Volume-based procurement (VoBP or VBP) started its rollout in China in 2018, featuring stiff competition and steep price cuts for mature drugs. More recently, VoBP has been broadening in scope and accelerating in pace. To make the best out of the inevitable, major pharmaceutical firms will need to strategize and prepare for upcoming rounds on both national and regional levels.

Volume-based procurement is a series of drug procurement policies carried out in China, aimed at encouraging generic substitutions and bringing down the cost of drugs that have passed their exclusivities.

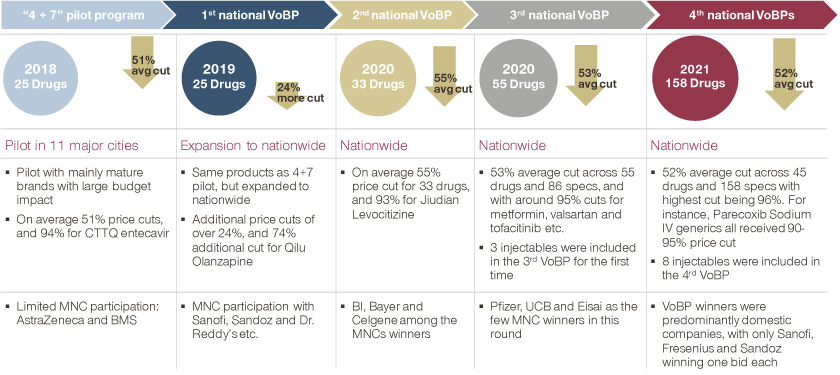

In the first VoBP pilot in 2018, there were just 25 drugs impacted and piloted in 11 cities (“4+7” cities). However, the magnitude of price cuts went beyond most expectations. One generic company cut its Entecavir price by 94 percent to secure a spot in the game, sending shockwaves across the industry.

Since then, VoBP has rolled out at both national and regional levels, with broadening scope and at an accelerating pace. At the national level, four more rounds of VoBP have been carried out and impacted over 150 drugs, mostly LOE (Loss of Exclusivity) oral tablets with QCE (quality consistency equivalence) generics. At the provincial and city levels, VoBP has been even more dynamic, with many generics failing to pass QCE as well as injectables and biologics included in various tendering processes.

National VoBP timeline to date

Provincial and national VoBP policies and implications

| Time | Policy | Implications |

| 11.29. 2019 | Notice on Several Policies and Measures to Further Deepen Health System Reform with Centralized Procurement and Use | VoBP on provincial level are encouraged to be implemented based on the examples of previous round of national VoBP |

| 06.05. 2020 | Notice on Issuing the Main Points of Correcting Unhealthy Practices in the Field of Medicine Purchase and Sale and Medical Services in 2020 | Promoted provincial VoBP for Non-QCE drugs in 11 healthcare reform pilot regions |

| 07.24. 2020 | Next wave VoBP list for 500 drugs released covering 80% of total spending | Provincial level VoBP to accelerate: 250 drugs to be in VoBP by 2021, all 500 drugs to be in VoBP by 2022 either at national or provincial levels |

| 01.28. 2021 | State Council Guidance to encourage regular and systematic VoBP | Encourages provincial VoBP and cross-province alliances; By 2021, 24 provinces have established VoBP policies |

| 04.15. 2021 | The 5th round National VoBP list covering 60 drugs, of which 30 are injectables | Broadening scope and accelerating pace for national VoBP |

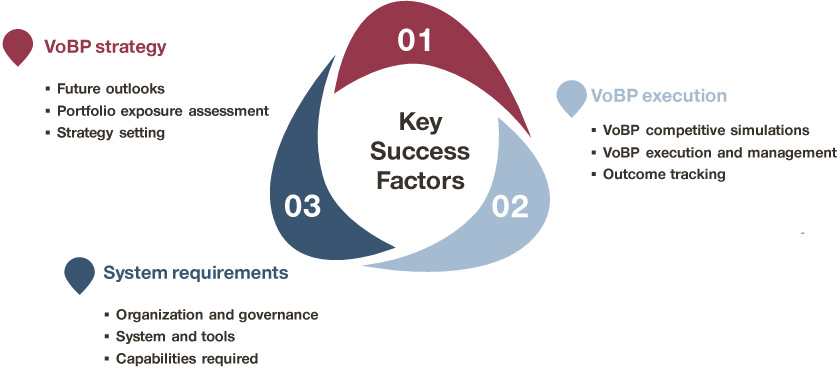

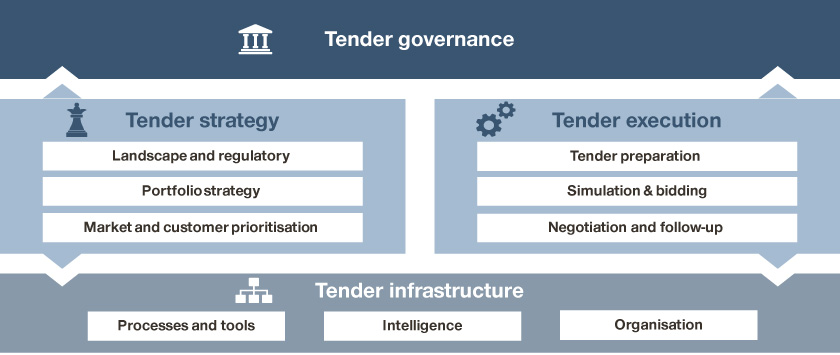

Three key areas to improve VoBP readiness:

Based on Simon-Kucher’s extensive experience working with leading MNCs and Chinese companies on VoBP, we have identified three key areas for major pharmaceutical firms to improve VoBP readiness:

- Articulate VoBP strategy

- Optimize VoBP execution

- Institutionalize VoBP system

VoBP readiness framework

Articulating the VoBP strategy is the all-important first step toward embracing the upcoming changes:

- To join, or not to join? This has been the recurring question for all major pharmaceutical companies when it comes to VoBP, more so for the originators that used to command a price premium over generics. Most MNC companies so far have opted to stay out of the game, as they see it as an impossible war to win.

- However, with an ostrich policy the stakes are high. Most MNCs have significant exposure to VoBP, many of the cash cow brands will lose around 70-80% of the volume guarantees staying out of VoBP, and their prices are subject to mandatory cuts nonetheless. Moreover, access to most public hospitals will be restricted post-VoBP, which could be particularly painful for specialty care brands that have relied on hospital procurement and physician prescriptions by nature.

- With the ever broadening scope for VoBP, it is imperative to develop realistic outlooks and scenarios, reassess portfolio exposure and VoBP implications, and adjust strategic, business, and financial goals to reflect the fast-evolving market dynamics. Internal alignment on the definition of success is particularly important for a clear VoBP strategy going forward.

With a clear VoBP strategy in place, execution becomes key:

- At risk of over-quoting Sun Tzu’s “know thy self, know thy enemy” speech, it is always good to start with an in-depth understanding of the competitive landscape. In recent rounds of VoBP, there have been smart plays taking advantage of the bidding rules and game theories, while there are also many more hard lessons learned due to miscalculations and missteps. In that regard, competitive simulation could be a valuable tool that can help map out different scenarios and outcomes, and help determine the optimal tender strategy going into the next rounds of VoBP.

- A robust management flow will need to be in place for effective VoBP execution, and typically entails cross-functional collaborations across brand teams, government affairs, finance, legal, market access teams at central and local levels, and in many cases, top management. The processes will need to be laid out clearly, with well-defined roles and responsibilities to ensure efficiency, effectiveness, and proper signoffs.

- VoBP tendering is not the end in itself though. The real work comes after the tender: winning the VoBP typically comes with reconfigurations of go-to-market models and cost structures, while opting out behooves more creativities and urgencies to identify and capture non-VoBP opportunities.

- With the rise of retail channels and online prescriptions, many pharma players are proactively exploring alternative channels to mitigate the VoBP impacts, with different extents of success so far.

- A leading neurology brand opted out of the VoBP to pursue an online patient education strategy jointly with JD Health, and saw a 2.5 fold jump of online prescriptions as a result.

- Another brand entered partnerships with Ali Health for targeted patient engagements making use of big data, leading to significant improvements in patient adherence and duration of treatment.

- The patient focus and insights gained from the process turned out to be an unexpected silver lining from losing the VoBP, and would go a long way towards mitigating short-term VoBP impacts and achieving long-term growth going forward.

Finally, an enabling infrastructure needs to be in place for effective VoBP planning and execution.

System requirements and infrastructure

When it comes to the system and infrastructure, there are always complaints about glitches and bottlenecks, and we have yet to come across a perfect one in real life. That said, Rome wasn’t built in a day. Everyone has a role to improve the system through open communication and close collaboration, working together to enhance organizational capabilities and readiness throughout the process.

Read more from this series:

Part 1: Embracing the Change: 2020 China NRDL Outlook

Part 2: Embracing the Change: Revisiting Simon-Kucher 2020 China NRDL Predictions

Part 4: Embracing the Change: Accessing Rare Disease Patients in China

Part 5: Embracing the Change: China Commercial Health Insurance Opportunities