Demand has slowed down and wages are rising at an alarming pace. In the current market, sustaining turnover and protecting shareholder value through margins is becoming increasingly challenging and requires close attention from management.

Here we share two typical downward pricing mistakes that we often observe and tips on how to avoid them:

Pitfall 1: Think that price decreases will bring more volume

Weak demand is a result of current macro conditions, making excessive price reductions mostly ineffective in stimulating demand. Instead, offer price reductions selectively and anticipate the possible competitive reaction.

Pitfall 2: Assume that index pricing is the “magic bullet” to price simultaneously with cost dynamics

Main cost drivers like wages and raw materials are moving in opposite directions right now. Index-based price decreases often fail to recover cost increases in other areas. In addition, one-sided agreements or delays lead to significant margin losses. Instead

- Align the drumbeat of your buying and selling cycles AND

- Invest in your contract design. For example, renegotiation clauses provide more flexibility to actively manage costs than delegating pricing to indices.

Six pillars of price defense in a stagflation period

To avoid the vicious cycle of accelerating price reduction trends, we urge our customers to work on six pillars of price defense.

- Prepare your fact base. It’s important to gather detailed figures on the increases in energy and wages and share raw materials costs evolutions. But it’s also crucial to determine the high-level impact on your overall purchasing basket: educate your customers on the math (e.g., a 20% decrease in raw material A does not necessarily translate into a 20% reduction in production costs).

- Define your strategy. Adjust your volume targets based on market attractiveness, competition intensity, and price deltas across regions and countries. Be prepared to protect the volumes on segments that are worth it… and identify segments that you are ready to let go.

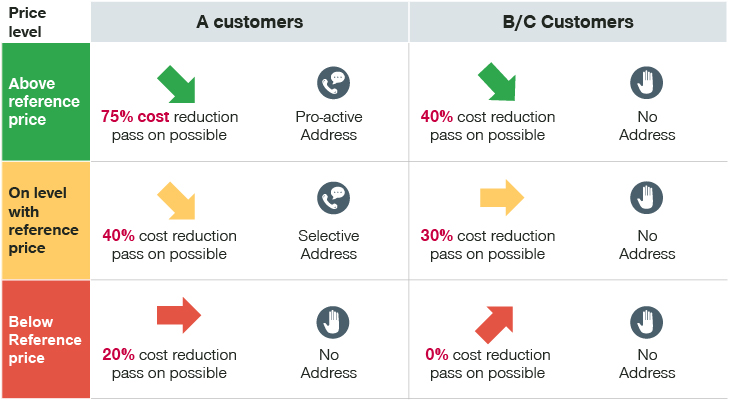

- Differentiate customers. Adapt your pricing policy to priority customer segments.

- Remember that time is on your side. Maintain your current pricing for as long as possible. Use timing as a negotiation driver as much as the price level itself – also with key accounts.

- Broaden your options. Push for alternative contracting schemes, pricing mechanisms, or price metrics (e.g., outcome-based) and promote less expensive alternatives (LEAs).

- Mobilize your salesforce. Prepare sales teams for negotiations by equipping them with facts, objection handling guidelines, and mock customer talks.

Key takeaways

- Don’t proactively offer price reductions – except very selectively with partner accounts.

- Enhance your contract design by developing supporting terms & conditions (renegotiation clauses, indices triggers…) beyond index-based pricing.

- Differentiate price reductions by customer, product, and market segment. There must be niches where decreases are not necessary.

- Define must-win areas where you want to maintain price levels to have more room to maneuver in other places.

- Identify the best timing for price reductions.

- Mobilize the salesforce for the negotiations.

Deciding how to act will be a vital stage of your strategy. Find out more about how your business can and should adapt to navigate market volatility.