In October 2022, producer prices in Germany fell for the first time in three years and against expectations. Coupled with the current price increase gap, this creates a dangerous situation for companies: price increases are still necessary, but customers' understanding of them is no longer given. Dr. Markus Mayer and Sebastian Strasmann, both partners in the Construction & Chemicals Practice of the global strategy consultancy Simon-Kucher & Partners, put the situation in perspective:

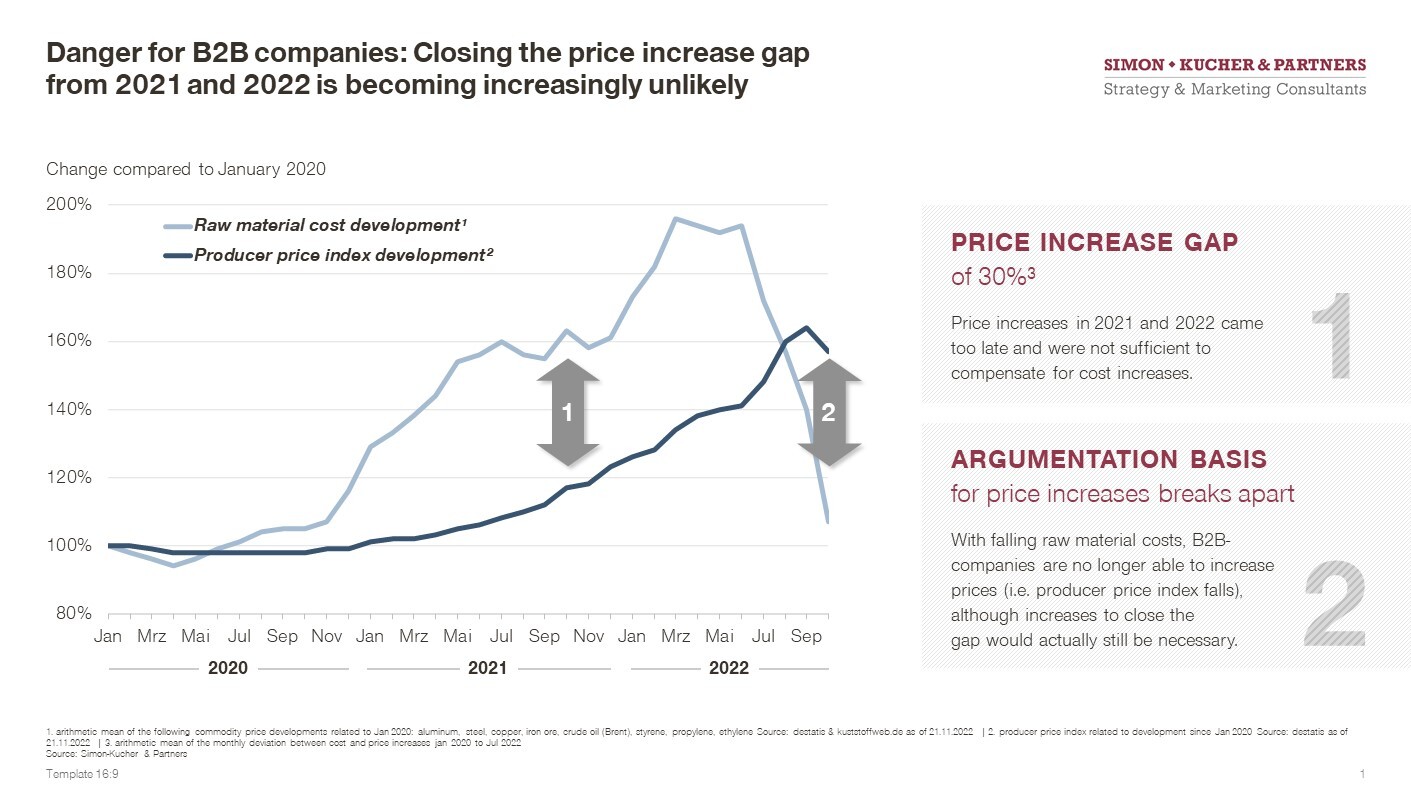

Munich/Cologne, November 25, 2022 - From 2020 to mid 2022, procurement costs have skyrocketed for many B2B companies. Many commodities have more than doubled in price. This has led to continuously rising selling prices in the manufacturing sector. Unfortunately, it was nevertheless not possible to implement urgently needed price increases at the speed and to the extent that would have been necessary. The wage increases that are now due are exacerbating the problem: a price increase gap has been created, and with it the need for companies to implement price increases in the future, in order to keep their earnings levels stable.

However, procurement costs for many raw materials have been decreasing again since summer 2022. Although some of these are still at significantly higher levels than in 2020 or 2021, necessary price increases are becoming increasingly difficult for B2B companies. This is confirmed by the findings from our spring 2022 customer study: In 2021 and the first half of 2022, companies primarily benefited from the market environment when successfully raising prices; only one in five companies implemented price increases thanks to dedicated preparation and the building of pricing power. This weakness is now taking revenge when commodity prices fall again. In this respect, it is also not surprising that producer prices in Germany fell to a historic extent in October 2022. Companies must now take countermeasures in the short term, as there is no alternative to implementing further price increases if they do not want to accept a long-term drop in earnings. To do this, they need to build understanding of this within their own sales force, and also build a consistent rationale to justify the need for the price increase. While it was still sufficient in 2021 to refer to the cost trend, this is now becoming considerably more difficult. Sales should not be left alone with this. Another decisive factor is contract design with the instruments of price validity, surcharges and hardship clauses. Companies should adapt them to the environment. Finally, they would do well to install governance mechanisms that allow the results of negotiations to be monitored at any time and allow for readjustments.

These measures will not make it possible to defend price levels against every cost trend, but they are proven means by which B2B companies can "limit the damage" in the short term.

For deeper insights into the topic or if you have any questions, the experts are available for a background discussion or interview.