Pharma and biotech-payer contracting in the US is no longer just about access to volume but more about holistic, measurable, and accountable patient outcomes. Are you ready to move toward enhanced outcomes-based contracting strategies?

For decades, pharma and biotech-payer contracts were built on volume-based models, such as rebates, in exchange for formulary placement and reduced utilization management. But this traditional approach often failed to answer a fundamental question: does the therapy improve patient outcomes and reduce the total cost of care?

Value, not volume: A shift in pharma and biotech-payer contracting strategy

Over the last decade, we have seen some movement toward outcome-based contracting (aka value-based, risk-share, or innovative contracting), but adoption has been slow.

The case for outcomes-based contract strategy

The slow uptake is mostly due to the model struggling to scale, often constrained by fragmented data, operational complexity, slow feedback loops, and inconsistent outcome tracking further limiting its effectiveness.

Despite these barriers, the benefits of outcomes-based contracting are real:

- Manufacturers gain market access through demonstrated value

- Payers reduce uncertainty by linking spend to real outcomes

- Providers align treatment decisions with measurable impact

- Patients gain faster, more equitable access to therapies that truly work in the real world.

As high-cost therapies continue to launch with uncertain long-term value, and new data and technology enter the market, value-based contracting is gaining traction. Payers are increasingly using real-world evidence (RWE) to guide access decisions and adopting contractual models that shift part of the clinical and financial risk to manufacturers – ensuring payment aligns more closely with therapeutic impact in real-world settings.

Major policy shifts, combined with the convergence of RWE, artificial intelligence (AI), and digital health technologies, are further accelerating this adoption. These are driving the growth of contracts that tie payment to performance-based results; since 2022, more than 58% of US payers had at least one outcomes-based contract or OBC in place.

What policy shifts are accelerating the adoption of outcomes-based contracting?

A wave of recent US policy and regulatory developments is accelerating both the viability and adoption of outcomes-based contracting. These shifts support the use of RWE in pricing and reimbursement, while also reducing structural barriers that have historically limited the scale of value-based models. Growing scrutiny of drug pricing under the Inflation Reduction Act (IRA) is further accelerating the need for manufacturers to clearly prove the effectiveness of their therapies.

What technology advancements are making outcomes-based contracting viable?

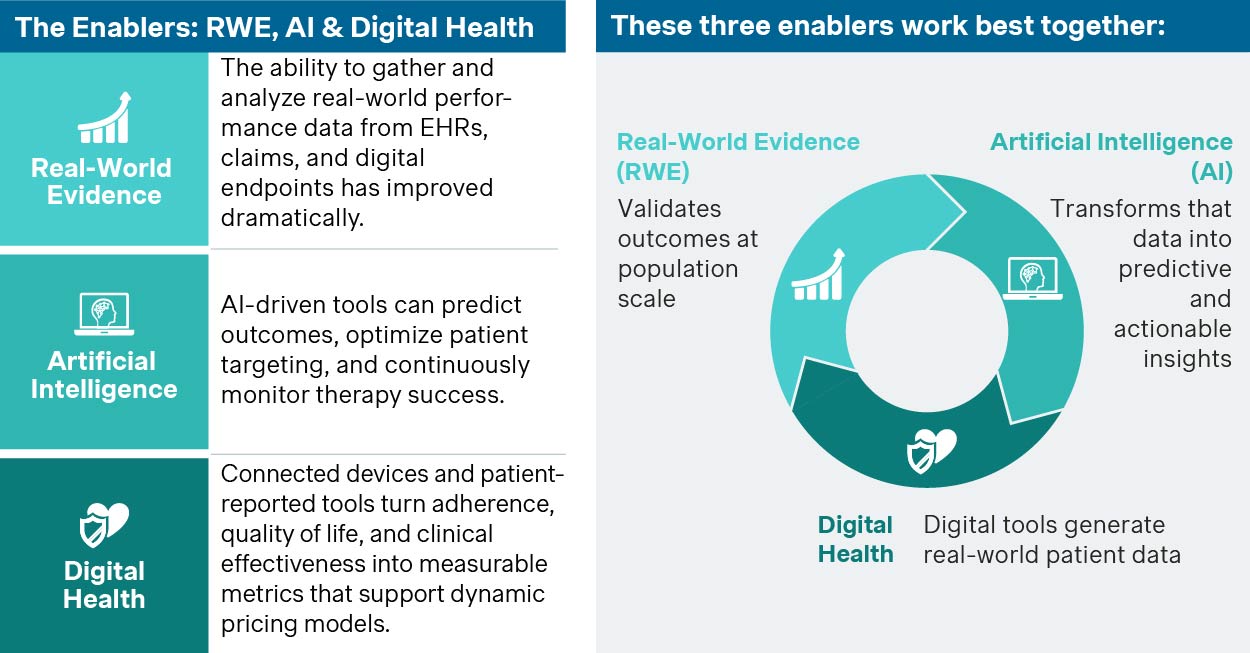

RWE, AI, and digital health are rapidly maturing to scale outcomes-based contracts. Together, they eliminate friction points, enhance transparency, and deliver the infrastructure to track, validate, and optimize outcomes-based agreements.

This integration makes value-based contracts not just possible but practical, credible, and scalable.

From pilots to scalable impact

Outcomes measurement is increasingly scalable. Policy, technology, and data infrastructure are also catching up. It’s time to move from experimental to transformational execution. Outcomes-based contracting is becoming essential for sustainable access, accountability, and innovation across the healthcare system.

A top 10 pharmaceutical company partnered with a regional payer on a cardiovascular outcomes-based contract. Using real-world claims data and remote monitoring, they tied payment to reduced hospital admissions. The result was a 22% drop in admissions and broader access for high-risk patients.

Industry leaders are no longer piloting outcomes-based contracts - they're scaling them across therapeutic areas. And increasingly, public payers are joining private plans in shifting risk to performance.

A biotech firm used AI-driven predictive analytics to enhance an outcomes-based contract with a US payer for an asthma drug. By identifying high risk patients in real time, they reduced ER visits by 28% and saved $6.2 million. They also met contract goals early, proving AI can drive both clinical and financial success in value-based care.

With strong results like these, AI is setting a new standard and is fast becoming a powerful tool for value-based care across chronic conditions.

A prescription digital therapeutic for opioid use disorder demonstrated improved treatment retention and reduced healthcare utilization, with per-patient costs decreasing by up to $3,832 in Medicaid populations. These real-world outcomes support value-based contracting by offering measurable clinical and economic benefits, making it a strong fit for Medicaid programs seeking scalable, outcome-driven care solutions.

Prescription digital therapeutics have moved beyond concept. And as they gain traction, they’re ready to reshape how chronic conditions are treated, paid for, and managed.

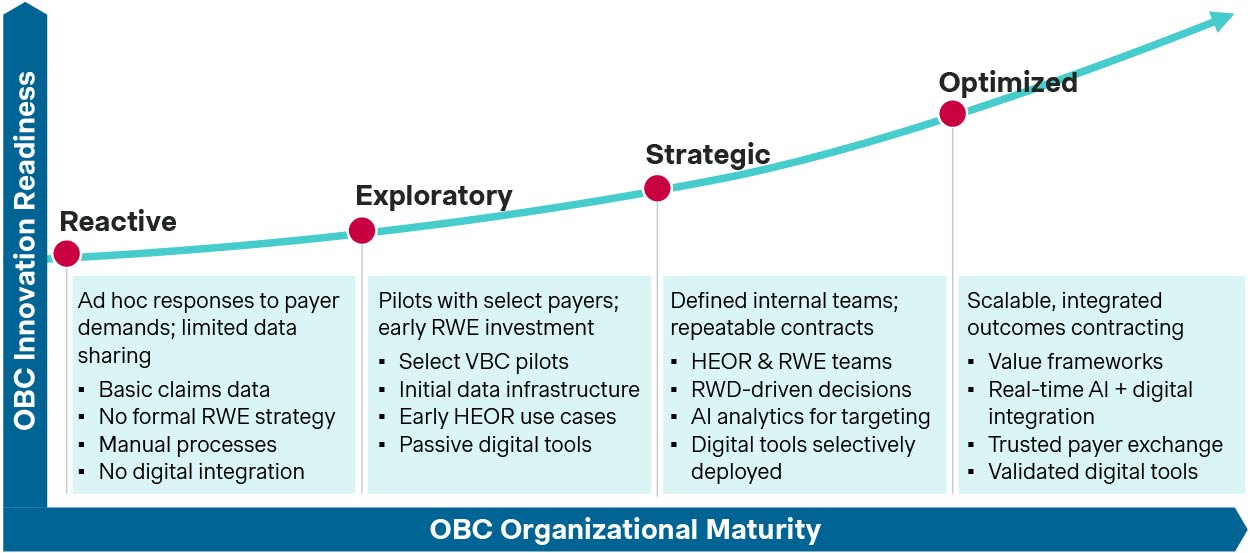

Where are you on the OBC readiness curve?

To implement and scale outcomes-based contracts successfully, organizations must align across data, operations, and contracting strategy.

Where is your organization today – and what will it take to move up the curve?

In a few years, innovative contracting or outcomes-based contracting won’t be a differentiator; it will be the baseline. The question is whether your organization will lead this transformation or be forced to react to it. If you're not investing in the data, technology, partnerships, and policy intelligence required to execute now, you risk being sidelined as others move faster and smarter.

At Simon Kucher, we use our outcomes-based contracting readiness and advancement framework to help clients assess where they stand and where they need to advance their strategies and capabilities:

- Benchmark cross-functional maturity (RWE, digital health, contracting, policy)

- Identify the infrastructure and capabilities needed to scale outcomes-based access

- Co-develop a roadmap to move from pilot to portfolio-level execution

- Develop contract strategy terms that align to brand and portfolio value

Let’s shape the future of your pharma and biotech-payer contracting strategy together

Success in this market will go to those who move beyond pilots and deliver proof in the real world. That means embedding digital tools into the therapy experience, partnering with payers through shared-risk models, and making real-world outcomes the foundation of access strategy.

As outcomes-based payer contracting becomes the norm, pharma and biotech companies need more than vision. They need the right strategy, systems, and execution. And our readiness framework helps you scale what works: digitally enabled contracts, real-world evidence generation, and lasting payer trust.

The shift is happening. Let’s lead it together.

Stay tuned for further insights on enhancing your US pricing and market access strategies.