The latest round of VoBP signals more transparency and balanced considerations, with more opportunities for the industry to strategize and plan ahead.

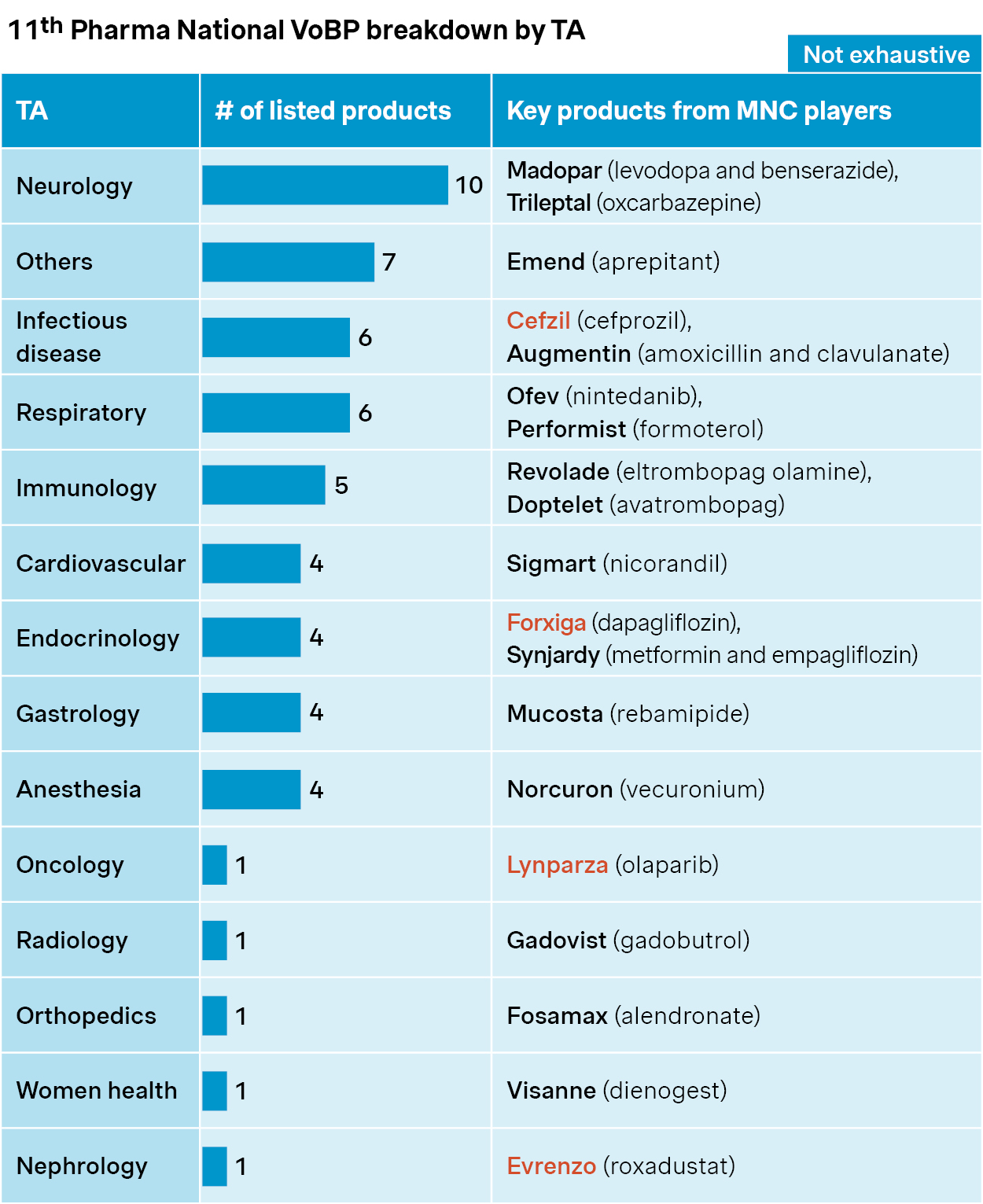

The 11th round of China’s national volume-based procurement (VoBP) was announced in July 2025, covering 55 drugs across 14 therapeutic areas.

As widely anticipated, many of the drugs on the list are blockbusters like Cefzil, Forxiga, Lynparza, and Evrenzo. These drugs carry sizable budget implications and face extensive generic competition – both key triggers for VoBP inclusion.

Source: Simon-Kucher, NHSA, Insight database. VoBP: Volume-based procurement; TA: Therapeutic area.

Goodwill signals

Unlike the last 10 rounds of national VoBPs, there were several goodwill signals that came with the latest announcement. These were partly a response to backlash from earlier tenders and shaped by constructive dialogue between government payers, hospitals, clinicians, and the pharma industry.

A more considered shortlist

Around 70 drugs were excluded from this round after three rounds of screening. Reasons ranged from safety concerns (e.g., vancomycin, lamotrigine) to IP disputes (e.g., enzalutamide). This signals a more collaborative approach – with input from clinicians and originators considered during drug selection.

Key exclusion criteria | Examples | |

Preliminary screening |

|

|

|

| |

|

| |

|

| |

|

| |

Expert consultation |

|

|

Risk-based assessment |

|

|

|

|

Source: Simon-Kucher. GQCE: Generic Quality Consistency Evaluation; IP: Intellectual property; IR: Immediate-release; IVF: In-vitro fertilization; NRDL: National Reimbursement Drug List; VoBP: Volume-based procurement.

Higher bar for generics

There are more stringent requirements on generic players, including at least two years’ manufacturing experience and a clean record of quality control and GMP compliance. In addition, the bidding rules stated that lowest price doesn’t necessarily win the bid, and the lowest bidder will be scrutinized to ensure it doesn’t bid below cost, and quality standards are not compromised to save cost.

More flexible post-tender market

The volume commitment for VoBP has seen some fine-tuning. Losing bidders can now participate in up to 40% of the post-tender market. Hospitals and healthcare professionals also have greater flexibility to choose brands based on clinical experience and preferences – particularly when those brands are among the winning bids.

| New policy highlights | Key implications | |

More balanced considerations |

| Pharma National VoBP will mainly focus on legacy product with mature clinical usage and adequate market competition Clinical and pharmacy expert opinions will be taken into considerations for product screening |

More emphasis on quality standards |

| Enhanced quality oversight will raise the bar for manufacturer qualification and improve overall transparency Exceptionally low bidding price will be discouraged to ensure fairness, sustainability and prevent vicious competition |

More brand choice for clinicians |

| Clinical experience and preference will be acknowledged with more brand choices and lower volume commitment VoBP losing players will have more room to play in the post-bidding market |

Source: Simon-Kucher. GMP: Good Manufacturing Practice; VoBP: Volume-based procurement.

Mixed outlook

The industry appears to welcome the latest developments with cautious optimism in general, and the capital market didn’t see the sector-wide dip which was typical of prior rounds.

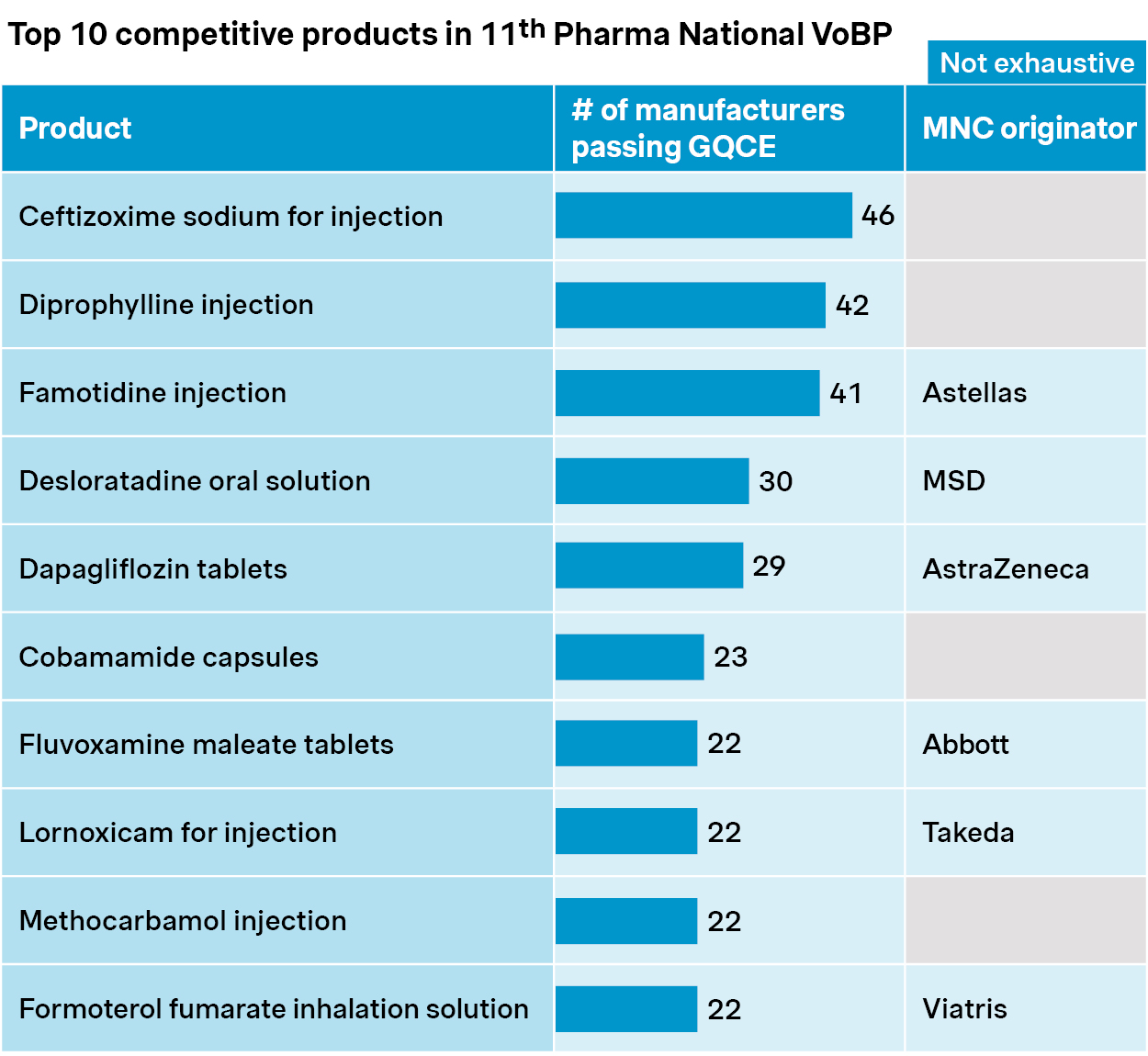

However, it may be too early to expect less competition and milder price impacts. In fact, competition is fiercer than ever for many products. More than 40 generic players are bidding for ceftizoxime and famotidine, and over 20 generic players for dapagliflozin, fluvoxamine, and lornoxicam.

The stakes are high for both established players and newcomers. Many of these are major blockbusters in the Chinese market, and the upcoming tender could drastically reshape pricing, volume, and market access in one fell swoop.

Source: Simon-Kucher, NHSA, Insight database. GQCE: Generic quality consistency evaluation; VoBP: Volume-based procurement.

Regional VoBPs are also accelerating with broader scope and faster execution. Among which, Anhui province was mandated to spearhead biologics VoBP this year.

Learning from prior VoBPs targeting insulins, coagulation factor VIII, and rituximab, the new pilot is likely to bring notable changes to more biologic categories. These may include plasma products, recombinant proteins, and monoclonal antibodies. The tender prices from regional VoBPs could be cross-referenced by other regions and national VoBPs, so the impact could go well beyond the pilot itself.

A broader trend across categories

Beyond drugs, the 6th round of medical device and consumable VoBP is also in store for NHSA’s 2025 plan. While the tendering rules and competitive landscapes may differ, the impact could be as significant and long-lasting. Past tenders have already reshaped markets for products ranging from coronary stents to spine implants and infusion sets.

Bracing for changes: How we help companies prepare and respond

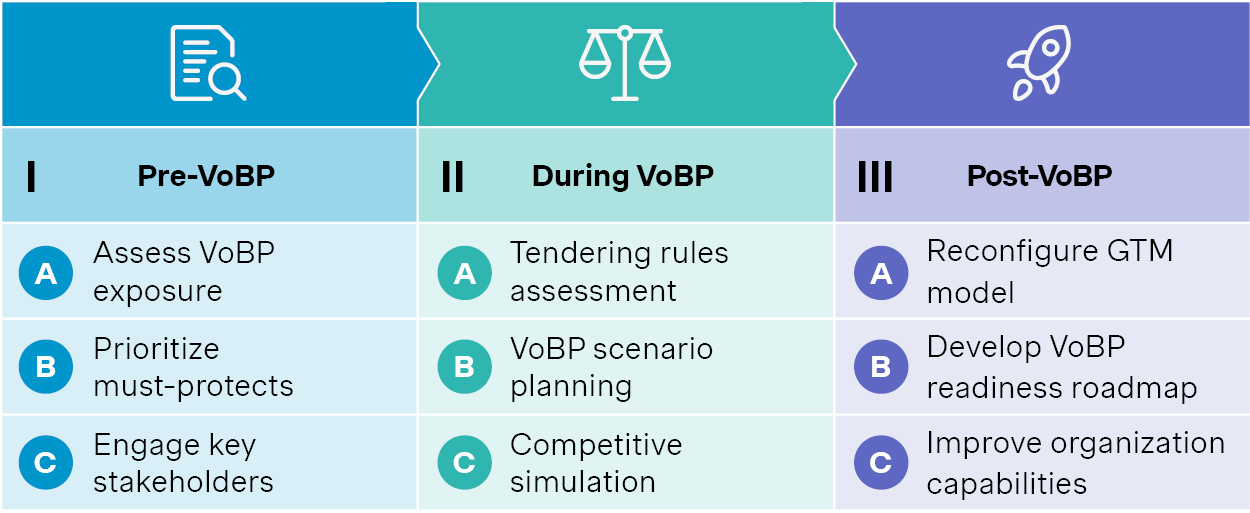

Based on our extensive experience across chemical, biologic, and medtech, we have developed a trilogy approach to cope with VoBP challenges.

Source: Simon-Kucher. VoBP: Volume based procurement

1. Start early – long before the tender

In our experience, the work should start well ahead of VoBP. The first step is to assess exposure, prioritize must-protect products and regions, and to engage with key stakeholders early on to shape tendering scope and rules.

For example, a manufacturer of an immunosuppressant drug started to systematically prepare clinical and real-world evidence to demonstrate its superiority and differentiation well ahead of a regional VoBP. These efforts helped delay its inclusion in several rounds of regional VoBPs.

Increased transparency signals in the latest VoBP suggest that early planning, policy shaping, and evidence preparation could play a more constructive role going forward.

2. Build smart scenarios and simulate the competition

As VoBP policies undergo constant fine-tuning, scenario planning will be key. It should be based on in-depth understanding of VoBP rules, which may differ from chemicals to biologics to medtech consumables, and from one round to another.

Competitive simulations are also essential. They can provide inputs to scenario modeling, and support making the critical go vs. no-go decisions during VoBP process.

In a recent regional biologic VoBP for example, a multinational player took a calculated risk. They offered a moderate price cut in exchange for preferential access and hospital listing, turning the VoBP into a breakthrough opportunity. As a result, they dislodged the incumbents to become the market leader.

3. Adapt and thrive in the post-VoBP market

The post-VoBP strategy needs to be in place regardless of the outcome, as the market will see drastic changes.

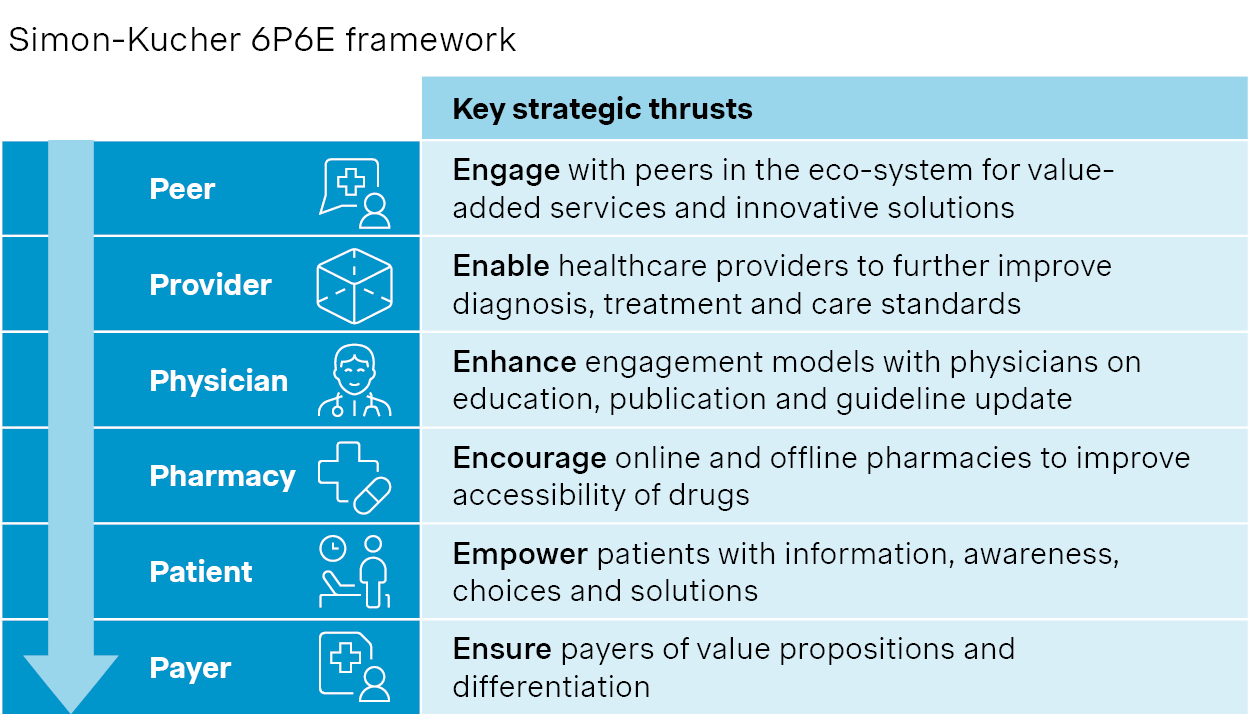

We have worked closely with leading players to revisit their go-to-market strategies and revamp their engagements with value chain partners. This includes co-developing disease solutions with peers, enabling providers through targeted support, and expanding patient access via retail and digital channels.

VoBP is increasingly seen as a catalyst for change and the more agile companies stand better chances to survive and thrive.

Source: Simon-Kucher.

Thanks to contributions from Cindy Piao and Jiuzhou Zhao!