During negotiations with original equipment manufacturers (OEMs), automotive suppliers are under immense pressure to gain an edge over their competitors. To achieve this, suppliers have to ask themselves three questions: How are purchasing decisions made, who makes them, and which criteria are important? Learn how to draw the right conclusions from the answers.

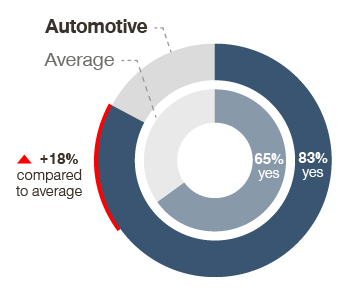

Price pressure is a very important topic for automotive suppliers. As our published Global Pricing Study (GPS) found out, more than 80 percent of the surveyed automotive companies believe they have experienced greater price pressure in the last two years. And this number has been at such a high level for the last couple of years – record-breaking numbers especially compared to other industries.

As a result of this perception, many automotive suppliers are under the impression that OEMs only choose to buy from them if they offer the best price. Our experience tells us this is only half true, at best. While price is a key criterion for OEMs when selecting suppliers, they also take into account many other criteria, such as plant location and delivery track record. Neglecting these is a surefire way to harm your chances of establishing a business relationship with automotive manufacturers. Suppliers need to understand the entire selection process in order to be truly successful with a targeted OEM. Answering these three key questions will ensure you take the right approach:

- How are OEMs making purchasing decisions?

- Who makes the decisions?

- Which criteria do OEMs consider?

1. How are decisions made?

Coming to a purchasing decision is a multi-stage procedure for OEMs. They first have to select which suppliers they ask to submit a quote. OEMs usually send a request for quotation (RFQ) to three to five suppliers – either following the cautious approach of only inviting established suppliers or a more adventurous tactic of including as many challengers as possible.

After receiving the offers, the critical phase begins. The buying center team discusses the quotes both internally and with the respective suppliers. These proceedings can be equally interesting; for example, target prices and specifications can be changed to align with the best offer, or initial specs that are deemed too risky for cost and/or on-time delivery can be adjusted. In the next step, the buying center either selects the supplier that best meets the project targets or postpones the decision.

What this means for suppliers: Throughout the acquisition phase, you need to stay in touch with your contacts. Having a consistent offer and negotiation strategy is only the basis; you also need to factor in new and reliable information to update your approach. Keep in mind: A purchasing department is defending its company’s interests just as you are defending your company’s interests. So during negotiations, you need to identify common ground and build on it. It’s equally important to understand what your role in the acquisition process is. If you’re only there to put pressure on an already established supplier, you shouldn’t give too many concessions; this will only harm your position in later negotiations when you actually have a chance and will be compared to your earlier aggressive pricing.

2. Who makes the decisions?

The person officially making the purchasing decision is the highest-ranking person in the purchasing department. They are designated to make a decision due to the level of strategic importance the project has been given (e.g. based on annual purchasing). In reality though, the decision is prepared by (and therefore depends on) the buying center. Very often, the buying center’s most important person is not the buyer or the purchasing manager, but rather someone with expertise in the project or product. For a product based on innovative technology, for example, this might be the engineering team, or for a low-value product with a high impact on the OEM plant’s logistics, it could be a production engineer.

What this means for suppliers: In order to use this in your favor, you’ll need to have access to all possible stakeholders so you can focus your sales activities on the most important one for your specific acquisition. This is Key Account Management 101. Very often, we see suppliers who just contact their usual acquaintances in purchasing and development and, in doing so, miss out on many opportunities.

But how do you expand your network within the OEM? Usually, you know at least one member of the buying center. Your interactions with this person should be used to identify and get in contact with other members, step by step. Most of them won’t be willing to talk to suppliers they aren’t familiar with already during a quotation. It’s important to get to know them at any available opportunity so that contacts can be reactivated at the right time. This can be a lengthy process, but there is an alternative way you can reach the key stakeholders. Provide your direct contacts with convincing argumentation about your product’s superior quality so they speak up for you in internal meetings. Remember: If the buying team doesn’t have proof that your products are a) more reliable, b) more effective, or c) more efficient than your competitors’, they have no option but to choose solely based on your price.

3. Which criteria are typically considered?

OEMs are profit-oriented businesses. Defining the impact of any given decision on the expected profit margin is complex. This is also true for selecting suppliers. OEMs have to consider a number of aspects to determine how choosing a certain supplier will affect operations. OEMs usually compare suppliers in terms of topics, such as:

- Relationships between initial prices vs. evolution during the project

- Technical solutions and production processes impacting the performance and quality of the vehicles equipped

- Suppliers’ plant locations leading to different logistics and/or risk exposures (geopolitical risk, natural risk, etc.)

- Quality and delivery track records

- Governance and financial stability leading to a different evaluation of the sustainable availability of suppliers’ products

- Interactions with OEM development, OEM quality division, OEM plants, and OEM warranty department

Unfortunately, the weight of these criteria in the selection process differs across OEMs and even within one OEM across several product areas.

What this means for suppliers: You have to identify the importance of different criteria as precisely as possible. You can do this by:

- Analyzing past successes and failures in acquisition, i.e. in which situations did you have a high hit rate?

- Providing alternative offers for current or future deals to speed up information gathering

- Simply asking the OEMs about it

In addition, you need to understand how you compare to your competitors in the most important criteria in order to accurately assess your situation and identify improvement potential. Once you have established this knowledge, you can create offers specifically geared toward the scoring logic of your customer.

Following this approach will enable you to generate more profit while maintaining or even increasing customer satisfaction.