Policy shifts, procurement pressures, and expanded early access are reshaping China’s medtech sector. Our experts unpack the impact of VoBP expansion, price transparency mandates, early access programs, and evolving reimbursement models on market access and commercial strategy.

2024 was eventful for China’s medtech industry: the Medical Device Management Law was seen as a positive, especially for innovative therapies. Meanwhile, volume-based procurements and price transparency requirements brought ongoing price pressure to the industry. More early access opportunities are now available in pilot zones, while new reimbursement pathways and innovative payment schemes are emerging across key regions.

More recently, the trade conflict between US and China has brought about more uncertainties, especially for those with global footprints and high stakes in both markets. Based on our annual survey and ongoing dialogues with industry leaders, Simon-Kucher has released China’s medtech 2025 outlook assessing the following latest trends and strategic implications.

Riding the policy headwinds and tailwinds

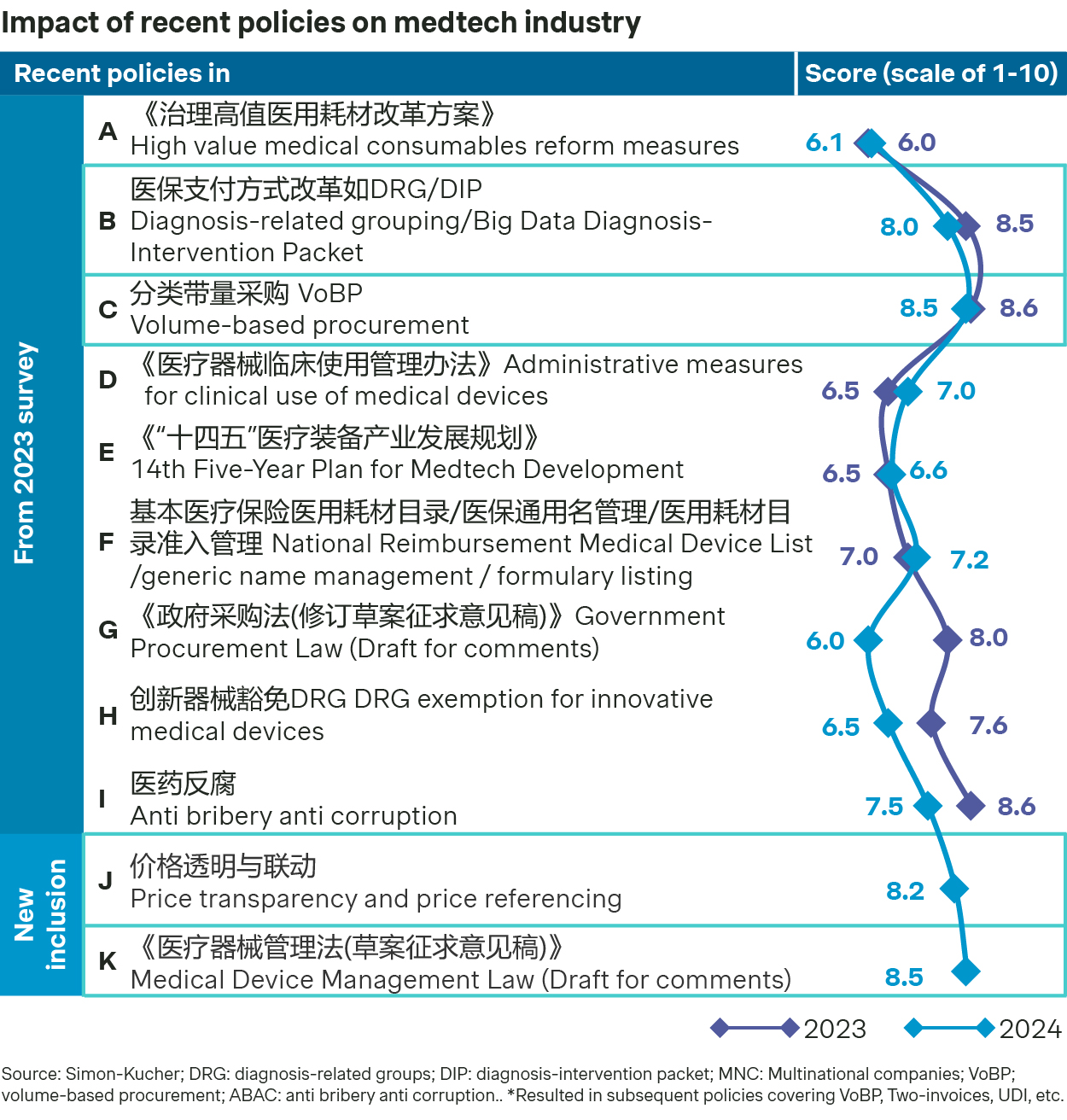

Among the many policies impacting the industry, volume-based procurement (VoBP) and payment reform continue to be on the top of the agenda for many medtech majors.

In the fifth batch of National VoBP, cochlear implants saw a significant price drop, with the average cost coming down to around 50k RMB from 200k RMB. Consumables for peripheral interventions also experienced a substantial price decrease. At the same time, the bidding rules have been refined with separate grouping for bidders, with up to 15 manufacturers shortlisted for allocated volume. As a result, the latest round of VoBP appear to be more rational with more multinationals participating and winning the bid.

Regional VoBPs continue to see ongoing expansion of medtech categories ranging from high value implants, in vitro diagnostics, and consumables like wound care. In 2024, the National Healthcare Security Administration (NHSA) prioritized seven provinces including some of the more sizable ones like Guangdong and Zhejiang, focusing on seven categories of consumables as pilots for regional VoBPs. The aim is to establish these regional models as normalized practices for national VoBP, so the stake could be much higher down the road.

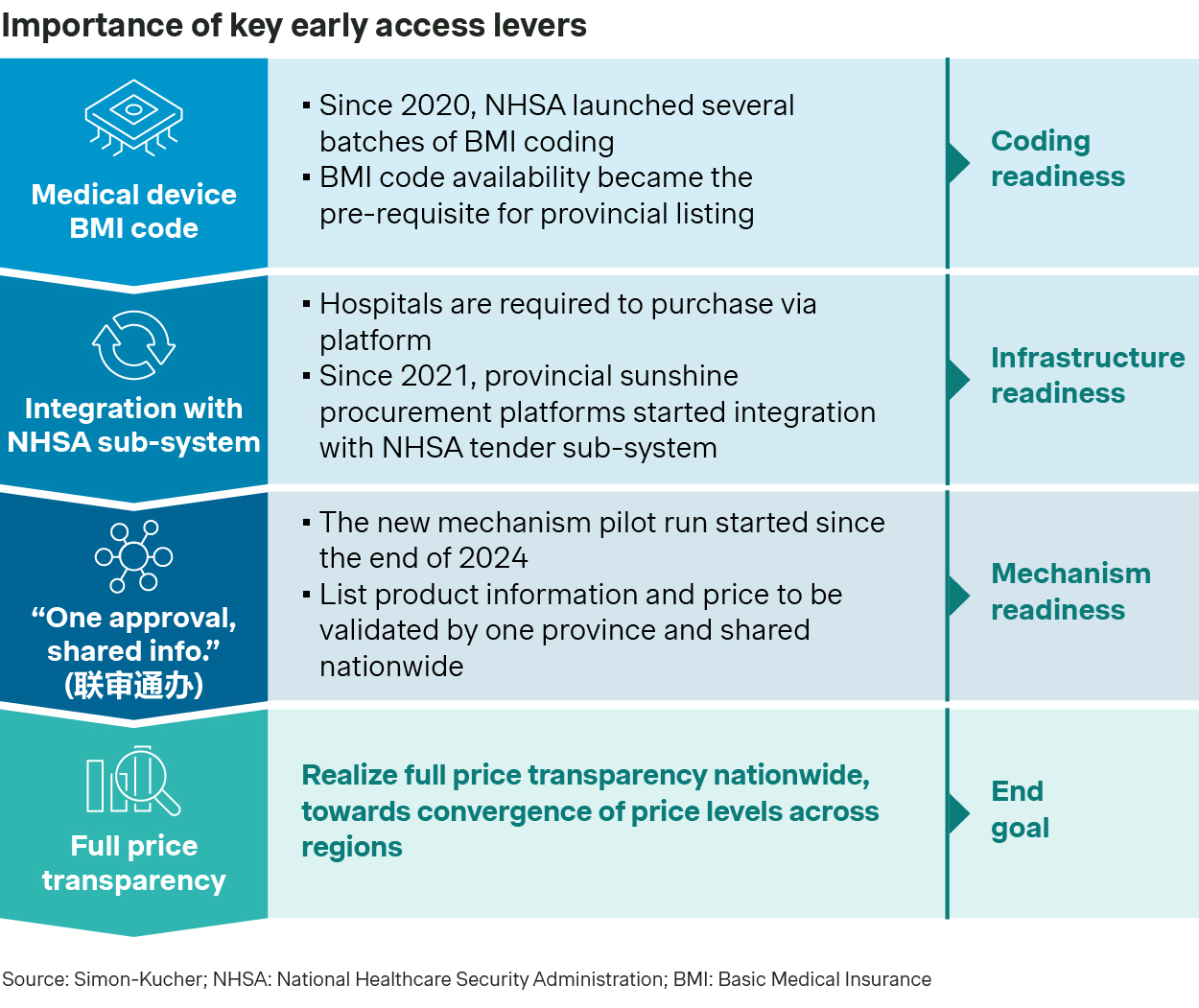

Price transparency has emerged as a new priority for the government in 2025 and can have significant implications for the industry. In some cases, cross-region price transparency is amplifying the impact of regional VoBP. In other cases, it can exert price pressure independent of VoBP, as the lowest price at provincial listing and hospital purchasing could be recorded and referenced with the improving pricing data infrastructure nation-wide.

While DRG and DIP are typically considered as cost containment measures on the providers in general, there are exceptions for innovative technologies. The CHS-DRG/DIP 2.0 policy, launched in July 2024, introduces an exception mechanism for high-cost critical disease treatments through refined disease grouping, and an increased exception case ratio so innovative medical devices can be exempted from DRG/DIP payment constraints.

More encouragingly, the release of the Medical Device Management Law draft has been welcomed by the industry, partly as it is expected to reduce clinical trial approval timeline by half, significantly streamlining the regulatory processes and encouraging R&D and innovations.

Capitalizing on fast approval and early access programs

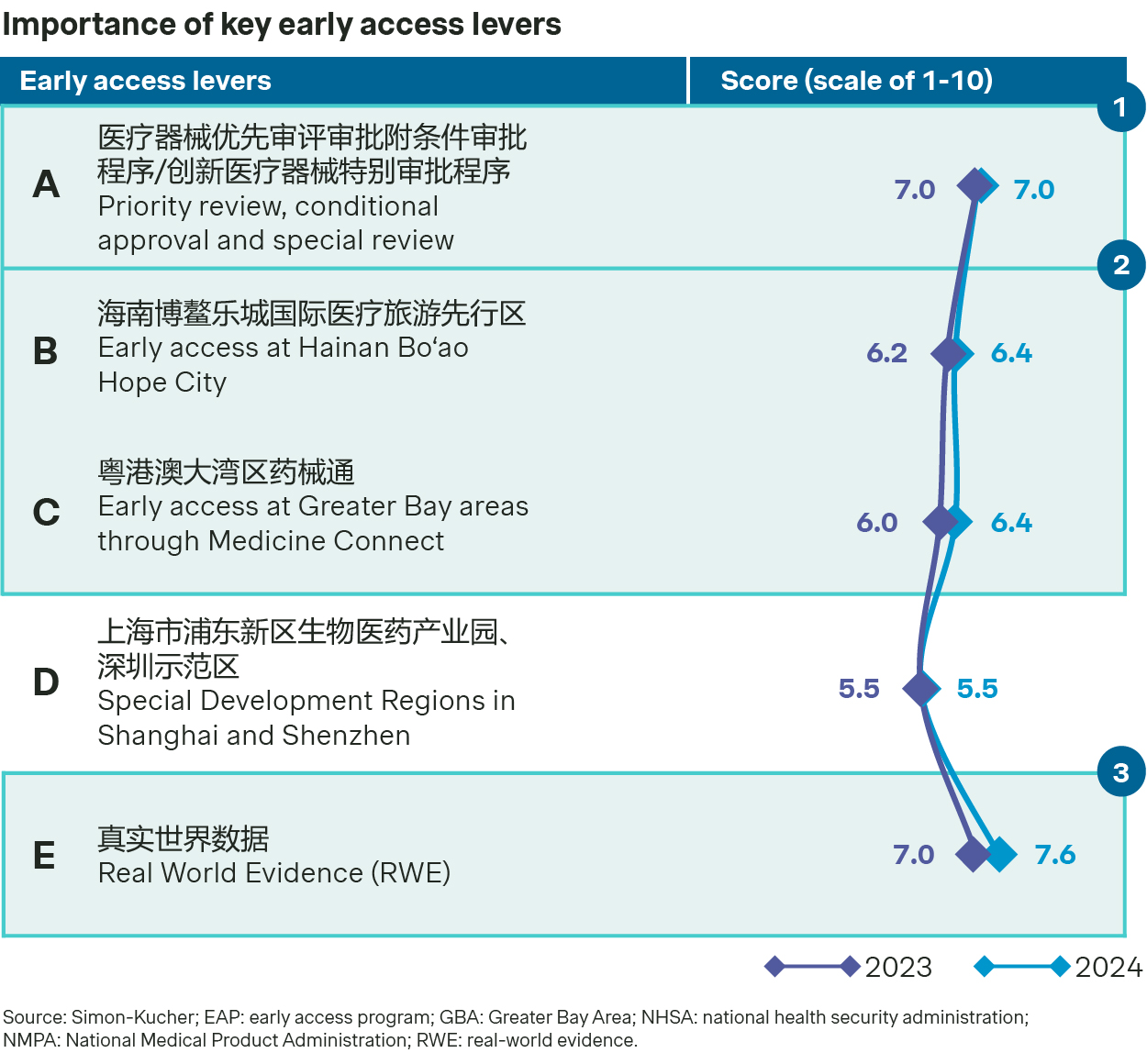

Participants in our 2025 medtech outlook survey appear optimistic when it comes to regulatory approval and early access opportunities, many with improved readiness to capitalize on the latest developments.

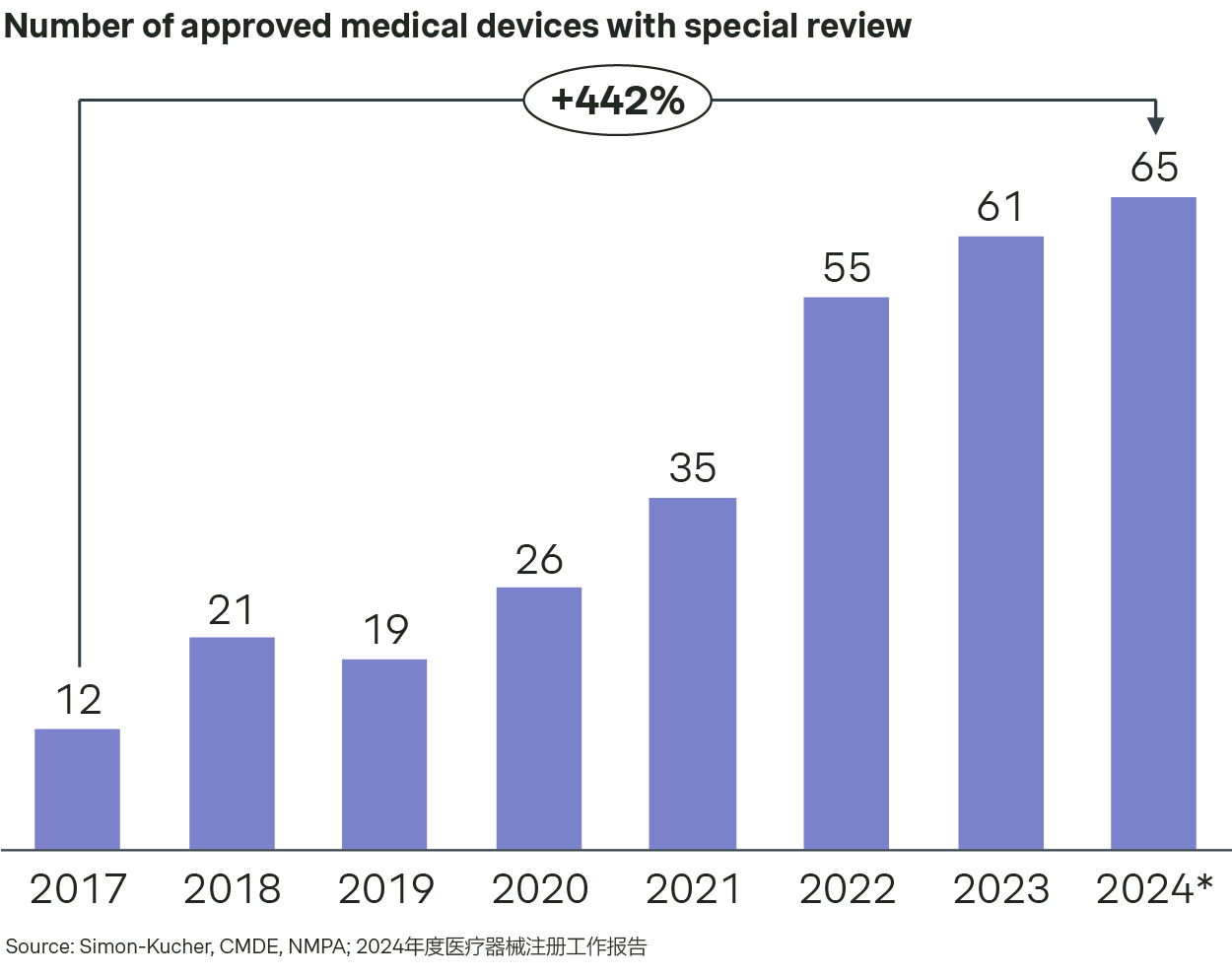

Over 270 innovative devices have gone through special approval pathway and were granted approval by NMPA from 2017 to 2024. There is a 290% growth in number of approved innovative devices with special approval during this period. Moreover, early access programs at Hainan Bo’ao and Greater Bay areas (GBA) have imported multiple oversea innovative devices for early utilization and continue to cover more devices.

EAP in Hainan Ba’ao also provides opportunities for innovative medtech devices to generate and utilize Real World Evidence (RWE) for approval in China. By November 2024, 17 drugs and medical devices received the National Medical Products Administration (NMPA) approval by the RWE pilot program.

In 2024, the NMPA approved a total of 65 innovative medical device products for marketing, a steady increase over 35 approvals in 2021, 55 in 2022, and 61 in 2023 respectively. The key eligibility criteria included approval of the core technology’s IP, domestic FIC, and an almost finalized design. The key advantages of this special review are as follows:

- Accelerated approval through a priority review across the entire application process, including sample test, technical review, and quality check.

- Expert guidance from clinical experts and regulatory experts with provided communication window.

- Local financial incentives, for instance, up to CNY 20 million for devices with special review and approved as type III in Jiangsu, CNY 4-6 million for type II and III devices approved with special review in Shenzhen, and CNY -6 million fund support for type III devices with special review in Fujian.

17 devices are included in 1st – 5th Batch (from August 2021 to September 2023)

| GBA early access program | ||

Devices | Imported hospital | |

6th Batch (Jan. 2024) | FARAWAVE Pulsed Field Ablation Catheter | Foshan Fosun Chancheng Hospital |

FARADRIVE Steerable Sheath | ||

FARASTAR Pulsed Field Ablation Generator | ||

AveirTM Leadless Pacemaker | Sun Yat-sen Memorial Hospital | |

AveirTMDelivery Catheter | ||

AveirTMIntroducer | ||

AveirTMRetrieval Catheter | ||

Heli-FX EndoAnchor System Heli-FX Applier with EndoAnchor Cassette | Guangdong General Hospital | |

Heli-FX Ancillary EndoAnchor Cassette | ||

Heli-FX EndoAnchor System Heli-FX Guide | ||

7th Batch (Sept. 2024) | EPack | Guangdong General Hospital |

Echopulse | ||

Cardiac Resynchronization Therapy Defibrillator | Sun Yat-sen Memorial Hospital | |

TriClip G4 Delivery System | ||

TriClip Steerable Guide Catheter | ||

Aurora EV-ICD MRI SureScan SW041 | ||

Epsila EV MRI SureScan | ||

Epsila EV Sternal Tunneling Tool | ||

Epsila EV Transverse Tunneling Tool | ||

Aurora EV-ICD MRI SureScan | ||

Innovative devices can seek early access opportunities to reach pockets of the market even before China’s regulatory approval. Drugs and medical devices approved outside of China are eligible for pilot use and RWE studies in the Hainan Bo’ao Lecheng International Medical Tourism Pilot Zone for example, and 17 drugs and medical devices have received NMPA approval through the Hainan RWE pilot program as of November 2024.

Meanwhile, therapies approved in Hong Kong or Macau may tap similar opportunities across the Great Bay area, across nine major cities including Guangzhou, Shenzhen and Zhuhai etc. To date, 37 medical devices have capitalized on the program to access one of the most affluent and vibrant regions in China. An increasing number of public hospitals are becoming user institutions with a rising share in adopted medical devices.

Exploring new reimbursement and innovative payment opportunities

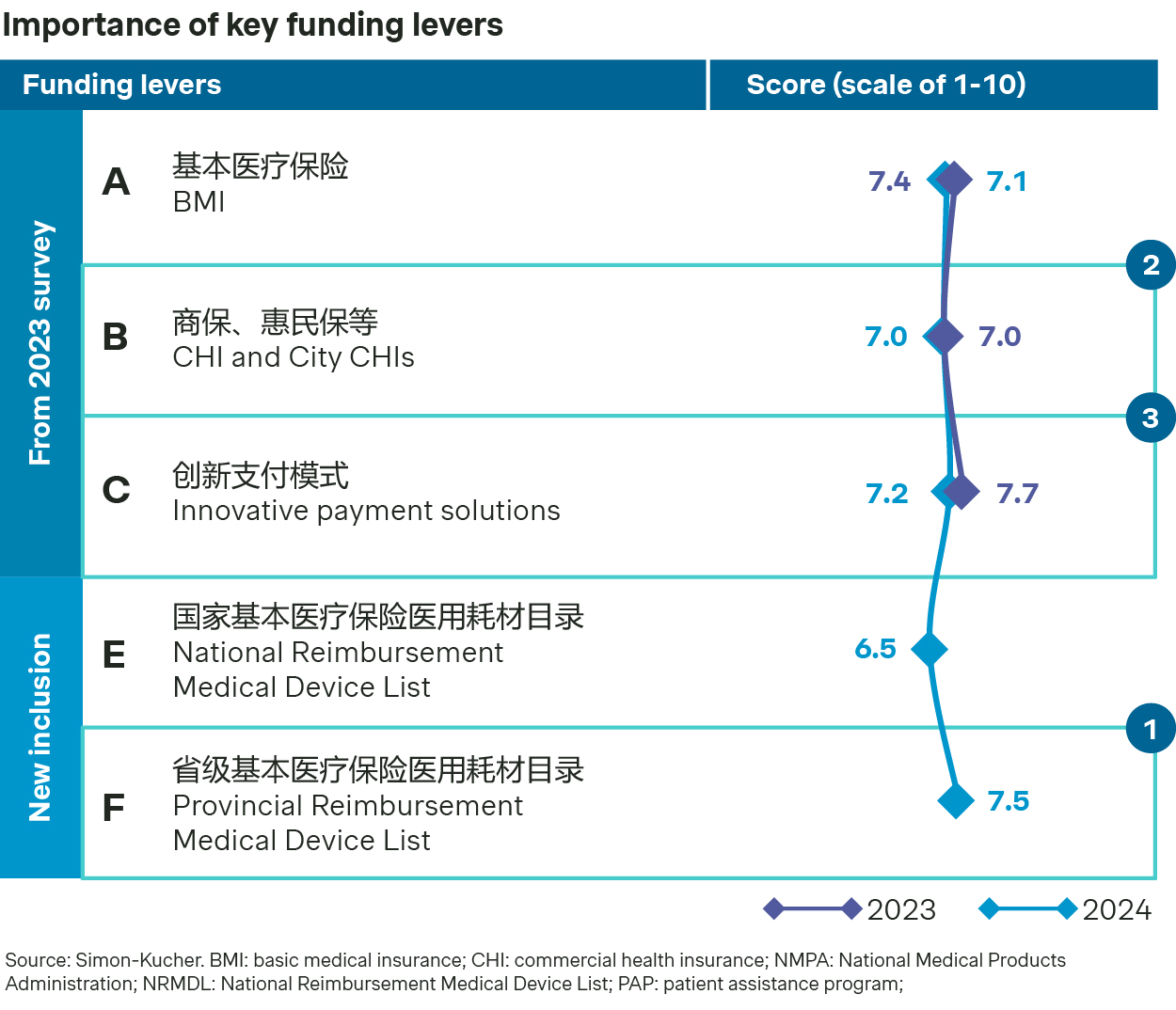

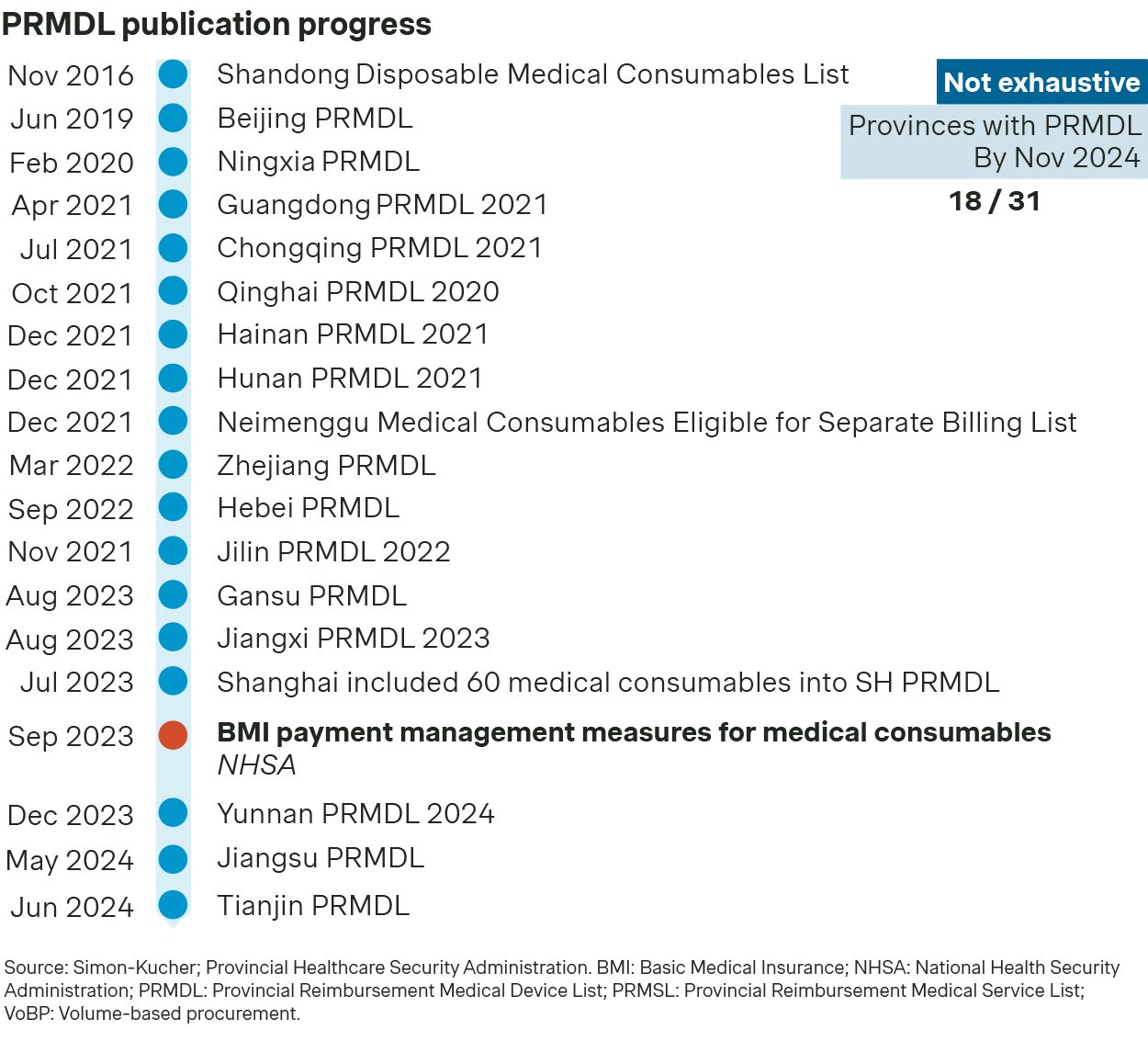

Reimbursement policies are fast evolving with each province expected to launch their own PRMDL by end of 2025. In parallel, commercial health insurance (CHI) and innovative payment solutions are fast emerging.

There’s a fast rollout of Provincial reimbursement Medical Device List (PRMDL) with different progress and features. BMI coding is now widely adopted as the basis to formulate PRMDL. Additionally, CHI and City CHIs in China are emerging as one of the alternative reimbursement options. More and more CHIs have included innovative medical devices into formularies. In affluent regions, innovative payment solutions have lately emerged, offering improved affordability for local patients.

The NHSA has set the target for all provinces to establish their local reimbursement lists by 2025. The process of setting up PRMDL has progressed swiftly, with 18 provinces having already published their lists.

Most of these lists have been created by distinguishing reimbursable medical devices from the service bundles, and some provinces have announced additional inclusions for new products and VoBP winners. BMI coding has served as the foundation for PRMDL development, with varying levels of detail being used to define the "generic name" for medical devices across different provinces.

Many provinces have not specified the payment standard for PRMDL and few provinces with payment standards remain implicit about pricing mechanism.

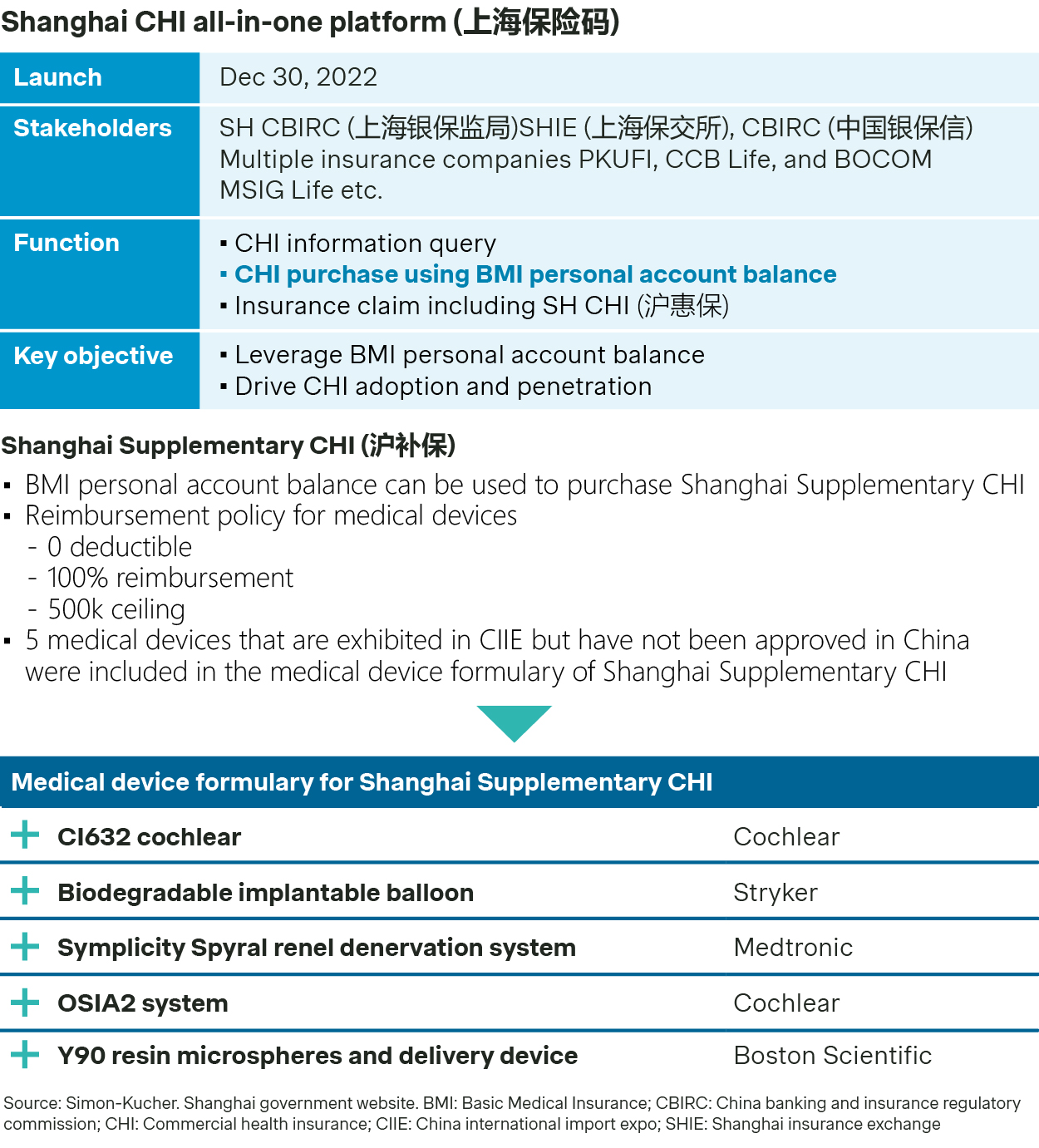

As the fastest-growing form of Commercial Health Insurance (CHI), City CHI has been riding on strong momentum to cover a population of over 150 million across 300 cities, and local governments have been supporting the ongoing upgrading of the coverage scheme. Shanghai, for example, has initiated an all-in-one CHI platform (上海保险码), so its residents can easily use their basic medical insurance (BMI) account to pay for CHI premium.

In addition, Shanghai launched a supplementary CHI scheme specifically for five innovative medical devices which were exhibited at the China International Import Expo (CIIE) and continues to pilot outcome-based payment solutions for high-value consumables like TAVR.

Wrap up

China’s medtech market has always been fast evolving, shaped not only by technological advancements but also by increasingly complex geopolitics. Given these dynamics, agility, resilience, and strategic foresight are more important than ever before for navigating the multifaceted changes and challenges that lie ahead.

Ready to lead with intent and make the most of innovation-first opportunities? Reach out to our medtech sector experts who can help you turn your next move into a sustainable commercial advantage.