2025 NRDL turns out to be among the most competitive ones thus far. Meanwhile, the new C-list doesn’t seem to be any easier. With the two roads diverging with distinct tradeoffs, we take a closer look into the latest results.

To much fanfare, the 2025 National Reimbursement Drug List (NRDL) results were announced in conjunction with the newly minted C-list in early December. For those that made it to either list, it is indeed a hard-earned victory calling for big celebrations. However, for many who didn’t, it wasn’t surprising as the stringency was foreboded throughout the processes early on.

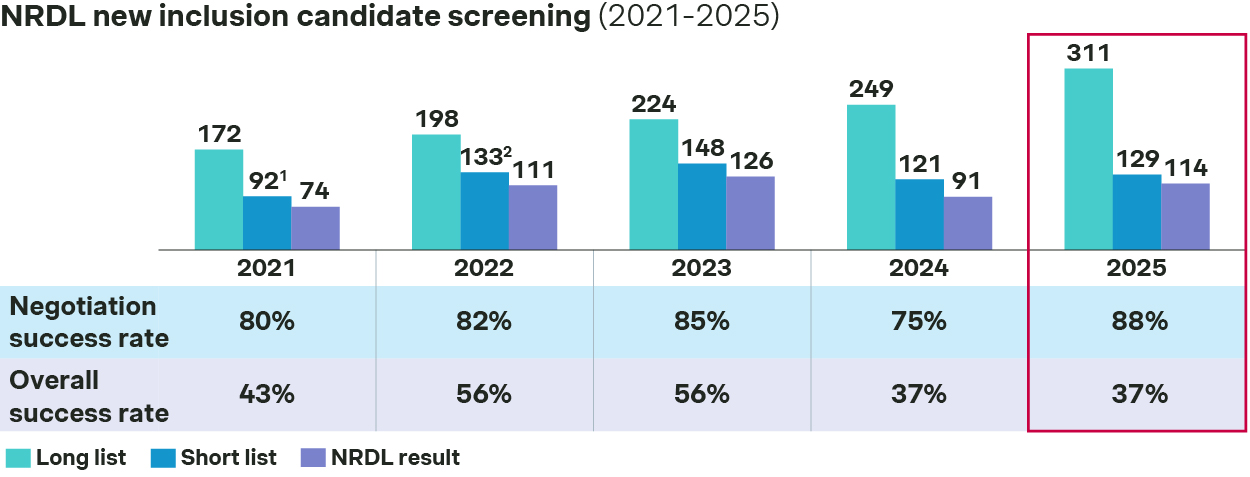

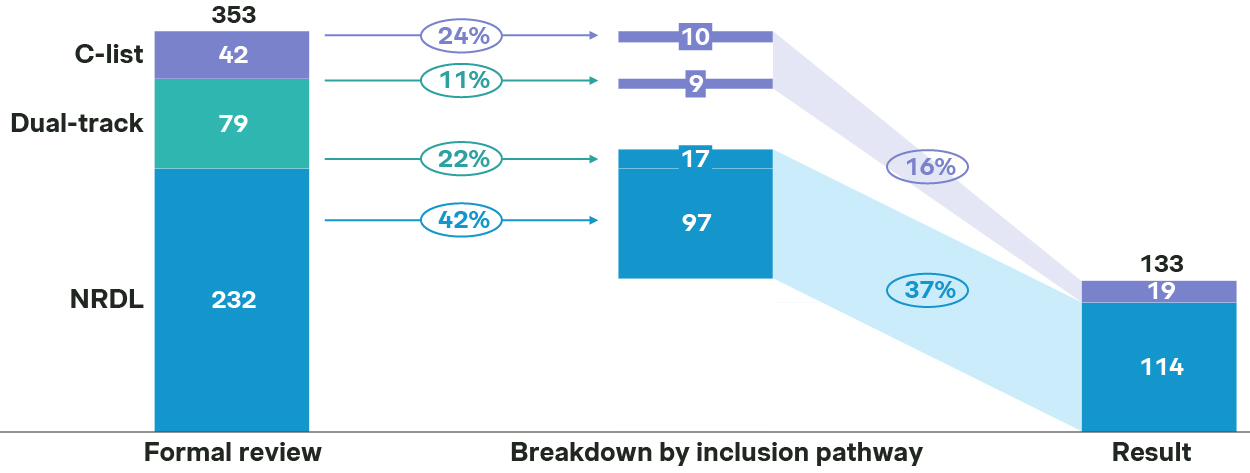

In fact, only 129 out of 311 NRDL new inclusion candidates made it to the shortlist, and 114 made it to the final list, resulting in an overall success rate at 37%.

Lowest overall success rate as 2024

![graph 1]()

Source: Simon-Kucher, NHSA, press release. - In comparison, the C-list turned out to be even more competitive, as only 24 out of 121 candidates made it to the shortlist, and 19 landed in the final C-list, with an overall success rate at a mere 16%

NRDL 2025 new listings

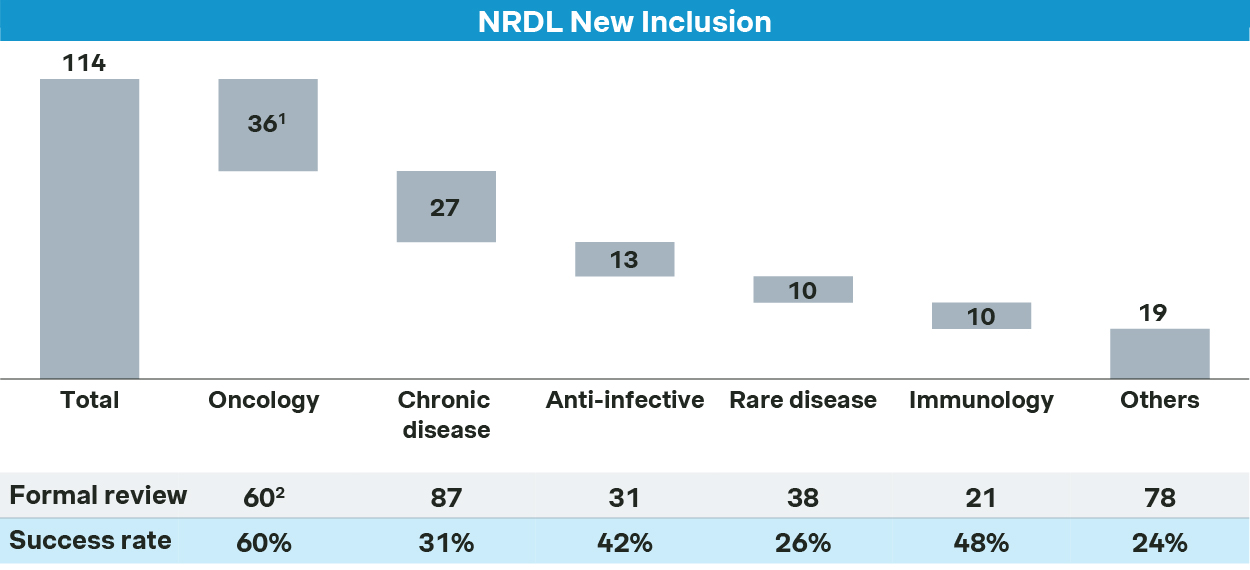

Oncology, chronic diseases, anti-infectives, rare diseases, and immunology come out as the top five therapeutic areas for 2025 NRDL new listings, each with different dynamics but many with common themes.

Oncology, chronic disease and anti-infective stand out as the top TAs

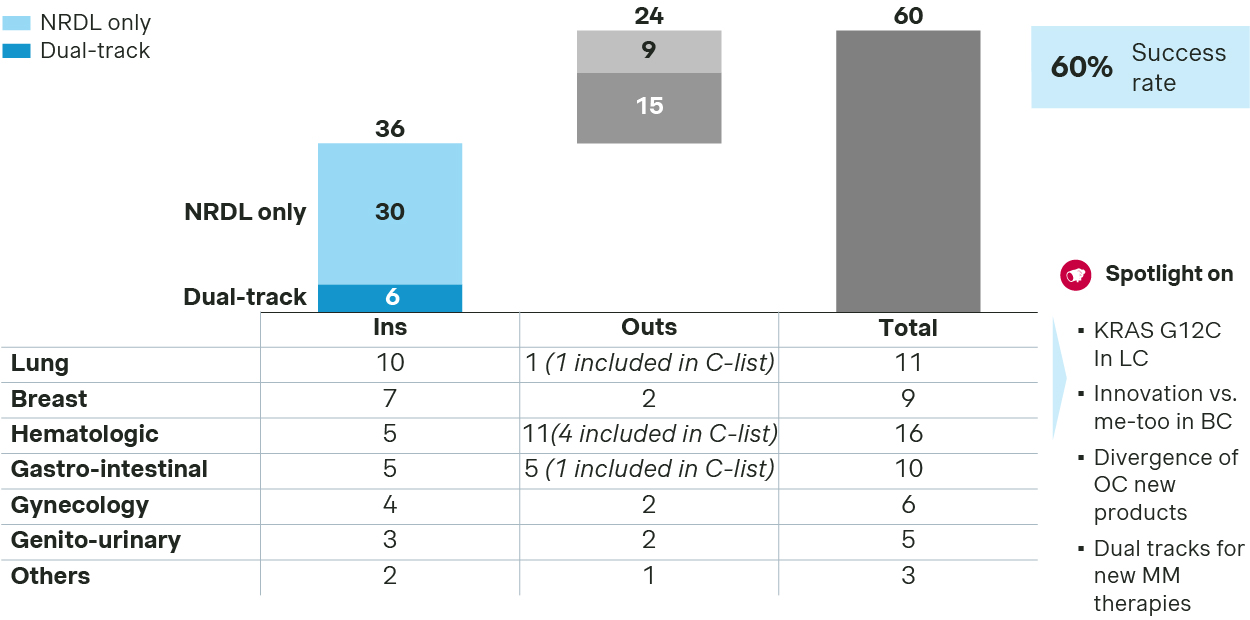

Oncology remains the top priority for NRDL. Of the 60 oncology drugs that passed the formal review for NRDL, 36 made it to the final list, resulting in 60% success rate - far above the overall average.

Oncology sees 36 new inclusions in 2025

- In lung cancer, KRAS G12C became the stage for a three‑way showdown. Three local brands were launched recently, all with the auras of Class 1 new drugs and Breakthrough Therapy designations. To differentiate themselves, each strived to highlight unique advantages across key clinical endpoints successfully as they do address the outstanding unmet needs for the rare driver mutation.

- Breast cancer saw multiple new listings, with AstraZeneca’s Truqap and Roche’s Itovebi making it to the final list by demonstrating their compelling values in treating PIK3CA related mutations. In the CDK4/6 inhibitors category, four new entrants were simultaneously listed to rival against the four NRDL‑listed incumbents, making it one of the most crowded spaces in oncology. In triple-negative breast cancer, the domestic TROP2 ADC Jiatailai prevailed over its imported counterpart Trodelvy for apparently better cost‑effectiveness.

- Among ovarian cancer therapies, the anti‑VEGF drug Enzeshu achieved superior PFS and OS against bevacizumab in second‑line platinum‑resistant patients thanks to its optimized structure and improved binding. Paishuning or senaparib also made the list as a next generation PARP inhibitor. In contrast, Elahere was dealt with a setback at the final negotiation stage, despite its positioning as the first-in-class precision medicine against FRα, as well as impressive efficacy data from global and China studies.

- The rivalry in multiple myeloma is particularly telling, with the next‑generation CD38 antibody Sarclisa from Sanofi landing in the NRDL list leveraging real‑world evidence from China early access program to strengthen its value propositions, while JNJ’s Talvey making it to the C-list alongside with Pfizer’s Elrexfio, leaving its sibling Tecvayli empty-handed despite its first-mover advantage. This may serve as a proxy to the new dynamics, with distinct strategic thrusts from different players but intense competition for either option.

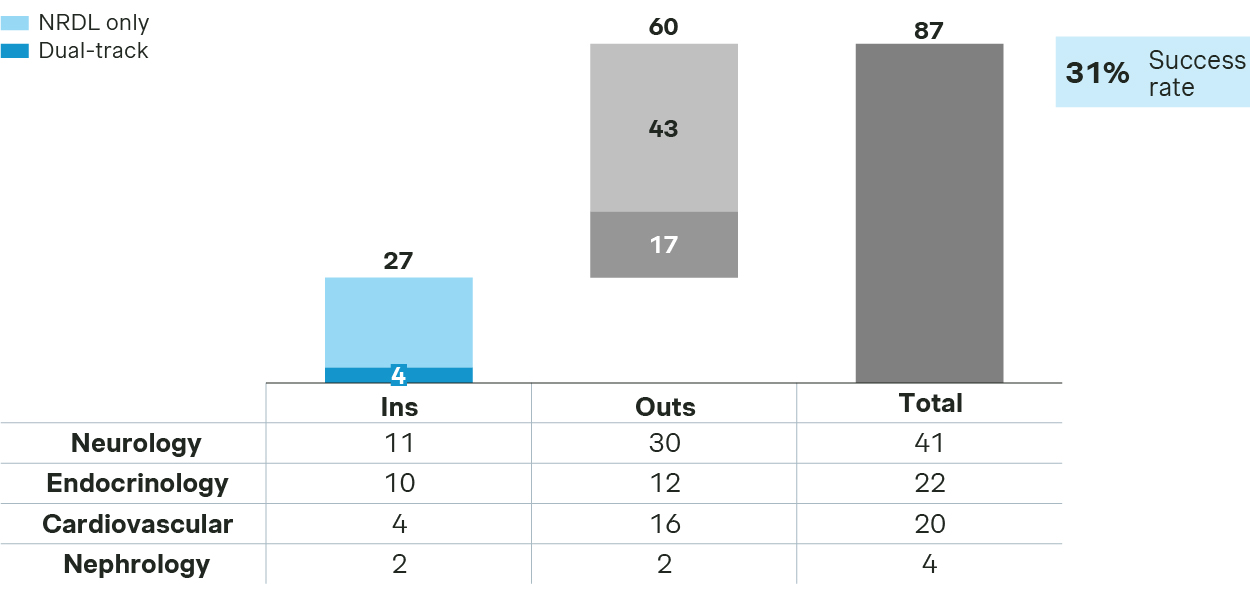

Competition in chronic diseases is even more intense, with overall success rate at 31%, lower than overall average.

Chronic disease sees 27 new inclusions in 2025

- Neurology saw a substantial number of submissions, but with a low success rate. Winners include Fycompa for seizures and Erzofri or long acting paliperidone for schizophrenia, while Nurtec and Rexulti are notably missing from the final list.

- Endocrinology candidates enjoy a better chance, with Mounjaro for T2DM and Urece for gout and hyperurecemia among the winners, while Isturisa or osilodrostat for Cushing’s syndrome missed the mark.

- In cardiovascular, all four PCSK9 inhibitors successfully made to NRDL. The three monoclonal antibodies each emphasized differentiated strengths, with ongericimab highlighting its dual advantages in reducing LDLC and Lp(a), ebronucimab underscoring its strong benefits for high-risk patient subgroups, while recaticimab demonstrating its dosing convenience, better safety, and adherence. Remarkably, Leqvio or inclisiran made a successful comeback after a failed attempt last year, making it the first siRNA therapy in the NRDL formulary.

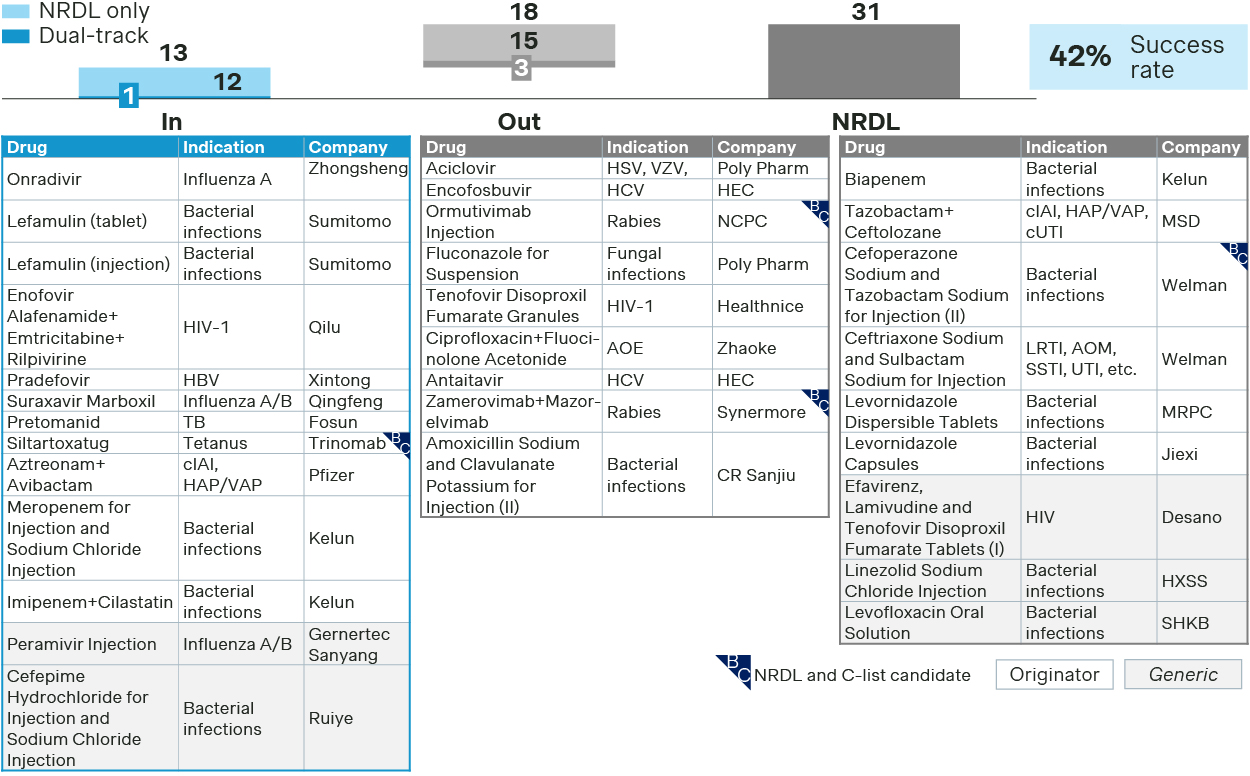

For anti-infectives, 13 drugs made it to NRDL, making it one of the top TAs for new inclusions.

Anti-infective see 13 new inclusions in 2025

- Emblaveo positioned itself as the only option for MBL-CRE. Besides demonstrating its superior clinical value, it also furnished evidence on reduced mortality and ICU stay, as well as endorsements by major guidelines, making a compelling case for NRDL listing. In contrast, Zerbaxa and Recarbrio were not successful with their bids for NRDL and C-list respectively.

- A prophylaxis therapy for tetanus, Xintituo or siltartoxatug made a rare success for preventative therapies by demonstrating superior efficacy, clearly defined target patient population, and manageable budget impact, while two preventive therapies for rabies failed in their respective dual-track bids for NRDL and C-list.

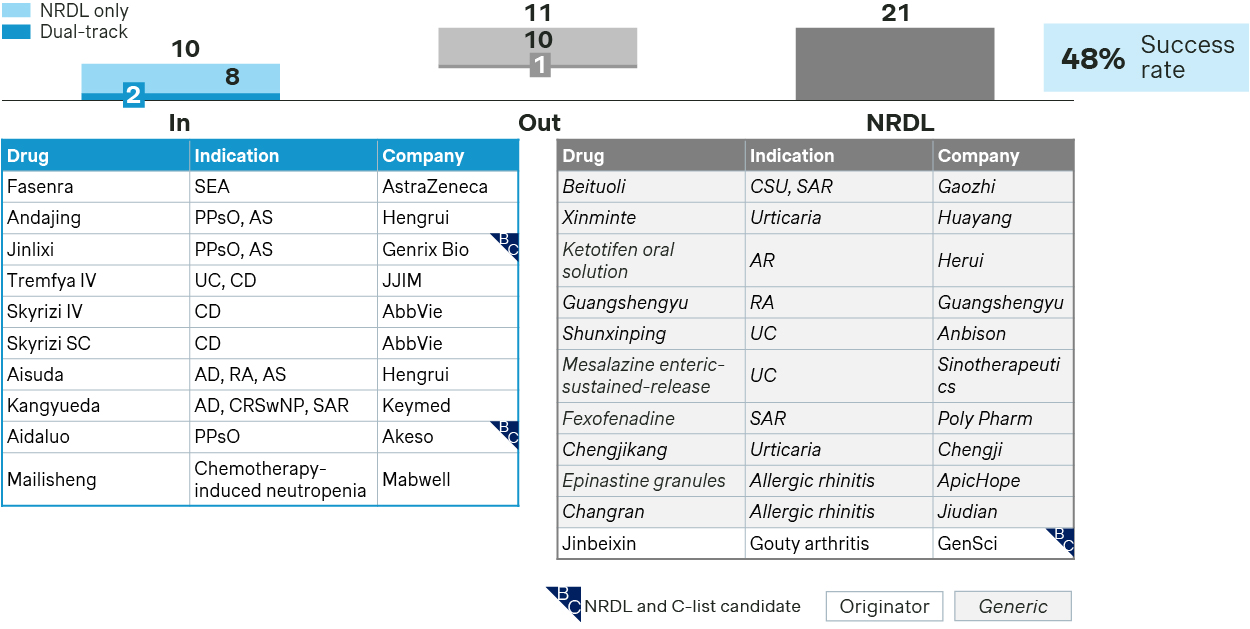

Immunology TA saw several newcomers and incumbents battling across overlapping indications.

Immunology see 10 new inclusions in 2025

- In asthma, Fasenra entered NRDL formulary as a challenger to incumbent Nucala, highlighting its dual mechanisms, fast onset, and long-acting advantages, and leveraged real world data showing improved asthma control in patients with suboptimal response to current standard of care, which was key to help it cross the finish line.

- In inflammatory bowel diseases, Skyrizi made to the NRDL positioning as the world’s first IL23 inhibitor approved for Crohn’s disease, highlighting significant benefits across multiple endpoints with compelling efficacy. Tremfya, instead, emphasized its convenience advantages for NRDL listing for both Crohn’s disease and ulcerative colitis.

- Demonstrating innovativeness, superior clinical values, and China evidence towards addressing outstanding unmet needs have always been the overarching themes for new inclusions. However, cost-effectiveness and budget impact are becoming increasingly important propositions for NRDL listing, as exemplified by stapokibart and ivarmacitinib in their successful bids for this round.

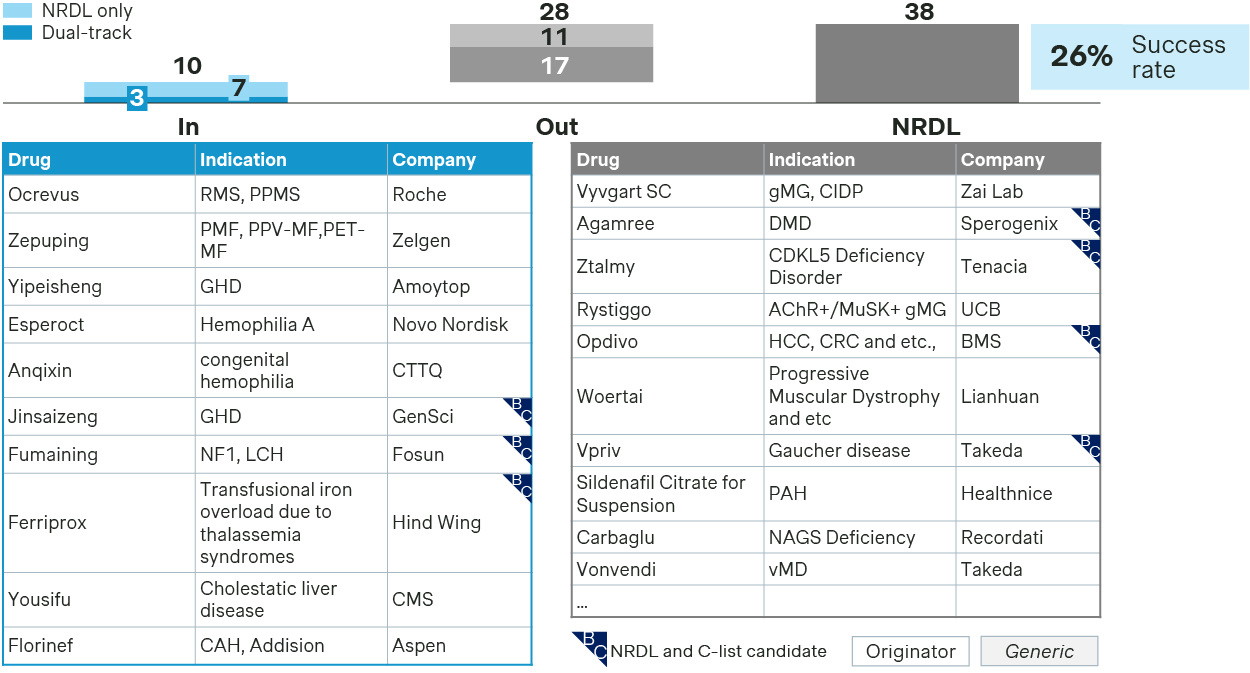

In rare diseases, only 10 of the 38 candidates made it to the NRDL listing, with a success rate of 26% which is lower than the overall average.

Low success rate for new inclusion of rare disease in NRDL

- The winners have all strived to demonstrate their values either by addressing significant unmet needs or offering a superior next-generation option, while preempting potential payer concerns with robust evidence.

- Fumaining or luvometinib achieved NRDL listing for two rare disease indications in one-go by highlighting Priority Review and Breakthrough Therapy designations from CDE, addressing unmet needs for pediatric NF1-PN, and positioning as the first targeted therapy for LCH and histiocytosis-related tumors.

- Zepuping was included based on its compelling clinical benefits in myelofibrosis, guideline recognition, and its positioning as a domestic next-generation upgrade to NRDL-listed ruxolitinib.

- Florinef or fludrocortisone acetate, listed on both the WHO Essential Medicines List and the WHO Essential Medicines List for Children, failed in prior bid last year but succeeded in this round, filling the clinical gap in treating salt-wasting congenital adrenal hyperplasia and primary adrenal insufficiency.

- In hemophilia, Esperoct adjusted its strategy from last year, pivoting from “no comparator” positioning to anchoring against NRDL-listed recombinant FVIII, and made convincing arguments on its long-acting advantages, adherence benefits, and social economic value for hemophilia A patients.

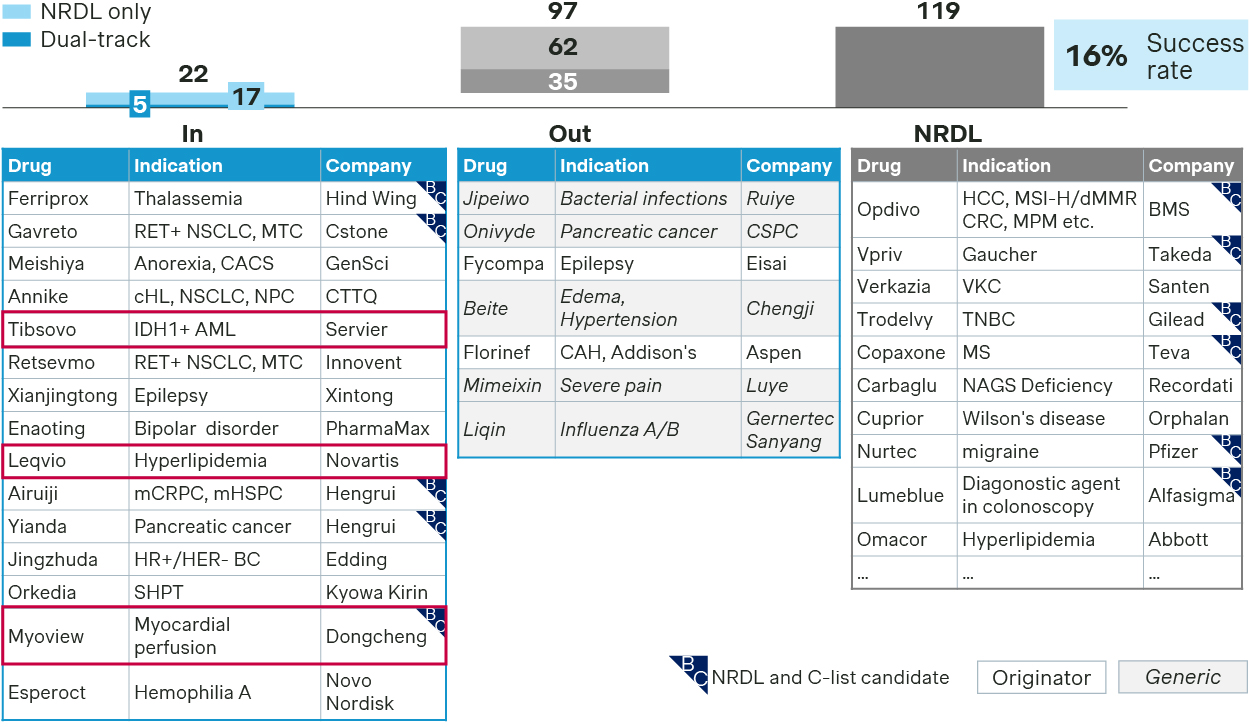

Esperoct is just one of the 22 successful comebacks for 2025 NRDL, and many came better prepared with revamped strategies and more tailored approaches.

Previous failures have strategized on value messages optimization, evidence package upgrade and payer concern preemption for successful comeback

- Sharpening value message: Tibsovo achieved successful NRDL comeback by optimizing its value dossier to better articulate its innovativeness and unique value propositions as a precision medicine for R/R AML, efficacy across China and global IDH1 patients, as well as additional benefits in reducing transfusion dependence, which helped move the needle this time around.

- Upgrading evidence package: Leqvio adjusted its comparator strategy while incorporating new China RWE post-launch, with more sustained LDL-C lowering efficacy compared to competitors, as well as real-world data on superior dosing adherence.

- Preempting payer concern: Myoview or Technetium Tc99m tetrofosmin, a radio-pharmaceutical for myocardial perfusion imaging, successfully managed its budget impact with a new pricing mechanism based on a per-patient rather than a per-dose regimen. This approach represents yet another innovative pricing approach for radiopharmaceuticals, following last year’s tiered pricing for Sodium Iodin I131 capsule.

NRDL renewals and re-negotiations

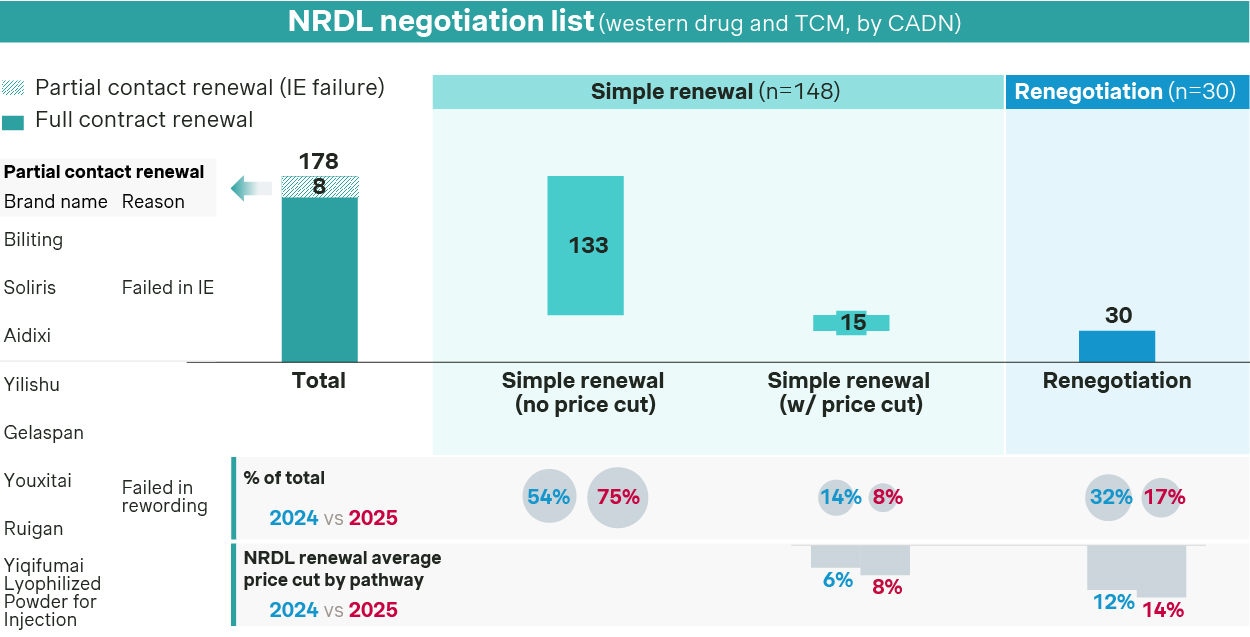

2025 NRDL contract renewal saw a 92% success rate this year, broadly in line with previous years.

148 renewal candidates are eligible for simple renewal pathway in 2025, while 30 candidates underwent renegotiation

- Most of the candidates were eligible for simple renewal, with 133 candidates making it through with no price cut and by successfully managing the budget impact expectations for current and future indications.

- On the other hand, price pressure trends higher for re-negotiations, with average price cut standing at 14% this year versus 12% in 2024.

- NRDL regular list saw the first batch of 8 drugs inducted after their first listings eight years ago, including Lucentis and NovoSeven alike. Notably, Apatinib was the only one with regular listing and indication expansion in one-go.

C-list debut

C-list turns out to be much more stringent than expected, with only 19 making it to the final list.

NRDL and C-list success rate breakdown by inclusion pathway

- Oncology stands as the largest beneficiary of the C-list, with 12 products making it to the final list.

Oncology stands as the largest beneficiary of the C-list with 12 inclusions

| Indication | Brand | CADN | MoA & Modality | Annual list price (RMB) | Application pathway | Company |

| TCE-MM | Elrexfio | Elranatamab | BCMA x CD3 BsAb | 1,706,118 | C-list | pfizer |

| Talvey | Talquetamab | GPRC5D x CD3 BsAb | 1,760,121 | C-list | Johnson & Johnson | |

| Fucaso | Equecabtagene Autoleucel | BCMA CAR-T | 1,166,000 | NRDL + C-list | IASO / Innovent | |

| Saikaize | Zevorcabtagene Autoleucel | BCMA CAR-T | 1,150,000 | NRDL + C-list | CARsgen | |

| r/r LBCL/DLBCL | Yescarta | Axicabtagnene Ciloleucel | CD19 CAR-T | 1,200,000 | NRDL + C-list | Fosun |

| Carteyva | Relmacbtagene Autoleucel | CD19 CAR-T | 1,000,000 | C-list | JW Therapeutics | |

| ALL | Yuanruida | Inaticabtagene Autoleucel | CD19 CAR-T | 999,000 | NRDL + C-list | Juventas |

| F-NHL | Tazverik | Tazemetostat | EZH2 | N/A | NRDL + C-list | Hutchmed |

| SCLC | Zepzeica | Lurbinectedin | DNA minor groove | 707,192 | C-list | Luye |

| NSCLC | Purocenta | Tolsulfamide | Chemoblation | 154,800 | NRDL + C-list | Chasesun |

| HCC/CRC/MPM | Yervoy | Ipilimumab | CTLA-4 mAb | 486,333 | C-list | BMS |

| BTC | Ziihera | Zanidatamab | HER2 BsAb | 700,856 | C-list | BeiGene |

Source: Simon-Kucher.

- Five CAR-T therapies for hemato-oncology at one million RMB price range landed successfully in the C-list, on top of the two T-cell engagers Elrexfio and Talvey both with list prices even higher on annual cost basis.

- Among the solid tumor therapies, Ziihera is indicated for late-stage metastatic biliary tract cancer as the first-in-class HER2+ bispecific antibody, a rare cancer type globally with rising incidence in China.

- For lung cancer, Zepzelca and Purocenta both appear on the final list, with the former pursuing C-list single-mindedly given its pricing constraint, while the latter undertaking a dual-track approach and landing in the C-list as a fallback to NRDL.

- Interestingly, the Alzheimer duet Leqembi and Kisunla both made it to the C-list. The former focused on highlighting safety profile and real-world efficacy, while the latter strived to differentiate with its dosing advantages, as it is administered once every four weeks with the possibility of discontinuation after amyloid plaque clearance. While both pursued dual-track strategy, C-list appears to be a better fit given the potentially sizable budget impact.

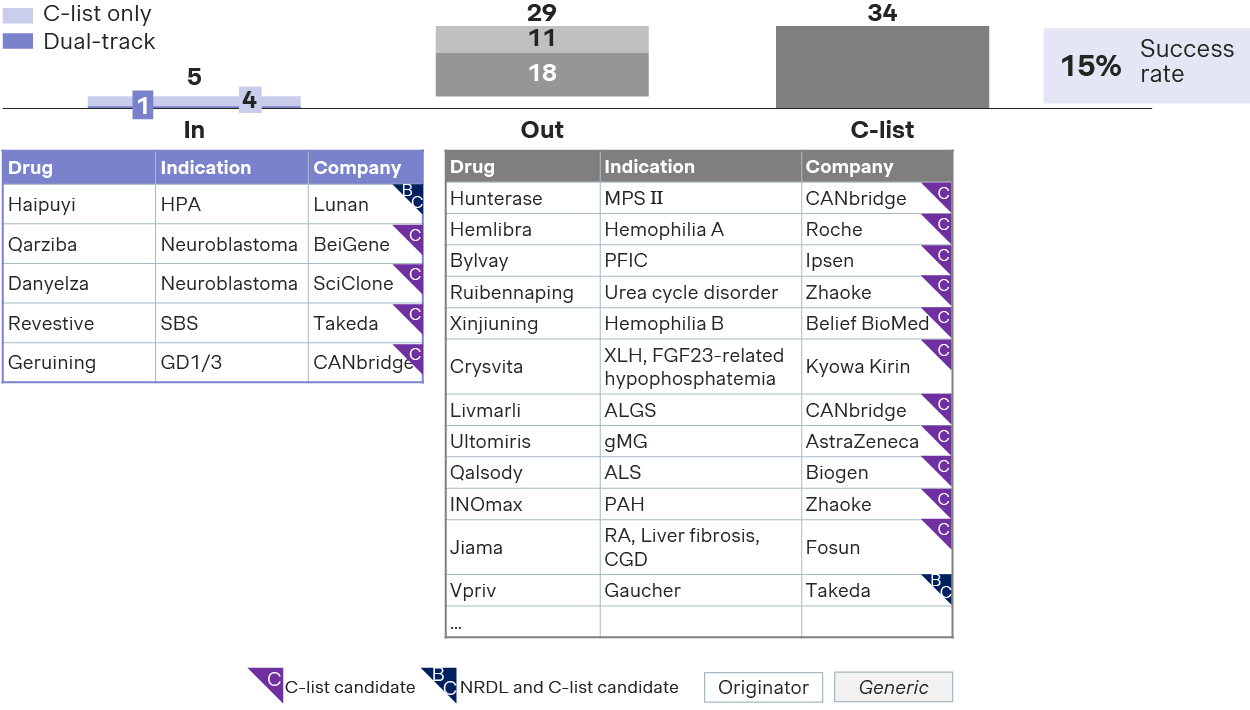

- Somewhat surprisingly, C-list inclusions for rare disease drugs seem to be underwhelming, with success rate at just 15%, even lower than that of NRDL.

Low success rate for new inclusion of rare disease in the C-list

- Only 5 rare disease drugs made it to the list, including two innovative therapies for rare oncology neuroblastoma.

- Revestive or teduglutide successfully pivoted from NRDL to C-list this year. It emphasized its uniqueness as the only targeted therapy approved for short bowel syndrome, in addition to guideline endorsements and RWE from global studies and China early-access program.

- Haipuyi or sapropterin also made it to the C-list positioning as the only option for tetrahydrobiopterin-deficiency-induced hyperphenylalaninemia, after the originator withdrew from the market.

- Geruining beat rival Vpriv to become the first C-list therapy for Gaucher disease by highlighting its efficacy for Type I and III patients and its local manufacturing and cost competitiveness as the first enzyme-replacement therapy made in China.

- On the other hand, the small C-list formulary could be disheartening to many other therapies for rare diseases ranging from ALS to PFIC, from XLH and urea cycle disorders, let alone the first gene therapy in China for hemophilia B.

- While somewhat underwhelming in terms of the number of inclusions and breadth of scope, the C-list must balance coverage with real-world impact, with successful adoption of the first batch being critical to its proof of concept. In terms of pricing mechanism, C-list products will be allowed to keep the current list price in self-pay market, while exploring innovative contracting terms with commercial insurances via rebates and risk sharing agreements. This offers more latitudes and incentives for commercial insurances, which in turn may help improve access and affordability for the high-value, high-cost therapies on the C-list.

- In terms of access, C-list products theoretically will enjoy preferred listing across CHI formularies, which could have been fragmented, tedious, and time-consuming in the past. They are also entitled to some of the privileges of NRDL listed drugs, with priority listing for provincial platforms and green channel for hospital listing, as well as exemption from cost containment measures like DRG and DIP.

- Despite the policy guidance, significant uncertainties remain around how the landing would pan out, especially in light of the significant disparity and heterogeneity across different regions and CHI formularies across China, and different sets of stakeholders thereof.

Looking ahead

As dust settles for 2025, both hopes and uncertainties are in the air.

For those who made it to the first C-list, there are more questions on the rollout and actual impact. As for those planning for comebacks in 2026, questions linger on whether they should pursue dual-track submission or double down on one path over the other, and what it would take to move the needle in either case.

With two roads diverging with distinct sets of opportunities, challenges, and uncertainties, it is a good time to reflect on the key learnings from 2025 and to revisit strategy and action plans for the year ahead.