About this series Simon-Kucher's Fleet Growth Playbook is a five-part series on how automotive fleet players, including OEMs, leasing providers, mobility platforms, and service networks, can capture growth in a fleet market in flux. Based on the Simon-Kucher Fleet Study 2025, each article explores a different commercial lever, from smarter pricing and value delivery to customer retention and integrated solutions. In this installment, we share how leaders are reshaping fleet sales and marketing to meet the expectations of a new generation of digital-savvy buyers. |

Fleet sales are evolving fast, with digital expectations driving the shift

The B2B fleet buyer has changed. In a margin-sensitive market, your commercial edge increasingly depends on how you engage, not just what you offer.

Today’s fleet buyers demand seamless, digital-first experiences with the same speed, personalization, and control they enjoy as consumers. And when those expectations aren’t met, they quickly move on. According to our Fleet Study 2025, 45% of fleet managers are likely to change providers over poor digital engagement or fragmented service.

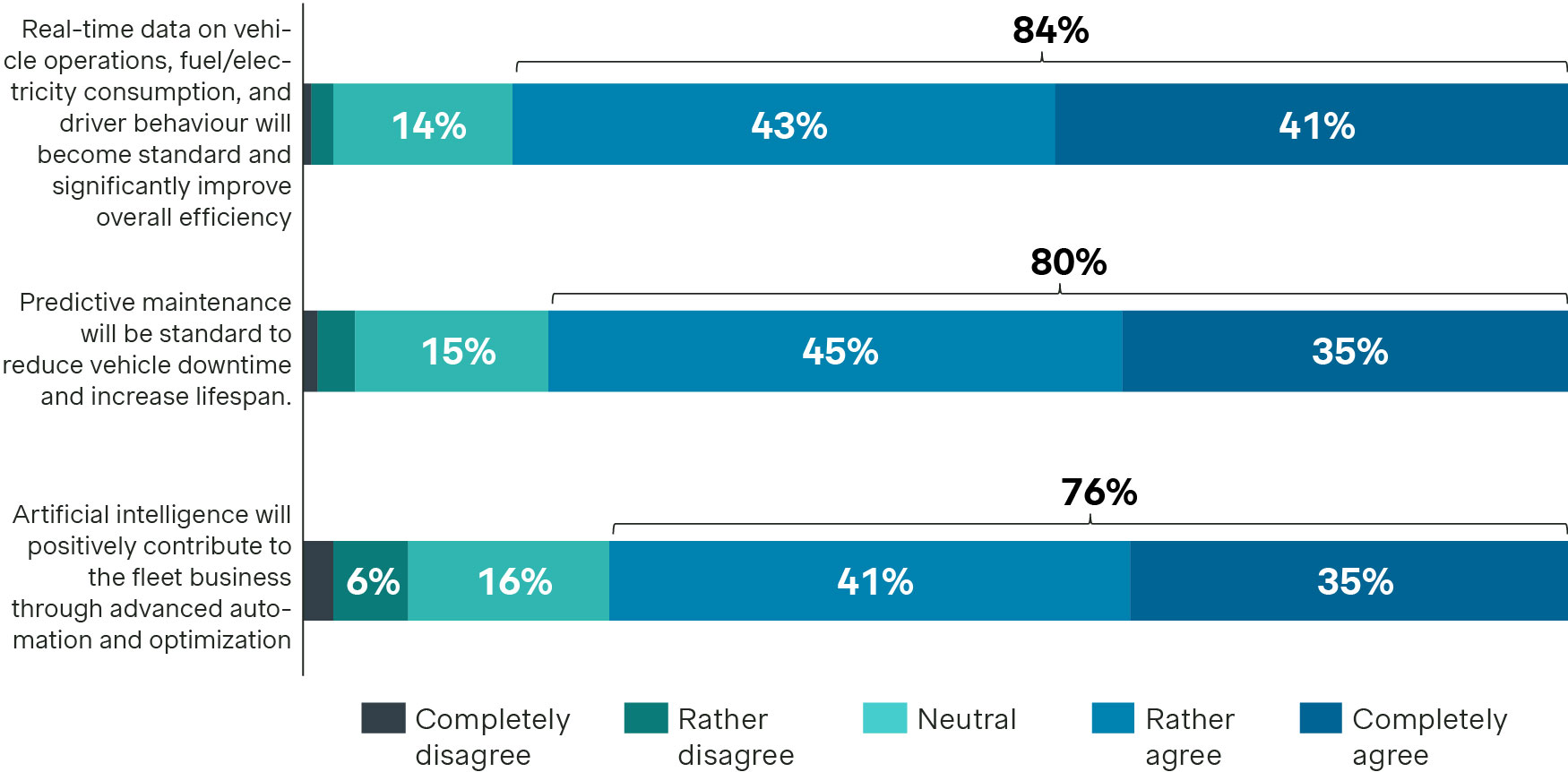

It’s clear that digitization is a top requirement. Leaders increasingly cite priorities like real-time data utilization, predictive maintenance, and AI integration as critical to the future of fleet operations.

Identified trends in the fleet industry digitization according to fleet managers

In response, fleet providers are rethinking how they attract, convert, and retain customers. The focus is shifting toward fleet digital engagement, omnichannel selling, and personalized account management. All are essential for customer loyalty and business growth.

The rise of the digital fleet buyer: Implications for sales and marketing

Fleet customers look very different today. They’re not your typical procurement officers tied to faxed order forms or quarterly check-ins. Many are younger, digitally fluent, and under pressure to reduce costs, improve sustainability, and streamline operations.

This shift is driving new expectations:

91% of fleet leaders plan to increase digital investments by 2030, prioritizing platforms that offer real-time visibility and automation.

They now expect self-service tools for vehicle selection, pricing configuration, contract management, and service bookings.

Over 60% say lack of transparency or online responsiveness is a top reason for switching providers.

This is especially true for fleet tech buyers and fleet electrification, where value also depends on continuous data access and digital insights.

By 2030, fleet managers anticipate a sharp rise in technological complexity. This will raise the bar for providers to deliver smarter marketing and more agile, digitally enabled fleet sales strategies.

Key challenges identified by fleet managers today vs 2030E

2025 Simon-Kucher Fleet Study (n=170)

Omnichannel fleet sales strategy is no longer optional

Relationships still matter in fleet sales. However, now they are developing across multiple channels. Providers should create a cohesive experience across digital, direct, and partner touchpoints, from configurable digital showrooms where fleet managers can explore vehicles, services, and TCO scenarios, to account portals offering usage data, maintenance alerts, contract overviews, and upgrade opportunities.

Real-time support through live chat and automation strengthens the customer relationship by resolving service queries quickly. Fleet telematics and app integrations add another critical dimension, providing value-added insights from route optimization to emissions tracking.

A modern fleet sales and marketing model, centered on digital access, personalization, and data fluency, is no longer a nice-to-have. Omnichannel strategy has evolved from a service efficiency tool into the engine of fleet sales growth. Companies that embed it across the customer journey see stronger conversion, higher upsell rates, and more resilient contracts.

Avoiding common mistakes in fleet digital transformation

Despite good intentions, many fleet companies struggle to modernize their commercial models. Common missteps include:

Fragmented data systems that prevent a unified customer view.

Poor handoffs between sales and after-sales, resulting in inconsistent and subpar customer experiences.

Lack of training for account managers on digital tools or consultative selling.

Another frequent error is moving too quickly to a fully digital model. It’s important not to forget that B2B customers still value expert human support, especially during onboarding or high-stakes decisions. The right strategy blends digital convenience with human insight.

Personalization and data-led selling are key

Fleet buyers are inundated with offers. The differentiator? Personalization. Providers that can tailor offers to customer needs by fleet size, industry, geography, or vehicle mix stand out and win trust.

This means moving beyond static dashboards to commercial actions powered by data. Winning fleet providers are leveraging:

Usage-based insights from telematics to recommend right-sized fleet solutions or maintenance plans. By analyzing underutilized vehicles, inefficient routes, and emerging maintenance risks, providers can lower customer TCO and reduce downtime. This not only improves fleet customer retention and trust but also leads to a larger share of wallet, creating immediate and measurable value.

Segmentation frameworks to create tailored marketing journeys and pricing packages. Personalized pricing and outreach based on fleet size, industry, and usage behavior allow providers to deliver differentiated value, whether through bundled leasing for SMBs or performance-linked contracts for enterprises. Precision targeting improves conversion and margin capture.

AI-driven analytics to predict churn risk, identify upsell opportunities, or personalize follow-ups. Advanced models can flag early signs of churn, such as declining platform usage or frequent service tickets, enabling proactive retention. Using these tools also makes it easier to identify customers most likely to increase contract scope, add services, or transition to EVs. Sales teams that act on these signals consistently achieve higher cross-sell and upsell rates.

Dashboards won’t cut it. As digital data becomes more abundant, only providers that turn it into timely, relevant commercial actions will stay ahead. Those that adapt quickly will build trust, reduce churn, and unlock long-term customer value, while those that fail risk being left behind by a new generation of digitally fluent fleet buyers.

How Simon-Kucher helps fleet leaders commercialize digitally

At Simon-Kucher, we work with fleet businesses to modernize go-to-market strategy through a commercial excellence lens. That means aligning people, processes, and platforms to increase conversion, satisfaction, and profitability.

With our support, you can:

Increase win rates through digital sales journeys from lead generation to contract renewal across online and offline touchpoints.

Tailor sales actions with CRM strategies and account segmentation based on customer fleet profile.

Differentiate value by embedding savings, efficiency gains, and ESG impact into portals and sales tools.

Boost marketing ROI with data-driven playbooks that integrate fleet telematics, customer history, and usage signals.

Strengthen sales impact by training teams on consultative selling techniques and digital engagement tools.

We’ve helped countless fleet providers move from transactional selling to relationship-driven growth, supported by digital systems that scale.

Want to accelerate your digital fleet sales strategy?

Contact our specialists to modernize your go-to-market model, combining pricing, sales, and digital transformation for sustainable growth.

Next up in the Fleet Growth Playbook series:

Next-gen service contracts: Driving fleet loyalty and profitability