AI began with sky-high expectations. CEOs, COOs, and CMOs raced to stake their claims, hoping to seize rapid gains. But the gold rush soon lost its shine.

Most insurers found that the first wave of AI didn’t live up to the hype. Instead of transforming their businesses overnight, they ended up with a patchwork of pilots, many stuck in the back office.

Today, the industry is taking a more measured view. The question isn’t how fast you can deploy AI. It’s where AI can drive real, lasting value. Increasingly, that answer is shifting from the back office to the front office.

The back-office boom, and its limits

Most insurance AI initiatives have landed in the back office. Claims automation. Fraud detection. Policy administration.

These efforts matter. They cut costs and streamline operations. But they rarely change the top line. That’s why leaders are now asking: How can we use AI to grow?

Why the future of insurance AI is front office

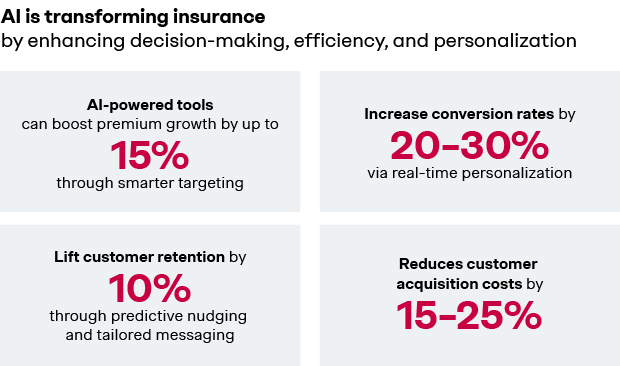

Front-office AI isn’t just about efficiency. It’s about fueling profitable growth across the entire customer lifecycle. Here’s where the real promise lies:

- Sales in all channels

AI can pinpoint the right customers, predict churn, and recommend next-best offers. It supports agents with smart prompts and arms digital channels with hyper-personalized journeys. - Product management

AI can identify unmet needs by mining customer data and market signals. This helps you design products that resonate—and adapt quickly to changing demand. - Price management

AI can simulate thousands of scenarios to find pricing sweet spots. It helps you manage risk while sharpening your competitive edge. - Customer experience across the lifecycle

From onboarding to renewals, AI can personalize every touchpoint. The result? Happier customers, higher retention, and more lifetime value.

Now is the time to act

Insurers who invest in front-office AI today won’t just cut costs, they’ll build a growth engine. They’ll sell smarter, price better, and launch products that truly fit customer needs.

At Simon-Kucher, we help insurers turn AI into profitable growth. Ready to find out how? Let’s talk.