Software & technology vendors are optimistic about growth, yet many struggle to turn innovation into revenue. Based on client insights and our recent 2025 Software Study, our experts outline the ten most urgent monetization and go-to-market challenges software leaders face today, and how the most successful firms are overcoming them.

1. AI is a strategic priority, but monetization lags

Nearly all software companies are racing to embed AI in their products. 76% have launched new AI capabilities. Yet, for most, the financial upside has been underwhelming. Fewer than one in five report more than 10% revenue impact from those features.

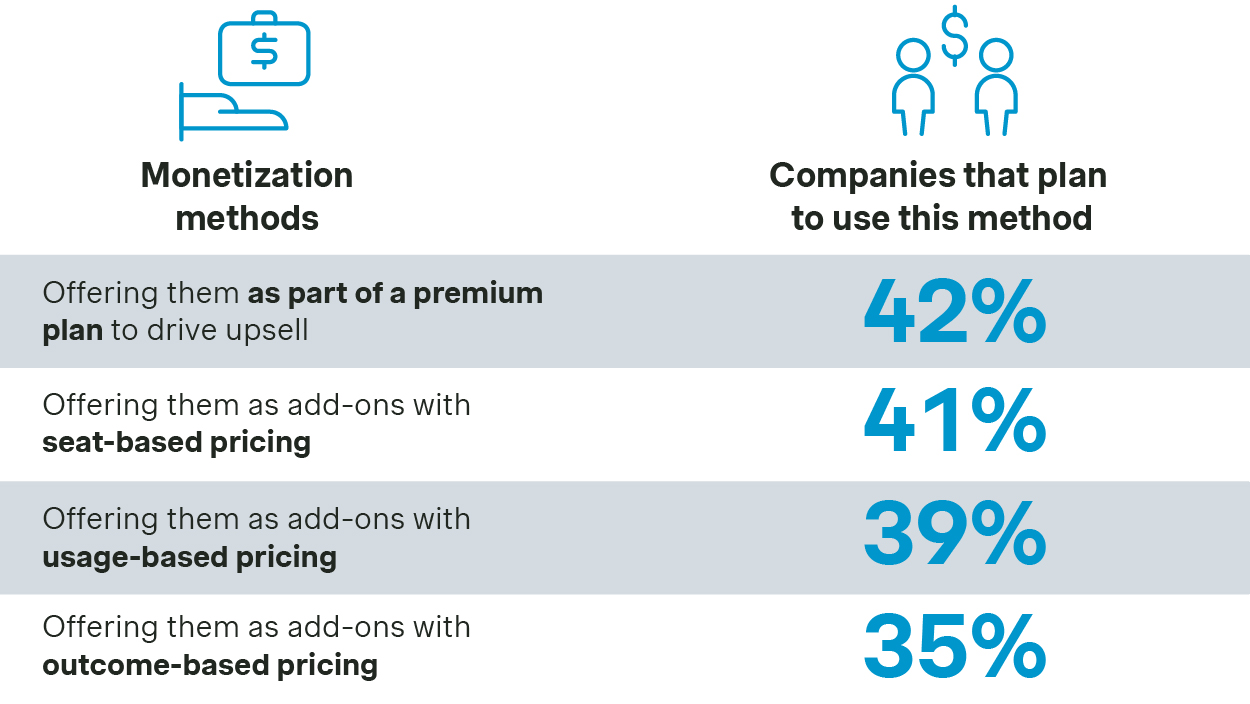

The issue isn’t the technology. It’s the commercial model. Many vendors bundle AI in standard plans without understanding customer willingness to pay, while others struggle with fragmented pricing logic or unclear value communication. Monetization models that reflect perceived value – balancing usage, outcome, or tier-based pricing – can turn AI launches into real revenue drivers.

Overall, companies use multiple models to monetize AI features, with 45% of companies planning to monetize with 2 or more methods:

2. High CAC and long sales cycles hinder GTM efficiency

For many SaaS companies, cost of acquisition continues to climb. While sales cycles are getting longer, win rates and lead conversion ratios remain stagnant. This imbalance puts pressure on efficiency and marketing ROI.

The root problem? Most companies still cast too wide a net. GTM efforts become far more effective when built around precise segmentation, value-based lead scoring, and deal prioritization frameworks that focus teams on the most promising and profitable opportunities.

3. Retention and NRR dominate the agenda

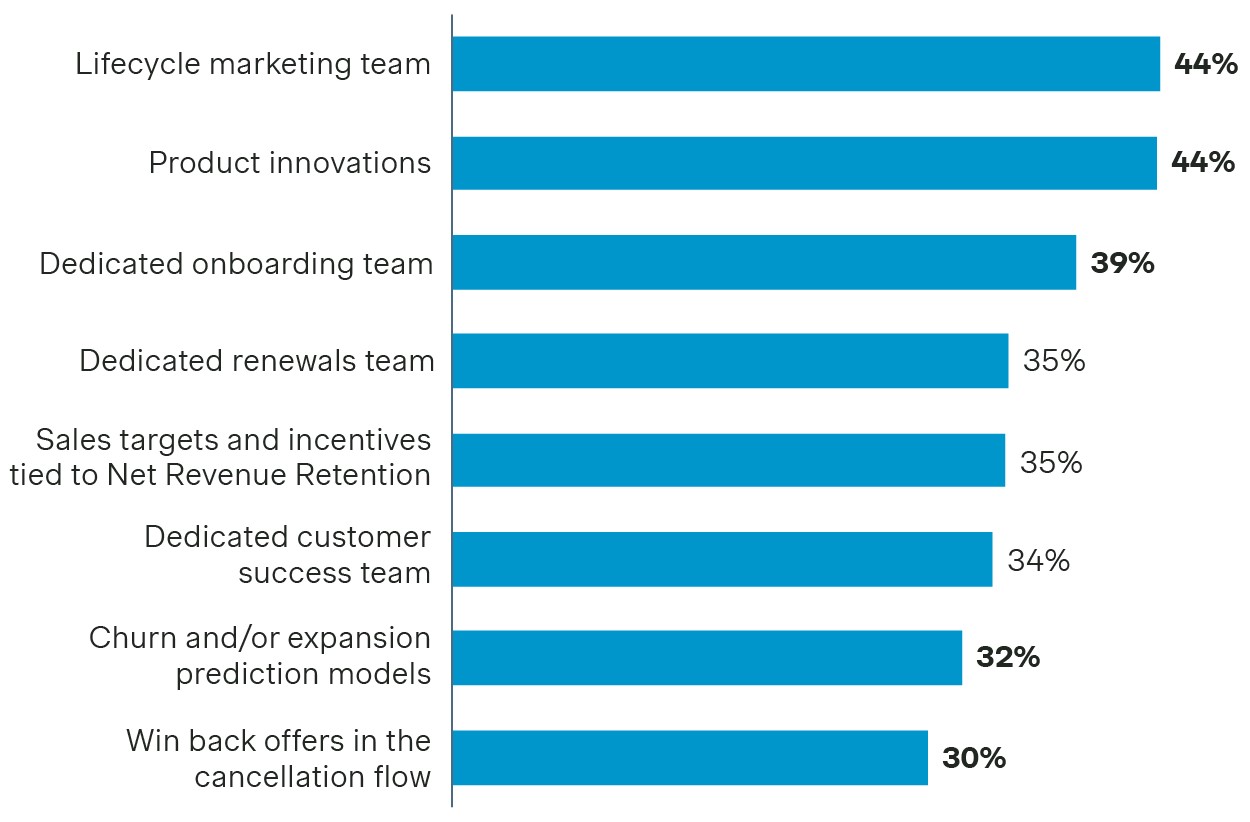

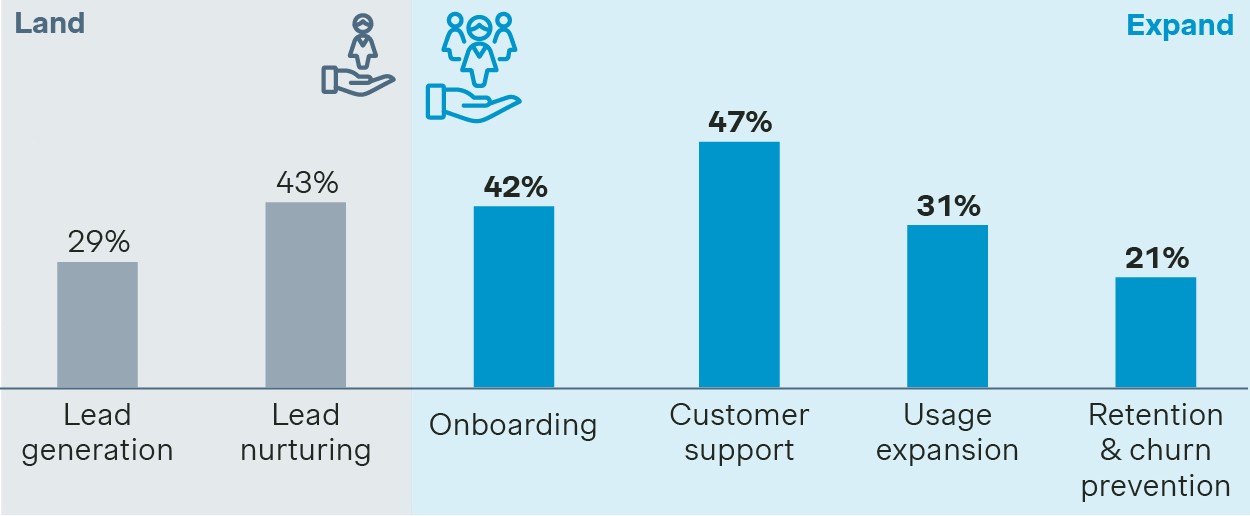

Acquisition used to be king. Now, it’s Net Revenue Retention (NRR). Top-performing companies focus heavily on early value delivery – onboarding, lifecycle marketing, and usage expansion – as the first 90 days set the tone for long-term growth.

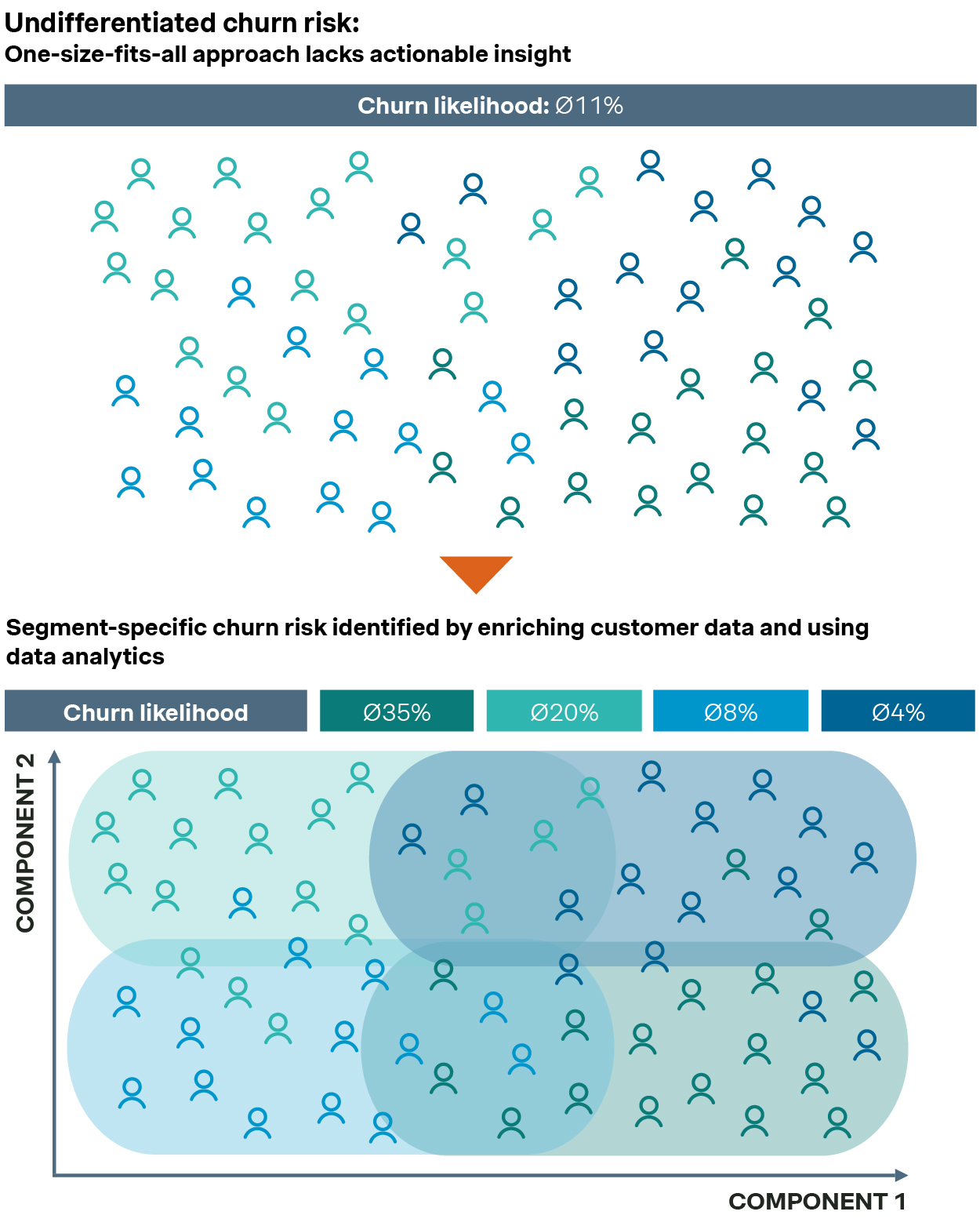

Many firms still underinvest in these areas. Successful retention strategies are grounded in behavior-based segmentation, proactive lifecycle engagement, and predictive churn prevention models that are embedded into operating rhythms.

4. PE/VC pressure drives urgency on pricing acceleration and growth

Private equity and VC-backed software firms face intense expectations: topline acceleration, margin expansion, and GTM scalability, usually on tight timelines. Pricing is one of the most efficient and high-impact levers to meet those demands.

Identifying pricing quick wins, rationalizing discounting, and embedding monetization playbooks into sales motions can deliver measurable results within the first 100 days of a transformation or investment cycle.

5. Packaging and pricing are misaligned with buyer needs

Many vendors still rely on outdated bundles or generic price levels that don’t reflect real usage patterns or customer willingness-to-pay. Friction in the sales process and value leakage are often symptoms of these legacy approaches. Structured packaging design (using leader-filler-killer logic) and price sensitivity testing can unlock both commercial clarity and upsell headroom across segments.

6. Sales orgs are shifting to AI-augmented field roles

Inside sales used to be the engine of SaaS growth. Today, companies are rebalancing toward AI-augmented field roles that better support complex sales and enterprise clients. Yet, role design, territory planning, and sales enablement often fall behind.

Clarifying role definitions, redesigning sales coverage, and embedding AI tools in the sales stack can significantly increase productivity and conversion without increasing headcount.

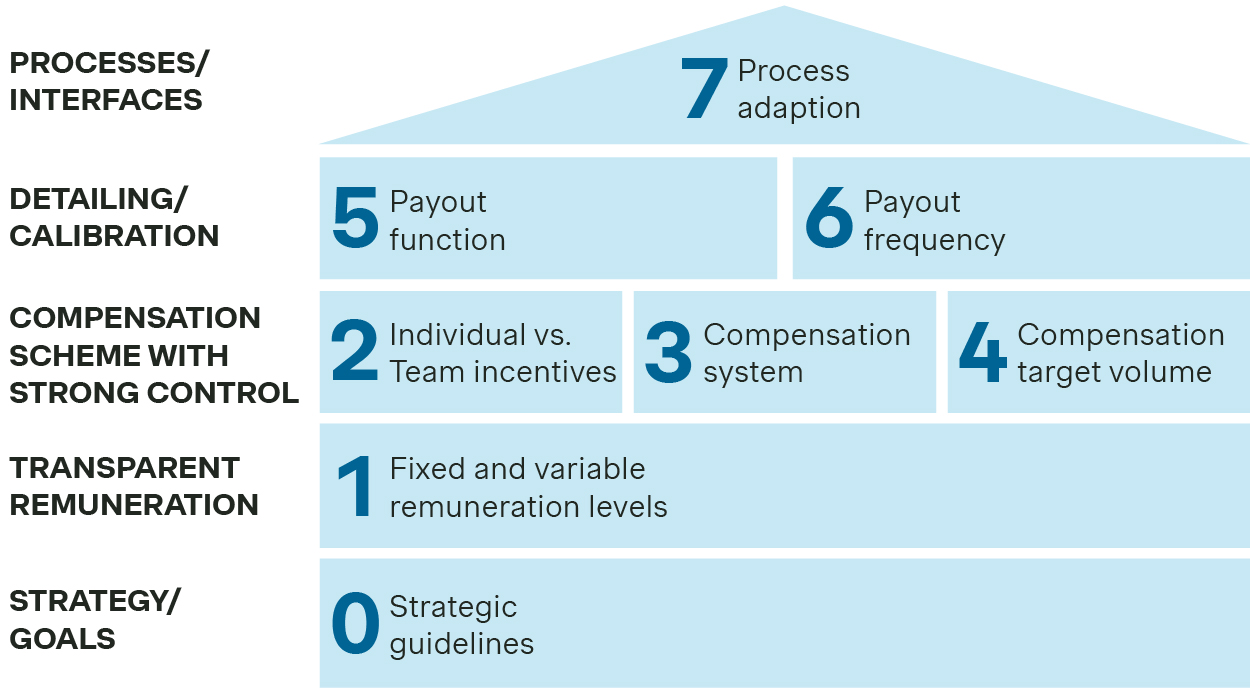

7. Sales, CS, and Product teams often lack aligned incentives

Growth is increasingly a cross-functional effort. But too often, incentives remain siloed. Sales may be rewarded for net new logos, while Customer Success is expected to prevent churn, and Product focuses on feature delivery.

Real impact comes from aligning KPIs and compensation across the funnel, so that expansion, retention, and usage metrics carry weight for all functions.

The design of an effective and sustainable compensation system consists of 8 building blocks:

8. Buying is multi-stakeholder; pricing clarity is top friction

Today’s software buying process spans IT, Finance, and business stakeholders each with different needs and priorities. While IT may focus on integration and compliance, business teams want usability, speed, and transparency. Unfortunately, rigid or unclear pricing structures often alienate both.

Creating models that are both predictable and value-reflective helps reduce friction and accelerate consensus in multi-stakeholder deals.

9. Revenue predictability is a growing concern

With more vendors adopting usage-based and hybrid models, forecasting becomes harder. Churn risk is harder to detect and revenue fluctuates with seasonality or behavior shifts.

To stay ahead, firms must strengthen their forecasting capabilities with data-led churn modeling, customer health scoring, and revenue visibility analytics that enable proactive intervention and churn prevention.

10. Channel strategies are often misaligned or undifferentiated

Indirect go-to-market models can be powerful when the partner strategy is clear and differentiated. Many firms struggle with generic or overlapping partner tiers, leading to poor activation and low ROI.

A more effective approach segments partners by role and value potential, introduces tiered incentives, and clarifies expectations with governance frameworks that scale.

Strategy sets the direction. But recurring revenue growth depends on commercial execution: on getting pricing right, aligning teams, and designing models that scale with customers. These commercial foundations increasingly define the difference between outperformers and the rest.

This article draws on insights from Simon-Kucher’s Global Software Study 2025, which combines input from over 500 software executives and 160 B2B buyers across North America and Europe.

Click here to download the full report and explore the full findings: Simon-Kucher’s Key Insights on B2B Software Monetization