We began this series with an overview of Chinese automakers, and their global growth ambitions. Now, we will look into how these competitors, especially Chinese EV startups, succeeded in dominating the domestic market. In part 3, we reveal how their unique product offering not only meets demand, but rivals that of top dogs like Tesla.

It is not an exaggeration to say that Tesla spurred on every car manufacturer in the world to up their game. From renowned brands like Volkswagen, to up-and-coming ones like NIO, automakers have been scrambling to beat Tesla in the race to electric vehicles (EVs).

However, while western manufacturers have fallen behind, Chinese automakers are hot on Tesla’s wheels. In this article we reveal what can be learned from their unique product offering, and why western car manufacturers should pay attention to Chinese competitors.

Automotive Connectivity Solutions

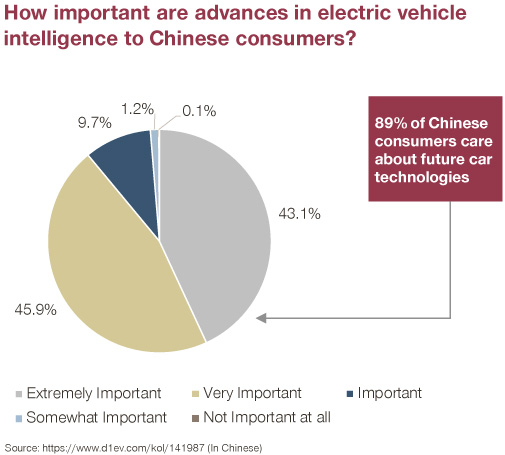

Through advanced human-interface machine (HMI) systems, and integrated apps, Chinese car manufacturers provide an outstanding connected experience. In a market where consumers value intelligence systems over traditional automotive capabilities, it is no wonder that Chinese concept cars are winning the race.

Chinese EV startups, in particular, have responded to China’s smartphone generation by developing more than just cars. With the backing of Internet giants, like Huawei, Chinese OEMs have been able to develop cars into moving smart devices.

- AIWAYS

AIWAYS’s newest EV, the U6ion, will be designed with an HMI dashboard with voice control and recognition. The dashboard will enable users both to control entertainment features, and the car itself.

This Chinese EV startup is developing its expansion strategy, currently selling its U5 SUV to five European countries. It is only a matter of time before the new U6ion model finds its way to tech savvy European consumers. - Xpeng

Developing a self-driving program on par with Tesla’s “Autopilot”, Xpeng, and competitor NIO, are at the height of EV intelligence systems. The automaker’s Xmart OS In-car Intelligent System provides consumers with a state-of-the-art HMI. The dashboard understands and recognizes users – monitoring everything from music preferences, to health. The Xmart OS is already operational in Xpeng’s G3 SUV, which has been well-received in Norway.

Automotive Battery Technology Solutions

With battery technology still falling somewhat behind, charging an electric car is not as quick and easy as refueling a combustion engine. For instance, most EV consumers in China reside in large apartment buildings where cars are parked in public garages. This has prevented many from charging their cars at home.

In order to overcome this hurdle, the Chinese government invested millions in the country’s public charging infrastructure. It is also why Chinese original equipment manufacturers (OEMs) have invested heavily in designing battery technology solutions that are attractive to consumers.

In a way, the West’s reliance on private charging piles has done car manufacturers a disservice when it comes to creating an engaging product offering. In Europe, for example, most public charging points are located in just three of its countries. These technologies are crucial learning points, therefore, for traditional western OEMs wishing to be serious contenders in the race to EVs.

- NIO

In 2020, NIO launched Battery-as-a-Service (BaaS), a scheme which gives users discounted car prices in exchange for battery subscriptions. Customers buy a car without a battery, subscribing to one of their chosen capacity instead. This battery can then be swapped or upgraded as required.

Today, NIO Power is a holistic internet battery service encompassing all of the brand’s different battery technology solutions. These include:- NIO Power Swap: Allows drivers to swap batteries at dedicated NIO Power Swap Auto Parks. The service is fully-automatic and only takes up to 3 minutes. The brand is planning to install its battery-swapping stations in Norway this year.

- NIO Power Mobile: The Power Mobile is a van with a portable power bank. Through NIO’s smartphone app, drivers can order the Power Mobile to charge their cars at their chosen location.

Tackling Range Anxiety

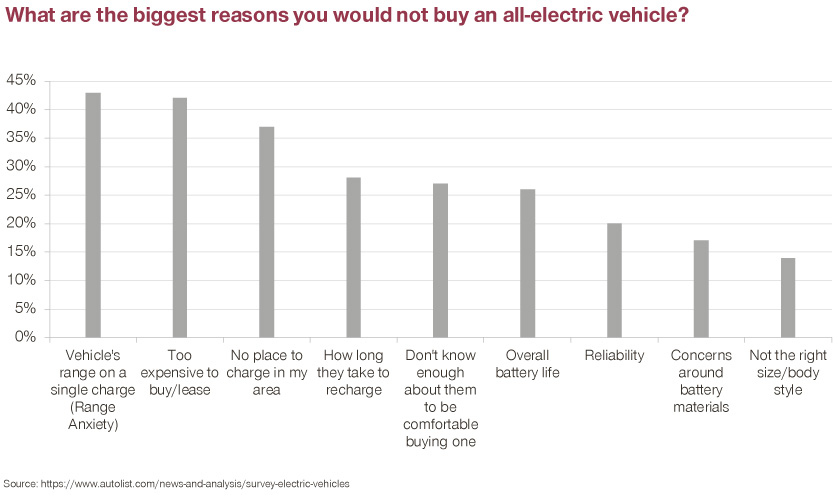

A recent survey conducted by Autolist, found that the biggest reason consumers decide against buying EVs is range anxiety. Range anxiety is the fear that the car will run out of charge before reaching an available charging point.

This is why Chinese car manufacturers are designing electric cars with long-lasting batteries.

Labelled as China’s longest range EV, the Xpeng P7 drives longer on one charge than Tesla’s Model 3.

- Xpeng P7

- Tesla Model 3: 560 km range on one charge

- Xpeng P7: 706 km range on one charge

So, Tesla’s current standing as Europe’s top dog – selling the continent’s longest range EV – could soon change, as Chinese competitors widen their horizons.

- NIO ET7

Meanwhile, in China, the Xpeng P7 could already be in danger of losing its record-breaking spot. NIO’s fourth model, the NIO ET7, is scheduled to launch in 2022, and promises to be the longest-range EV in the world.

The model will offer three different batteries. The most impressive of which, will have a 150 kWh battery, with more than 1,000 km range.

Key Takeaways

Chinese OEMs responded directly to their domestic customer base by designing pioneering future car technologies. Backed both by the Chinese government and Internet giants, Chinese automakers have created complex intelligence systems on wheels with long-range batteries that, thanks to NIO, can be upgraded, swapped, or charged anytime, anywhere.

Future car technology as a unique product offering has played a huge part in the domestic success of Chinese OEMs. Keep a lookout for the next part of our series, where we explain what sales and marketing strategies contributed to their sudden rise.

Read more from this series:

Part 1: A Panorama of Electric Vehicle Companies in China

Part 2: Chinese OEMs: A New Level of Electric Vehicle Marketing and Sales Strategies

Part 3: Pricing Strategies: What the West can Learn from Chinese Car Manufacturers