The chemicals industry has recently seen a boom in mega-deals – all with the goal to grow the top line. However, after a mega-deal is closed, most giants fall back to cost-cutting initiatives. This is a lost opportunity, considering better pricing not only helps to grow the top line but is also the bigger profit driver.

Merger and acquisition activity in the global chemical industry has skyrocketed in the last year, with one record-breaking mega-merger after another drawing international attention. Dow merging with DuPont, China Chem’s acquisition of Syngenta and Evonik’s purchase of an Air Products division, are just a few high-profile deals that have created giants in the chemicals industry.

There are a couple of significant reasons for this deal-making frenzy. First, there is a lack of alternative growth opportunities, as most players operate in mature and concentrated markets and the top five players own more than 50% of the market. It is imperative to buy into growth. Second, many factors have created an M&A friendly environment: cheap access to capital; low costs of raw materials; and the ‘Trump factor’ – a promise of tax cuts for companies in the US paired with high import tariffs. The market is rewarding growth – organic or not – allowing companies to pay high multiples of 15 or more for sought after targets.

With these factors in play, it is no surprise that most investment stories focus on size and top-line growth. However, once the deal is complete and it is time to explain the financials behind the transaction, most newly formed mega-companies do not argue for top-line power, but for cost savings. For example, Praxair and Linde said “the merged company is expected to create significant value for shareholders through…scale benefits, cost savings, and efficiency improvements from existing cost-reduction programmes”. Bayer-Monsanto declared “sales and cost synergies assumptions in due diligence”. DowDuPont asserted “cost synergies of approximately $3bn and the potential for approximately $1bn in growth synergies”. Yet, while the company gave a two-year timeline for achieving the cost synergies, it failed to specify when or how such synergies will be reached.

Missed Opportunity

While being cost-efficient is critical, focusing post-M&A efforts exclusively on cost initiatives is a missed opportunity. The potential to drive profit growth in the chemicals industry through the top line and better pricing is significantly higher. In fact, price is the biggest of all profit drivers for chemicals companies.

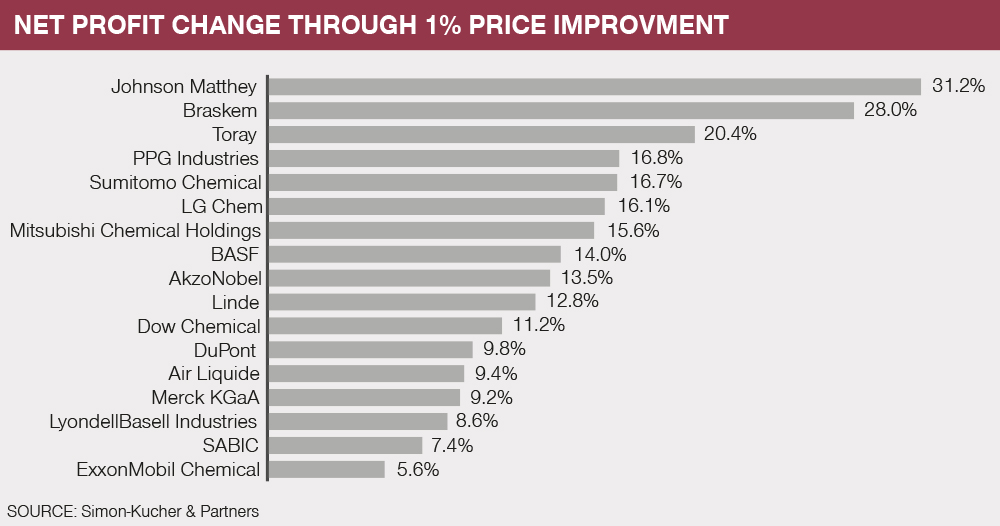

The graph, above, illustrates this point by showing how the net profits of some of the world’s largest chemicals companies in 2017 would have increased if these companies were able to improve their prices by only 1%, with everything else unchanged. In all cases, the impact is tremendous, ranging from 5.6% to more than 31% profit growth. Such leverage could not be gained through cost-cutting, supply chain optimisation, or other operational improvement-related initiatives.

Price is not only the biggest profit driver, it has two other significant advantages. There is a time advantage, which is created because price has an immediate impact on profit and cash flow, whereas the impact of cost-cutting measures is typically not fully realised until several months or even years have passed. Furthermore, there is an investment advantage: pricing initiatives do not require costly severance payments or large upfront investments for building manufacturing sites.

Post M&A price improvement

Of course, pricing does not refer to an abuse of market power to raise price levels – ultimately, that is what regulators are trying to avoid when reviewing potential mergers. It is also not as simple as just raising all prices by 1%. For most chemicals companies, there are typically pricing opportunities in five areas:

Price increase management: In 2017, only two out of 100 chemicals companies achieved the price increase targets they had set for themselves, as a study of 112 firms in the industry indicated.

In fact, chemical companies achieve only 41% of a planned price increase on average – a poor result. Some of the root causes are lack of preparation, poor internal and external communication, and insufficient or poorly managed monitoring.

While last year’s low and stable oil prices camouflaged the industry’s shortcomings, 2018 will tell a different story as raw material costs begin to increase again. For the new mega-companies it will become imperative to have effective price increase management in place – and soon.

Market segmentation and alignment on strategic objectives: In many mega-companies, market segments are either not clearly defined or they are not prioritised to provide a clear commercial focus.

This holds particularly true for recently merged companies that are still trying to build agreement on which markets, products, and customers to focus.

In addition, existing market segmentations are often not suitable to inform pricing decisions. All of this makes it tremendously challenging to align on strategic priorities across the organisation, leading to conflicting goals – from capturing market share (“low prices!”) to increased margin levels (“high prices!”) –and inconsistent and costly pricing actions.

Value-based list price management: While products are rarely sold at list, these prices are a tool to communicate the value of products to the market. However, many list prices are based on cost-plus calculations instead of reflecting the value that products and services provide to customers.

Only when value and prices are aligned, can salespeople focus on value selling instead of continuously adjusting prices to conform to market levels and conceding additional discounts. Mergers and acquisitions are often moments to revise the structure of product portfolios and should also be used to revise list prices.

Monetisation of services: Market-leading companies especially tend to offer value-added services for free, often in an effort to justify the premium that customers have to pay for their products.

This provides an opportunity to smartly unbundle services and monetise on solution value, for example through the introduction of surcharges or service prices. A merger provides a great background to start monetising. To make service pricing work and to effectively tap into segment-specific willingness to pay, the sales approach needs to be adjusted and differentiated by customer segment.

Optimised and conditional discount structure: In many chemicals companies, customer-specific prices depend more on a “gut feeling” and negotiation skills of the sales force than on a structured approach.

This leads to price inconsistencies across accounts, where it is not the best customers who get the best prices, but the customers who complain the most. This, in turn, leads to heated price negotiations and frustrating experiences for all parties involved. Implementing a structured and systematic approach to discounting not only creates profit opportunities, but, more importantly, prevents companies from being exposed to tremendous profit risks stemming from large accounts that are treated unfairly.

The areas and possibilities for improved pricing in an organisation are multifarious, yet, what they all have in common is a deep impact on profitability. Therefore, companies should be considering pricing opportunities as early as possible in the due diligence process, and they should understand how opportunities will differ by market, product group and customer segment. After the deal, a pricing diagnostic helps to uncover the areas with the largest leverage and the ones that are easiest and fastest to implement.

Often, such a diagnostic alone reveals significant quick win opportunities that make profits from cost-cutting initiatives pale in comparison. Lastly, the new mega-companies should develop mid-term pricing excellence programmes, in the same way they design initiatives to develop synergies on the cost side. The effort will pay off, as such pricing excellence programmes typically increase earnings before interest, taxes, depreciation, and amortisation of chemicals companies by two to four percentage points.

This article was first published on icis.com in April 2018.