Companies in the Business Process Outsourcing (BPO) industry face tough competition nowadays. To stay ahead of the curve, an excellent sales organization is needed. How do BPO companies perform in this respect? We conducted a mystery shopping study to find out.

In today’s economic environment, companies need to be more flexible and agile as ever. Combined with the fact that only few industries need organizations to have a complete vertical integration of all their functional areas, this means that the sector of Business Process Outsourcing (BPO) is growing. In fact, analysts expect the global BPO services market to grow until 2027 to 397 billion US Dollars at a CAGR of around 8.3 percent.

However, seizing a piece of this pie is increasingly difficult for outsourcing providers due to the likewise growing competition. An effective sales organization is the foundation to stay ahead of the curve. Especially now, as the still ongoing COVID19 crisis amplifies the trend of the digitalization of sales. Even once the health crisis is over, companies capitalizing on approaches like hybrid selling, digital sales tools, and value selling will find themselves in a strong position, significantly ahead of many competitors.

To gain insights on how the industry is currently set up in this regard we conducted a mystery shopping study among 19 leading Business Process Outsourcing providers with a special focus on customer service companies.

BPO industry with overall low sales maturity

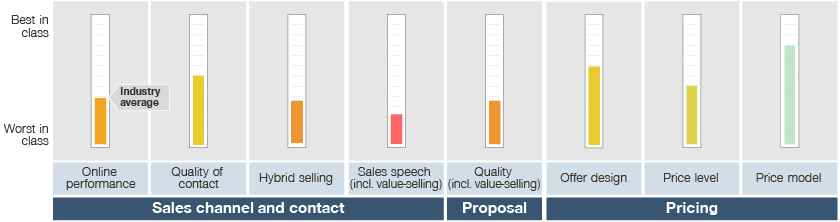

What were the key insights? Throughout our holistic evaluation of all dimensions of the sales process and experience, we observed an overall low sales maturity. Divided into three areas – sales channel and contact, proposal, and pricing – we benchmarked the BPO industry’s capabilities against best-in-class practices. The result: Especially regarding hybrid selling (i.e., the combination of traditional an online sales channels) and value selling (highlighting the added value as product or service offers the consumer) there is lots of room for improvement!

Let’s take a closer look into the individual categories:

Sales channel and contact: Online performance

More and more customers in the B2B sphere are expecting a highly professional omni-channel experience, starting with their explorative information research online. But when assessing the search ranking visibility of the benchmarked BPOs, a conspicuous absence became apparent. Not a single player was featured in the top 20 results for a set of common search terms. When was the last time you took the time to check out the second page of Google results? This invisibility is impacting the company’s economic success chances. Similarly, connecting with the companies isn’t easy either. Only 20 percent offered a contact opportunity right on their homepage.

Sales channel and contact: Quality of contact

Let’s go a step further: How high is the quality of contact? On average, the surveyed companies took a week to create offers with some requiring only two days, while others took several weeks to compile a quote. Crucially though, half of the BPOs however did not share a proposal at all, despite an initial sales call. On the bright side: By being faster than the average (which is achievable!), companies have the opportunity to stand out. When it comes to interactions before giving a quote, most of the study participants preferred e-mails over more personal channels such as phone calls or video conferences – certainly a missed opportunity to build and nurture a customer relationship. On the brighter side, at least all providers conducted a follow-up (call or e-mail) after sharing their quote.

Sales channel and contact: Hybrid selling

Most companies have not yet optimized their hybrid selling approach. Among their mistakes are unstructured video calls, chaotic environments, technical hiccups, and insecure body language. Often, they were also insufficiently prepared, leading to missed opportunities to sell their company as well as their offering while also failing to systematically capture required information. In addition, less than half of the companies analyzed have sales reps that use social media platforms like LinkedIn for marketing in an effective manner (e.g., by adding potential clients to their contact list), thus enabling easier follow-ups.

Best-in-class companies stand out by having a structured script at hand, pleasant and easily comprehendible facial expressions and gestures, and a professional technical set-up (incl. a suitable background).

Sales channel and contact: Sales speech (including value selling)

Looking at their sales approach, the majority of benchmarked companies do not have an active value- as well as up-/cross-selling approach. Only 40 percent communicated the benefits of their services throughout the whole interaction. Less than a third systematically used value-selling, linking the company’s advantages to the client’s value. A big mistake, especially for providers of a relatively interchangeable service. Effective value-selling would enable companies to differentiate their services effectively from the competition, win the sales pitch, and even gives them a change to achieve higher prices. The best benchmarked companies did exactly that and highlighted the total cost of ownership savings from outsourcing in addition to quality improvements.

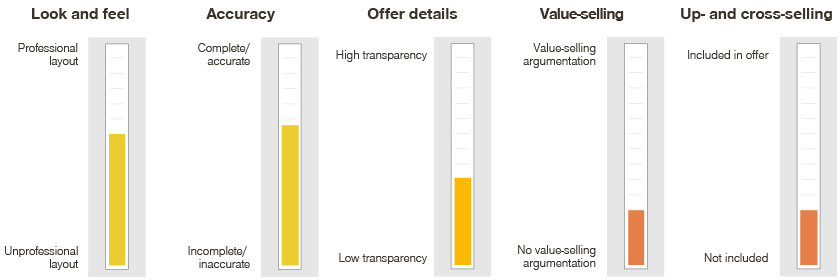

Proposal: Quality (including value selling)

Another vital step to procure business is an effective proposal process. Unfortunately, the surveyed companies didn’t consistently leverage proposal documents as sales instruments.

The worst in class players included the commercial offer in an unformatted e-mail – without a proper offer document or any form of sales material.

Pricing: Offer design

As for pricing, BPOs perform a little bit better than in the other categories. For example, 80 percent of analyzed companies provide different offer versions. However, they fail to have a structured versioning approach with clear price-performance hierarchy (good – better – best) and a defined up-selling pathway, which makes choosing the suitable option for customers difficult.

71 percent of providers stripped costs, i.e., reduced the scope compared to the initial request to lower the costs and become more competitive. Only few companies leveraged the opportunity of offer versions to pitch both the budget service as well as the higher priced service with the requested scope.

Pricing: Price level and price model

We were able to observe a large price spread (bigger than 70 percent) in the BPO market. But is their pricing optimized to capture value pockets? For example, all companies displayed a price differentiation by language. But significant less (a third) differentiated their prices by serviced times or agent location and only 17 percent by skill level – clearly missing out on capturing the value from a higher quality level

How to get on the road to sales excellence

As you can see, most BPOs have potential for improvement regarding their sales capacities. The measures to get ahead differ according to a company’s maturity level. The foundation is a status quo assessment. Afterwards, companies can look at optimizing their sales organization and processes, embedding (digital) support tools, and preparing appropriate value selling materials and trainings (incl. hybrid selling). On the highest level, sales teams should train their negotiation skills, implement value pricing (tools) and price model optimization, and redesign their sales channel mix and customer journey. In doing so BPO companies can increase their revenues up to 20 percent and their EBIT by 5 percent points.