Simon-Kucher & Partners recently worked on a project for a Private Equity-owned market leader in business services. The company was underperforming on their inbound and outbound sales results after having undergone a major salesforce restructuring.

A thorough assessment of the sales organisation pinpointed concrete causes of underperformance to address. However, this was only possible through close collaboration with both senior and mid-level management, leading to excellent client buy-in and an estimated ~25% revenue uplift.

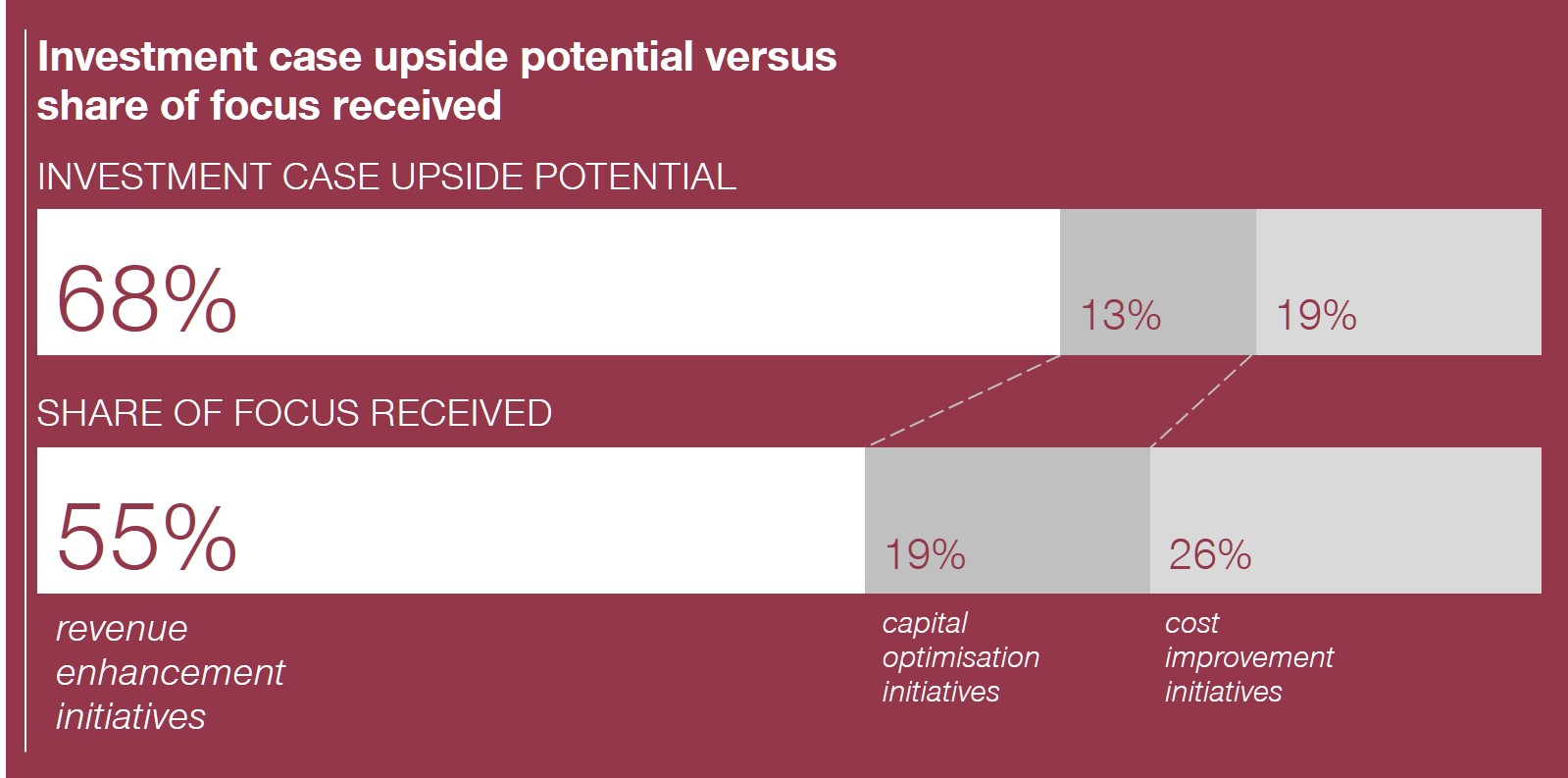

Although there is awareness of the remarkable value creation opportunity of top line initiatives, Private Equity professionals admit that they do not spend enough time and focus on these initiatives proportional to cost and capital.

Why do almost 40% of Private Equity revenue enhancement initiatives fail? From our experience, whether a portfolio company exceeds or fails to meet their top line goals usually comes down to the same 3 things:

- Balancing senior management & Private Equity involvement

- Focusing on the right factors for each portfolio company

- Building capability in key top line areas