With heightened competition and longer acquisition cycles, existing customers are more than ever the main source to sustained growth. Nurturing those relationships, thereby preventing logo churn is now a standard commercial practice. Best-in-class SaaS recognize the compounding financial impact of churn and are already working on it. Discover how a churn prediction strategy can unlock long-term growth.

In an environment of fast changing customer needs and longer sales cycles, SaaS companies recognize the value and importance of their existing customers. A critical growth factor revolves around actually retaining customers that you already have. Yet due to the increase in competition it has never been harder to do so. Emerging alternatives and accelerating technology have dramatically lowered switching costs, putting many SaaS companies under pressure.

The results of the 2024 SaaSiest Benchmark Report are therefore not surprising. Over half (51%) of investor respondents anticipate “achieving sustainable growth and retention” to be the biggest challenge confronting B2B SaaS companies in 2024. Nonetheless, some companies appear to overlook its significance. Some even showcase a lack of maturity regarding churn prevention.

In our Global Software Study, only half of respondents said they “utilize tools to prioritize accounts to focus on”, and less than half “utilize tools to estimate churn risk at a customer level”. This leads to the conclusion that a significant number of SaaS companies have large potential to improve their churn prevention strategies.

This article aims to illustrate the importance of a churn-proof strategy and to give a glimpse of how to develop this into a standard commercial tool. We delve into the rationale of investing in a thorough retention strategy, our approach to developing it, and the likely impact on key SaaS indicators such as net revenue retention and churn rates.

Why should you build a churn prediction model now?

It is widely accepted that growth solely through acquisition is costly and unsustainable in the long term for B2B SaaS companies. In our Global Software Study, a significant share of SaaS respondents plan for double-digit topline growth for 2024. Scale-ups could possibly achieve such results by adding new customers only. But for large and more mature B2B SaaS companies, this would be unmanageable, particularly in times of uncertainty.

So how can these companies protect and expand their existing customer base while avoiding logo churn?

Active churn management is becoming a crucial strategy to preserve revenues and long-term financial stability. A churn prediction model has the ability to quantitatively determine the risk of customers unsubscribing from your product and the corresponding value loss.

As our MyBase solution states, nurturing relationships with existing customers is key for at least three quantitative reasons:

- On average, retaining customers is 5x cheaper than winning new customers

- Compared to new customers, existing customers are 50 percent more likely to try new offers

- Existing customers are generally responsible for 90 percent or more of companies’ profits

On average, SaaS industry benchmarks point to a 7-13% ARR lost every year from churning customers. Therefore, it is vital to design a powerful retention strategy to sustain ambitious growth targets.

Case study 1: ML model to prioritize customers for sales interventions

- Curious about which customers to prioritize to prevent churn or which strategies are most effective in repairing strained relationships and retaining customers? These were the key questions posed to us in a recent collaboration with an energy software provider.

- We developed a Machine Learning-driven model aimed at optimizing customer interactions. This innovative approach allowed sales to discern the most critical customers for targeted sales interventions.

- The model also recommends tailored care service measures, ultimately strengthening the customer-provider relationship.

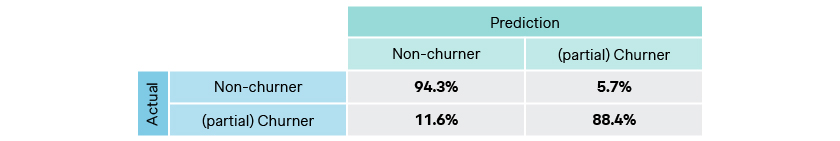

- Our model showcased remarkable accuracy by identifying 88% of future churners within the initial 12 months of its pilot phase.

- This breakthrough provided the sales team with actionable insights, guiding them on precisely whom to engage and equipping them with effective strategies to address customer needs proactively.

Case study 2: Churn risk profiles to prevent churn and foster customer retention

- We partnered with a prominent EU-based B2B media platform that was bleeding from customer churn and had lost over one-third of their customer base.

- The urgency to reverse this trend led them to seek our expertise in identifying the root causes of churn and formulate proactive measures to prevent its recurrence in the future.

- For instance, many churners were leaving due to the poor dashboard capabilities, a symptom we tracked by monitoring the usage of the dashboard export function.

- Our solution involved crafting a sophisticated model that, for each customer, generated a detailed churn risk profile, based on multiple variables – usage of certain functionalities being the most important.

- This invaluable tool empowered the sales team by offering actionable insights to prioritize accounts effectively. For instance, if a customer’s usage of certain functions dropped, that resulted in a signal in the model’s report.

- The sales team received comprehensive reports specifying which customers to engage with and recommended primary and secondary care actions. These actions ranged from proactive renewal offers to one-off loyalty discounts, enabling the transformation of high-churn-risk customers into satisfied, loyal customers.

Case study 3: Incentive system linking performance and bonuses to customer retention

- In tackling the challenge of customer churn for a leading Nordic digital payment provider, we devised a strategic solution by implementing an innovative incentive system.

- This system intricately linked the performance and bonuses of both business developers (BDs) and account managers (AMs) to the crucial metric of customer retention.

- The model specifically rewarded the lifetime value of each customer, ensuring a holistic approach to customer satisfaction. The metric used for the incentive was customer lifetime value growth.

- BDs oversaw facilitating smooth onboarding to payment functionalities and seamless transitions to AMs. Simultaneously, AMs assumed the responsibility of monitoring lifetime engagement, spending patterns, and other pertinent metrics for a churn risk assessment.

- For instance, a customer reducing their spending with the payment provider by more than 10% (drop was agnostic of seasonality patterns) was considered at risk of churn.

- The incentive-driven model prompted BDs and AMs to reach out to customers deemed at risk, engaging them directly to uncover and address any sources of dissatisfaction.

- This proactive customer-centric strategy not only curbed churn but also fostered a more robust and enduring relationship between the digital payment provider and its customers.

These are just a few examples of B2B clients heavily focusing on their customer base and churn retention tactics in recent times. Moreover, in our 2023 Global Software Study, we saw that best-in-class SaaS companies are 19% more likely to have a churn estimation tool.

Still, we believe churn prevention deserves greater importance. A churn prevention model enables customer success to address and mitigate leavers before churn occurs.

Let’s dive into the steps to build your tool.

Our approach to designing churn prediction models

A churn prediction model forecasts customer attrition risk by analyzing usage patterns and other data. It helps companies spot customers that might leave, enabling early and proactive intervention to retain them through tailored strategies. At Simon-Kucher, we typically develop churn prediction models in a four-step approach:

1. Identify potential churn drivers

Here, we identify key factors influencing customer churn based on your business context and customers. We analyze customer behavior, engagement metrics, subscription changes, and feedback to discern patterns indicative of churn risk level. A common example is low login frequency and activity periods, which are typical symptoms of customer dissatisfaction and potential churn risk.

2.Test and shortlist drivers using historical data

Here, we leverage historical data to test and identify the most influential drivers of customer churn. We employ both data analysis and churn interviews to narrow down the drivers with the highest predictive accuracy. We often ask “what is the primary factor that would cause you to consider leaving?” to control for “cause-effect” behavior in the data.

3. Design statistical logic and thresholds for each driver that lead to a churn trigger

Here, we create the predictive model, for instance using ML or GenAI technology, to signal potential churn risk at an account level. Comprehensive and sophisticated data sets are required to forecast the likelihood of customer attrition on each account and assign a risk score. This process is not a one-off design. We always consider a pilot phase of six months with constant reviews in between.

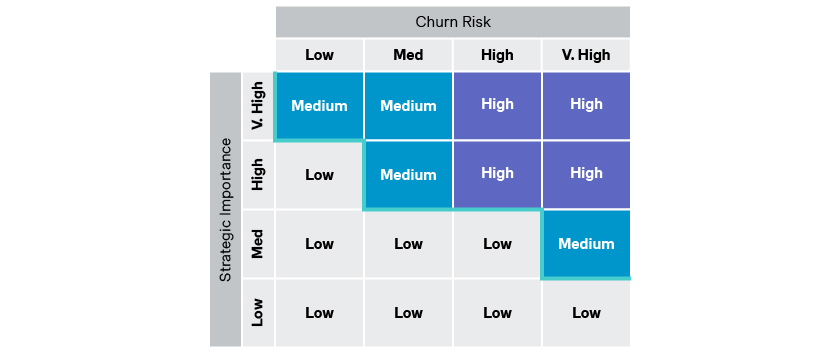

4.Create risk level clusters and prioritize accounts based on their value (i.e. ARR)

Here, we group accounts with a similar churn risk level. Subsequently, we prioritize them by value generated. For instance, high-value accounts, often measured by Annual Recurring Revenue (ARR), receive special focus for tailored retention strategies.

We have applied this methodology across several industries, including both Software, Telecom and Energy. The approach may sound relatively straightforward. However, we often observe several pitfalls when working with B2B tech companies. For instance, developing a churn retention model should not be a siloed sales topic. Instead, the most effective models ensure that product, operation, and sales teams work closely together in identifying the most promising churn drivers.

Another example is the absence of clear directives on proactive actions, targeted incentives, or win-back initiatives to retain customers. Once the model identifies a potential churn customer, it is of paramount importance to have a clear owner who can implement the effective measures established in the prescribed timeline.

Decrease customer churn rate by 10 to 30 percent

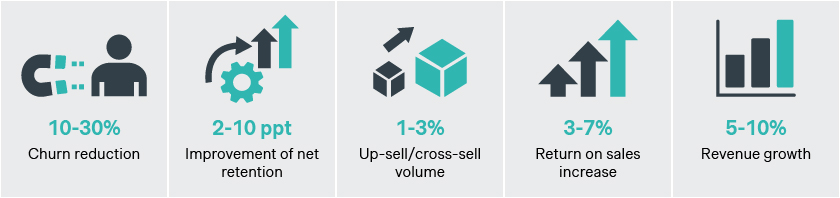

We see an increasing demand among B2B tech companies who are bleeding from customer churn and want to focus on better retaining their customers. The impact of a churn prediction tool on their long-term growth journey has been far from our pre-project expectations. In particular, following the development of a churn prevention model, we tend to see a significant improvement across all key SaaS indicators:

With nearly four decades of expertise, we support SaaS enterprises to achieve their growth targets. Reducing customer bleeding is a must-strategy to succeed in 2024.

Ready to craft your churn prediction model? Reach out to us today and let’s embark this journey together!