Persistently declining inflation and continued pressure from a strong franc have led the Swiss National Bank (SNB) to ease monetary policy – culminating in a 0% policy rate on June 19, 2025, marking the end of Switzerland’s short era of positive interest rates.

The interest income boost Swiss banks enjoyed in 2022 and 2023, driven largely by interest on the SNB sight deposits and elevated lending margins, has largely evaporated. At the same time, banks are facing a prolonged decline in commission income – adding further pressure to their revenue base. To sustain profitability and enable future growth, banks must act decisively to realign their revenue models and mitigate renewed margin pressure.

A new wave of pressure on bank revenues

The return to a low-interest rate environment is reshaping the commercial landscape for Swiss banks. The 2022–2023 rate hike cycle gave a temporary boost to interest income – largely because the SNB began paying interest on banks’ sight deposits, which rose from CHF 0.8 billion in 2022 to CHF 7.4 billion in 2023 (SNB). That support has now definitively ended with the SNB's policy rate at 0%.

Meanwhile, banks are facing renewed challenges in their mortgage business. Despite the SNB’s recent rate cut, long-term interest rates have remained stubbornly high. Refinancing costs have not eased significantly – in fact, tighter market liquidity, rising capital requirements, and increased funding spreads have made refinancing more expensive. This is squeezing margins, particularly for banks with a strong focus on residential lending, as is common among retail institutions.

Adding to the pressure, commission income, particularly from investment services and deposit-related products, continues to decline. Many banks actively reduced their fees in recent years, especially during the phase of rising interest rates. In an effort to remain competitive and respond to growing client price sensitivity, they trimmed commissions across a range of products – often at the expense of long-term income stability. With interest margins under renewed pressure and the SNB’s rate at zero, the lack of a stable fee income base is becoming even more problematic.

The numbers behind the pressure

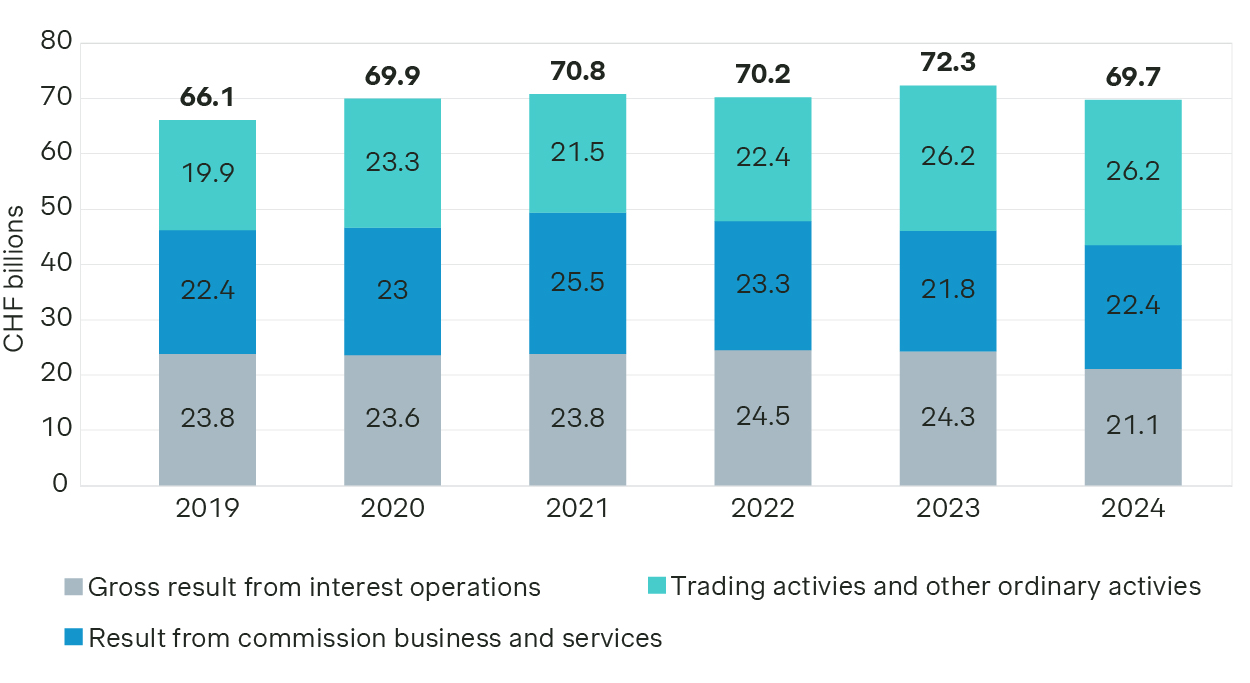

Swiss banks saw aggregate net income fall from a record CHF 72.3 billion in 2023 to CHF 69.7 billion in 2024 (SNB, 2025). The drop is notable and reflects a clear loss of earnings momentum. The sector’s two main revenue sources, interest and commission income, have either declined or stagnated. Non-core activities such as trading are increasingly holding up the overall result.

In 2022 and 2023, many banks benefited from temporarily elevated lending margins and substantial interest earned on central bank sight deposits. That support has gradually eroded over the past year. After six consecutive rate cuts, initiated in early 2024, the SNB has now reduced its policy rate to 0%. As a result, interest income fell from CHF 24.3 billion to CHF 21.1 billion in 2024, and margin pressure is intensifying. Higher refinancing costs, a reduced willingness to engage in maturity transformation, and growing competition in lending are further weighing on profitability.

Commission income has not recovered either. Since peaking in 2021, it has dropped by more than CHF 3.5 billion and remained flat in 2024 at CHF 22.4 billion. This highlights the fragility of banks’ fee-based income and need to extract more value from client relationships.

With aggregate income now in decline and the revenue mix increasingly fragile, banks must act decisively. Sustained cost control remains necessary – but it is no longer sufficient. To restore momentum and enable long-term growth, banks must give greater weight to revenue-side initiatives, which have too often been sidelined.

Why this cycle is different

This new rate environment presents challenges that differ fundamentally from the 2015–2022 period. Back then, banks could rely on abundant central bank liquidity, apply negative rates to large client deposits, and use cheap funding to expand mortgage portfolios at scale.

Today, those levers are no longer available. Liquidity is tighter, SNB deposits have declined, and stricter Basel III requirements are constraining balance sheet flexibility. In parallel, capital and liquidity costs have increased, making lending structurally more expensive.

At the same time, clients have become more yield-sensitive and quicker to reallocate assets. This reduces pricing power and limits banks’ ability to pass on costs or hold margins. As a result, many institutions face a commercial environment where traditional interest-driven strategies are no longer sufficient.

What’s needed now is a fundamentally different approach – built on active revenue management, better client segmentation, and enhanced value delivery across every segment.

The proactive revenue protection playbook

To preserve profitability, Swiss banks must go beyond cost control and take proactive steps to stabilize and grow revenue across both interest and fee-based income. The current environment demands a shift from reactive adjustments to forward-looking commercial strategy.

1. Refine lending strategy and pricing

Banks must reassess their mortgage and lending approach with a focus on margin resilience:

Identify client segments where the bank can create the most value based on its distribution model, expertise, and balance sheet structure.

Assess willingness to pay across segments and financing types and reflect these insights consistently in pricing.

Factor in the entire client relationship, not just isolated product margins, when managing pricing and profitability (relationship pricing).

2. Broaden and optimize the funding base

Rising refinancing costs and tighter market liquidity have triggered a “fight for cash”:

Analyze behavioral patterns and value drivers in the client portfolio to derive segments with different interest rate sensitivities.

Apply differentiated pricing strategies across deposit segments and adjust them dynamically based on forecasted deposit flows.

Design deposit products around client needs and steer funds into appropriate product structures.

3. Strengthen client acquisition and net new money

With organic growth slowing, professional acquisition management is more critical than ever:

Prioritize attractive target segments with a strong strategic fit (e.g. investment clients with substantial deposits), and tailor messaging to segment-specific needs.

Define value propositions, outreach channels, and tactical measures for each priority segment.

Support acquisition teams with digital tools to improve lead prioritization and pipeline management.

4. Enhance the client value proposition

To reinforce loyalty and protect revenue, banks must offer solutions that go beyond products:

Make mortgage offerings more modular and flexible to address diverse financing needs and life situations.

Design hybrid investment solutions that bridge advisory and discretionary models – targeting clients who pay for advisory services but benefit little, or those hesitant to fully delegate their wealth management to the bank.

Use loyalty programs and ecosystem offerings – within and beyond the bank – to deepen relationships.

5. Focus on relationship-level profitability

Banks should shift commercial steering from product to relationship level:

Use AI-driven pattern recognition to uncover hidden client needs, flag pricing inconsistencies, and generate qualified leads with actionable next steps.

Equip sales teams with tools that visualize client-level profitability and support pricing and negotiation (e.g., peer pricing).

Continuously monitor client books using transparent profitability metrics, and drive targeted up-selling and repricing measures to secure long-term margins.

How we can help

We are a global consultancy and recognized leader in pricing and growth strategy, with 40 years of experience. We specialize in unlocking better growth through pricing, sales, marketing, and product optimization.

In Switzerland, we work with leading banks to strengthening commercial performance, helping them adapt to changing market dynamics and regulatory requirements.

If you’re interested in a forward-looking commercial strategy, reach out to us today.