Europe has traditionally been difficult for international automotive manufacturers to gain significant market share. However, a surge in innovation and the growing popularity of electric vehicles could turn this around. In our series, we discuss how aspiring newcomers can set off strongly on their odyssey to new markets. This article focuses on attitudes and preferences toward car design and feature requirements, and compares the automotive product design approaches in Europe and China.

Automotive manufacturers operate in one of the most globally relevant industries, with many looking to expand beyond their local markets. However, the regional differences that influence a brand’s acceptance among potential customers are commonly overlooked. To properly position a product in a new market, it is crucial to understand the role of culture in product design and its impact on driver perceptions, attitudes, and preferences.

Chinese vehicle design: “All-you-can-eat”

It cannot be denied that many Chinese automakers have traditionally relied on benchmarking for product design, drawing inspiration from popular car models. They select their target competitors and try to mimic their products – a tactic which often backfires. The selection of main competitors is often questionable and fails to meet the expectations of target customers.

However, in the last decade the Chinese automotive industry has received a digital makeover. The country’s first-time buyers are increasingly younger with a larger disposable income. With the majority of new customers having grown up in the smartphone era, “digital” is a must-have in the modern EV. Chinese OEMs already tend to well-equip their cars in practically every aspect and digital is just the icing on the cake in the wake of the “electrified car” era. Today, in-car voice assistants support drivers with all areas of their daily lives, from selecting infotainment and delivering WeChat messages to sharing recommendations for eateries and taking care of payment for online shopping purchases. Drivers can even activate autonomous driving mode, with sensors and software kicking in to control, navigate, and drive the vehicle.

Yet while manufacturers use complex technology to turn their cars into powerful mobile devices, the design options for the Chinese customer are kept unduly simple. With many buyers in the process of choosing their first vehicle and with limited experience of brands, it is common for a Chinese customer to be presented with a small selection of options.

European automakers have also started designing cars specifically for the Chinese market to account for customers’ specific tastes and preferences. Audi, for example, swapped its “build-your-own” approach for a choice of just four models while allowing the customer to select their desired paint color. “Our task is to translate the brand values of Audi into a design language that fits to the Chinese market and to our customers in China,” explains Audi’s Chief Designer Sandra Hartmann. “To be successful, we have to discover the preferences of our Chinese customers even before they have discovered them.”

European vehicle design: “My way, or the highway”

But will Chinese manufacturers adapt their offerings for the European market in return? We imagine it will be tempting for Chinese manufacturers to transfer their existing simple selection and connectivity concept to the West. Many believe that their fancy Artificial Intelligence, HMI, and 5G functionalities will foster brand affinity and differentiation, betting on value for money and undercutting local manufacturers on price. They forget to answer the question of whether the international market is truly ready for the “Internet of Vehicles”.

In contrast, it is common for carmakers in Europe to offer a barely equipped entry version with plenty of options for customization in order to address individual needs and monetize willingness to pay. The typical approach of sparsely equipped trim lines and a large variety of additional options is widely favored by European customers. China’s overly designed cars would leave little room for customization and be detrimental to customers’ value perception, never mind the OEMs’ deserved profits.

Additionally, Chinese brands may struggle to convince Europeans of their overly-equipped vehicles’ benefits. New tech offerings are still seen as an optional extra and not an intrinsic part of the vehicle. It is noteworthy that cybersecurity and privacy policies are much stricter in Europe, and therefore certain innovative features may not be feasible on European soil. For example, when it comes to autonomous driving features, the European Parliament highlights road safety, liability issues, data processing, ethical issues, and infrastructure as challenges that still need to be addressed. There are plans to introduce a ban on “black box” systems for high-risk uses of Artificial Intelligence, such as in self-driving cars. High-risk applications will have to demonstrate their compliance with regulations before being deployed in the European Union.

As new vehicle technology continues to raise concerns for both customers and regulators, Chinese manufacturers may want to review their features before targeting the European market. These should be aligned with customers’ core needs and the benefits clearly communicated.

But should newcomers try to imitate the customization options of their European competitors on their journey to Europe? Not necessarily…

Is there such thing as too much a choice?

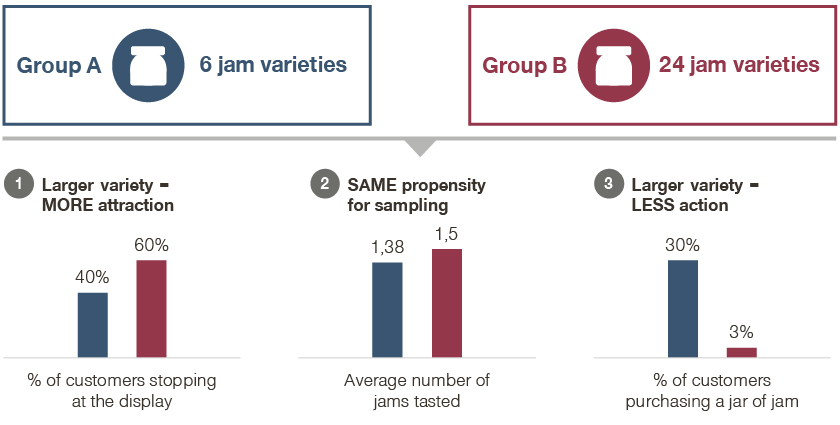

In a world where customers are already bombarded with options on a daily basis, it is easy to become overwhelmed when not managed properly. No matter how badly customers want choices, they agonize over decisions. The full liberty of configuring their own offer means they often get lost in the depth of choice. This is highlighted in Jan’s book, The Pricing Puzzle, which uses the example of customers choosing a jar of jam:

As the jam study shows, it is still wise to give the customers the impression that they are well-informed about purchase decisions. Still, when confronted with too many choices, consumers tend to shy away from a purchase, to the detriment of retailers. Google analytics experts agree: too many choices are a bad thing for car buyers. Their study on dealership inventory and brand websites shows that offering too many options could backfire. When looking at online vehicle configurators, it was found that buyers preferred pre-determined configurations or packages.

How automotive brands can help customers make the right choice

In Europe, customization on an individual level or differentiation by segment is of growing importance for companies to retain customers and extract deserved value. However, companies often fail in creating customized offers and there are no universal truths regarding the granularity and degree of customization. Meanwhile, the same customers may be left feeling frustrated with Chinese offers that leave them with almost no choice. We believe that combining the best of both worlds is the way to go. Some OEMs in Europe display the same mindset and have already started reducing complexity for their EVs. While trim structures are widely spread and complex for conventional cars, EV offers are more focused and targeted with leaner trim line structures, such as the Volvo XC60 Recharge and Tesla’s Model 3. New entrants in Europe can also increase their chances of success by simplifying and guiding customers’ decisions on which vehicle to purchase, which requires a value-based bundling strategy.

Way to go: Value-driven target customer profiles

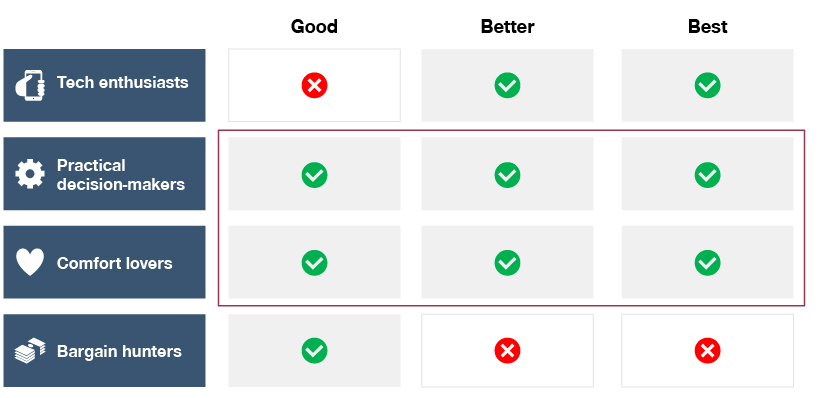

Manufacturers need to derive the optimal bundling strategy, creating full transparency surrounding customer preferences and using proven analytical methods to quantify how customers perceive specific features. This would enable identification of customer segments and the application of a good-better-best trim-line hierarchy with limited add-on options. Target segments could be, for example, “tech enthusiasts” with a higher willingness to pay for premium options, and “bargain hunters” – more price-sensitive customers who seek advanced features but don’t necessarily have the willingness to pay. Then there are those who could be willing to accept both, such as “practical decision-makers” and “comfort lovers”, with these segments forming the backbone of the portfolio trim-line structure.

This good-better-best approach is already evident with Mitsubishi’s Outlander Plug-in Hybrid model. Buyers can choose from a Basic option at just under 40,000 euros, the Spirit package at almost 43,000 euros, or the Plus package that is equipped with all premium features for just under 46,000 euros.

Read more from this series:

Part 1: Six Pillars for Carmakers from Emerging Markets to Succeed in Europe

Part 2: Product Design: Helping Customers to Navigate Choice

Part 3: Automotive Newcomers: Sales Model for the B2C Market

Part 4: Automotive Newcomers: Sales Model for the B2B Market