Investing money in the right digital initiatives is one of the top priorities for company leaders today, but our experience shows that companies don’t spend enough time and effort on thinking about how to monetize those efforts. That’s why rather than how to spend money, in this article we discuss how to make money, using digitalization as a top line growth driver.

Digitalization is a driving force of change in business, opening up new opportunities for growth and value, rather than just bottom line optimization. Our Global Pricing Study shows that 75 percent of companies have invested and continue to invest in digitalization. As more and more is spent on digitalization initiatives over time, it is natural to start seeking a return on investment. However, the relationship between digital investment and revenue growth is often a fuzzy one.

It is broadly acknowledged that digital technologies can increase cost effectiveness. However, focusing solely on these areas means many companies fail to target their investments toward the greatest revenue impact. They often follow disruptive trends and buzzy technologies in a misguided effort to evolve, failing to connect the capital investment to revenue increases or recognizing the full extent of benefits that new technology brings to their customers. So despite making a strategic commitment to invest in digitalization, they fail to see a clear path to positive returns.

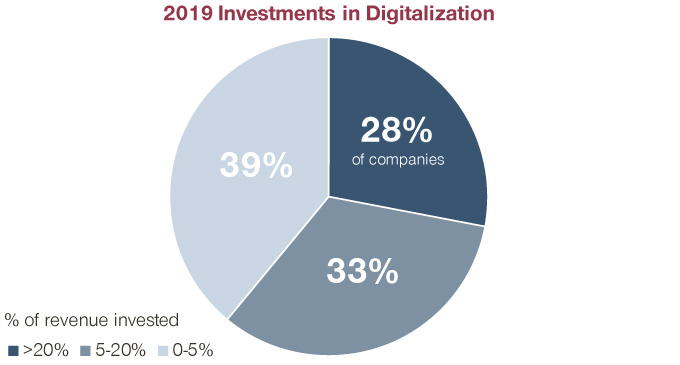

In our State of Digital in Industrials survey conducted in October 2020, we asked companies what percentage of their 2019 revenue was invested in digitalization initiatives. In terms of money spent, the number is staggering 28% of companies in the B2B space invest over 20% of their revenues in digital. To ensure they maximize the return on their investments, companies need to focus on the measures that have the strongest effect on their top line.

Defining Digitalization

Digital means different things to different people, industries, and companies. In the industrial space, it can mean moving toward concepts of industry 4.0, connected devices, and new data sources tied to the product offering. The automotive industry talks about self-driving cars and the expansion of ride-sharing to more than the movement of people. In retail, digital efforts focus on expanding to omnichannel experiences and more personalized customer platforms. At Simon-Kucher, when we talk about monetizing digital, there are three paradigm shifts that all digital initiatives have in common. First, the move from product centricity to customer centricity means that the same customer is now at the core of everything – but buying through different sales channels. Digital means you can keep track of that customer, using the data points to improve the experience and personalizing the offering with additional services that the customer needs. In short, customer centricity is about extracting new and increased value across the entire customer value chain and life cycle, driving increased customer lifetime value (CLTV) and retention. Companies need to strike the right balance between a focus on product verticals that tends to drive bottom line financials, and customer centricity that drives the top line.

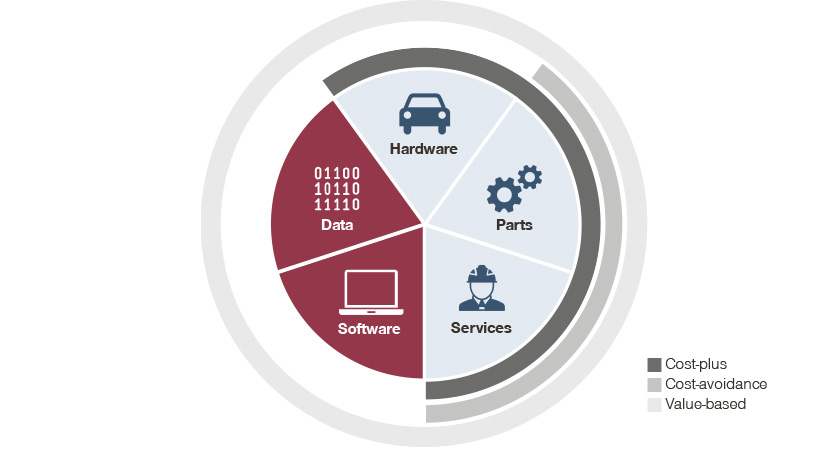

The second shift is around pricing, with digital forcing companies to move to a more value-based approach. Previously, companies would create a product, think about the production costs, and apply a cost-plus margin to determine the price. Then they would look for customers, hopefully with the right willingness to pay. In contrast, with a customer-centric approach, you start from the customer, collecting information and finding out about their needs and willingness to pay. This determines the price, which then determines the products to design, and R&D receives this information with a target costing approach. Pricing is flipped on its head.

The third shift is that companies can monetize their data by creating scaleable, revenue-generating data assets. This requires a transition from thinking about data for productivity and efficiency to defining a commercial data strategy that uses customer and market information for extracting value and driving growth, in both up-stream and down-stream markets. Companies that make proper use of their customer data are not only better able to compete, as they design products around what their customers actually want and are willing to pay for. By putting a commercial lens on data strategy, companies can personalize experiences, create more engaging and effective sales dialogues, and nudge customers toward more desirable outcomes by incorporating behavioral economics into digital channels.

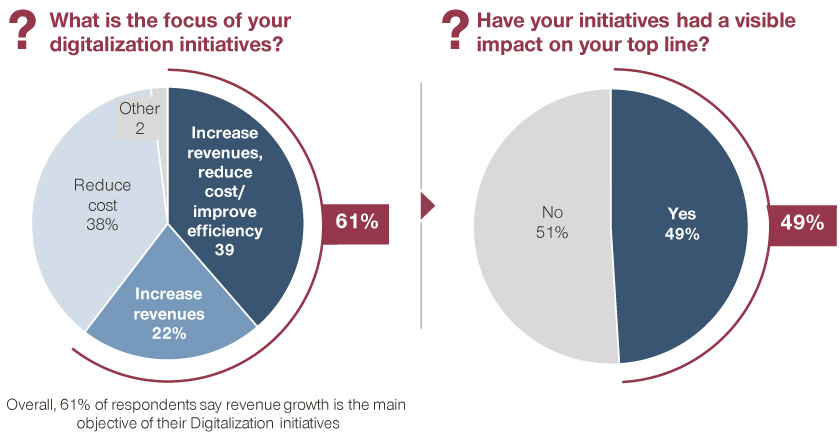

In our State of Digital in Industrials survey, we asked companies about their goals when embarking on digital initiatives and almost two thirds had digital as a goal to increase revenues. However, only half of those companies were able to see a visible impact on their top line.

These results strongly indicate a failure to monetize. Let’s explore the monetization opportunities in more detail, breaking down digitalization into three key areas:

- Digital business models

- Revenue models

- Digital sales strategies

Digital business models: Digital products, digital channels, and the entire value ecosystem

When we asked companies in our Global Pricing Study, 93 percent expected digitalization to affect their business model, with 73 percent viewing it as an opportunity, rather than a threat. Here, the potential risks and opportunities for the business model can be separated into two categories: channel strategies and product strategies.

Channel strategies could address an additional channel to market, e.g. web shops or mobile applications, or disintermediation of the middlemen (think of travel agents, insurance brokers, and retailers).This has the obvious impact of reducing cost-to-serve and barriers to entry, and increasing transparency and granularity in how to go to market. This is especially relevant in times of COVID-19, which has accelerated a natural movement to digital business models and is forcing companies to innovate their go-to-market strategy in real-time. Let’s take the example of a leading chemicals producer, serving mainly the buildings material space, which decided to circumvent the distributor and the retailer, taking the margins in those parts of the value chain and investing in digital technologies to come up with a more personalized customer experience.

When it comes to products, different avenues are possible. This could be digitalizing a physical product, such as newspapers or music; for example, the proliferation of streaming services like Spotify. There are also ways to enhance a physical product with digital integration, such as smart cars, homes, and even washing machines. When combined with a digital service layer, such as adding a sensor that predicts when a machine requires maintenance or spare parts, companies can reach the optimal state of digital monetization. All of these areas can reduce development times and marginal costs while increasing economies of scale and levels of customization.

Some companies aim to move to digital channels, others to move to digital products, but it is optimal to reflect the convergence of both for maximum impact. For example, John Deere digitalized their core hardware (tractors and agricultural equipment) by adding sensors to improve efficiency and precision. They then created a digital customer experience with a web-portal for online ordering as well as CRM systems to track customer preferences and improve OEM design and CPQ systems to rapidly quote and win profitable orders. Finally, they came up with innovative new digital product offerings by enhancing data streams. Today, when a farmer is on the field and collecting data, they receive recommendations for optimal conditions for harvesting programs while simultaneously helping to make the driving patterns of the vehicle more efficient.

Revenue: How to monetize digital

Most B2B firms have two additional products in their portfolio that they didn't offer ten years ago: data and software. Here, the traditional cost-plus pricing approach just doesn't apply, as variable costs are close to zero. Moreover, customers are typically open to recurring revenue models when paying for services, making it suddenly much more important how you charge.

We asked B2B businesses about this phenomenon, and learned that less than half of revenues today are made with hardware and physical products, the rest through services and software. The latter often go hand in hand with a recurring revenue model. However, we are also increasingly seeing these models applied to less “traditional” areas. Here are a few examples of companies that have adapted their monetization approach to tap into the full potential of their products:

- An elevator company previously selling elevators to building owners now sells elevator rights in monthly rates

- A medtech company no longer sells surgical surgery robots to hospitals, but rather the hospital pays per surgery, in line with how patients are charged

- A water treatment provider sets up its equipment on site, then charges for the volume of the purified water that is used by the factory

- Instead of selling truck tires, Michelin charges per mile driven by putting GPS devices on trucks

The beauty with recurring revenue is that whenever a company innovates to make its product more valuable, e.g. last longer, they are able to monetize that benefit. That is why the moment you move to a recurring revenue model, you need to think about the value created by your products and services. Most companies end up with extremes. Either they throw everything into one package (all you can eat) and try to find customers to buy it, or they have a long tasting menu and customers have to sift through to find the services offerings they want – not very sales friendly. However, if you truly understand customer needs and segments, you can create a very logical upsell path into larger monetization pockets.

Digital sales strategies: Using digital technologies to improve value-selling

Digitalization cannot be accomplished with technology alone; integrating an effective employee and organizational strategy is absolutely critical to realizing the full benefits of digital transformation. After all, B2B companies are in the business of people and relationships. In our Global Pricing and Sales Study, we looked at what differentiates the best in class companies from the rest. Front runners have better training and are better at collaborating with third parties. They train sales reps on the digital products that they sell and how to use digital technologies throughout the sales process.

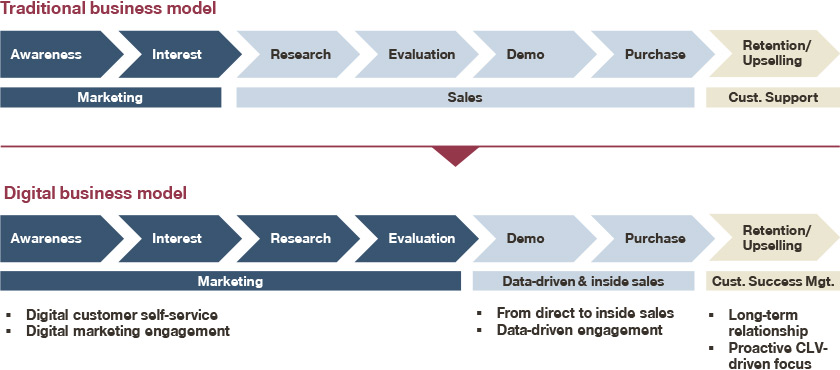

Our study also shows how buyer behavior is changing, an essential dimension to consider in both B2C and B2B environments. An impressive 65% of the entire purchasing process is now conducted online, and that upward trajectory is expected to continue its forward momentum. Sales reps experience that customers now reach out to them equipped with information, and in some cases, have already made a purchasing decision in advance.

Some areas of the sales team will reduce in importance over time as many of those functions, e.g. product research, product evaluation, customer support, are being taken over by the digital marketing team. This should not be viewed as a threat to the experienced sales force, but rather an opportunity to focus on higher-value efforts. The good news for sales is that digitalization enables them with more information and makes them smarter in customer interactions.

Assessing digital maturity: What can you do to become a digital champion?

In one of our webinar polls, we discovered that an only 50 percent of participants had a general direction for their digital strategy, and an alarming zero percent had a crystal clear strategy that included goals, metrics, a roadmap, responsibilities, and budgets. It is safe to say that there is still a lot of work to be done.

The key success factor for digitalization is a commercial focus on revenue generation and top line growth. It is not exclusively an IT project, but rather, a business strategy which technology enables to drive revenue generating opportunities.

This means not only assessing how “digital” you are as an organization, but also how you monetize digital. Many of you might be wondering where to get started? Our Commercial Digital Diagnostic helps executives understand opportunities in relation to their current state, market activity, and customer expectations, and produces a prioritized roadmap to get their transformation started.