Chinese rare diseases environments are dynamic and rapidly changing, and a number of new access and affordability options are emerging for innovative therapies. To win in the market, it takes a patient-first mindset, creative approaches, and an actionable strategy tailored to the characteristics of innovative therapies and the unmet needs of Chinese patients.

Official estimates put the Chinese rare disease population at 20 million, and that is likely an underestimate. One reason is that it is difficult to identify and diagnose rare disease patients in China. Another is that the very definition of rare diseases in China has not been clear cut to date. Orphanet, one of the rare disease databases, recognizes over 6,000 rare diseases; of which only 121 made it to China’s official rare disease catalogue released in 2018.

Fortunately, this is not the end of story, as this was just the first batch of China’s rare disease catalogue, and the compilation of the second batch is well underway. More encouragingly, a number of policies have been rolled out, ranging from encouraging R&D and regulatory approvals of innovative therapies, to improving rare disease diagnosis and treatment standards, as well as preferential tax and reimbursement considerations etc.

| The policy and regulatory environments for rare disease therapies have been increasingly progressive and supportive in China | ||||

| China policies on rare diseases therapies | ||||

| R&D | Regulatory approvals | Diagnosis &Treatment | Supply | Reimbursement |

|

|

|

|

|

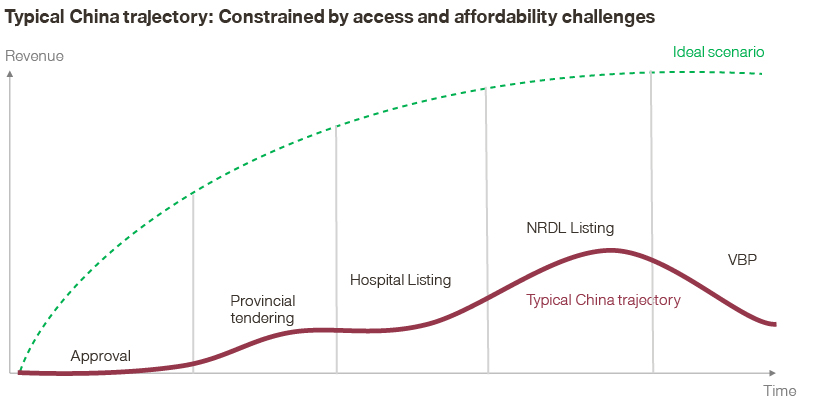

At the same time, access and affordability have always been major hurdles for innovative therapies in China, and more so for rare diseases. In stark contrast to the uptake curves for new launches in many markets, a typical China trajectory features much slower initial uptake, impeded by market access challenges like provincial tendering and hospital listing, as well as patient affordability gaps, as it takes time for new therapies to be eligible for reimbursements in China, if at all.

For rare disease therapies, uptake is further constrained by gaps in disease awareness, diagnosis, and treatment expertise, as well as the dispersed patient population and affordability challenges, further limiting access to the patients in need.

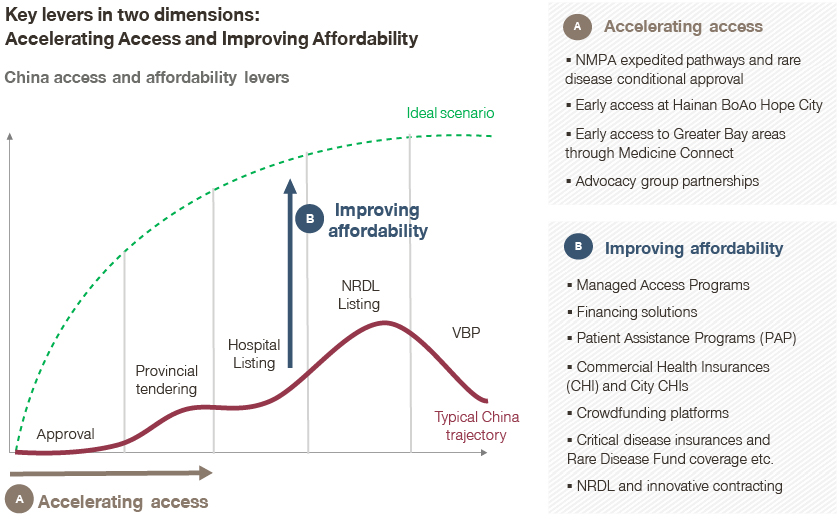

Building on Simon-Kucher’s extensive experience working in the Chinese rare disease space, we have identified a number of actionable levers to overcome the challenges along two key dimensions: accelerating access and improving affordability.

Accelerating access for rare disease therapies

A number of recent developments have made it possible to accelerate market access in China, and in some cases early access to pockets of the Chinese market even before the formal regulatory approval by the NMPA (National Medical Products Administration), which in turn helps with the approval process.

| A | Accelerating Access: New options are emerging for innovative therapies to access China market | ||||

| Accelerate Success | Key stakeholders | Case studies | |||

| A1 | NMPA expedited pathways and rare disease conditional approvals |

|

|

| Impact Control |

| A2 | Early access at Hainan BoAo Hope City |

|

|

| |

| A3 | Early access to Greater Bay areas through Medicine Connect |

|

| ||

| A4 | Advocacy group partnerships |

|

| ||

| A5 | Managed Access Programs |

|

| ||

- The Hainan Boao Lecheng International Medical Tourism Pilot Zone, also aptly shortnamed Hope City, has been one of the top destinations for many innovative therapies coming to China recently.

- Endowed with power from the State Council, Hope City has the unique opportunity to treat patients with drugs, devices, and innovative therapies approved overseas but not yet approved in China.

- Takhzyro, or lanadelumab from Takeda, a plasma kallikrein inhibitor indicated to prevent attacks of hereditary angioedema (HAE), made its way to Boao Lecheng Weijian Rare Disease Clinical Medicine Center shortly after its FDA approval, and that helped its NMPA approval in December 2020.

- More recently, innovative therapies can also expect approvals through RWD (real world data) generated at the pilot zone. Pralsetinib, a RET inhibitor from Blueprint Medicines with CStone as a partner in China, was approved in March 2021 with RWD from Hope City.

- The Medicine Connect program is a similar pilot for the Greater Bay area endorsed by NMPA and seven other regulatory bodies.

- In March 2020, a list of 54 drugs and medical devices approved in Hong Kong and Macau for oncology, rare diseases, and other urgent conditions was submitted by Hong Kong University Shenzhen Hospital for access to the area, including nine major cities in Guangdong.

- In April 2021, RhoGAM (anti-D immune globulin) became the first therapy approved for use in the Greater Bay area through the Medicine Connect program, paving the way for early access to rare disease drugs approved in Hong Kong but not yet available in mainland China.

- Rare disease PAGs (patient advocacy groups) like CARD (China alliances for rare diseases), CORD (Chinese organization for rare disorders), and PAGs for particular diseases are emerging in China as important influencers in many ways.

- HD Care, a Huntington’s disease patient group, sent over 100 letters to the NMPA and NHSA (National Health Security Administration) to communicate the unmet needs for innovative treatment options.

- Huntington’s disease was subsequently included in the first batch of the China rare disease catalogue, and Teva’s Austedo was included in the first batch of the Overseas New Drugs Urgently Needed (ONDUN) list in China. 18 months later, Austedo received NMPA approval, and was then included in the 2020 NRDL within another seven months.

- Going forward, partnerships with PAGs will have an increasingly important role to play in connecting with patients, facilitating clinical trials and access, as well as shaping rare disease policies and priorities.

- Managed access programs (MAPs) offer the latest new route for early access in China.

- MAP generally refers to expanded and compassionate use of un-approved therapies for patients who are not enrolled in a clinical trial, when safety and efficacy of therapies for patients can be anticipated.

- Per Article 23 of China’s new Drug Administration Law, compassionate use is permitted after IRB/IEC (Institutional Review Board/Independent Ethics Committee) approval, but limited to hospitals hosting the clinical trial.

- In June 2021, Iptacopan for PNH (paroxysmal nocturnal hemoglobinuria) became the first drug through Novartis MAP, with blessings from the NMPA and PUMCH, the leader of the rare diseases hospitals network.

Access options like those mentioned above help innovative therapies get to Chinese patients early, and sometimes well ahead of NMPA approval. The window is valuable in garnering goodwill and KOL support, as well as Chinese data and real world evidence, which are key for the eventual approval.

Moreover, some of the programs will continue to play key roles upon formal approvals and launches in China, and go a long way toward accessing the market and reaching patients.

Improving affordability

New therapies typically come with high price tags, which poses particular challenges to many rare disease patients and their families. To bridge the affordability gaps, the full range of funding pathways should be taken into account, aimed at developing multi-channel solutions for the patients in need.

| B | Improving affordability: Different funding pathways help bridge the affordability gaps for new therapies | |||||

| Improve affordability | Key stakeholders | Case studies | ||||

| B1 | Financing solutions |

|

|

| ControlImpact | |

| B2 | Patient Assistance Programs (PAP) |

|

|

| ||

| B3 | Crowdfunding platforms |

|

|

|

| |

| B4 | Commercial Health Insurances (CHI) and City CHIs |

|

|

|

| |

| B5 | Critical disease insurances and Rare Disease Fund coverage etc |

|

|

|

| |

| B6 | NRDL and innovative contracting |

|

|

|

| |

- To start with, simple financing solutions could mean a lot for patients, helping them manage the cost burden, while improving initial adoption and subsequent adherence.

- Roche entered a strategic partnership with Shanghai Pharma to bring Hemlibra to hemophilia patients through financing and cash back schemes, which proved to be highly effective.

- PBMs like MediTrust and SP Care could play an important role in designing the financing schemes. MediTrust, for example, launched the “Kangfu-Clover Rare Disease Care Center” in June 2021, to provide innovative financing and service solutions for rare disease patients.

- Online health majors are also moving in that direction, and JD Health launched its “Rare Disease Care Center” in February 2021, aiming to offer a one-stop solution platform for patients in need.

- The Patient Assistance Program (PAP) has long been in place in China, and requires close collaborations with charity foundations like China Charity Federation (CCF) and China Primary Health Care Foundation (CPHCF) for effective reach and disbursements.

- Spinraza, the innovative SMA (spinal muscular atrophy) therapy from Biogen, launched its PAP working closely with the CPHCF, and alleviated qualified patients from 87 percent of the cost burden for the first year with loading dose, and 74 percent of the cost burden for subsequent years with maintenance doses.

- In its first phase of rollout from May 2019 to December 2020, Spinraza PAP reached over 120 SMA patients, and at the same time laid the groundwork for the next phases and other funding pathways.

- CPHCF also spearheaded a number of rare disease initiatives and PAPs, including the one for multiple sclerosis, with 40 percent reduction of drug costs for most patients, and free drugs for qualified low-income patients.

- Crowdfunding platforms started out as online peer-to-peer (P2P) patient support programs, and some have evolved toward membership models to provide coverage for rare diseases patients.

- One of the platforms, Shuidi, has built its leading positon as an early mover, and has served over 1.7 million patients with P2P support.

- More recently, Shuidi launched a membership model for paid members, and offers drug discounts and partial coverages for rare diseases like ALS, PAH, and multiple sclerosis.

- Another major platform, Xianghubao, features a similar program with broader coverage for rare diseases including ALS and PAH, as well as HEM, MPS, MG, and SMA etc.

- Commercial Health Insurances (CHIs) have been in China for decades in many varieties, with city CHIs as the latest wave and gathering strong momentum.

- With the first pilot in Shenzhen, city CHIs have taken off over the past couple of years in over 100 major cities across China, typically featuring the PPP (public-private partnership) model operated by commercial insurances with strong endorsement from local governments, and tailored coverage schemes to address the specific unmet needs of their local citizens.

- As a latecomer to the game, Shanghai launched its own version of CHI in May 2021, but optimized the design and rollout based on learnings from other city CHIs, and featured a specialty drug formulary including those for Huntington’s and Fabry disease etc. Within three weeks of launch, it enrolled six million residents – 30 percent of the city’s population.

- Critical disease insurances (CDIs) and rare disease funds in contrast are typically led by public payers at a regional level, including HSA (healthcare security administration), health commissions, and finance bureaus etc., and provide coverage for treatment of rare diseases that are included in the China rare diseases catalogue.

- Zhejiang was among the first to evolve its CDI toward the rare diseases fund. Besides Cerezyme and Kuvan that were under its CDI coverage, Fabrazyme and Myozyme are also included for coverage.

- In 2021, Cerezyme, Fabrazyme, Myozyme and Replagal were included in Shandong CDI coverage.

- In March 2021, Chengdu launched its rare diseases scheme with slightly different coverage and a larger formulary, with Cerezyme, Kuvan, and Myozyme, as well as Spinraza, Vimizim, Treprostinil, and Vyndaqel making it to the list.

- More recently in July 2021, Jiangsu released its first batch of rare diseases coverage, with Cerezyme, Myozyme, Fabrazyme, Replagal, Spinraza and Vimizim made to the formulary.

- CDI formularies will be dynamically adjusted going forward, opening the window for innovative therapies planning for China launches.

- Last but not least, the NRDL remains the most important reimbursement opportunity with nationwide coverage and highest impact, and has been increasingly open and inclusive to rare diseases therapies.

- In 2019, 11 rare disease drugs made their ways to the NRDL, which was great news for patients with PAH, multiple sclerosis, thalassemia, and Niemann-Pick disease etc.

- In 2020, seven more rare diseases drugs for PAH, IPF, ALS, SSc-ILD, recurrent multiple sclerosis, acromegaly, and Huntington’s were included in the NRDL; of which Austedo and Mayzent made it to the list seven months after their China approvals.

- The 2021 NRDL process officially kicked off in July, and will unfold over the next four months. Besides the associated typical rounds of negotiations and high level of associated drama, we expect a number of new themes emerging in 2021, including new contracting models that would better balance the clinical needs, socio-economic benefits, and budget impacts of innovative therapies.

In summary, China’s rare disease environments are dynamic and rapidly changing, and a number of new access and affordability options are emerging. None appear to be a silver bullet, and it requires a patient-first mindset, systematic approaches to identify and prioritize the right combination of levers, and an actionable strategy tailored to the characteristics of the innovative therapies and the unmet needs of Chinese patients.

Read more from this series:

Part 1: Embracing the Change: 2020 China NRDL Outlook

Part 2: Embracing the Change: Revisiting Simon-Kucher 2020 China NRDL Predictions

Part 3: Embracing the Change: Strategizing on Volume-based Procurement in China

Part 5: Embracing the Change: China Commercial Health Insurance Opportunities