When companies want to optimize their pricing to cover their costs, marginal cost pricing is the first strategy. If you want to compete through pricing, marginal costs are a key consideration. But how does marginal cost pricing work as a strategic choice?

What is marginal cost pricing?

Marginal cost pricing is setting a price equal to the cost of producing another unit. Each product or service is priced at the marginal cost of producing/delivering it.

“Marginal” cost specifically refers to the additional cost of producing one more product. Or, it can mean the cost of one more unit of a good or funding the provision of one more service.

The theory behind marginal cost pricing is that prices will consistently reflect the actual cost of production. This ensures efficient resource allocation, avoiding underproduction or overproduction. In managerial accounting, it is used to optimize production through economies of scale.

What marginal cost pricing looks like

You offer an item that has a fixed cost of $10, meaning each purchase necessitates that you pay $10 for overhead. You also have a variable cost of $10 per unit covering material, labor, and so on. So the total cost of producing the item is $20 ($10 fixed and $10 variable).

Manufacturing 1,000 per month means on average $20,000 in expenses per month (1,000 units * $20 per unit)

Now, you want to increase production to 2,000 items per month.

The fixed costs remain the same regardless of the level of production. So, the increase in cost rests solely with the variable $10 for producing the additional items.

Now the marginal cost is the additional variable cost per unit:

Marginal cost = change in total cost / change in quantity

= ($20,000 (for 2,000 items) - $10,000 (for 1,000 items)) / (2,000 - 1,000)

= ($20,000 - $10,000) / 1,000

= $10,000 / 1,000

= $10 per unit

To increase production to 2,000 items, you add the marginal cost of $10 per unit. For 2,000 items, each costs $20 ($10 fixed and $10 variable) and incurs a marginal cost of $10.

So, producing 2,000 items means the total cost should be $30 per unit.

When does marginal cost pricing make sense?

A marginal cost pricing strategy is most suitable for a perfectly competitive market. In that case, it offers low prices to customers. It’s an efficient approach that is easy to implement. It also provides a competitive advantage when market share is evenly distributed.

However, at Simon-Kucher, we understand that markets are rarely perfectly competitive and advise accordingly. Companies have varying degrees of market power, which usually calls for alternative pricing strategies.

Is marginal pricing profitable?

Marginal pricing can ensure a certain level of profitability. However, it is far from the most profitable pricing strategy. Forgoing more complex pricing strategies may harm your profitability.

Another reason to be wary of marginal pricing when discussing profitability is that the logic behind it is a race to the bottom. It incentivizes minimalism, particularly in production costs, which is not the best option for most businesses.

To maintain a higher level of profitability with marginal pricing, you usually need to cut corners. This is most commonly demonstrated by sacrificing product quality. By reducing the fixed and variable manufacturing costs, you can outcompete others by offering lower prices.

This is usually counterproductive. This strategy can harm your profitability while incentivizing decisions that damage your reputation.

Marginal cost pricing alternatives

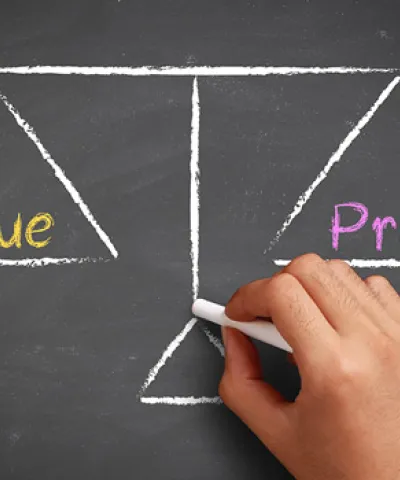

The more profitable alternatives to marginal pricing are value-based alternatives. Instead of cost-based pricing strategies like marginal cost pricing, we recommend a value-based strategy.

Value-based pricing strategies provide you with a far higher ceiling in terms of pricing. Instead of cutting costs, you focus on providing greater value to the customer. That way, you can charge a higher price while maintaining quality product and service standards.

There is more value in focusing on the importance of value perceived by customers rather than production costs alone.

Value-based pricing

We recommend value-based pricing strategies for long-term profitability.

In our experience, customers are willing to pay more for the value they receive from a product or service. As such, pricing strategies should align with the value proposition of what you’re selling.

Marginal costs alone may not reflect the value delivered to customers. Marginal pricing simply offers a level of perceived security.

Value-based pricing also aligns your pricing strategy with customer preferences. That means shifting your focus from costs of production to value delivered to customers.

Value drivers

To implement a value-based pricing strategy, we start with identifying value-adding features. By quantifying those value drivers, you can set prices accordingly.

All of this is easier said than done, but more than worth the effort. Anchoring value-based pricing requires:

- Thorough and continuous customer research

- Market research

- Ongoing support for sales teams

- A shift in mindset around pricing

At different levels of an organization, different changes are required. But such holistic approaches equip you to monetize your value proposition and secure optimal margins rather than acceptable margins.

Other pricing practices

There are other alternatives to marginal cost pricing and other cost-based strategies. Depending on the company's circumstances, we often recommend and assist with segmented and dynamic pricing strategies.

These more sophisticated pricing approaches focus on maximizing perceived value, profitability, and competitive advantage.

Maximize profitability with value-based pricing strategy

Our approach to pricing is to aim to maximize profitability. We advise against strategies that focus exclusively on covering costs. As such, we work with companies to develop pricing strategies that optimize revenue and margins while considering the following:

- Customer values

- Willingness to pay

- Customer segmentation

- Competitive dynamics

With this approach, pricing is optimized to produce maximum profit. The focus is also on customer satisfaction, providing long-term profit and growth.

Why Simon-Kucher?

At Simon-Kucher, we enhance pricing strategies to boost profits and customer value. We leverage a data-driven approach and in-depth market analysis to help businesses implement a pricing model that aligns with their objectives and market positioning.

Whether through a value-based pricing model or a competitive pricing strategy, we enable companies to set higher price points while ensuring that customers perceive the value proposition.

Explore alternatives to marginal cost pricing and learn more. Talk to us.