The Medicare Drug Price Negotiation process as part of the US Inflation Reduction Act is underway, with the initial rounds of negotiations set to begin. We’re here to help you understand the challenges involved, and how to successfully navigate through them.

As we begin 2024, we are currently in the ‘calm before the storm’ when it comes to implementation of the Medicare Drug Price Negotiation process (as part of the Inflation Reduction Act).

The first cycle of negotiation

Manufacturers of the first ten drugs selected for negotiation [Table 1] have submitted their dossiers to CMS and presented their case on the appropriate comparator therapies and their value over those alternatives.

| Table 1. List of 10 drugs selected for the Medicare Drug Price Negotiation Program (2026) | |

|---|---|

| Drug name | Participating manufacturer |

| Eliquis | Bristol Myers Squibb |

| Jardiance | Boehringer Ingelheim |

| Xarelto | Janssen Pharma |

| Januvia | Merck Sharp Dohme |

| Farxiga | AstraZeneca AB |

| Entresto | Novartis Pharma Corp |

| Enbrel | Immunex Corporation |

| Imbruvica | Pharmacyclics LLC |

| Stelara | Janssen Biotech, Inc. |

| Fiasp; Fiasp FlexTouch; Fiasp PenFill; NovoLog; NovoLog FlexPen; NovoLog PenFill | Novo Nordisk Inc. |

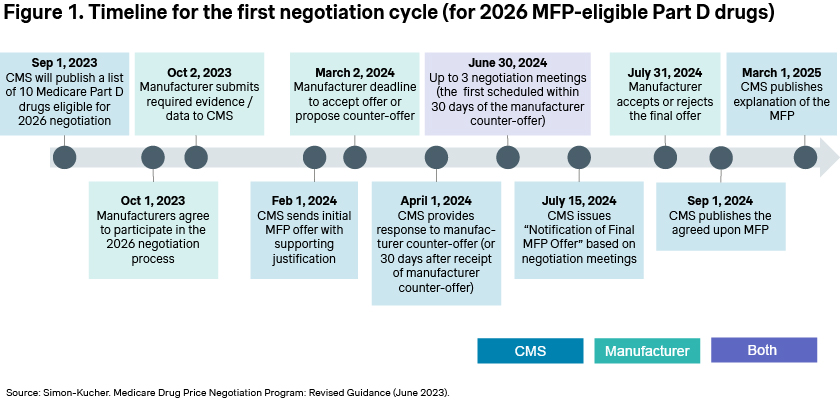

Manufacturers have also now received CMS’ initial offer, with the stated goal of finalizing negotiations by June [Figure 1]. If an agreement is reached, the negotiated prices will be published in September 2024, but the rationale underlying those decisions may not be published until March 2025.

While the upcoming round of negotiations will again focus on Part D drugs, starting in 2026, Part B drugs will also become eligible for negotiations with an initial price applicability year (IPAY) in 2028.

CMS’ evolving negotiation strategies and the impact on ASP calculations

There is still a lack of clarity around CMS’ strategy for negotiating Part B drugs, as previously mentioned in one of our articles on the Inflation Reduction Act.

CMS collects and publishes the Average Sales Price (ASP) for physician-administered drugs to set Medicare reimbursement rates for these therapies. For drugs selected for negotiation with an eventual Maximum Fair Price (MFP), it was initially hypothesized that CMS will no longer collect and publish an ASP, given that Medicare reimbursement for these drugs will be based on the MFP, not the ASP. However, CMS’ guidance states that CMS plans to continue to collect and publish ASPs for Part B therapies with an MFP. This will be useful for commercial payers, as reimbursement for these therapies from commercial payers has been increasingly based on the ASP, rather than the Wholesale Acquisition Cost (WAC) or other price metrics. It has also been posited that the volume and price of therapies sold under an MFP would be excluded from the ASP calculations. At the moment, however, it appears that this will not be the case.

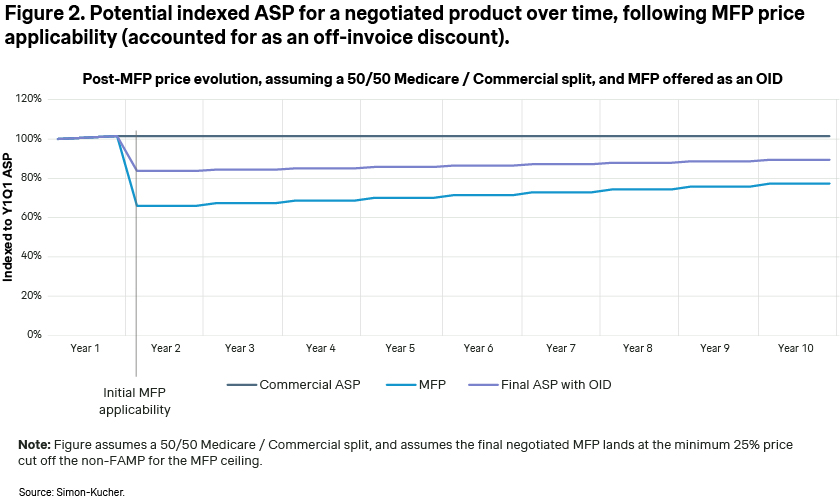

Unfortunately for manufacturers, the inclusion of MFP-based sales in the calculation of their ASP will significantly impact their ASP. The impact, of course, depends on the relative weight of commercial vs. Medicare use of their products, but may be considerable, as illustrated in Figure 2.

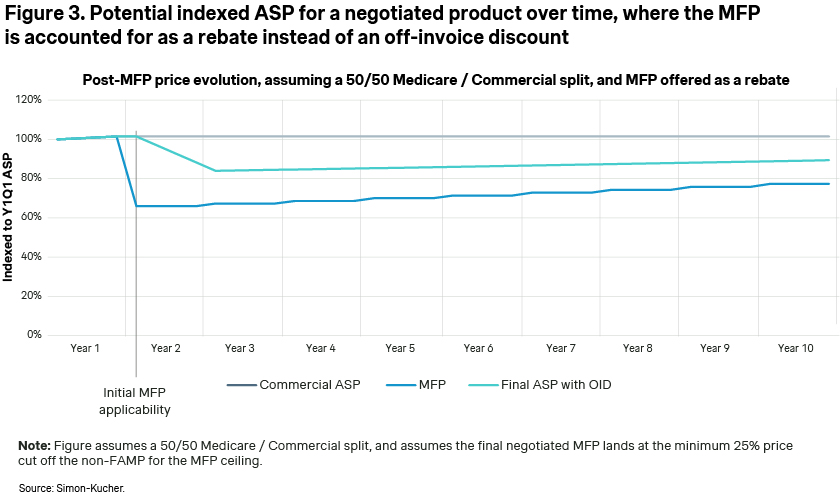

According to CMS’ guidance, the exact method of MFP implementation for eligible patients is currently up to the manufacturers, allowing them to choose between an immediate on-invoice discount or potential chargeback/rebate. In one of our previous articles on provider based contracting, we highlighted how the method of discount implementation has a dramatic impact on the steepness of the ASP decline. Offering the discount as a rebate vs. an on-invoice discount has the impact of smoothing out or amortizing the discount over 12 months and reduces the decrease in ASP [Figure 3]. The viability of this approach for manufacturers is uncertain, as it depends on future CMS guidance or potential pushback from providers.

Implications of MFP discounts on manufacturers and providers

The real challenge for manufacturers will be that if the MFP discount impacts their ASP, they will have a significant problem with providers if they plan to sell their products for non-MFP eligible individuals at a higher price more in line with their current ASP. If they do so, the acquisition cost for the products administered to non-MFP eligible individuals will be higher than the ASP-based reimbursement providers would receive from commercial payers. This would put providers ‘underwater’ for those therapies administered to non-MFP-eligible individuals — i.e., commercially insured patients.

For therapies that are predominantly used in the Medicare population, manufacturers may be willing to sacrifice sales for commercially insured patients or hope that providers are willing to be underwater for these patients. However, for therapies with a substantial number of commercially insured patients, manufacturers may have no choice but to offer the MFP price to providers for all patient types, regardless of MFP eligibility. Such a development may increase criticism that these IRA provisions are not a negotiation but are instead simply price controls.

It is also quite possible that the inclusion of MFP-eligible sales in ASP calculations may change between now and IPAY 2028. The legislation has provided CMS with quite a long runway to figure out details of the IRA implementation – although how much CMS can change or implement on their own vs. how much would require a new act of Congress will be subject to much debate, especially as a new round of elections will soon be upon us.

At Simon Kucher, we continue to monitor developments with regards to the Inflation Reduction Act. We are also actively helping our clients understand which therapies may be selected for negotiation, and possible scenarios around the MFP determination and the subsequent impact on ASP and potential strategies to achieve our clients’ objectives.

How we can help

The Inflation Reduction Act has the potential to be one of the most significant developments in the pharma and biotech market in the US since the creation of Medicare Part D.

Manufacturers receive billions of dollars in sales through the Medicare channel and correctly assessing the impact will be vital to the continued healthy success of the pharma and biotech market in the US.

Let’s work together to unpick these challenges. We can help you fully understand all implications for your brands undergoing negotiation, as well as the second order impact on your non-negotiated brands.

Reach out to Nathan Swilling today!

Trending Topic

Better Market Access

The role of better market access is to remove any hurdle that prevents or hinders patients from receiving available treatments. In the right place, and at the right time.

Today, the impact of market access spans clinical development, regional commercial activities, patient engagement, and post-launch compliance. Yet, for many pharmaceutical companies, planning for commercialization only truly begins when a drug has been submitted for approval — far too late in the process.

Get to know our insights on local trends, regional and global developments and global to local excellence.