Bridging innovation and value through pricing

Tariffs continue to shock global trade, and many businesses are still responding with reactionary price hikes. For premium brands, this is an opportunity to lean into value and rethink how innovation is brought to market.

In moments like these, the ability to thoughtfully link pricing to value becomes a strategic advantage. Rather than defaulting to reactive pricing, premium brands can use innovation as a lever, not just to justify higher prices, but to reinforce their market position and capture consumer trust.

Monetizing innovation helps brands take two critical steps during times of market disruption:

- To move beyond simply citing “cost increases” when raising prices.

- To draw a clear connection between the price being charged and the value being delivered to consumers.

- To invest in the brand as a way to attract new consumers and retain existing ones

When prices go up, no matter the reason, premium brands should be ready to explain how the value of their offering has increased alongside it. That’s not always easy. Since “innovation” can look different across industries, even experienced product and marketing professionals may find this a challenging task.

Our framework for monetizing innovation helps organizations choose the right approach by identifying which internal resources can be leveraged and where external research or benchmarking is needed to fill the gaps.

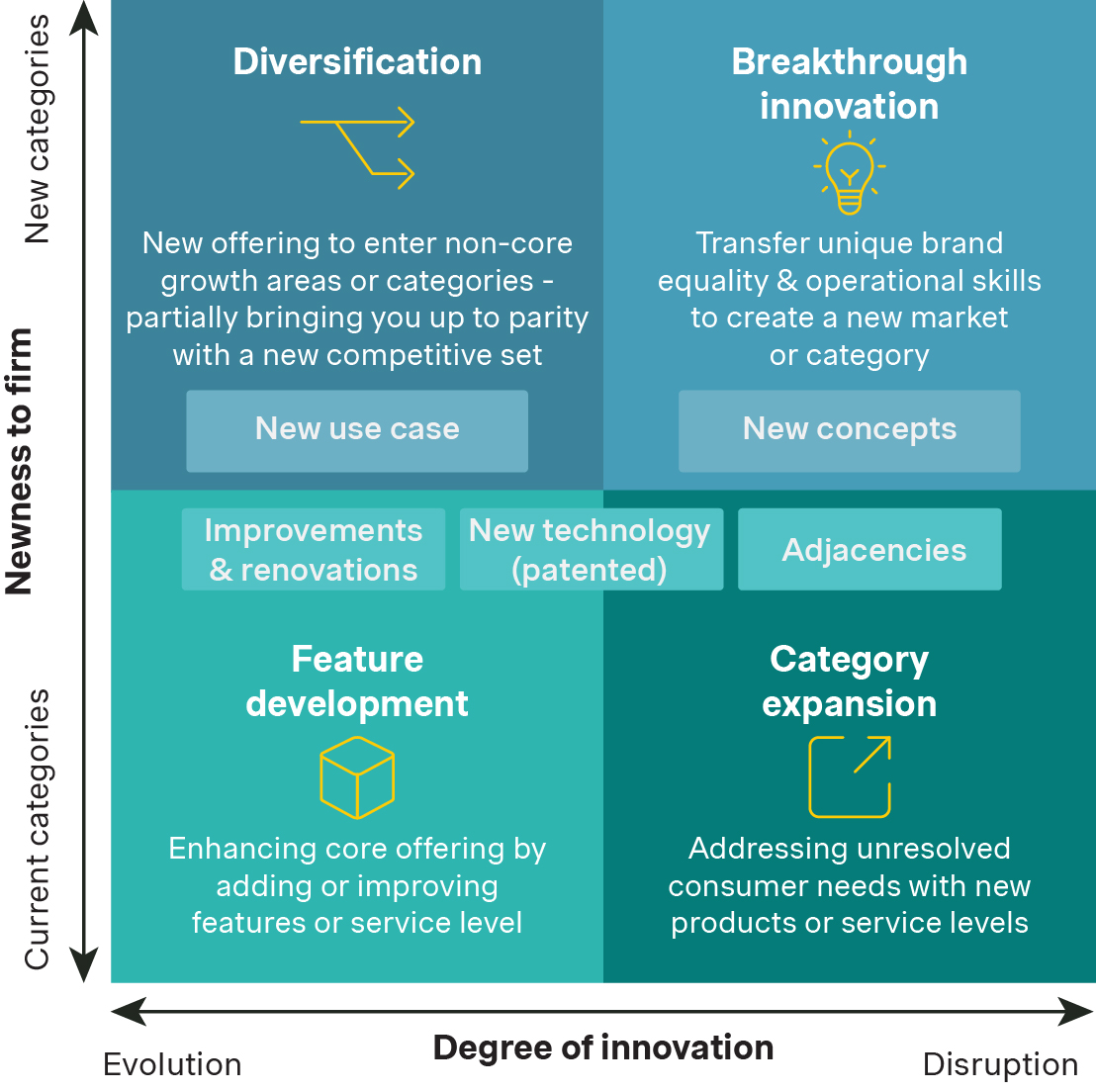

This framework classifies innovations along two key dimensions:

- Newness to the organization: whether the capability or concept already exists within the organization.

- Degree of innovation: how novel the offering is to the broader market.

Feature development

A good example of Feature Development, the lower-left quadrant of the framework, would be a premium sunglasses brand that recently enhanced the scratch resistance of its lenses. While the feature isn’t new to the market, and the brand had previously offered a less advanced version, this improvement still represents a meaningful step forward. It reflects a thoughtful evolution of the core product and creates a clear, value-based rationale for a price increase.

To land on the right price, the brand should rely on its current price architecture and any available data on consumer willingness to pay. It’s also worth investing in clear, confident messaging that communicates the added value to customers that focuses on the benefits of the added feature rather than the technicalities (which are often the “reason to believe”), because for a price increase to stick, consumers must believe it’s justified.

Feature development may not be groundbreaking, but when executed well, it can still deliver significant commercial impact.

Diversification

The upper-left quadrant, Diversification, refers to entering new, non-core growth areas that are unfamiliar to the organization but already established in the market. This is where innovation often carries more risk, as it requires brands to expand to new customer segments, build new capabilities, and adopt a fresh lens on value creation.

Consider a premium sunglasses brand expanding into prescription eyewear. While this move represents a departure from the company’s core product line, it taps into a well-developed market with known value drivers. To price effectively, the brand can begin by leveraging insights from its current offerings, such as customer preferences for lens quality, frame materials, or style premiums.

However, what holds true in the fashion or lifestyle segment of sunglasses may not fully translate to the prescription space. Consumers buying prescription glasses may prioritize function, fit, and durability differently and expect a different justification for price premiums. This is where external research and benchmarking become crucial. By studying how category leaders in prescription eyewear differentiate on price, the brand can adjust its approach to align with new consumer expectations while preserving its premium positioning.

Diversification can unlock significant growth, but succeeding in a new category requires more than brand equity. It demands a balance of internal insight and external validation to ensure pricing reflects both perceived value and market realities.

Category expansion

Category Expansion, represented in the lower-right quadrant, applies to innovations that broaden an existing category by addressing unmet or underserved needs. The distinction between category expansion and feature development often hinges on the degree of novelty introduced relative to existing market offerings. As innovations become more disruptive, existing price structures become increasingly irrelevant.

In such cases, historical pricing benchmarks offer limited guidance, requiring premium brands to engage in a more rigorous valuation of the innovation at hand. A critical starting point is to assess the full spectrum of consumer willingness to pay, particularly in relation to competing products. This helps to not only gauge the perceived value of the innovation but also quantify the premium associated with brand equity.

Still, internal insights alone are often insufficient. Accurately defining the price point may require robust external validation, through competitive benchmarking, consumer research, or conjoint analysis, to ensure the price aligns with both market expectations and the differentiated value being offered.

Breakthrough innovation

The upper-right quadrant of the framework, Breakthrough Innovation, applies to entirely new markets where both the offering and the organization’s experience are uncharted. In these cases, success depends on blending internal strengths with robust external validation. Brands must leverage their existing equity, capabilities, and positioning, while also investing in product testing, focus groups, and rigorous quantitative research to uncover the full extent of perceived consumer value.

Because these markets lack established benchmarks, pricing should not default to cost-plus or internally driven models. Instead, it must be anchored in how customers interpret and ascribe value, ensuring that pricing reflects demand-side dynamics, not just supply-side assumptions.

Ultimately, the right approach to monetizing innovation depends on how disruptive the innovation is, to both the organization and the market. While rising costs are a constant, innovation offers an opportunity to shift the pricing conversation away from cost justification and toward value leadership. For premium brands, that distinction is critical when asking consumers to pay more.

There’s no single formula, but with the right strategy, brands can link pricing to perceived value, reinforce premium positioning, and protect margins even in volatile markets. Our approach helps companies decode that strategy, leveraging proven frameworks, market insights, and consumer research to align pricing with innovation in a way that feels fair, credible, and brand-enhancing.

Ready to turn innovation into better growth?

Connect with our experts to learn how a tailored monetization strategy can help your brand lead with value and capture the full financial potential of your innovations. Let’s talk about how we can support your pricing journey.

Contributing author: Christian Anastos