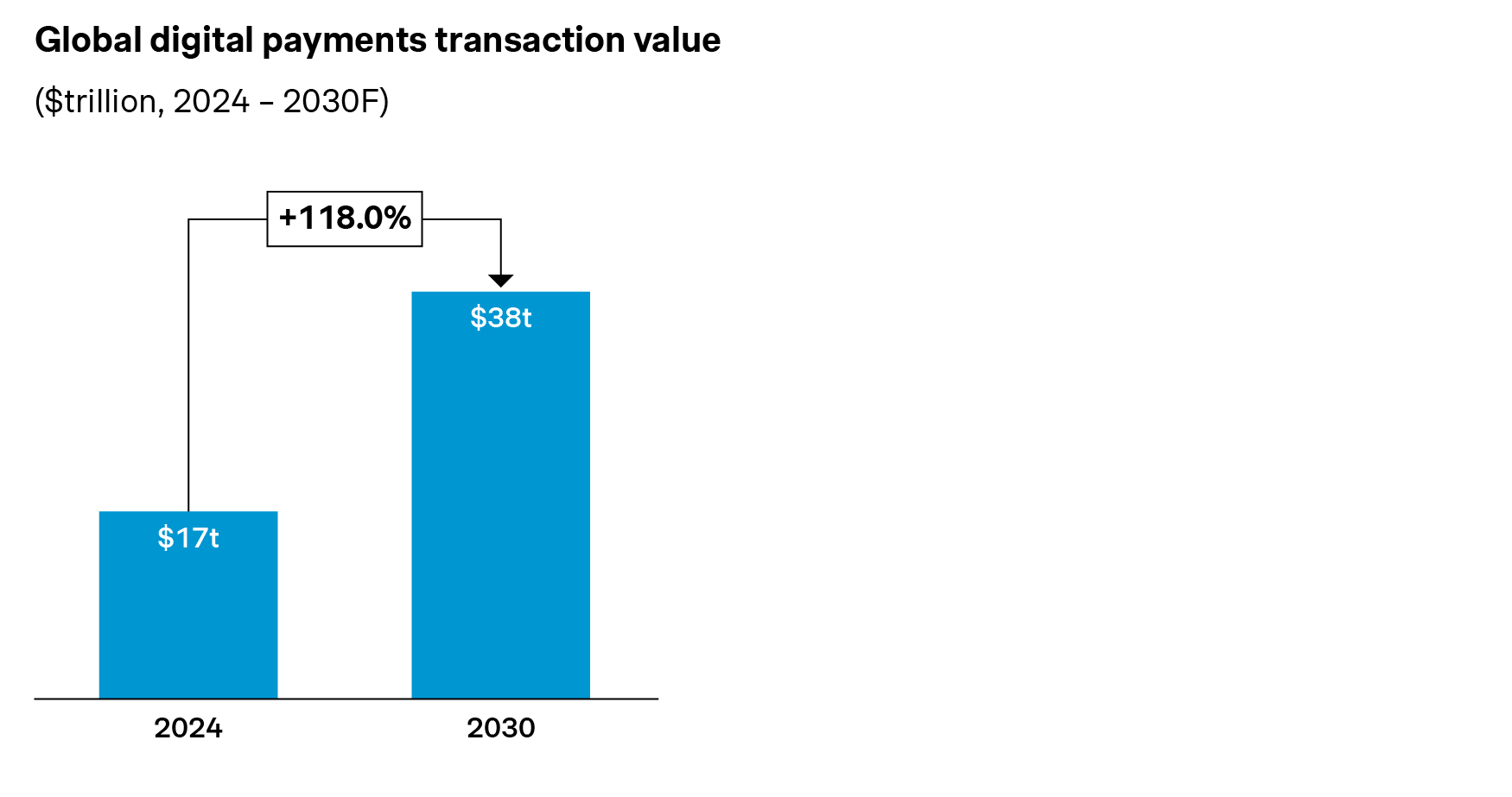

Global digital payments are rising exponentially, but it’s more than a volume story. With smart embedded payments, it’s a value story marked by strategic shifts. Read our latest blog where we break down five powerful forces shaping how consumers and businesses transact worldwide.

By 2030, the total value of global digital payment transactions is projected to more than double, reaching over $38 trillion!

What is driving this growth? This series explores the trends shaping growth in both consumer and business payments.

Which trends are driving the transaction value growth in digital payments?

Over the last few years, the growth in digital payments was mainly driven by the shift from cash to digital, and boosted by the rise of e-commerce and innovations such as contactless cards and mobile wallets.

Looking ahead, the growth narrative is expanding. It’s no longer just about replacing cash but centers on embedded payments - from online marketplaces and subscription platforms to AI agents, super apps, and invisible checkouts. Payments are becoming more embedded, smart, and contextual. This enables new types of transactions and entirely new payment flows.

We see the following five key factors shaping the next wave of payments growth:

Embedded payments into consumer and business flows: Payment solutions embedded in user or business experience reduce customer friction, drive conversion, and create new revenue streams for businesses. In fact, tech companies that provide embedded payments solutions to other businesses can earn up to 60-70% of their revenue from payments.

As an indication of this, in March 2025, Uber expanded its embedded payments capabilities by launching Uber Wallet for drivers and couriers. This new solution allows them to receive earnings instantly, manage funds seamlessly, and make purchases directly within the app. Similarly, Shopify’s 2025 Summer Edition launched Horizon, an AI-powered system with a standout feature: embedded payments built directly into end-to-end operational workflows.

Digital payments expanding into new use cases and customer segments: Payments are extending into new sectors, segments, and scenarios.

In June 2025, the Central Bank of Brazil introduced Pix Automático, a new feature of its widely adopted Pix system that enables recurring payments for services like utilities, tuition, and subscriptions. Millions of unbanked and underbanked users now have access to digital payment capabilities. It also expands regular financial services for consumers without credit cards and strengthens financial inclusion in the region. Similarly, Sri Lanka launched GovPay in February 2025, a unified digital platform that allows citizens to make real-time payments across government agencies. This represents a major advancement in public sector payments, bringing digital payment capabilities into civic infrastructure and increasing financial inclusion at a national scale.

Infrastructure modernization: Real-time, interoperable payment rails are accelerating settlement and enabling high-volume use cases such as instant account-to-account and cross-border payments.

For instance, Europe launched Wero in late 2024. This pan-European digital wallet allows users across participating EU countries to make instant account-to-account payments, offering a real-time alternative to card networks and strengthening the region’s payment sovereignty. Meanwhile, Indian real-time payment system, UPI crossed 12 billion monthly transactions in early 2025 and continues expanding into cross-border corridors, such as via PayNow in Singapore.

Agentic AI-powered payments: Smart and proactive payment systems are starting to transform how consumers and businesses make transactions. Instead of requiring users to initiate every transaction, AI anticipates needs and executes payments on their behalf.

In 2025, Mastercard launched "Agent Pay", an AI-driven solution that autonomously manages the entire purchasing journey from choosing payment methods to optimizing terms and coordinating logistics. Amazon's Alexa+ launched in February 2025 also leverages generative AI to handle tasks like restaurant reservations and shopping list management. Both examples reflect a growing shift toward delegated finance, where AI agents streamline transactions and enhance decision-making.

Stablecoins entering mainstream payments: Stablecoins are evolving from speculative digital assets into trusted payment instruments - offering speed, transparency, and low-cost settlement across countries.

PayPal is already using its own stablecoin (PYUSD) alongside established options like USDC to enable faster and cheaper cross-border transactions than most existing rails today. Improved customer experience and lower costs are expected to result in more transactions. Retail giants like Walmart and Amazon are also reportedly exploring proprietary stablecoins to streamline customer payments and reduce dependence on card networks. Together, these changes signal a future where programmable money plays a foundational role in digital payment flows.

By making transactions easier, cheaper, and more accessible for users, these developments are expected to fuel the next chapter of digital payments growth. Ecosystem connectivity, adaptability to innovations, and data-driven automation - coupled with excellence in go-to-market execution - will define competitive advantage. In the meantime, speed and security will be expected as table stakes.

We can help you activate growth

At Simon-Kucher, we work with leading payment providers, fintech innovators, and global businesses to drive growth from digital payments. The opportunity is clear: payments can be more than a cost center. And we can help you harness their full potential as a growth driver.

If you’re thinking about what comes next in your payments strategy, we’ll help you move forward with clarity and confidence.

Reach out to us today!