched in the same indication from January 2022 to December 2023. When extracting the rating scores (highest rating per product in case of several subgroups) for each country, a positive outcome was defined by an ASMR rating range from I to IV in France, along with any of the added benefit ratings (“non-quantifiable” “minor”, “considerable”, and “major”) in Germany. Conversely, the absence of a therapeutic improvement/additional benefit was denoted by an “ASMR V” rating in France and a “no added benefit” rating in Germany.

The analysis found that 66% of cases demonstrated matching HTA outcomes, indicating either a positive or a negative relative therapeutic improvement rating in both countries (respectively 44% and 22%) (Figure 1: The match between ASMR rating and G-BA rating over the last two years (2022-2023)).

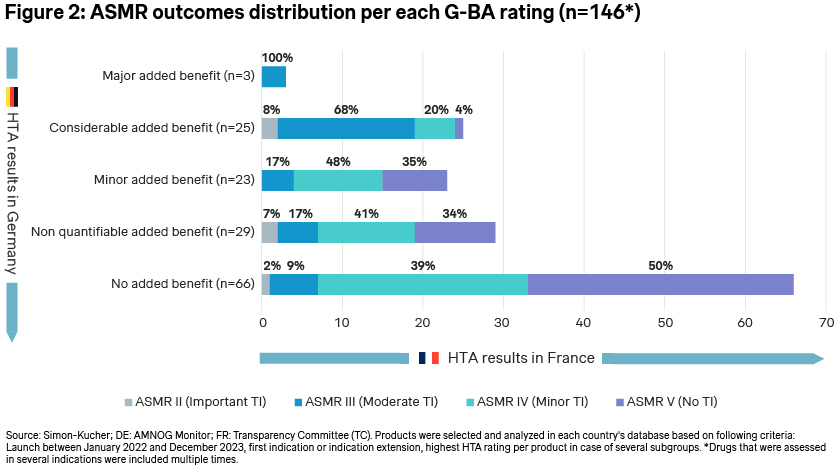

While the general trend of positive or negative HTA outcomes in France and Germany aligns in the majority of cases, a more granular examination of the rankings reveals that there is no direct correlation between the added benefit ranking by the G-BA in Germany and the ASMR rating scale in France (Figure 2: ASMR outcomes distribution per each G-BA rating (N=146*)). The analysis indicates that receiving a “no added benefit” in Germany does not necessarily equate to an ASMR V rating in France. For instance, out of 66 drugs that received “no added benefit” by the G-BA, the TC still granted a minor therapeutic improvement (ASMR IV) in 39% of cases and a moderate therapeutic improvement (ASMR III) in 9% of cases. Conversely, among the 25 drugs that received a “considerable added benefit” rating by the G-BA, 4% were still ranked with an ASMR V rating, indicating no therapeutic improvement by the TC. These notable differences may stem from varying acceptance of comparators, differing valuations of clinical endpoints (such as progression-free survival in oncology) or methodological requirements to acknowledge patient-relevant benefits (e.g., measurement of health-related quality of life).

In summary, while directly comparing HTA outcomes and their implications for pricing is complex and country-specific, there appears to be some alignment between France’s and Germany’s HTA rating systems, but with notable differences that need to be looked at through country-specific lenses.

Do the latest healthcare reforms in France and Germany indicate a convergence between the two systems?

Recent healthcare reforms in both France and Germany suggest further alignment in their directions for drug pricing and reimbursement. Beyond a shared commitment to direct and faster drug accessibility, governments in both countries are gradually implementing cost-containment measures. Germany is set to follow France’s early lead after the latest introduction of the “Financial Stabilization of the Statutory Health Insurance System” (GKV-Finanzstabilisierungsgesetz) law in November 2022, which aims to reduce the nation’s 17-billion-euro healthcare deficit.

Let’s explore some key aspects of Germany’s latest healthcare reform, comparing them to France’s pricing and reimbursement regulations. Our attention will then turn to France, highlighting how the country’s latest healthcare trends and measures align with or differ from Germany’s pricing and reimbursement rules.

Is Germany’s healthcare reform on par with France’s P&R regulations?

Germany’s latest AMNOG reform encompasses substantial cost-containment measures as the German healthcare system faces increased costs. At the same time, the system suffers from a reduced inflow of funds. As part of the reform, a number of new rules have been implemented, specifically targeting the pricing and reimbursement of new drugs. These measures encompass, among others, the following two changes that directly impact the visible list prices of pharmaceuticals in Germany.

- New pricing guardrails for AMNOG price negotiations

The new reform mandates new AMNOG pricing guardrails for products with patent-protected ACTs, impacting the monetization of drugs with “no added benefit” or “minor/non-quantifiable” added benefit. While in the old AMNOG regulation a “no added benefit” rating would mean that prices should not exceed those of the most economically appropriate comparator therapy (ACT), the new regulation mandates a minimum discount of 10% versus the patent-protected ACT. Linking a “no added benefit” rating to a percentage discount versus the most economical ACT exemplifies France’s pricing approach, particularly in the case of an ASMR V rating (“no therapeutic improvement”), where a discount versus the least expensive comparator is expected. Furthermore, under the new regulation, a “minor/non-quantifiable added benefit” no longer allows for a premium versus the patent-protected ACT in Germany, similar to the ASMR IV rating in France that implies price parity versus the comparator. While pricing guardrails are formally established in both countries, the reimbursement price is still subject to negotiation and varies on a case-by-case basis.

- Mandatory volume-based price model components

The introduction of mandatory Price-Volume Agreements (PVAs) in Germany goes in the same direction as existing and commonly used PVAs in France (even if contracts in France now favor straight discounts vs. PVAs in price negotiations). While previously, volume-based price components were only optional and applied in practice in selected cases in Germany, the mandating of PVAs to some extent aligns with France’s volume-based discount mechanisms. In both countries, PVAs are negotiated on a case-by-case basis with different ways of operationalization but with details kept confidential. However, in a recent public ruling for cemiplimab, the German arbitration board opted for a PVA model, applying a 1.85% discount on cemiplimab’s annual revenue growth and transformed it into a prospective list price decrease. While this ruling is public and will set a precedent for price negotiations, it doesn’t imply that every product will necessarily have the same PVA model in Germany.

Several differences between the two countries are emerging. For example, in Germany, the PVA effect is prospective, impacting the visible list price based on annual revenue or volume growth, whereas in France, it typically affects the confidential net price based on defined revenue thresholds. Additionally, PVAs in France are non-mandatory and often more stringent, allowing for additional contracts and terms to be negotiated with the CEPS. The future application of PVAs in both countries, particularly the determination of discount rates in Germany, remains uncertain and could become a crucial negotiation factor in the future.

Is France moving toward German AMNOG processes?

Before the introduction of Germany’s AMNOG reforms in 2022, the French Government had already implemented various cost-containment measures in its pricing and reimbursement regulation. In its latest healthcare developments, France focuses on direct and faster access to new drugs and explores experimental arbitration processes, close to that of Germany.

- “Direct Access” model

The introduction of the new “Direct Access” reform in France in 2022 marks a significant change. Under this reform, certain drugs with an ASMR rating of I to IV now qualify for direct reimbursement after the TC assessment at a free temporary price for 10 months. This will later include paybacks so that the negotiated price retrospectively takes effect during that period. The reform accelerates access to specific eligible drugs, a benefit that was previously reserved for innovative drugs qualifying for the Early Access Program (EAP). While France’s “Direct Access” reform is moving in a direction similar to Germany, it still differs significantly from the German reimbursement process: In Germany, new drugs are reimbursed right after marketing authorization, contrasting France where reimbursement is only granted after the TC assessment. The free pricing period in Germany was recently reduced from twelve to six months as part of the new AMNOG reform, whereby the negotiated price retrospectively takes effect from the seventh month through payback mechanisms. This differs from France, which does not employ a real free pricing period and instead implements paybacks based on the negotiated price from the first month onward.

- Experimental “arbitration-like” procedure

The integration of an “arbitration-like” mechanism in the Accord Cadre (2021-2024), a framework agreement between the industry association of French pharmaceutical manufacturers (LEEM) and the CEPS, serves as another instance of France’s inspiration from Germany’s P&R system. For both countries, if the negotiating parties fail to reach an agreement, an additional procedure is put in place to decide on the final reimbursed price and, if possible, terminate negotiations. In France, this procedure is available only for innovative products with an ASMR rating of I-III that could not reach an agreement after a minimum of 10 negotiation rounds. This stands in contrast to Germany, where arbitration is formally set in four official negotiation rounds and is an option for all drugs. While in Germany, a third-party arbitration board has the final decision-making authority, France opts for a more straightforward negotiation process, without the involvement of third parties. The concerned stakeholders remain the manufacturer and CEPS. The evolution of this procedure in France is still under evaluation, given its experimental nature, and may be removed, expanded, or refined.

France and Germany’s synchronized healthcare trends

France and Germany aren’t simply influencing each other, they are also strategically moving in parallel. This synchronized evolution of healthcare policies reflects a deliberate convergence, which can be illustrated with their simultaneous reforms for combination treatments.

With the latest AMNOG reform, German legislators have introduced an additional rebate of 20% to sick funds for each prescription of a combination therapy consisting of two AMNOG-assessed active substances. Combinations that achieved a considerable or major added benefit rating for a specific patient population are exempt from that ruling (for prescriptions in that specific patient population). Concomitantly, France embraced a ground-breaking reform known as “AMM Miroir”, unlocking reimbursement of a drug without market authorization (MA) used in a combination treatment with another drug which does have MA for the combination itself. This applies when the drug without the market authorization for the combination is already on the T2A exclusion list (i.e., pass-through reimbursement for expensive hospital drugs) for at least one indication, and if the other drug in the combination submits a P&MA dossier for the reimbursement of this combination. The “Mirror” market authorization ensures unchanged reimbursement prices and mandatory rebates for the drug without the market authorization for combination (implementation decree with level of rebates still pending).

Conclusion and outlook

The P&MA systems in France and Germany are undeniably heading in similar directions. Recent healthcare reforms showcase that both countries are actively adopting elements from each other’s pricing and reimbursement frameworks, indicating a synchronized tandem movement observed in both directions—France to Germany, and Germany to France, with concurrent change.

Germany’s recent healthcare reform, notably the ‘GKV-Finanzstabilisierungsgesetz,’ has already catalyzed substantial changes in national price negotiations, with a further reform underway, potentially aligning Germany’s system even closer to that of France. Speculation around the introduction of confidential discounts in Germany and potential revisions to international price referencing questions a further shift in the direction of France or other European markets.

Similarly, discussions in France suggest potential shifts toward the German model. While concrete measures have not been observed yet, the integration of an ASMR rating equivalent to the “non-quantifiable” is being considered for added benefit rating in Germany for pharmaceuticals currently receiving an ASMR V due to data immaturity.

While there is a big question mark around whether and how these changes will come, the future poses further intriguing questions: Will Germany adopt confidential discounts similar to France, opening avenues for list-to-net price differentials? Conversely, will France move closer to Germany’s model, by adopting a new ASMR rating to help mitigate the negative price implication of immature data, similar to the non-quantifiable added benefit rating in Germany?

Staying abreast of policy changes in both France and Germany is crucial to fully grasping this complex environment and understanding the implications of these new measures for successful pricing and market access. With extensive P&MA expertise and experience in national price negotiations in both countries, Simon-Kucher is your strategic partner in navigating these shifts. Reach out to our experts for further inquiries and insights into pricing and market access-analyses.

Trending Topic

Better Market Access

The role of better market access is to remove any hurdle that prevents or hinders patients from receiving available treatments. In the right place, and at the right time.

Today, the impact of market access spans clinical development, regional commercial activities, patient engagement, and post-launch compliance. Yet, for many pharmaceutical companies, planning for commercialization only truly begins when a drug has been submitted for approval — far too late in the process.

Get to know our insights on local trends, regional and global developments and global to local excellence.

Thanks to contributions from Juliette Levisalles!