Instead of disintermediating agents from insurance sales, data and digital technologies are redefining producer experiences for better sales outcomes. In this article, we explore how to stop overpaying or underpaying for sales performance and start optimizing agent channel resources.

Insurance sales can be a challenging endeavor. It takes a high degree of tenacity, discipline, and resilience to stay positive and enthusiastic in the face of frequent rejections. To motivate salespeople to continue selling, organizations frequently turn to compensation plans like commissions, bonuses, and rewards tied to sales quotas and revenue targets. Leaders might also use games or contests with trips to exotic destinations, reserved parking spots for top performers, and more as rewards to encourage high performance.

There are several problems with typical sales games or sales incentives. First, they often treat sales performers equally or take a broad-brush approach to setting targets. Agents frequently report feeling unmotivated when managers implement these programs. “They look at us as if we’re all the same average individual,” remarked one sales producer recently. “When each of us is unique with different strengths, opportunities, and skills.”

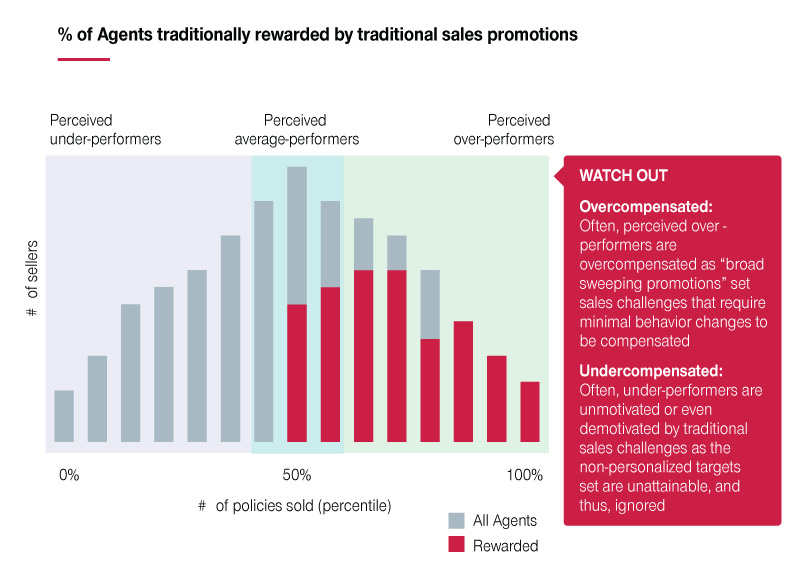

Another issue with these one-size-fits-all approaches is overpaying and underpaying for performance (Chart 1). Traditional incentive programs that encourage desired behaviors from the largest segment of the producer population end up neglecting large swathes of the sales force. “Star performers,” your clear sales leaders, easily achieve the targets for sales incentives without requiring any change in behavior or effort. Meanwhile, below-average contributors find themselves struggling to meet quotas and targets for reasons both under and out of their control. In the end, both the sales force and the carrier’s needs are not met. Sales and rewards are out of balance in this model, leaving money on the table for both the carrier and the salesperson.

How can insurance organizations leverage new technologies like data, analytics, and AI to optimize sales campaigns for better sales outcomes? Is there a scalable, dynamic way to deliver personalized producer experiences that is also able to adapt to an ever-evolving marketplace?

Chart 1: One-size-fits all approaches leave money on the table

Personalize producer experiences

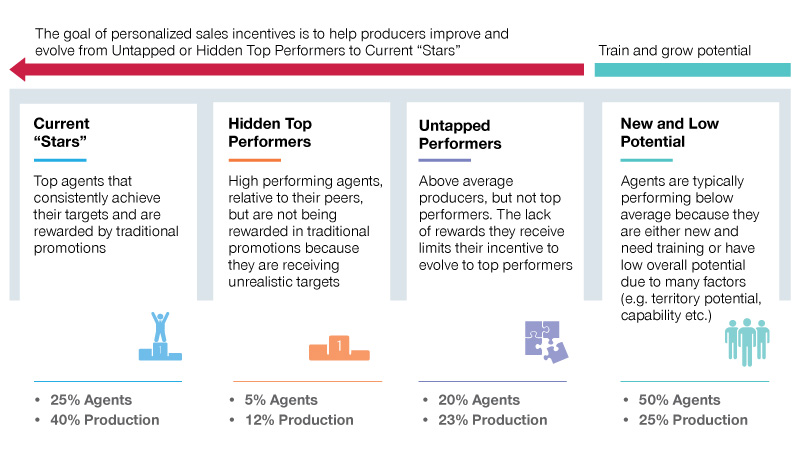

Like most naturally occurring phenomena, the distribution of sales producer populations tends to approximate a bell curve or Gaussian distribution. There is a large population of average performers with long tails on either side, one made up of stars and hidden top-performers and the other consisting of untapped and low-potential performers (Chart 2).

To properly motivate producers, sales campaigns should be tailored to the individual as much as possible. Sales challenges and their accompanying bonuses, commissions, or rewards should require the individual producer to make an extraordinary effort to reach the target. Only then can sales challenges optimize every dollar spent on compensation and maximize business results.

Chart 2: Sales challenges should be personalized

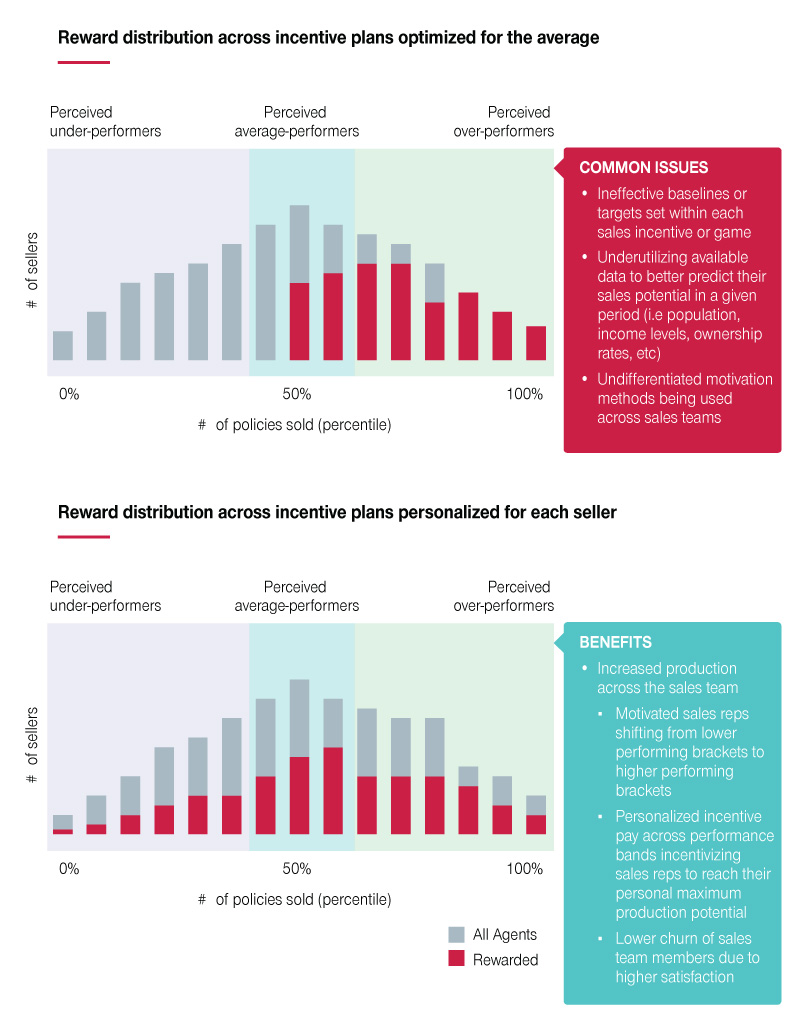

A gamified campaign platform supported by insurance carriers’ geographic and sales data gives these carriers a data-driven way of setting highly-personalized, level-appropriate targets for individual producers (Chart 3). For example, over-performers who consistently beat baselines and targets can be given the option to compete with similarly high-performing producers. Data analysis might reveal a junior sales associate is struggling to meet targets due to prospecting issues, such as not making enough cold calls or following up after customer meetings. The gamified platform can be programmed to deliver a personalized experience with reachable yet challenging goals for cold-calling and follow-up activities.

Chart 3: Optimizing for the average vs. optimizing for the individual

Recognize extrinsic and intrinsic motivators

Some star performers respond more to extrinsic motivators like recognition, promotions, and rewards, while others are driven more by intrinsic factors like social relationships, skill mastery, and autonomy.

A sales producer motivated by recognition needs a different set of challenges and rewards than someone who finds fulfillment in social relationships. For example, an extrinsically motivated producer might respond more positively to an intra-agency competition where they can gain recognition from their colleagues, while an intrinsically motivated producer would thrive in an inter-agency competition where they compete in a team and can mentor junior associates.

There are several ways to measure intrinsic motivation, including in task-specific ways like through puzzle-solving or field studies. Insurance organizations can benefit from a comprehensive survey to learn more about their producers’ motivation profiles.

Leverage parametrizable architectures

Powered by AI, analytics, and the right data, a sales campaign platform can be programmed to deliver highly personalized challenges including specific incentives on different schedules to individual producers. The platform can do this automatically without requiring the large amount of manual work associated with current broad-brush sales incentive programs.

Parametrizable game structures also provide sales campaign platforms with an agile and time-effective way of aligning incentives with organizational goals. New sales challenges and priorities can be deployed without having to reinvent the wheel. Game variables can be easily adjusted and adapted in real time to new priorities and market conditions. For example, when the sales cycle hardens, it might make sense to prioritize retaining high-value customers and identifying super-bundlers for new business development. Sales managers can reconfigure sales campaigns and reward points around sales volumes by customer segment and high-value customer retention wins. With support from AI and machine-learning programs, parametric games can adapt and improve over time.

By disregarding individual differences, strengths, needs, and motivations, one-size-fits-all approaches to producer experiences fail to fit anyone. A comprehensive approach integrating advanced analytics, game mechanics, and personalized challenges can optimize compensation resources to encourage desired sales behaviors.

Reach out to our expert Michael Nadel to learn more about Simon-Kucher's insurance sales acceleration tools, strategies, and applications.

Additional resources: