Today, CDMOs face sharper price pressure and tougher negotiations. Our latest study shows that value communication, rather than blanket price hikes, is now the key to defending margins and sustaining growth.

Pricing has become both a defining challenge and an opportunity for Contract Development and Manufacturing Organizations (CDMOs) in 2025.

The latest CDMO results from the Simon-Kucher Global Pricing Study (GPS) show a clear shift in mindset: after a year of modest pricing adjustments amid slower project demand, most CDMOs now plan more aggressive price increases in line with the expected demand recovery. Yet, realizing those increases is far from straightforward.

Most CDMOs continue to struggle with price realization, driven by suboptimal value communication and rising customer pushback. As price pressure intensifies, the industry is pivoting - away from ad hoc, one-size-fits-all price hikes - and toward more systematic, data-driven price/value positioning adjustments. This blog explores how CDMOs are rethinking pricing, reinforcing value communication, and building commercial capabilities to defend margins and drive sustainable revenue growth.

Here is what the latest data reveals.

Bolder CDMO pricing moves meet execution challenges

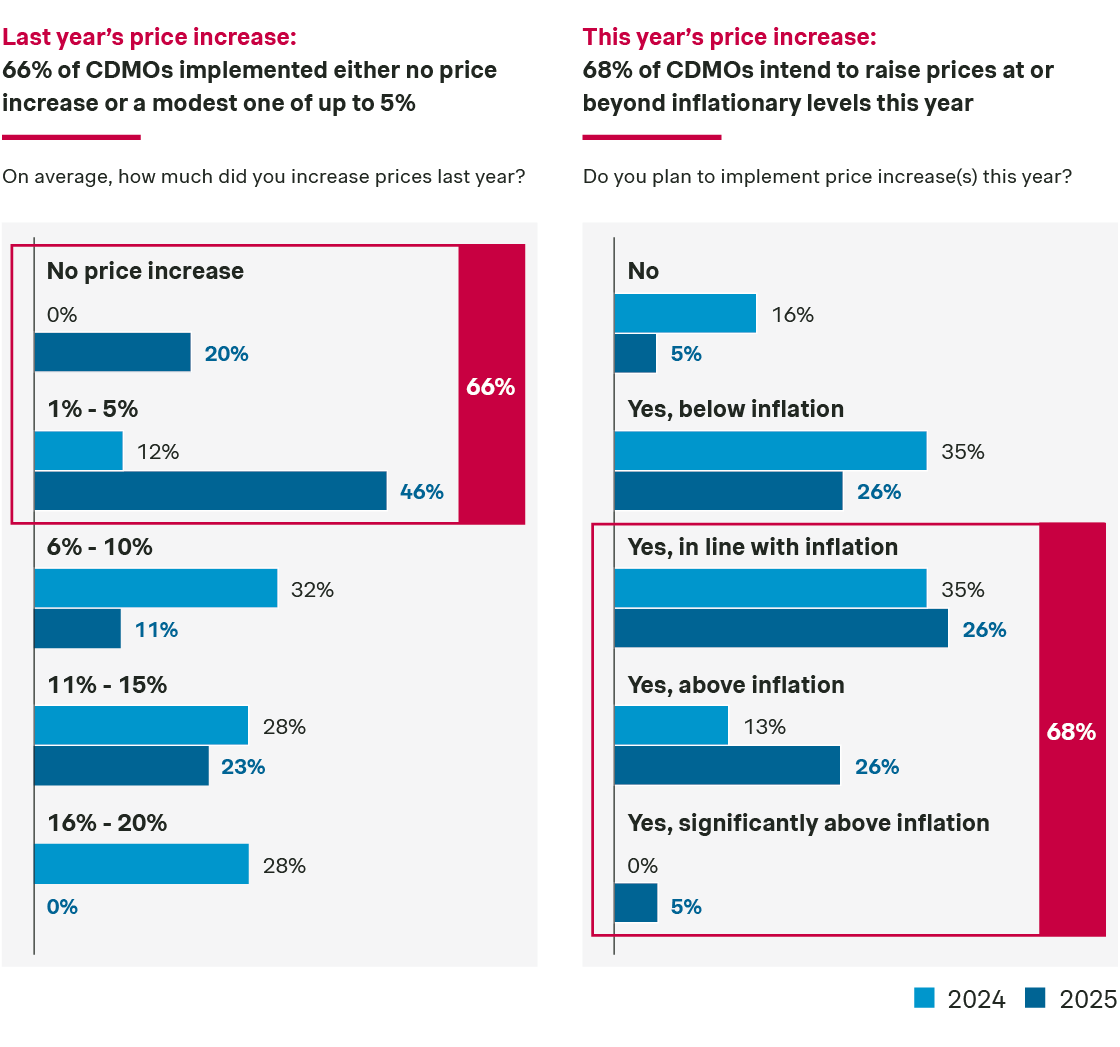

Last year, most CDMOs kept price hikes modest (with 66% in the 0-5% range), and only a minority planned increases at or above inflation levels. Now, the majority intend to implement price uplifts throughout this year at or beyond the inflation levels, reflecting a more aggressive approach to offset rising costs and bolster margins.

Source: Simon-Kucher Global Pricing Study 2025

Execution remains the weak link, despite concerted efforts. They captured, on average, less than half of their intended increases. Our GPS report shows 68% failed to achieve even 50% of their planned uplifts, highlighting the ongoing gap in CDMO price realization between ambition and execution.

According to the report, ineffective value communication and customer pushback are the main obstacles impeding their pricing realization efforts. Addressing this execution gap is paramount: without effective realization, even the boldest pricing strategies will fall short of driving profitability.

Source: Simon-Kucher Global Pricing Study 2025

Price pressures intensify, spotlighting urgent need for stronger value communication

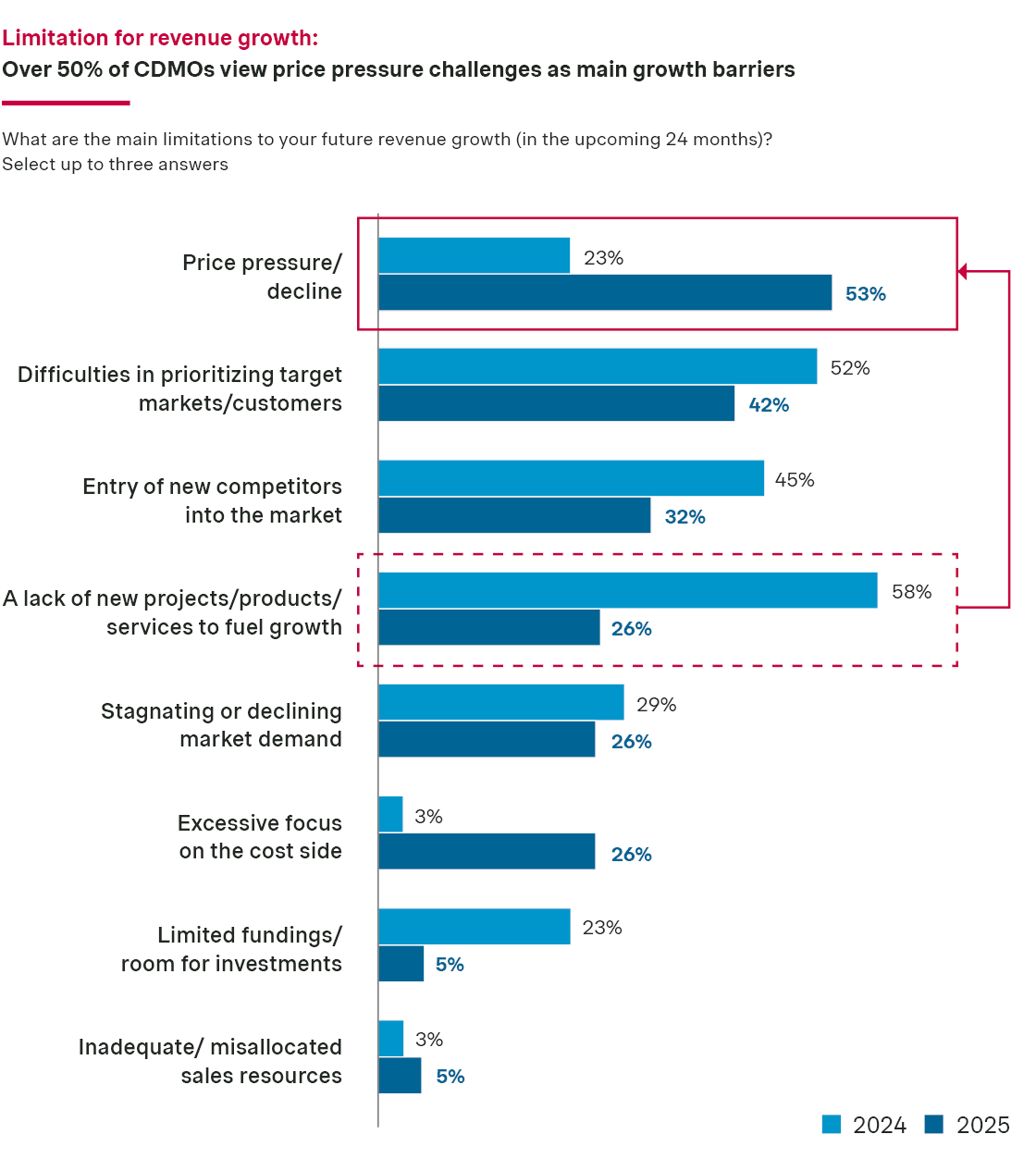

Price pressure has become a key concern for CDMOs in 2025. Unlike last year, few companies are worried about demand softness as project pipelines have largely stabilized. Instead, competitive and customer pressures on price have increased. In the last GPS report, about one in five CDMOs (23%) identified price pressure as a barrier to growth, largely through increased discount demands and concessions. That number has more than doubled this year, with every second company now experiencing heightened pressure, further squeezing margins and increasing the urgency to defend pricing.

Source: Simon-Kucher Global Pricing Study 2025

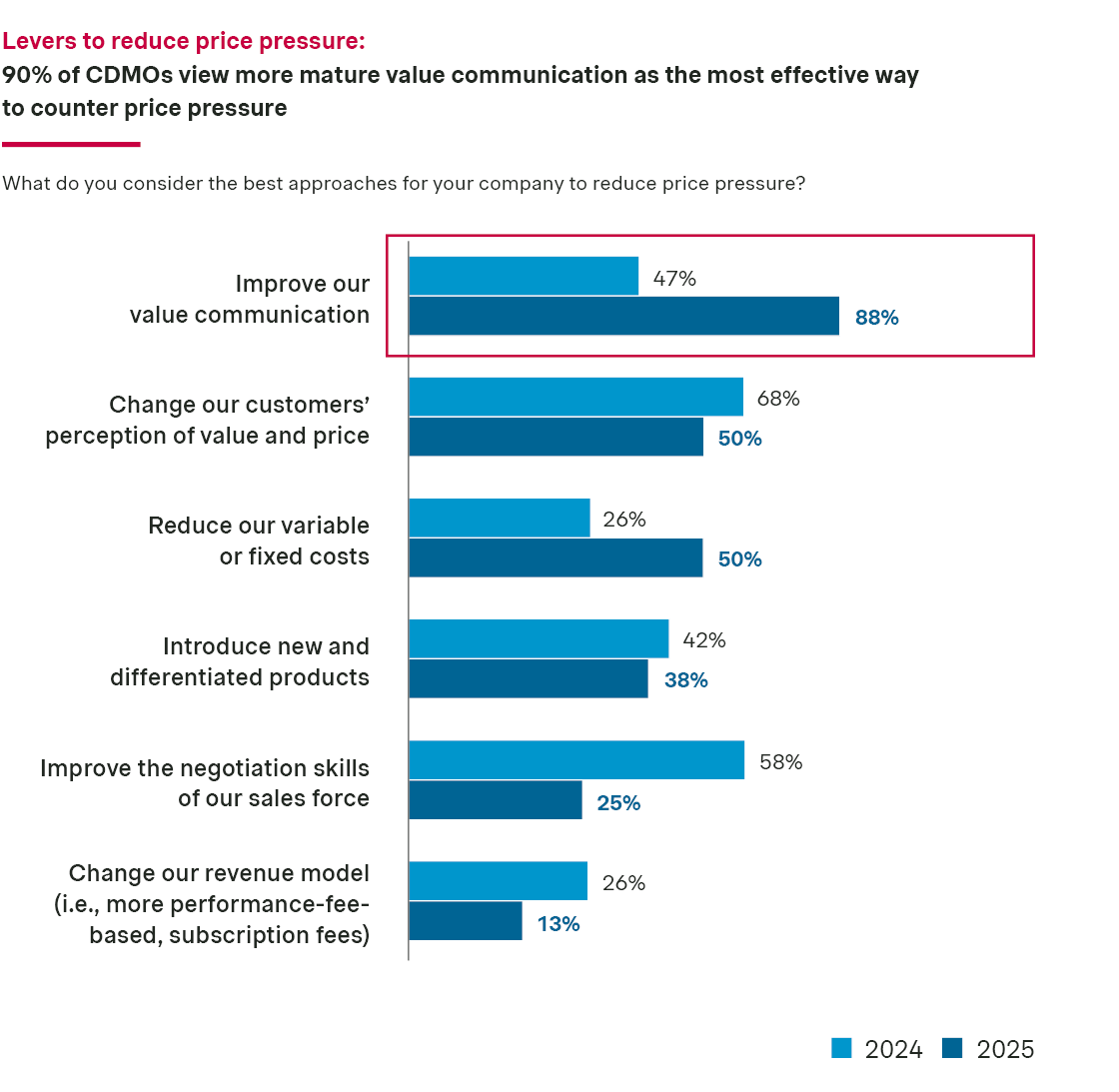

Rather than resorting to perpetual discounts, the industry is strengthening its value proposition. Better value communication has emerged as the pivotal response to pricing pressure. 88% of CDMOs cite value communication as the most effective approach to counter pricing pressure, placing it ahead of changing value perception and cost reduction (both 50%).

Source: Simon-Kucher Global Pricing Study 2025

The reason is clear: when customers understand the differentiated value a CDMO provides, they are more likely to accept higher prices and less inclined to demand discounts.

Leading CDMOs are building pricing resilience by investing in four core capabilities:

- Quantifying the impact of their work on customer outcomes (e.g., speed, quality, reliability)

- Shifting from feature-focused communication to benefit-driven messaging

- Tailoring messages to individual customer needs

- Equipping sales teams with data-backed insights to handle price objections

Putting mature value communication at the center of price pressure mitigation strategies marks a strategic shift toward a more customer-centric defense of pricing. Instead of merely pushing through price hikes, CDMOs are striving to earn them by clearly articulating their value and differentiating themselves from the competition.

Repositioning for value and structuring negotiation discipline

Today, CDMOs are embedding clear value communication into both their pricing strategy and commercial execution.

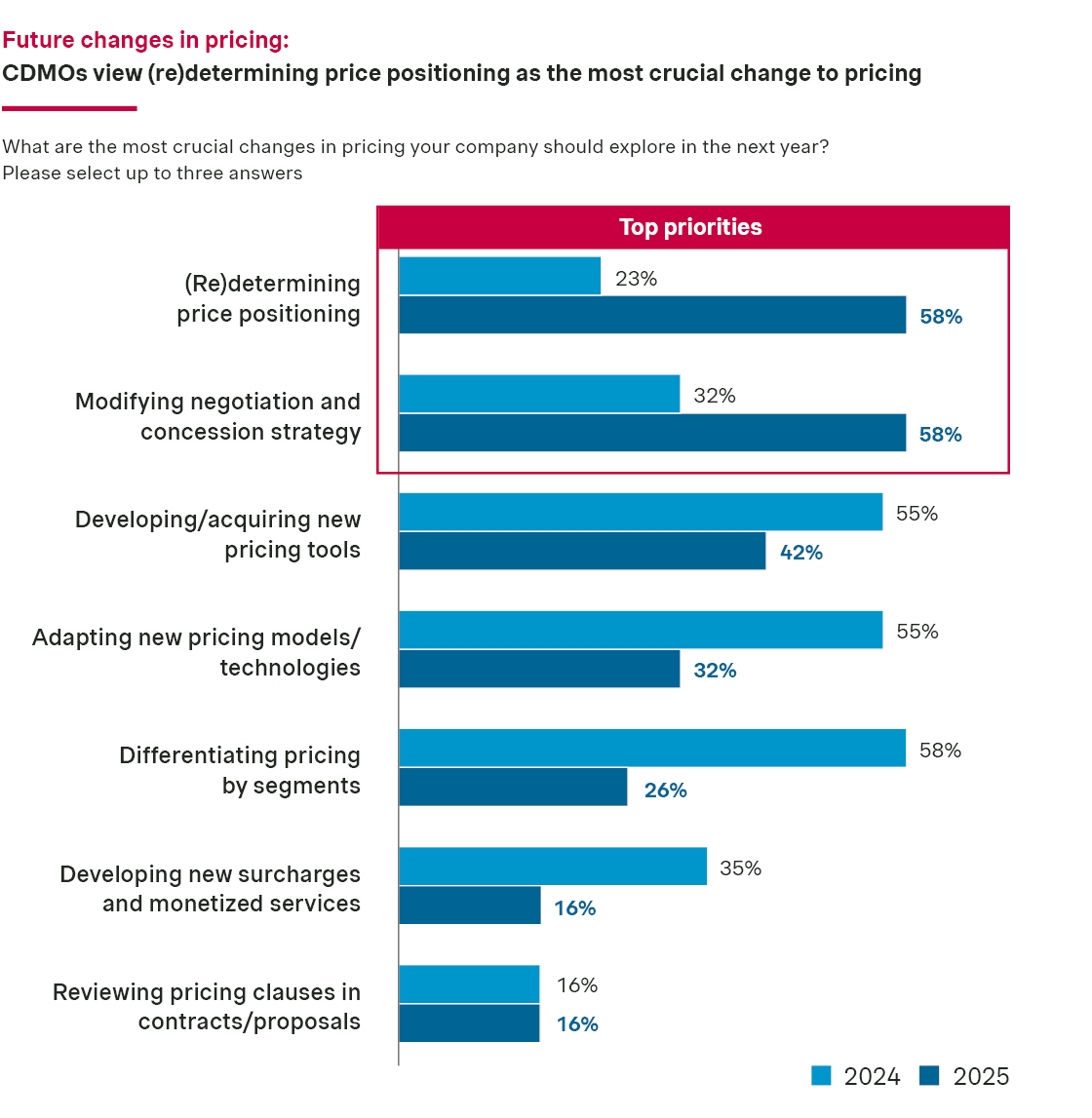

The GPS report highlights the need to reassess price positioning to understand how a CDMO compares to competitors and to align price levels accordingly.

Many still lack a clear view of their market position: Are they delivering premium, differentiated services or competing in a commoditized space? CDMOs are using structured self-assessments, leveraging customer feedback and competitive benchmarks to shape credible pricing narratives. Those that can clearly express what sets them apart - whether speed, quality, expertise, or service model - are better positioned to protect margins and justify premiums.

At the same time, CDMOs are transforming how pricing is applied in negotiations. The latest GPS insights show strong momentum in refining negotiation and concession strategies - they are doing this not just by training sales teams, but also by codifying these practices into structured, company-wide frameworks. Almost 60% of CDMOs plan to introduce stricter pricing guardrails, standardized concession logic, and defined escalation paths to ensure that pricing decisions are no longer ad hoc or overly dependent on individual dealmakers. The aim is consistency: similar deals should be priced similarly, regardless of who is leading the negotiation. By institutionalizing negotiation strategies and linking them to defined value drivers, CDMOs can reduce internal pricing leakage, increase realization rates, and strengthen customer trust. Together, sharper market positioning and a harmonized approach to negotiation create the foundation for more resilient and profitable pricing in a highly competitive market.

Source: Simon-Kucher Global Pricing Study 2025

How we can help improve your CDMO pricing strategy

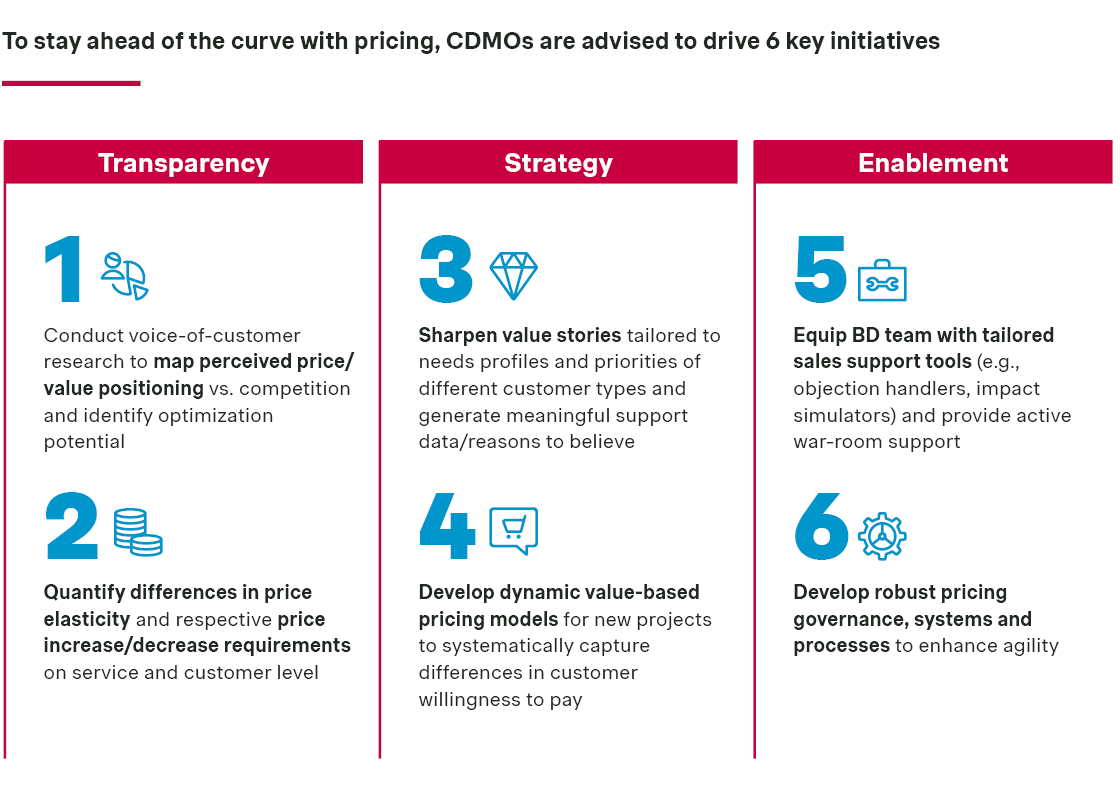

Success for CDMOs will depend on proactively managing price pressure, enhancing pricing capabilities, and communicating value with clarity. By adopting bold but disciplined pricing strategies, reinforcing governance and segmentation, and equipping teams with effective negotiation tools, CDMOs can navigate a tightening market and improve price realization. Achieving this requires a strategic, data-driven approach aligned with evolving customer expectations and intensifying competition.

Source: Simon-Kucher Global Pricing Study 2025

If you would like to review what these insights mean for your business, or discuss how to implement not just pricing improvements but also broader commercial strategies, we are here to help. Simon-Kucher has deep expertise in CDMO pricing strategy and commercial growth. We can partner with clients to build actionable growth strategies – from refining pricing models and segmentation to improving value communication and negotiation effectiveness – and ultimately help organizations unlock their full profit potential in the coming years.

Reach out to our team to explore how strategic pricing can become your competitive advantage.

Separate from our GPS results, the latest Simon-Kucher CDMO Growth Outlook report is also available now.

With contributions from Mackenzie Smith.