In part one of this series, we discussed the benefits of a better offering. In part two, we explain how the value of this offering can be captured and reflected via better pricing.

As we’ve learned from our series introduction, the CDMO market has experienced significant growth in recent years, with no signs of slowing down. Despite this positive trend, CDMOs face several commercial challenges that must be addressed to fully take advantage of this growth. Among creating a better offering, pricing is another complex issue for CDMOs.

When pricing projects, CDMOs need to consider multiple factors – from the type of service and the complexity of the project to the scope of work and the timeline.

The problem? Many CDMOs follow a cost-plus approach, characterized by spending immense time on accurate costing before simply adding a theoretical, one-size-fits-all margin target on top to generate the final price.

This cost-plus approach comes with several pitfalls. It doesn’t factor in the perceived value for the client, or the volume or complexity of the service provided. Other factors such as the internal delivery situation are neglected as well, leading to capacities being filled with unattractive deals and clients, rather than ensuring capacity for the most valued ones.

Another challenge with cost-plus is that you offer the same pricing to all clients regardless of their specific needs or requirements. The higher willingness to pay of clients with higher value perceptions for your services may not be fully extracted, as simple markups are applied.

Lastly, value considerations in pricing are often unstructured and non-transparent despite pricing being a crucial aspect for CDMOs. Final prices are oftentimes a black box, with each business developer having different price drivers in mind. For example, for a recent survey we did at one of the leading CDMOs, we asked 10 different business developers about their top five price drivers. The result: More than 20 different price drivers were mentioned. While only a few of those drivers were mentioned frequently across stakeholders (e.g., timeline, molecule complexity, development phase), the majority of them can be identified as “individual perceptions” that were mentioned by more than 30 percent of respondents (e.g., indication, client pipeline). This unstructured and non-transparent view of pricing prevents CDMOs from comparing pricing considerations across deals and understanding them in hindsight.

Ultimately, for CDMOs to truly benefit from the future growth on both the revenue side and the profit side and achieve planned margin targets, they need to change. To stay ahead and participate in the expansion of the market, it’s key to navigate the complexities of better pricing, essentially moving away from the current non-transparent, unstructured, and cost-based pricing approach to a structured value-based pricing approach.

Prices that are competitive, profitable, and in line with client demand usually aren’t the result of a cost-plus approach. There is a better way.

The following blog tells you more about why and how to adopt better pricing strategies to fully benefit from the market’s growth.

Why improving your current pricing is relevant

Better pricing strategies help you stay ahead of the competition and achieve long-term success in the pharmaceutical and biotech industries. How can you benefit from them? Firstly, they can increase profitability, as you systematically extract the full value of the offering. They also enable you to increase your sales success rate, as prices are more in line with client-perceived value, resulting in higher client acceptance.

Furthermore, better pricing can improve operational efficiency by ensuring internal clarity on pricing strategies and aligning pricing approaches and communication across stakeholders. This also results in consistency. Project prices will be de-coupled from the subjective perception of the individual who priced it and become an objective estimation that can still be followed through on in hindsight.

What does a better pricing look like?

From cost-plus to value driven, how can better pricing be defined? Let’s take a look:

Accurate: Knowing the key value drivers of each offer element and for different client situations, ensuring that pricing is in line with client willingness to pay

Consistent: Having a standardized internal perspective on the pricing strategy and price setting methodology on top of a consistent understanding of the cost base

Simple: Establishing processes that incorporate internal and external value considerations in a structured and efficient way with supporting infrastructure and easily scalable processes

Consider value in your pricing today

The solution is to have a well-defined pricing strategy translated into a clear methodology and supported by powerful value-pricing tools. Not the case at your CDMO? Here’s how to achieve it in four steps:

1. Define your pricing strategy

If you asked everyone in your organization, would each person give you a slightly different description of your pricing targets? And is your pricing strategy communicated differently depending on the stakeholder you ask? If so, then you probably lack a clearly formalized pricing strategy.

Best practice: All of your commercial stakeholders share the same vision and strategic ambition. The pricing strategy is defined in detail, from vision to positioning and execution, with each statement articulated as an ambition.

Your vision doesn’t have to be fully reflected in operations but can also be something to strive for. For example, an overall vision statement might be “We should be a premium, profitability-focused price leader across all markets and segment categories.” Whereas for pricing, you can be more specific: “We should link discounting guidelines to clear counter performance from the clients.”

Be sure to define and document all aspects of the strategy to help guide and direct commercial efforts and enhance consistency.

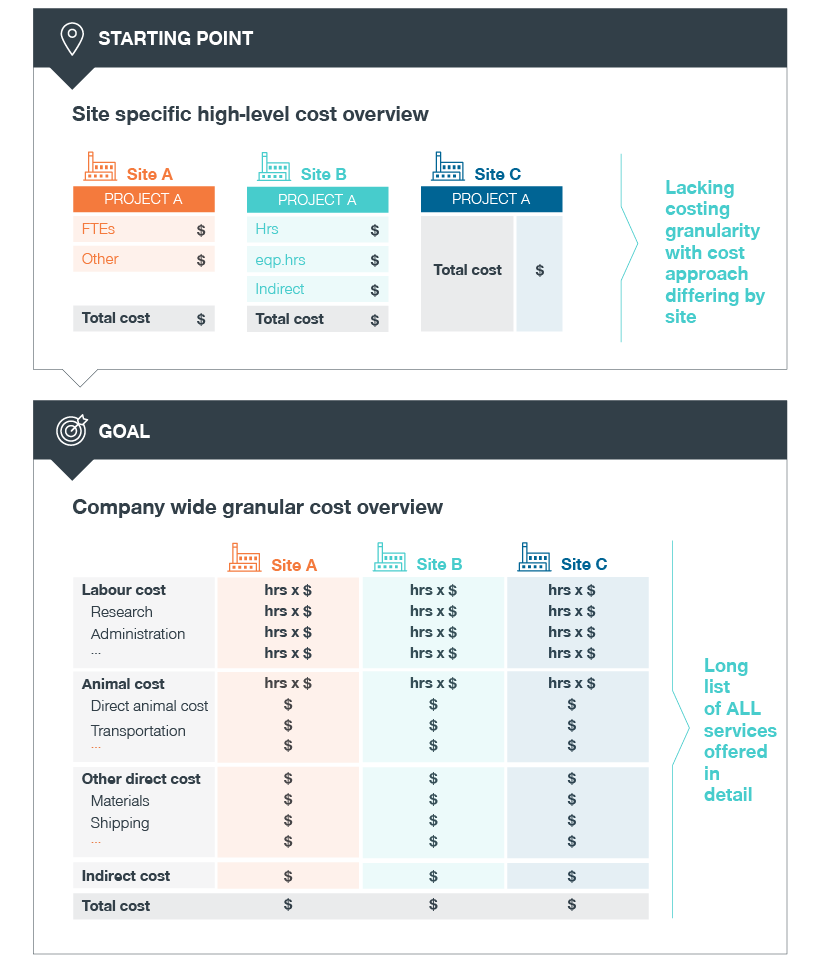

2. Harmonize your cost structure

Can you rely on companywide consistency, or do you handle costs individually between sites? Can you easily conduct a cost analysis and draw relevant insights, or do you struggle to get an overview of your costs and profitability? If it’s the latter, then this best practice will help.

Best practice: Your costing methodology should be standardized, and costs should be aggregated into categories across sites and distributed across work packages. Here, you should identify the different cost centers (e.g., personnel, equipment, product). To define a granular cost base, you then need to break down the number of hours required to conduct a project.

Having a shared overview of your typical standard and one-off costs, resources, and customized offerings makes your processes more efficient and enables you to easily compare and forecast costs for current and future projects across sites. It gives you a clear understanding of what resources projects require as well as more accuracy in your profitability analyses.

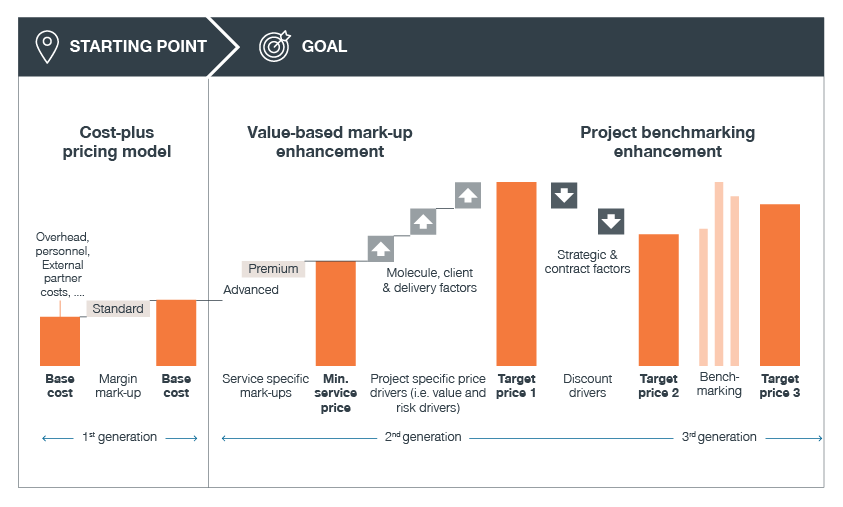

3. Infuse value-based pricing principles

Have you managed to harmonize your cost structure, but your pricing remains cost-plus, e.g., you apply a margin to your cost base to reach your final price? If so, you are not alone. Many CDMOs follow this approach with only individual consideration of value drivers.

Best practice: Moving to a value-based pricing mindset is essential for any CDMO looking to maximize profitability. By defining relevant price drivers and using data to determine value-based markups, you can ensure that prices reflect the value provided to clients.

A structured methodology is key to finding out what actually drives clients’ willingness to pay. In our experience, the drivers come in several categories, such as molecule factors (e.g., complexity of manufacturing process), client factors (e.g., urgency of request, client segment), and delivery factors (e.g., total installed capacity, current capacity utilization).

Here, the relevance of price drivers can differ by modality (e.g., cell and gene therapy, small molecules, RNA) or client size. Assuming a novel modality, for example, a large pharma company places higher value on large installed capacity, while a small biotech focuses more on the ability to address timeline urgency quickly.

To take things to the next level, you can validate the price points by considering relevant benchmarks from historical projects. This can then be put into a strong and user-friendly tool to be used by commercial stakeholders – but it typically requires a solid historical information bank.

Collecting data is a key component of the overall process. KPIs provide an objective basis for determining pricing, while tracking allows you to determine benchmarks for future pricing. Anchoring prices to the value provided, rather than the cost of production, ensures that prices reflect client willingness to pay.

When prices truly reflect value and client willingness to pay, profitability increases significantly. It’s easier to explain prices and underlying price drivers internally and externally and ensures commercial consistency across accounts and business development representatives.

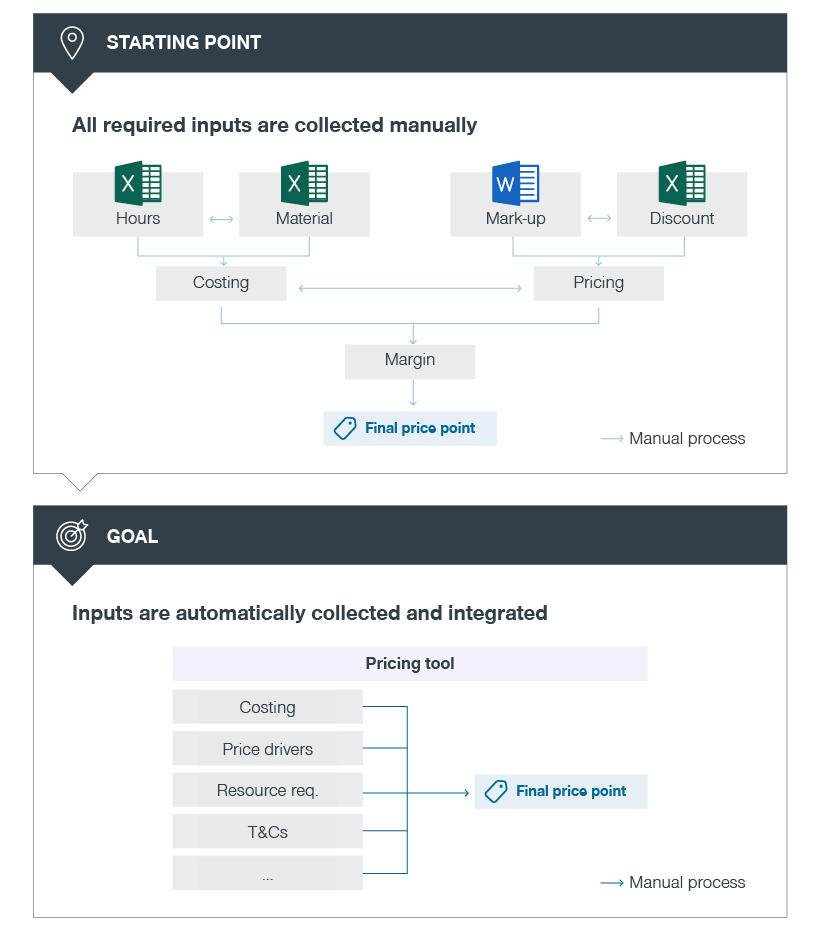

4. Utilize value pricing tool support

Do your pricing processes involve a lot of manual work, using many different sources? Are your inputs a mixture of Excel sheets, PowerPoint files, PDFs, and maybe even the memories of a few specific colleagues? If so, your pricing is likely riddled with inconsistencies.

Best practice: If you really want your developed pricing strategy and methodology to take off, you need a user-friendly and well-integrated tool. Here, you can go for a standalone Excel tool, which is less resource-intensive, opt for fully automated software, or go with a solution that is somewhere in between. Either way, the benefits of a well-designed pricing tool entail (among others) enhanced pricing quality via diligent comparison to relevant benchmarks, increased alignment across stakeholders due to aligned value considerations, and less manual work to calculate and consolidate final prices.

What’s next?

Through value-based pricing, we can help your CDMO fully capture the value of your services and unlock better growth.

Based on extensive industry experience, we know how to identify your most important value drivers. We can help you quantify the value of each service element, define new processes, and set up the relevant tools to support the new value focus in pricing. In order to bring your offering and value-based pricing together successfully, a smart quoting process is key – part three of our blog series reveals more.

We believe CDMOs should benefit not only from the volume of service they deliver but also the value they generate. This requires a solid end-to-end process in terms of:

- Read part one: Better offering to unlock CDMO growth

- Read part two: Better pricing to unlock CDMO growth

- Read part three: Better quoting to unlock CDMO growth

Our series explores each of these topics, supported by best practices and extensive experience in helping CDMOs achieve better growth.

Want to see what this looks like for your company? Reach out to Kaan-Fabian Kekec and Omar Ahmad today!