Commercial health insurance (CHI) has an increasingly important role to play in China’s healthcare security system. City CHI has been the latest wave taking off across over 100 major cities, offering new opportunities for innovative therapies to accelerate access and improve affordability. Large pharma players would benefit from a holistic view and forward thinking to assess how CHI fits with their China strategies and plan ahead.

Shanghai launched its city CHI in May 2021, and within two months it enrolled over seven million subscribers –37 percent of the city’s population.

Shanghai was not the first to launch its city CHI. In fact, it was a late mover after over 100 cities launched their own versions of CHI. There are certain advantages as a late mover though, learning from the successes of others to optimize Shanghai’s own design and rollout to achieve maximal impact.

China CHI landscape

CHI has always had a role to play in China’s healthcare security system, and policies have been evolving toward encouraging and accelerating CHI developments:

- Back in 2009, the State Council issued a number of policies encouraging CHI as a supplement to public reimbursements.

- In the roadmap laid out by Healthy China 2030, the government articulated its objectives to establish a comprehensive insurance system by 2030, including public insurance, CDI, CHI, and medical aid, and expects CHI premium revenue to reach RMB 2 trillion by 2025.

Partly as a result of the strong policy support, CHI has seen strong annual growth at over 20 percent over the past two decades, first driven by major diseases insurances, and then by medical care insurances in different forms, with city CHI as the latest wave.

City CHI first came onto the stage in 2015, with Shenzhen as the first city to launch its pilot:

- City CHIs are designed to address the disease profiles and unmet needs of the local population, as a supplement to public reimbursements like the NRDL and critical disease insurances.

- City CHIs typically feature flat annual premiums, meaningful coverage, and strong PPP (public private partnership) among commercial insurances, local governments, as well as TPAs (third-party administrators), PBMs (pharmacy benefit managers), healthcare providers, and hospitals, as well as pharmaceutical and medtech companies alike.

While great in concept, city CHI has not been an immediate sure-fire success:

- When Shenzhen launched its CHI at a mere 30 RMB per year per head, it sounded too good to be true, and many had doubts about its economic viability and sustainability.

- Many were quick to point out that Shenzhen features one of the youngest demographic profiles in China, and the big question remains on whether it can be replicated in other cities.

Since then, several new versions of city CHI have emerged, with some featuring higher annual premiums in the 100 RMB range, and others posing strict criteria on pre-condition exclusion and renewal terms:

- The flip side though are another set of questions on the relevance and meaningfulness of the scheme, especially to the subsets of the local population that need the CHI most, and stood in the way of uptake and rollout.

Building on the success factors while addressing the limitations of pervious CHIs, the latest wave of CHIs have made optimizations to the design and rollout, as seen in the cases of Guangzhou Suisuikang, Hangzhou Xihu Yilian, and Shanghai Huhuibao:

- In particular, these schemes removed the enrollment and renewal restrictions for pre-conditions, making them appealing to the bulk of the population.

- To ensure economic viability at the same time, the coverage schemes differentiate between those with or without pre-conditions. Shanghai Huhuibao, for example, would offer 70 percent coverage for both inpatient and specialty drug coverage for those without pre-conditions at the time of signing up, and 30-50 percent for those with pre-conditions. This is still meaningful for those with pre-conditions while minimizing adverse selections.

- In addition, the new schemes typically feature specialty drug formularies that are larger and more diverse than previous versions, including not only oncology drugs but also rare disease drugs for Huntington’s and Fabry disease etc.

- Equally important, the new CHIs continue to build on the PPP model, with close collaborations among the leading commercial insurance companies, local government agencies, PBMs, and TPAs, as well as MNC and large, local pharma players. The strong pull from the enhanced design combined with the push by local governments were key to the successes of the recent wave of CHIs.

CHI opportunities

Leading pharmaceutical companies were quick to realize and capture the opportunities with city CHIs:

- Janssen, for example, has had a number of successes with many city CHI formulary listings, with Tracleer, Remicade, Velcade, and Invega listed in Shenzhen, Erleada, Velcade, Stelara and Ventavis listed in Hangzhou, and Darzalex in Beijing.

- Pfizer’s breast cancer drug Ibrance enjoyed CHI formulary listing in Hangzhou, Suzhou, Shenzhen, Guangzhou, Chengdu, and Shanghai etc., working closely with TPA and PBM stakeholders.

- Leading local company Zai Lab launched PAPs and charity donations to garner goodwill with local governments, and was successful listing its ovarian cancer drug Zejula and medical device product Optune in Suzhou, Hunan, Shanghai, Beijing, and Fujian etc.

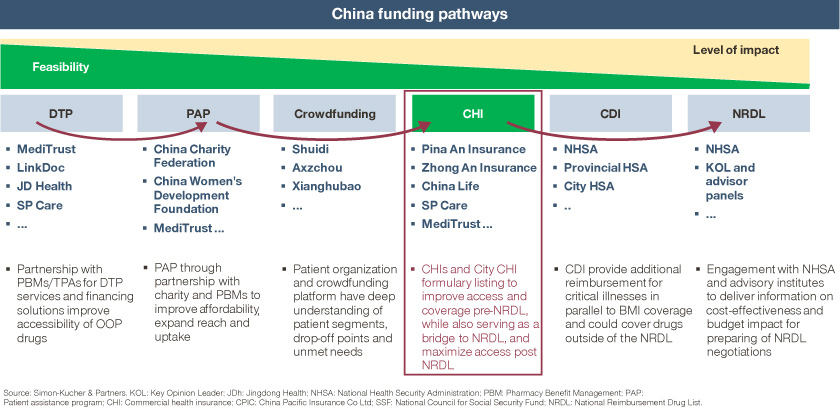

Besides facilitating access and coverage for innovative therapies at a city level pre-NRDL, city CHI could also play an important role in the multi-channeled access solutions, and improve access and affordability across life cycle stages:

- City CHI formulary listings would help gain early traction at a local level, building up support from KOLs and patients, and generating real world data and evidence in clinical settings. These go a long way toward strengthening their cases going into NRDL negotiation, based on Simon-Kucher’s experience with the 2020 NRDL processes.

- In fact, out of the 35 drugs listed in selected city CHI formularies, 19 made it into the 2020 NRDL, faring much better than the average success rate of 17 percent.

- Post-NRDL, city CHI would provide further relief on the out-of-pocket cost burdens, and also help maximize access for non-hospital channels.

- In addition, the Lecheng CHI at Hainan medical tourism zone features 49 drugs that haven’t been formally approved in China, and would help achieve early access and coverage in Boao and Hainan even ahead of NMPA approval.

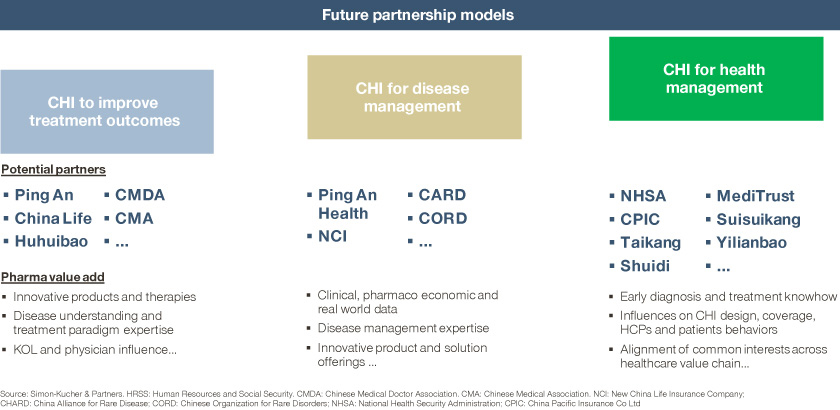

Capturing city CHI opportunities does require an in-depth understanding of the landscape, as well as strategic foresight, early preparations, and effective engagements with the key stakeholders along the CHI value chain. Moreover, as the China CHI landscape is dynamic and still rapidly evolving, pharmaceutical companies may consider proactively shaping the policies and spearheading innovative engagements toward improving treatment outcomes, participating in disease management, and contributing to health management, by working closely with key partners to address the unmet needs in China’s healthcare system. In that regard, new opportunities are abound, and may go well beyond the immediate benefits of CHI formulary listing city by city.

In summary, CHI will have an increasingly important role to play in China’s healthcare security system, and offers new opportunities for innovative therapies to accelerate access and improve affordability. Large pharma players would benefit from a holistic view and forward thinking, to assess how CHI fits with their China strategies and to plan ahead accordingly.

Read more from this series:

Part 1: Embracing the Change: 2020 China NRDL Outlook

Part 2: Embracing the Change: Revisiting Simon-Kucher 2020 China NRDL Predictions

Part 3: Embracing the Change: Strategizing on Volume-based Procurement in China

Part 4: Embracing the Change: Accessing Rare Disease Patients in China