A new age of hypergrowth

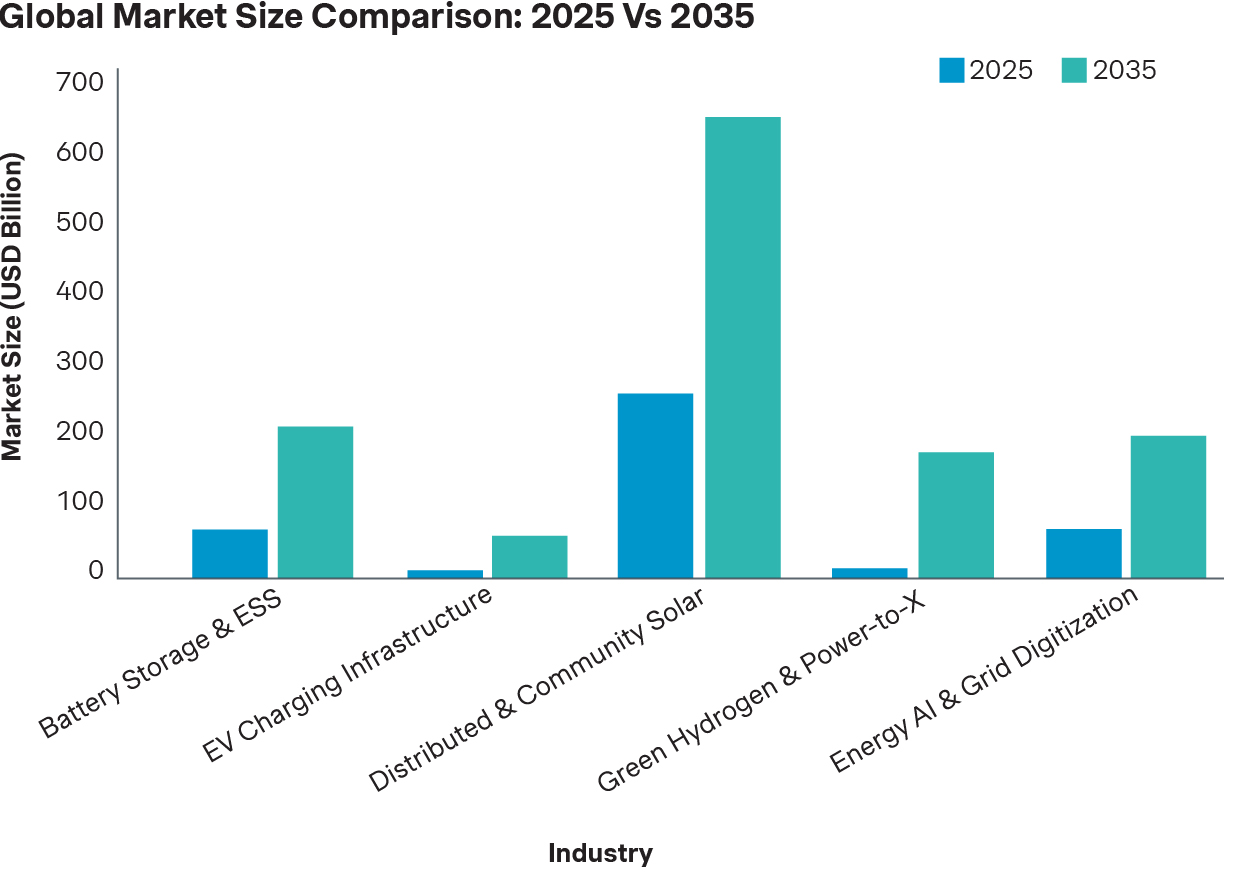

The global energy transition is sparking one of the most significant economic growth waves since the industrial revolution. Driven by decarbonization policies, technological breakthroughs, and geopolitical shifts, several sub-sectors are scaling at unprecedented speed:

- Battery storage & energy storage systems (ess): essential for balancing grids that are reliant on more volatile renewable energy.

- Ev charging infrastructure: the backbone of large-scale transportation electrification.

- Distributed & community solar: democratizes power production via rooftops and local projects.

- Green hydrogen & power-to-x: enables low-carbon solutions for hard-to-abate sectors.

- Energy AI & grid digitization: makes the complex modern grid manageable and efficient.

Global markets for these sub-sectors are expected to scale massively over the next 10 years, some by more than 15x their current size.

Yet this is not the kind of hypergrowth that the business world has come to associate over the last decades with the software space. These energy industries are all rooted in capital-intensive, hardware-driven models. Growth here demands large-scale infrastructure investments, regulatory compliance, and long b2b sales cycles. In many ways, the path ahead looks less like the rise of powerhouse Silicon Valley companies, and more like the industrial scaling of Ford or Westinghouse a century ago.

Four pillars for successful commercial scaling

For companies leading the charge in energy’s next frontier, innovation alone is not enough. In capital-intensive, hardware-driven sectors, hypergrowth depends on disciplined and scalable commercial execution. Four foundational capabilities consistently distinguish companies that scale successfully:

A. Precise market segmentation and targeting

Effective go-to-market strategies start with rigorous segmentation. Leading companies move beyond basic industry classifications to segment customers by:

- Market size (tam, sam and som)

- Specific customer needs and service requirements

- Solution fit and expected lifetime value

- Conversion potential and share of wallet

This granular view enables targeted coverage and prioritization; this is especially critical when sales capacity is constrained. The result: higher ROI per commercial dollar spent and faster growth.

B. Fit-for-scale commercial organization

As companies grow fast, their commercial structures must evolve rapidly with them. Three elements stand out:

- Role specialization: separating account executives (“hunters”) from account managers (“farmers”) improves focus and performance. In some markets, hybrid profiles that focus on large accounts (“ranchers”), and who combine strategic cadence with opportunistic drive, are the best fit.

- Span of control: maintaining lean, effective management layers and limiting the span of control helps to increase accountability and ensure efficient communication channels within the organization.

- Regional alignment: strong central leadership in sales and revenue operations is crucial to ensuring consistency and scalability. At the same time, global frameworks must accommodate local nuance and empower regional teams to account for market specifics.

When designed well, these commercial structures unlock both agility and operational efficiency across expanding geographies and product portfolios.

C. Talent strategy and onboarding

Top-tier commercial talent is in short supply, especially in industries with long sales cycles and technical complexity. Finding and retaining top salespeople in the energy space is hard. Furthermore, the path to productivity is slow: recruiting can take 6+ months, with onboarding cycles stretching to a year. To compete, hyper scaling companies should:

- Hire in anticipation of growth; with 1.5 year-long recruiting and onboarding cycles, initiating the hiring processes only when a resource is needed means that the resource comes 18 months too late

- Offer structured onboarding programs that speed up the path to productivity

- Have clear role definitions and growth paths

- Create incentive systems aligned with performance and retention targets

Without this, even strong strategies falter due to weak execution on the front lines.

D. Systems and data infrastructure

High-growth energy companies must digitize the commercial engine and sales workflows. Core enablers include:

- CRM and CPQ platforms for transparency, process discipline, and sales efficiency.

- Automated tools for pipeline management and proposal generation to reduce cycle times and slow down hiring needs for additional operational resources

- Integrated data architecture for visibility, forecasting, and strategic sales steering.

Companies that lag on systems often suffer from missed opportunities, inaccurate forecasts, and poor visibility into bottlenecks, which ultimately stall growth.

Project case study: 7 key learnings from scaling in energy

Scaling a commercial organization in the energy space is not just a structural redesign exercise - it’s a deep cultural and strategic transformation.

A real-world case from the industrial energy storage space illustrates this well. Facing rapid market expansion, a global multi-billion-dollar company set an ambitious goal: to grow both revenue and profit at least tenfold within five years. To achieve this, the company sought to identify gaps in its sales organization, coverage model, and sales processes - and to then define a future-state blueprint, complete with a practical implementation roadmap aligned with its growth goals.

Throughout this transformation, the leadership team uncovered seven critical lessons, that are highly relevant to any organization navigating the challenges of hypergrowth:

- Increased transparency can trigger resistance:

- Legacy mindsets must be addressed:

- Decentralization eventually becomes a drag:

- Cultural tensions can stall momentum:

- Tools are enablers - until they aren’t:

- Incentives must match ambition:

- Great talent needs time:

Clarifying target customer segments, roles, and sales priorities is essential for scale. However, increased transparency often meets internal pushback; regional teams may resist against central oversight, and role changes can ignite political friction if not handled with care.

Organizational change challenges entrenched habits. Introducing central control, adjusting spans of control, or modifying incentive plans and compensation models may meet strong resistance. Particularly stakeholders in traditional industrial cultures, who are used to autonomy, may push back hard.

While decentralization can enable early growth, it often becomes inefficient at scale. Centralizing key services can boost performance, but long-standing (decentral) teams may fear losing relevance or control. Change management is key to overcoming these barriers.

Hardware-based businesses often prize precision and control, while hypergrowth demands speed and agility. Leaders must actively manage the tension between “perfect” and “good enough” to avoid stalling execution in a “perfection trap”.

CRM systems, CPQ tools, and structured sales tools are key enablers. However, overloading teams with too many tools - or launching ineffective tools prematurely – can cause confusion and reduce productivity. Start with simple, robust and scalable tools first, and focus on user adoption, not just deployment.

Top sellers will not be inspired by compensation plans tied only to company or team performance alone. High performers, who drive revenue hypergrowth, expect significant upside and clear differentiation. At the same time, moving too quickly to variable-heavy pay without clarity and structure can backfire.

Hiring in the energy space is typically slow, and onboarding can take 12+ months, far longer than in software. Without structured ramp-up and enablement, even the best hires may stall. Building sales capabilities early is critical; do not assume talent will scale just because the market does.

Ready to scale? Let’s get it right

Hypergrowth in energy is both thrilling and high stakes. It is not just about selling more – it’s about building a resilient commercial engine that can scale with the market.

Wherever you are on your hypergrowth journey, remember success depends on aligning commercial strategy, organizational structure, processes and systems from day one. The right expertise can make the difference between scaling successfully – or stalling under your own momentum.

Navigating hypergrowth? Don’t go it alone. Partner with experts who understand both the ambition and the execution. Reach out to the team at Simon-Kucher experts today.