In recent years, the Private Equity industry has benefitted from a record high in investment, fund-raising and strong opportunities for fruitful exits, making it a preferred asset class. However this success comes at a price: Accumulated dry-powder and an increasingly competitive space have boosted purchase multiples to all-time highs, making it difficult to find and win suitable targets.

As a result of this, funds are having to work harder to achieve an ROI by identifying & executing long-term commercial improvements such as pricing, customer segmentation and sales initiatives.

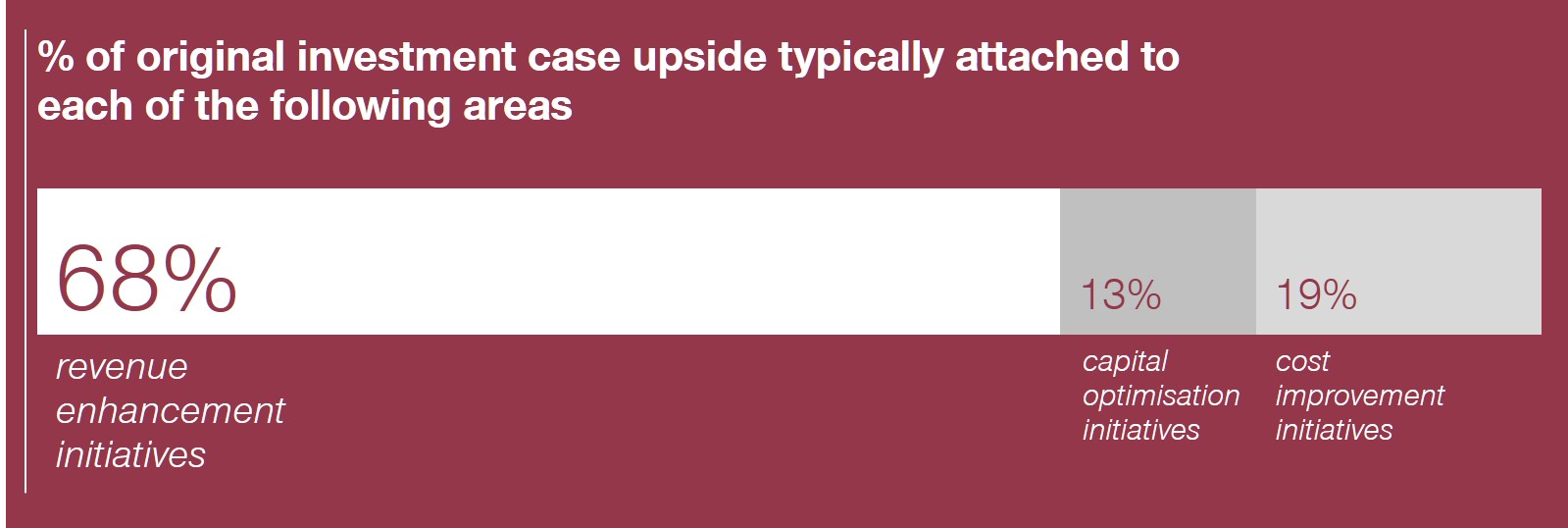

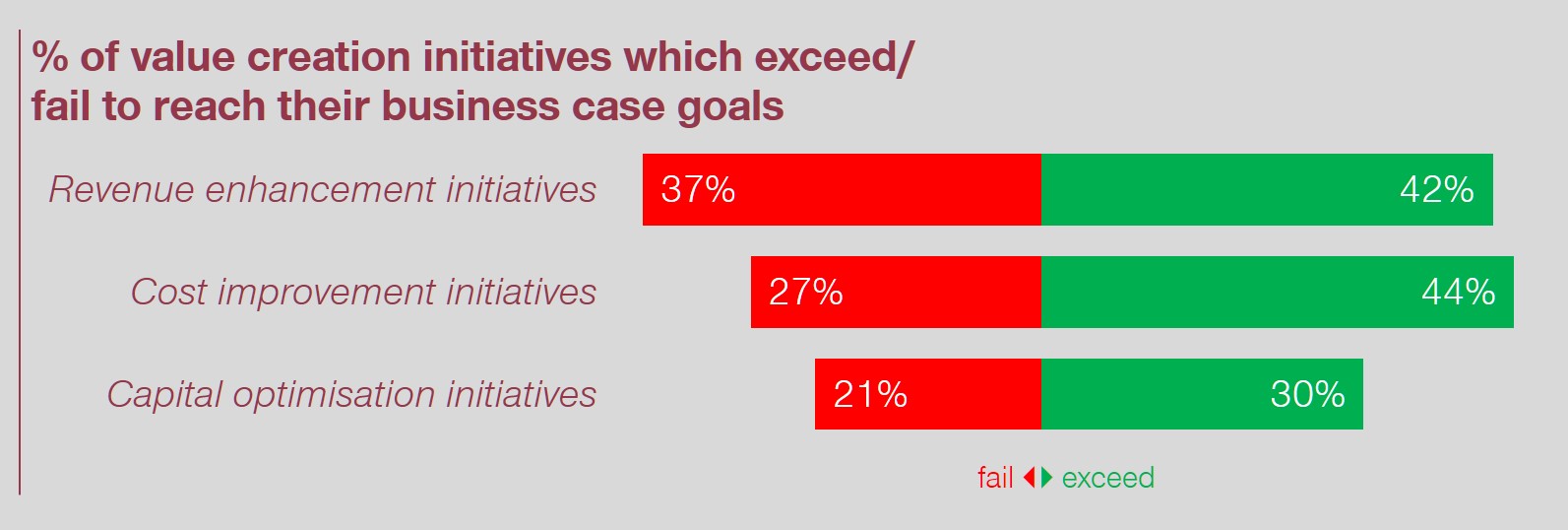

Simon-Kucher & Partners runs an annual survey with senior leaders in the Private Equity space. Our latest round of interviews with industry professionals have revealed an increasing focus on value creation via top line initiatives to deliver ambitious investment goals. In fact almost 70% of investment case upside is linked to top line initiatives.

However, despite basing the vast majority of the investment case on top line initiatives, 37% fail to reach their business case goals. This is a worryingly high number for Private Equity professionals.

Business case goals are generally more ambitious for revenue initiatives than for cost and capital initiatives, so perhaps this figure is not surprising. Furthermore, when these initiatives go well, they go very well as the upside for revenue enhancement initiatives is virtually unlimited compared to cost & capital initiatives.

- Balancing senior management & Private Equity involvement

- Focusing on the right factors for each portfolio company

- Building capability in key top line areas

Get these things right, and you can expect to see substantial upside.