During the last, challenging year, many logistics companies have fared particularly well. What are the reasons for that? And can this success be maintained in the future? In the recently released Simon-Kucher Global Pricing Study, we take an in-depth look at the logistics industry and try to find the answers.

The last year was heavily marked by the effects of the COVID-19 crisis. Many industries, like tourism and restaurants, were experiencing a (sometimes mandated) sharp decline in demand and are still facing substantial profit losses. Luckily, the logistics industry has been doing comparatively well, as we found out in our recently published Global Pricing Study (GPS) 2021. For key insights about the logistics sector, we surveyed decision-makers in logistics companies from 15 countries.

Largely positive verdict for 2020

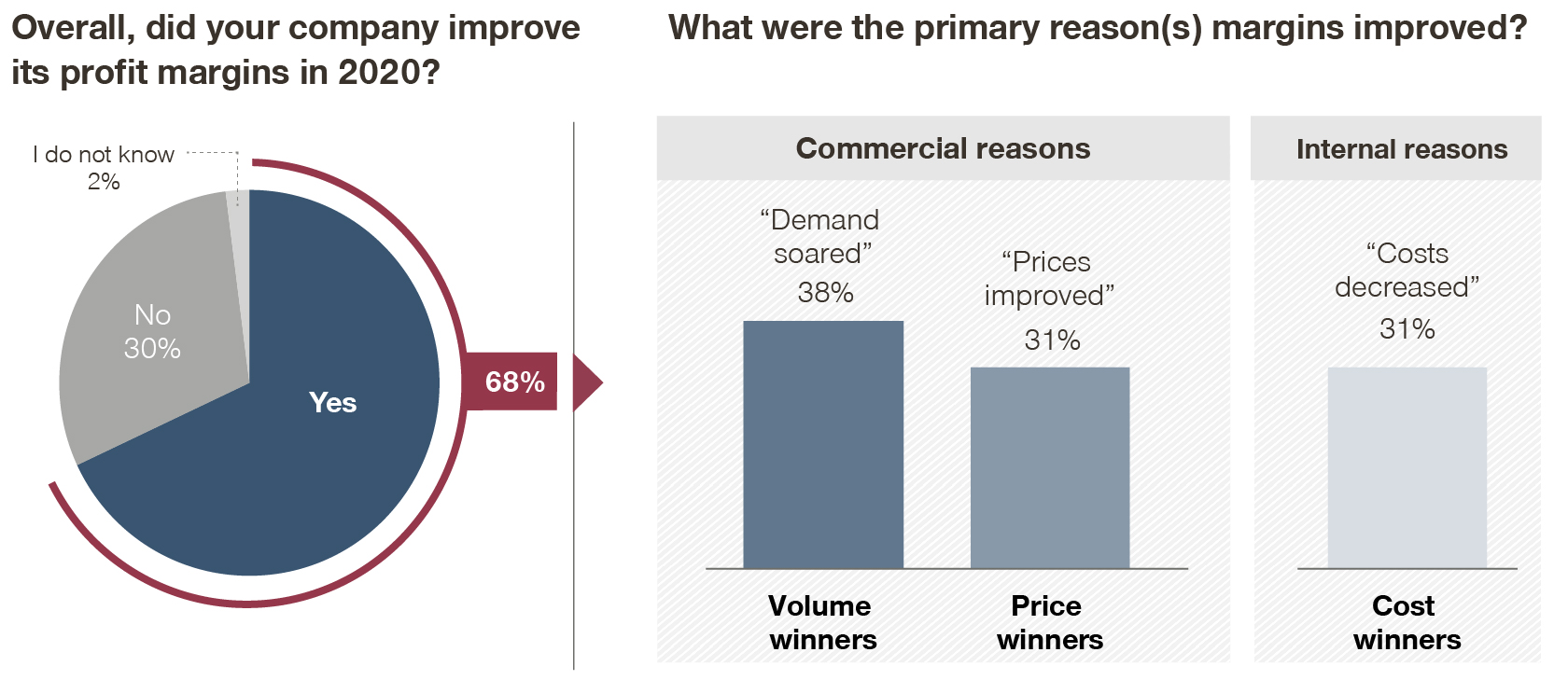

Despite the difficult year, the logistics sector has shown an above-average number of companies with margin increases. Overall, 68 percent report improved profit margins for 2020; compared to other B2B industries, they are among the top five most successful sectors (along with software, aerospace & defense, construction, and wholesale & distribution). Those margin improvements were equally driven by favorable volume, cost, and price developments.

And there’s more good news: Compared to the last Global Pricing Study in 2019, fewer logistics companies have been involved in a price war during the last year; this figure decreased from 48 percent to 30 percent. All of the above might be the reason why logistics companies have quite a bright outlook into the future: 58 percent expect the economic climate in 2021 to be better or even significantly better compared to 2020.

Will this development continue?

However, recent gains are not exclusively a result of actively taken commercial measures and even short-term winners might still end up falling behind, when looking at the GPS results in detail.

Even though many companies report margin increases, as many as two out of three players attribute this to the impact of the COVID-19 crisis. Nonetheless, almost 70 percent of these think this effect will last, considering it to be a sustainable gain.

Will they be right or wrong? While demand for logistics services will likely remain high, there are many challenges lurking in 2021 and beyond. A generally highly volatile environment, changing economic conditions and a rise in inflation could easily reverse the wins of 2020. To reset for the future, logistics companies have to maximize the opportunities of pricing and sales as profit levers, as well as adjust quickly to new market conditions and demands. Companies have to set course on these topics now to avoid margin erosion in the years to come. Progress, however, varies significantly across surveyed companies.

No commercial excellence yet achieved

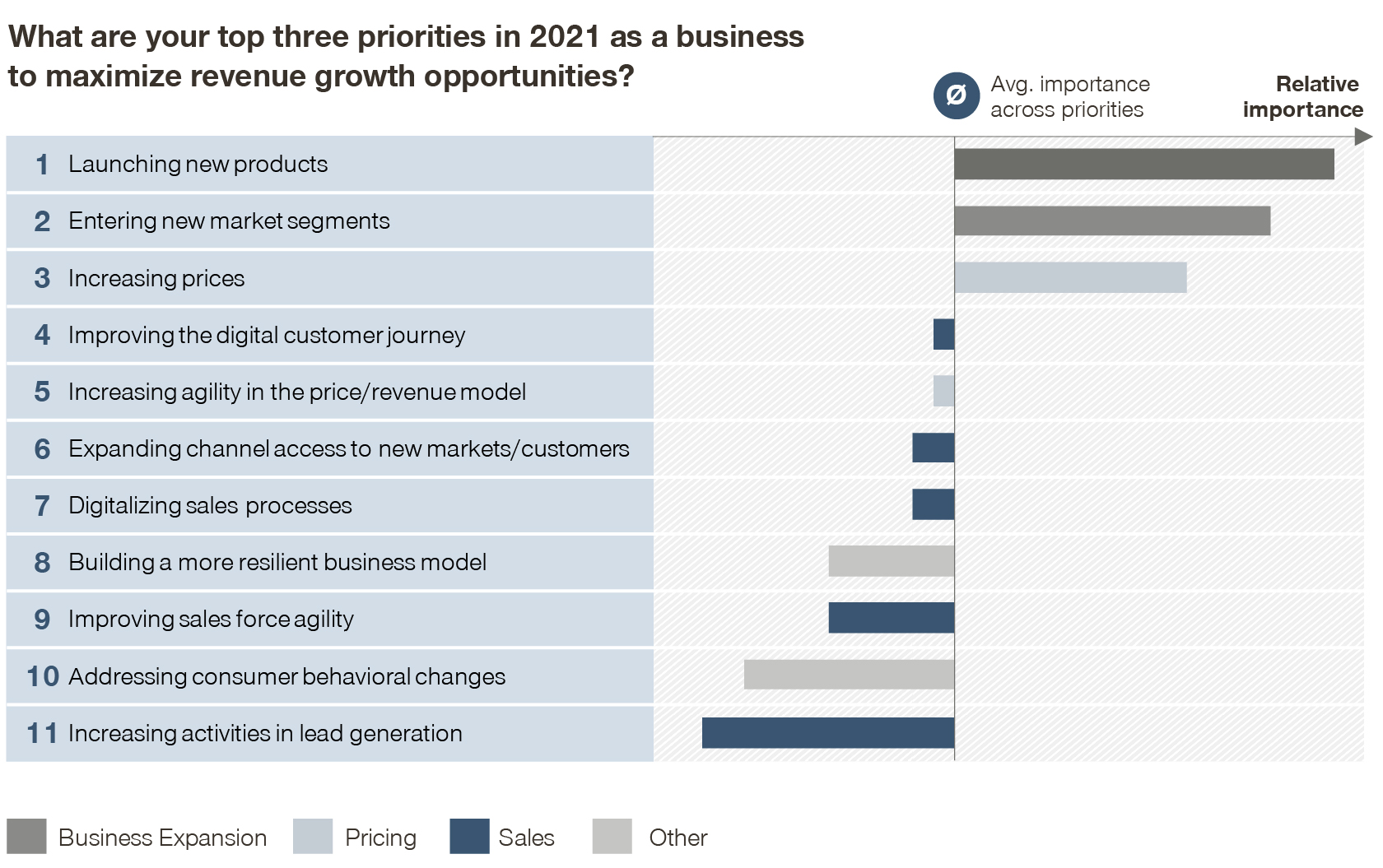

Questioned about their top priorities in 2021 as a business to maximize revenue growth opportunities, study participants overwhelmingly named business expansion initiatives like launching new products or entering new market segments above pricing and sales topics.

The consequences of this strategic neglect becomes apparent when looking at last year’s numbers: Unsurprisingly, the companies surveyed didn’t exactly excel in their pricing endeavours. Of their planned price increases for 2020, only one in four logistics companies surveyed achieved at least 80 percent price realization. 50 percent even managed to establish only zero to 40 percent of their planned increase!

Why is that? Too many logistics companies obviously do not put a strong enough focus on pricing topics. For example, only a little more than a third of our study respondents named increasing prices as the biggest driver of future profit growth.

Similarly, sales topics rank low in terms of strategic importance for many (yet not all) companies. Beyond doubt, those players shelving investments into sales process digitalization, improving the digital customer journey, and promoting sales force agility risk falling behind once economic conditions change. The study showed that best in class companies meanwhile invest heavily into ramping up their digital capabilities in these areas, likely resulting in a future “digital divide” between these two groups of logistics players. Clearly, the fault lines in profitability will run along this divide.

Conclusion: Profitable pricing and (digital) sales as basis for future success still lacking

This does not bode well for the future: Even though logistics companies have not experienced as much economic pressure during the last year than other sectors, the alleviation might be short-lived and deceptive. New risks are already appearing on the horizon, like volatile market environments, disruptors, exchange rate fluctuations, and price inflation. To be prepared for them, logistics companies have to put their profit on a secure footing – achieving commercial excellence and developing solid strategies in this regard ensures that they can maximize the opportunities of pricing and sales as a profit lever. Players missing out on investing now, will likely have a hard time catching up in the future.