The clash between B2C executives' growth plans and changing consumer spending habits: what are the next steps for executives?

As costs continue to soar and strong macroeconomic headwinds persist, US consumer business executives need to be equipped with the tools and solutions to not only navigate but also build long-term stability. Unfortunately, there is no silver bullet or one-size-fits-all solution; companies will need to take a multifaceted approach to secure profitable growth.

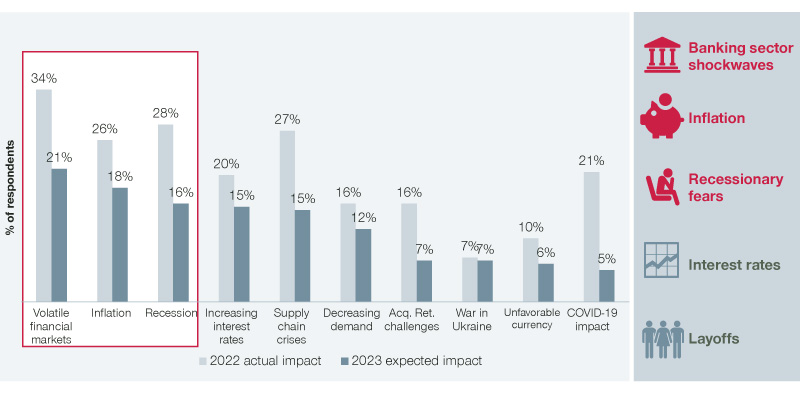

Many compounding macroeconomic factors continue to create uncertainty and instability for B2C businesses. As certain headwinds have stabilized and even recessed, executives revealed persisting concerns over volatile financial markets (21%), ongoing inflation (18%), and fears of recession (16%), continuing to impact their businesses in 2023.

Taking active steps to prepare for and grow revenue through a recession (whether it is here or still pending), as well as thrive through ongoing inflation, will include a multi-faceted strategic approach to pricing, sales, and marketing. Enabling customer acquisition and retention, strengthening one’s value proposition to the market, and implementing a value-based pricing philosophy will help consumer and retail companies weather the storm and become champions in their industry.

Additionally, executives expect margin erosion to worsen in 2023, from 74% of revenue reaching the bottom-line last year to 61% in 2023. As such, consumer and retail companies must act swiftly and aggressively to combat trends of falling margins through pricing, sales, and marketing efforts to unlock both quick wins and sustainable growth.

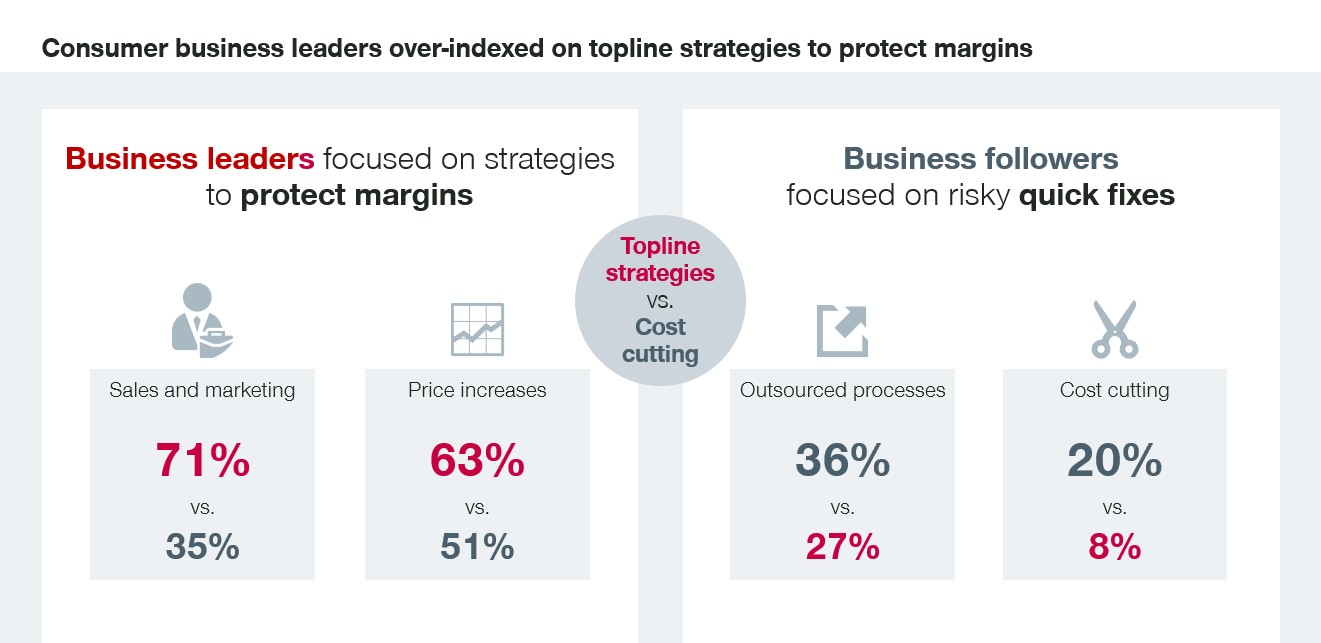

Despite these headwinds and setbacks, 76% of consumer sector growth leaders see a recession as an opportunity for sustainable margin preservation and long-term growth. But this is not a false sense of optimism; our Growth in Recession Study shows these leaders have not only hardwired recession proofing into their business strategies but have also demonstrated tactics that deliver on this confidence, to protect their margins and enable topline growth. In 2022, 71% of these companies invested in their sales and marketing campaigns in efforts to boost and maintain customer acquisition and retention, as well as sustain growth in brand recognition. 63% of consumer executives implemented price increases to combat margin degradation from continued rising costs as a result of inflation and supply chain crises.

These tactics proved successful and should be used as a blueprint to achieve sustainable growth.

Conversely, consumers feel similar sentiments to these growth leaders, noting that although the financial situations of US households have tightened in the past six months, our recent consumer study, Growth in Times of Uncertainty, reveals consumers are feeling cautiously optimistic in the near term, with 66% of respondents feeling confident about their near-term financial future.

Will there be a clash at that intersection of consumers’ willingness-to-pay and the business’ need to pass on costs to protect margins?

Consumers have already reported feeling price increases hit their wallets. So, while 35% of B2C companies reported experiencing rising costs, more than half of these companies passed on 50% or more of the increased cost to consumers in an effort to protect margin degradation.

However, companies must tread carefully due to consumer inflationary fatigue, ensuring that price hikes are applied surgically where they can be justified from the customer’s perspective. It is essential to increase the value perception or importance of the product or service to convey this price increase and introduce safeguards to limit churn and protect the brand longer-term.

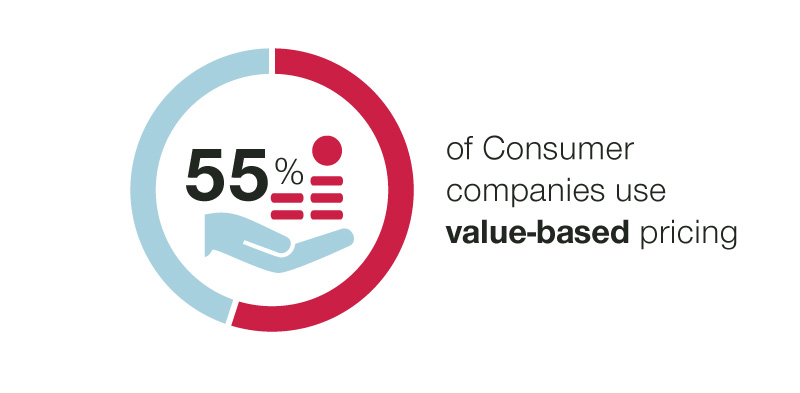

Nearly half of all companies do not utilize value-based pricing; shifting pricing philosophies to value-based pricing can help maximize profit wins through full targeted capture of customers’ willingness-to-pay.

Value-based pricing is a holistic price-setting philosophy that includes setting price levels according to the consumer value of the product or service and incorporates competitive pressure, costs, and regional nuances.

Segmented value-based pricing can help extract the full willingness-to-pay while avoiding negative volume effects. Additionally, value-based pricing allows companies to have logic-based, differentiated pricing based on relevant attributes, and can further provide insights to refine companies’ strategic directions more broadly.

Proper implementation of strategic levers can establish a foundation for stability and growth for consumer businesses

Though there are no silver-bullet solutions to defend against the impact of the current economic volatility and impact of headwinds, there are definite dos and don’ts. Many average-to-poorly performing companies plan to invest their efforts in risky quick fixes such as cost-cutting, outsourcing processes, and passing all costs along to consumers. These reactionary tactics can leave businesses vulnerable to topline erosion and aggressive market share moves by larger and more profitable companies.

Consumer companies from our study revealed they plan to position their businesses to achieve multifaceted success through uncertainty in 2023, particularly in making operational improvements (68%), increasing prices (63%), and expanding offering and services (43%). Conversely, reducing variable or fixed costs was the lowest priority (10%). Outside of operational improvements, businesses are investing in revenue generation and growth initiatives to brace themselves best against macro-economic headwinds.

Ultimately, companies should focus on how to improve business performance through their primary KPIs in the following ways:

- Increased customer acquisition: By investing in marketing and sales activities, companies can expand their customer base.

Result: Increased revenue and long-term growth. - Improved customer retention: Implement or optimize personalized loyalty schemes to boost frequency of purchase, stave off switching to competitors, and increase sales in digital channels; similarly, introduce a clearly executed, real-time personalization process to trigger incentives, discounts, or rewards across the customer lifecycle.

Result: Increased customer loyalty and repeat business. - Strengthened value proposition: Companies can strengthen their value proposition by fully understanding, prioritizing, and better communicating the value drivers in which their brand overperforms, and target customers and prospects deem most important.

Result: Increased revenue through deepened share of wallet with current customers and new customer acquisition. - Enhanced brand recognition: Investing in marketing activities will build brand awareness and recognition.

Result: Increased trust and loyalty among customers and a competitive advantage in the marketplace. - Support effective pricing strategies: Investing in pricing research and analysis can help companies set prices that reflect the value of their products or services by target customer segment.

Result: Capture a larger share of the market and generate higher profits. - Enables agility in response to market changes: Better positioned to respond to changes in the market and adapt to new customer demands.

Result: Stay competitive and maintain a growth trajectory over the long term.

Investments in pricing, sales, and marketing can position companies for sustained growth. Having a strategic roadmap and plan to tackle all these initiatives is critical for long-term success.

In the next installment of the series, our experts will deliver insights on how to leverage sales, marketing, and pricing tactics as a strategic lever in your growth strategy.

Contributing Authors:

- Landon Echols, Manager

- Kevin Mulumba, Senior Consultant