Over the last 15 years, private markets have expanded from $3T to an impressive $13T, with private equity, spanning buyout, growth, and venture, taking center stage. This growth was primarily powered by an increased appetite from institutional investors seeking higher returns. Despite inherent liquidity constraints, LPs kept investing in these assets to hedge against public markets. When strict rules like Basel III curtailed banks’ SME lending, a gap emerged that private debt was quick to fill. Private markets excel by meeting a unique trifecta of needs: they generate elevated returns, offer robust hedging benefits, and provide access to underserved sectors. This influx of capital introduced a new tension: how to scale without sacrificing returns. As funds grow, managers seek to diversify while striking a delicate balance between their reputation (TVPI) and their growth ambitions (AUM).

In our recent conversations with fund managers across industries, almost half indicated the need to launch alternative strategies to grow. As dry powder inventories stabilize and secondaries markets mature, capacity management will be key to sustaining growth. Recent geopolitical changes could erode returns on deployed funds, making diversification through alternative strategies even more critical for long-term resilience.

While expanding beyond one’s flagship fund is a fortunate venture, it is not frictionless. Fund managers need to carefully balance ambition with discipline. Three common pitfalls include:

- Investors may see fund managers as AUM gatherers, weakening the brand.

- New strategies that don’t align with the brand’s core values can create internal conflicts.

- Excessive diversification may unsettle LPs, as it can signal a dilution of focus.

How can you navigate these waters? Next, we have outlined three key areas of consideration to help you unlock the next phase of your growth successfully.

1.Where to grow next: Understand your core offerings and adjacencies

If you're looking to grow beyond your flagship strategy, start by exploring the areas that are closest to what you already do. Whether that's a new industry, region, asset class, investment stage, or fund type, each fund manager is uniquely positioned to take advantage of these adjacencies.

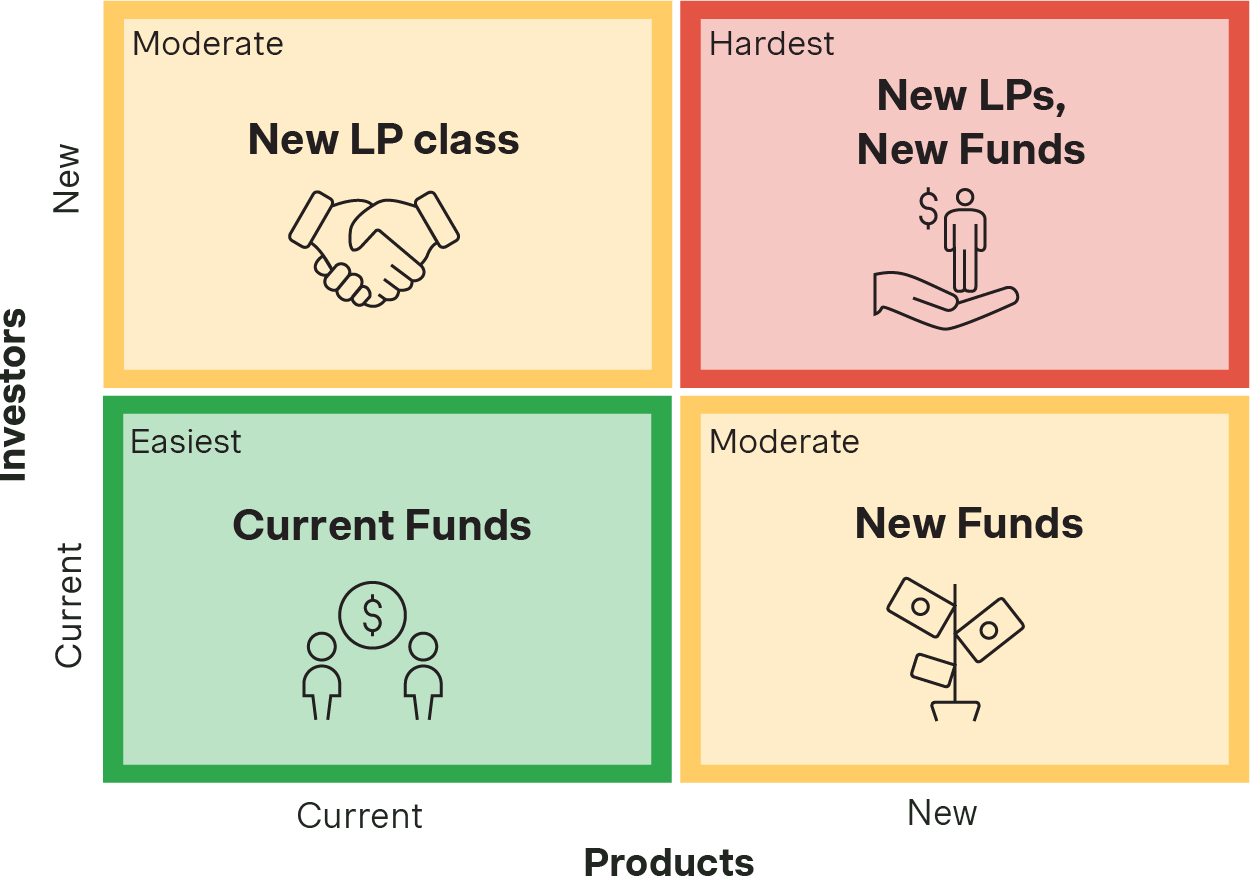

Start with an inclusionary approach and map growth opportunities on a 2x2 chart, with products (current vs. new) on one axis and investors (current vs. new) on the other. Rank each growth opportunity within its quadrant by fund size, scalability, and fees, then compare against ease of execution. Scaling within existing investors will be easiest, expanding to new investors or launching new strategies will add complexity, and doing both will be the toughest growth path. It is key to compare impact with feasibility before finalizing a growth strategy.

Fund managers also need to consider internal capabilities (i.e. their pitch) required to scale these strategies. LPs back managers who’ve been there, done that, and know how to win in the space they’re targeting. For example, launching a secondary fund in an industry where you already have a primary fund will be a lighter lift than entering a new industry – especially when in-house expertise matters in those industries (BioTech, AI, or advanced manufacturing).

2.Who to target next? Investor segmentation that drives results

Understanding internal capabilities shapes potential offerings, but assessing investor needs determines the right ones to pursue. Institutional investors like SWFs and Large Pension Funds have higher check minimums and prioritize risk diversification. Asset Managers with investment strategies that mandate investing in multiple asset classes are better suited to meet their needs. Some individual investors like affluent investors and HNWI have relatively less capital to invest and require Asset Managers to consolidate their funds to gain exposure to assets with high barriers to entry.

At a high level, most investors care about the following:

- Expected financial performance measured through IRR and TVPI.

- Capital deployment restrictions, i.e., high or low capital needs.

- Risk management (liquidity, diversification, and principal protection needs).

- Strategic alignment such as sector-specific and geographic exposure.

Within these segments, one should also look at market shares or right to win of top competitors and niche competitors before finalizing a new strategy. Through carefully analyzing internal capabilities and competitive dynamics, Asset Managers can more accurately identify the investors they should target for the new strategies they plan to launch.

3. How pricing can unlock new value and fuel fund expansion

Pricing is one of the most under-utilized growth levers that asset managers use to increase their bottom line. The right pricing strategy can help asset managers grow in three key ways:

- Capture additional value: Asset Managers with flagship strategies at capacity can extract additional willingness to pay from their investors by adjusting management fees, carry (more amiable with LPs), and hurdle rates.

- Differentiate from competition: Asset Managers can provide lower management fees and higher carry to position themselves as partners to investors instead of AUM gatherers.

- Strengthen investor alignment: Asset Managers can tie fees more closely to performance outcomes by incorporating performance-based components, ensuring both parties benefit from successful investments.

Fund growth with segmentation and pricing

By understanding one’s core offerings and aptly segmenting one’s target investor base, Asset Managers can prioritize new investment strategies that satisfy the unmet needs of their current investors or set up the right infrastructure to go after new categories of investors. Competitive forces always play a key role in investment strategies. Creative pricing introduces an additional tool to grow beyond flagship funds. By leaning in on their strengths, fully understanding what investors need, and using pricing as a key lever, they can capture extra value while setting themselves apart from the competition. It’s all about balancing ambition with discipline, ensuring that new strategies boost rather than dilute their core offerings, and setting up a strong foundation for long-term success.

Contact our team today to discuss how to grow your next fund with focus, flexibility, and lasting impact.