Over the last few years, there was a pricing power in consumer-packaged goods (CPG) we hadn’t seen in a long time. Demand was relatively inelastic, and people were willing to accept higher prices. Meanwhile, consumption tied to in-home living boomed, possibly due to increased liquidity and a sharp shift in consumer occasions. These factors emboldened companies to push their pricing strategies to the limit, perhaps more than they otherwise would. However, that dynamic didn’t last forever.

As inflation persisted, consumer sensitivity crept back in. Certain categories had ridden a wave of volume growth that wasn’t structurally sustainable. Inflationary pressure began chipping away at consumers’ real disposable income. The result? A blend of elevated pricing and softening demand.

Now, brands are in a tough spot. They’ve locked in higher prices but face volume pushback and growing private label competition. In retrospect, some firms probably overdid it. There’s a margin reset ongoing that can only be mitigated by a sharp rethink of value or a real innovation breakthrough..

Top global retailers have taken public stands against what they perceive as “abusive” price increases, highlighting the growing tension between manufacturers and the trade. Carrefour in France made headlines by placing warning labels on products that had quietly shrunk in size without a corresponding drop in price, and even went as far as delisting certain products over what it deemed "unacceptable" pricing behavior. Meanwhile, in the US, Walmart has come under scrutiny from consumers for price hikes that appeared inconsistent with its promise of affordability, prompting backlash across social media. These examples underscore the urgent need for CPG companies to rethink their revenue strategies, not just through overt price changes, but through more nuanced mix management approaches that preserve margin while staying aligned with retail partners and consumer expectations.

The burning question: How do you drive profitability without continuing to pass on costs, or playing the inflation catchup game? How do you protect margins without sparking consumer backlash? This opens the door to some of the more subtle, strategic levers in the commercial toolbox.

What makes mix so hard to manage?

![active mix]()

Major commercial levers like portfolio and promotion management, pricing, and price pack architecture come with a defined operational machinery behind them. Most organizations have teams, tools, dashboards, and routines to activate those decisions. Mix management, on the other hand, is much more ambiguous – strategically rich, but operationally underdeveloped.

What most companies are doing is mix attribution. It’s retrospective, not prescriptive, and often a plug variable balancing the RGM math. You run the standard decomposition (revenue = volume × price) and whatever can’t be explained by list price or discounts… that’s mix! It’s what’s left over after the known effects are accounted for.

Mix also isn’t a lever with clear “on/off” switches. It’s the outcome of many interconnected commercial choices across portfolio, channel, pack, region, and customer. That makes it hard to manage proactively, especially when there isn’t a shared language or KPI structure around what constitutes "good " versus "bad" mix.

Finally, mix might sound great in theory: “Let’s drive better mix!” However, are you really going to kill SKUs that are contributing positive margin just to improve a KPI? That’s where most mix conversations fall apart. You end up with a cleaner margin structure… for a smaller absolute bottom/line.

Key takeaway: Mix management needs to move beyond clean-up logic, intentionally shaping the composition of what you sell, not just pruning what you wish you didn’t.

The four key pillars of active mix management

1. Transparency: Moving from mix reporting to insight generation

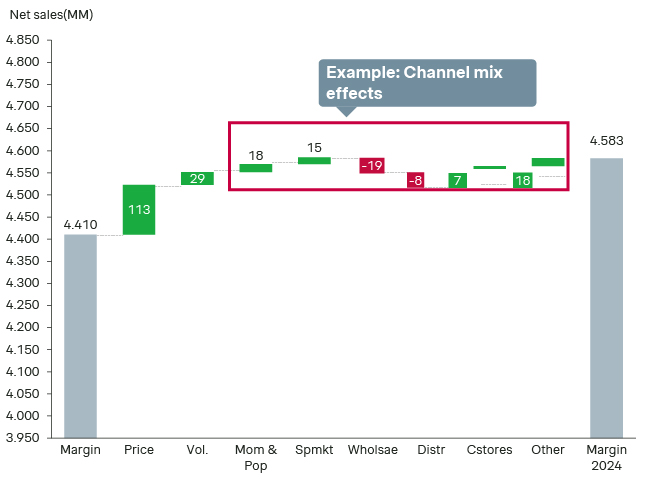

CPG businesses are multidimensional by nature and mix math is far from trivial. A single invoice touches multiple hierarchies: a pack size in a category sold through a region, into a channel, under a banner, as part of a promo. That sale simultaneously shifts the mix for products, packs, price points, channels, and even customers. Attributing mix “effects” precisely requires a structured methodology to isolate incremental deltas at each level without double-counting or misassigning.

Here, transparency is key. It means designing a robust, modular decomposition engine that can break revenue changes into volume, price, and mix effects — and within mix, isolate the right dimensions (product, pack, channel, customer, region, etc.) with clean, non-overlapping logic. This often involves:

- Establishing baselines or reference structures: Isolate the effect of price and volume to understand the contribution of mix changes”

- Agreeing on the scope and detail of mix analytics: Validate the level of granularity from the start to ensure the conversation is aligned

- Using volume-weighted indices or fixed-mix baselines to control for structural drift

- Building visual drill-downs that move from macro trend (i.e. mix effect was -1.2 pts) to micro insight (i.e. positive mix contribution came from declining share of mid-size packs in convenience in Region A)

Only once this transparency is in place, with the right math, data architecture, and interfaces, can you expect stakeholders to move beyond reporting the mix effect and start diagnosing and managing it.

2. Strategy: Turning transparency into active mix management

A critical leap many CPG organizations haven’t fully made is from transparency (seeing the mix effect) to strategic alignment (ensuring mix supports commercial ambitions). Most create their annual plans with targets for total revenue, volume, price uplift, etc., but those are typically aggregated and don’t consider how mix can contribute to profitability while reducing reliance on price increases. When you drill down, few have an articulated answer to:

What mix profile do we need — across products, packs, channels, customers — to make this budget not just mathematically achievable, but strategically sustainable?

Do you have mix targets? Not just “trackers” but actual strategic intentions: we intend to grow X pack size faster than Y? Do you want premium variants to represent 25% of sales by Q4? Are you planning to shift 5pts of channel mix from discounters to e-commerce? Without clear targets, you can’t steer or correct mid-flight. And without mix targets, sales and marketing teams often make well-intentioned decisions that inadvertently erode mix, especially when volume incentives dominate.

Is your target mix coherent with the budget? You might say, “we want 5% revenue growth and stable margins,” but when you reverse-engineer that against actual portfolio margins and channel dynamics, the only way to get there would be through a very specific, and often unrealistic, mix shift.

If your KPIs are mixed but the budget holds together, has this really just been a financial exercise? Have you articulated a vision of how your portfolio (categories, value segments, pack roles, etc.) should look like in 3-5 years? What about channel landscape? Mix management can’t just be about margin contribution. It has to be threaded into the broader strategic overview.

Strategic alignment is about embedding mix as a planning variable, not just a reporting output:

- Back-solving mix requirements from topline and margin goals

- Building “budget-consistent mix scenarios” as part of the planning cycle

- Setting explicit mix ambitions (e.g., premium share, pack architecture migration, channel volume targets)

- Ensuring trade partner objectives are harmonized.

Only then can mix become a lever that helps deliver strategy, not just describe how you missed it.

3. Quantification: Getting the bang for your buck

If I spend a dollar or push a percentage point on X lever, what is the marginal return in terms of improved mix quality (and downstream margin uplift)?

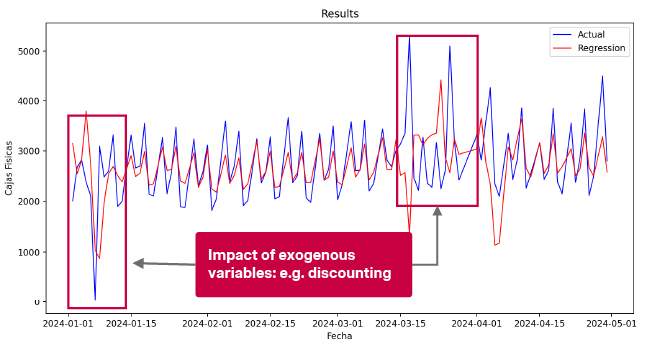

The levers are already there and most organizations are pulling them: trade terms, sales incentives, planograms, POS execution, promotional tactics, etc. However, they often don’t measure their impact with a mix lens. Quantification means knowing what a marginal dollar or action will return in terms of mix improvement, by region, category, and channel.

Mix is so specific. The same action that improves mix in juices might worsen it in water. A lever that works in modern trade might do nothing in traditional retail unless it’s paired with something else like credit or merchandising support. What's required is an internal strategic pricing engine, but for mix. A structure that lets you simulate “if I do this here, this is the likely mix effect and economic return.”

Not every lever is worth building out in every business. Start with those that match your execution maturity, GTM model, and the readiness of your commercial teams. Meanwhile, sales and trade teams need to stop thinking of volume only and start thinking of quality of volume. That’s not natural for most commercial teams because incentives, targets, and dashboards are usually volume-first.

Finally, the only way to compare across these wildly different levers is through advanced analytics, making your commercial strategy measurable and comparable. The goal is to isolate the causal impact of each lever on the mix target, normalize the result in financial terms (per dollar or per unit of effort), and then plug those coefficients into an optimization engine.

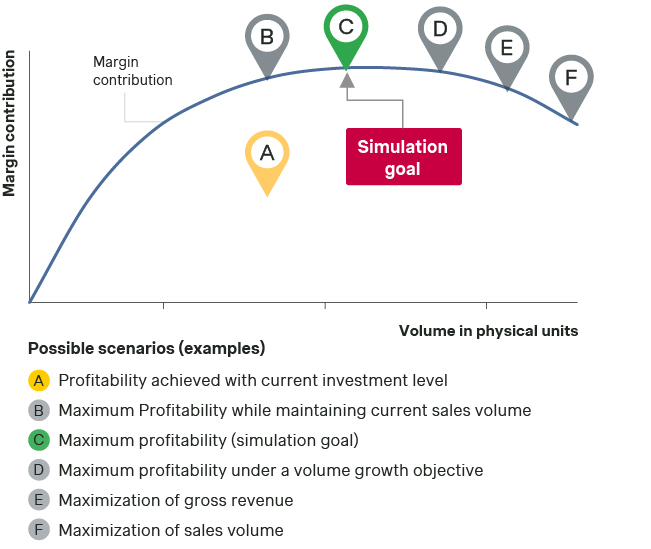

4. Dynamism: Validating scenarios with those accountable for delivery

Don't stop at optimization on a spreadsheet. After building the simulation engine, workshops with top management, sales leaders, regional managers, trade marketing, and even key account reps pressure-test your active mix management approach. Does this make sense? Can we execute this? Will clients go for it? What are the workarounds you’ll use when this hits resistance?

Simulations rarely produce one single answer. Instead, they offer a frontier of viable trade-offs. For instance, one scenario might optimize profitability at the cost of volume (Scenario C), while another maximizes gross revenue or protects volume share (Scenarios E or F). The real work lies in identifying which target is operationally sustainable and ensuring it aligns with both commercial ambition and ground realities.

No matter how sophisticated the model, if it assumes behavior that doesn’t match how salespeople really operate, chase bonuses, manage risk with clients, and balance effort versus payout, then it’s not going to land. Sales teams are smart, adaptive, and extremely pragmatic. If the mix-targeted incentive scheme doesn’t help them hit their volume and revenue targets more easily, they’ll find the workaround. They’ll gravitate to the products that convert fastest, the clients that order big without a fight, and the SKUs that clear inventory.

This is where the whole thing comes full circle. You start with transparency, move to strategic alignment, quantify the levers, optimize the spend, but it only works if it’s co-owned by the teams on the ground. When they understand the logic, believe the math, and see a path to win under the new rules, that’s when mix management becomes operational, not just conceptual.

How Simon-Kucher can help

At Simon-Kucher, we empower CPG companies to build effective mix management strategies. Our revenue growth management framework helps our clients move from reporting to action, quantifying what truly drives profitable mix shifts and aligning those insights with incentives, budgets, and execution. The result? Smarter investment, stronger commercial focus, and sustainable growth.

Get in touch to see how we can turn your mix into a strategic growth engine.