The e-commerce channel in the consumer healthcare (CHC) sector has grown massively in the last few years and continues to become more and more important. However, change is in the works. With a diverse landscape and new players entering the market, it’s not clear which direction the channel landscape will take and what channels it will be composed of. Therefore, CHC players need to carefully determine what needs to be considered when setting up an online strategy to win in the e-commerce space.

The evolving e-commerce landscape

The e-commerce channel has been experiencing huge growth rates for years, which have also been fueled by the COVID-19 pandemic. Despite lower growth rates in 2021, they were still in double digits.

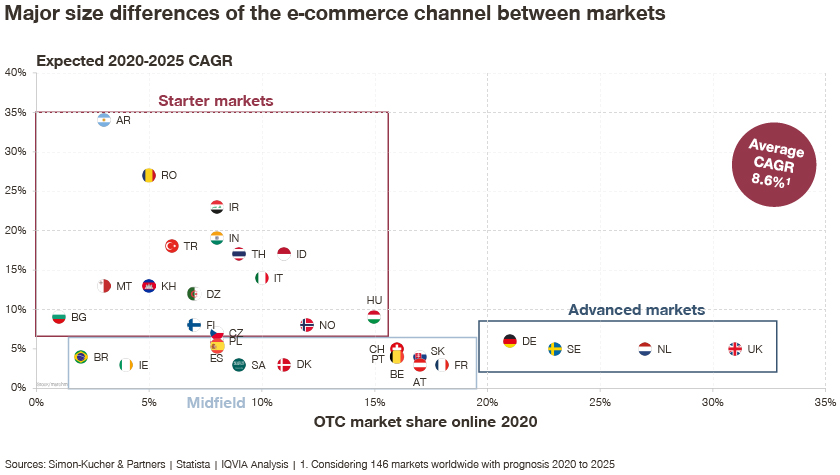

The trend toward online shopping is now also firmly established in the CHC sector. In fact, the global online revenue share of OTC pharmaceuticals has more than doubled since 2017. However, the online share as well as the related growth rates vary greatly among countries. While the UK, Sweden, the Netherlands, and Germany have high OTC online shares, other countries like Romania, Turkey, and Argentina experience lower shares but relatively high growth rates.

In the past, the growth of the e-commerce channel was driven by, among other things, online pharmacies’ aggressive pricing strategies. This has concealed a core problem of the sector, as nearly all major players across the channel are making losses.

A perfect example of this is Zur Rose, one of the largest players in the e-commerce healthcare market which is experiencing an EBITDA of minus 143 million CHF.

Due to these developments in the market investors are now demanding changes be made to increase profits (and more to be invested in profitability instead of growth), which is reinforcing the pressure on the entire channel. This pressure is further intensified by increased refinancing costs due to higher interest rates. These developments will likely reshape the already diverse market landscape – and not all players are going to survive these pressures over the coming years.

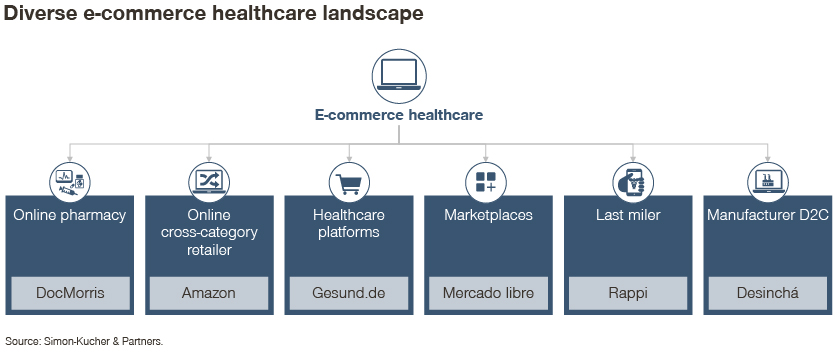

A closer look at the current online channel highlights the diversity of the parties involved. Here, a variety of players with different business models and product assortments can be observed. In addition to healthcare platforms, new players are entering the online pharmacy segment, such as last milers and external players (e.g., Europe’s largest beauty retailer Douglas), making the channel even more complex.

This diverse landscape is driven by changing consumer preferences for time-saving solutions (i.e., last milers and online pharmacies). One of our consumer studies confirms that time savings are a deciding factor for making a purchase online for more than a quarter of all online shoppers.

The current pressure combined with the complexity of the landscape is likely to result in a consolidation of the market in the near future. This consolidation process is going to affect all player segments and will shape the e-commerce business model of the future.

The uncertainty about the future direction of e-commerce poses major new challenges for many CHC players. Therefore, they need to fully understand the different channels and their characteristics to decide how best to act and invest.

Aiming for e-commerce success: Five aspects to consider

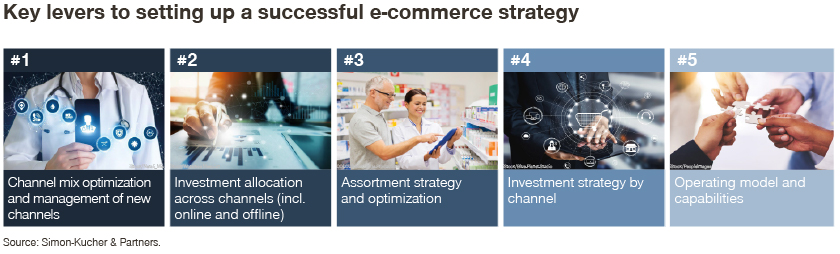

To achieve e-commerce excellence, a sophisticated e-commerce strategy is essential. CHC players must therefore consider the following five aspects when setting up an e-commerce strategy and structure:

1. Channel mix optimization and management of new channels:

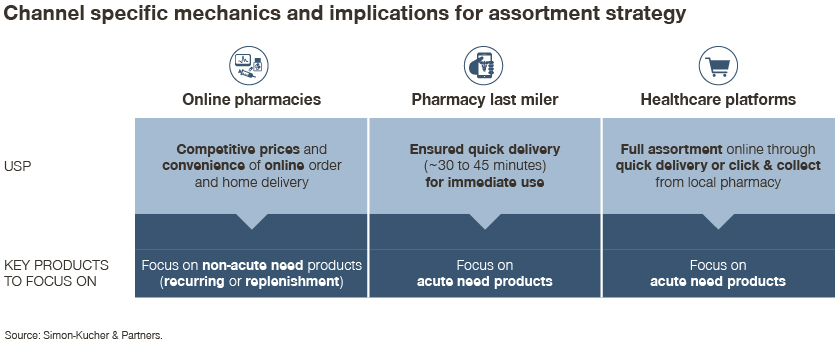

The first steps for CHC players are to decide which channels to prioritize, which ones to use for “test and learn,” and which ones to shift focus from. In this context, criteria such as size, growth rates, channel maturity, brand fit, and ability to reach the target consumer segments are typical indicators used to define the optimal channel mix. However, each channel has its own mechanics and therefore requires its own specific management.

2. Investment allocation across channels (including online and offline):

After establishing transparency over the channel landscape and deriving their strategic goals, CHC players need to distribute their investments across the channels to reach those goals. As the number of channels increases, it becomes more important to optimally allocate the investments so that both new and growing as well as established channels get the resources they need. It is essential to consider all investments needed to foster growth in a channel, including Gross-to-Net (GtN), trade marketing investments, and the cost for sales teams when deciding how to allocate investments.

3. Assortment strategy and optimization:

Which assortment is required for each channel to be successful? How does the product portfolio need to be managed across channels? To answer these questions, CHC players need to fully understand the different channels and their customer preferences. The focus of last milers, for example, is on quick delivery of products needed at short notice. Therefore, consumers who choose this channel usually prefer small packs, whereas large packs are especially in demand from online pharmacies looking to replenish their supply. Besides portfolio management, shopper activation is another channel-dependent aspect. Therefore, companies need to understand how they can leverage the different channels’ mechanics to activate consumers.

4. Investment strategy by channel:

Each of the different channels has unique requirements and growth levers (e.g., GtN, digital marketing, trade marketing, promotions), which must be determined according to the strategic objectives. Once again, CHC players need to understand the channel-specific characteristics to identify the ideal investment for each channel. For example, investments into promotions and bundling are usually part of an optimal investment strategy in the e-commerce space, but such investments are not possible on healthcare platforms due to their business model. These channel-specific differences are therefore essential when developing an investment strategy by channel.

5. Operating model and capabilities:

The right operating model combined with the essential capabilities forms the basis for a successful e-commerce strategy. Therefore, CHC players must review their current structures. Which roles and capabilities does the operating model require, and how should (new) roles be defined? Important questions to answer include how best to organize the management of omni-channel customers (KAM versus eKAM, etc.) and whether sales or marketing should manage last milers or healthcare platforms that aren’t active customers.

Furthermore, given the dynamic nature of these channels, it is crucial for the operating model to enable teams to work in an agile way. In fact, there needs to be a shift in guiding principles – away from traditional structures (i.e., collaboration in silos) toward agile, cross-functional, and multidisciplinary teams. This approach is characterized by decision autonomy combined with an open failure culture.

E-commerce is becoming increasingly important

E-commerce is here to stay. The channel is expanding while the landscape is becoming more and more complex due to the growing number of players entering the market and the new macroeconomic challenges emerging.

To position themselves for the future, CHC players need to establish transparency over the current channel landscape and understand the various e-commerce participants. This forms the basis for a strategy that takes channel-specific characteristics into account. The ideal strategy implies an appropriate channel mix, the right assortment strategy, and suitable channel-specific growth investments – all based on the right operating model for the overall strategic objectives.

__________________________________________________________________

More from this series:

Evolving Distribution Channels: How Can CHC Manufacturers Leverage the D2C Trend?