Medical technology companies have been trying to catch up with other sectors when adopting digitally enabled operating models. And with mixed success. The pandemic was a helpful catalyst to put digital engagement and e-commerce on the agenda, though the transition from “ambition” to “success” has yet to be realized.

Meet Arun, a cardiologist working in a hybrid environment, balancing his time between interventions in the hospital, consultations, and diagnostic interventions in his private practice. In his daily life, he manages his busy personal schedule through a mix of digital engagement and transactional platforms. He enrolls his children into after-school activities and conducts payments online, extends the warranty of housing supplies, and relies on automated payments for utility bills and subscriptions models for his automated home electronics. All family holidays are booked online, and he monitors his financials and investments in real-time via a smart set of notifications and alerts that advise him to act when needed.

What do we learn? Arun accepts that his professional life looks very different when it comes to information access, digital engagement, and transactions with his favorite suppliers and partners. When will the loyalty toward Elisa, the sales representative who is spoiling him with the high-touch service model, be overtaken by the need for immediate and customized access to information and products, which – for him – come with reasonable prices and minimal effort?

Meet Elisa, a sales representative at a leading medtech company responsible for selling innovative cardiology products and solutions within her territory. Elisa has been investing hard in developing and maintaining relationships with her clinicians. Growth targets are ambitious though, and she is running out of bandwidth to ensure the attention needs across her customer base are met. She is getting internal pressure that the out-patient private clinics are not driving sufficient return to justify the visits to her key customers like Arun in his private practice. At the same time, Arun is complaining to her that access to products and pricing is not in line with his expectations and conditions at the hospital where he works. He has been waiting too long to get an offer in his mailbox, and the product ordering process is cumbersome.

Sound familiar? Reality is more complex with cross-functional involvement of budget holders and clinicians throughout the buying process, though a similar experience can be outlined for procurement managers or department heads.

Of the 79 percent of companies that will have invested in digital by the end of 2022, only half had a digital strategy in place in 2019. While the pandemic has pushed medtech companies to embrace a new way of working, it has also forced them to complete years of digital transformation in just a few months. Such a reactive approach is typically suboptimal, especially in an environment where a legacy sales model is a limiting factor to change, and in particular to the adoption of an effective digitally driven commercial model.

Legacy sales models are salespeople focused. On the contrary, digital sales models focus on the customers and how they buy. Transitioning from an analog commercial model to a digital one means putting the “customer” at the center of the evolving commercial organization.

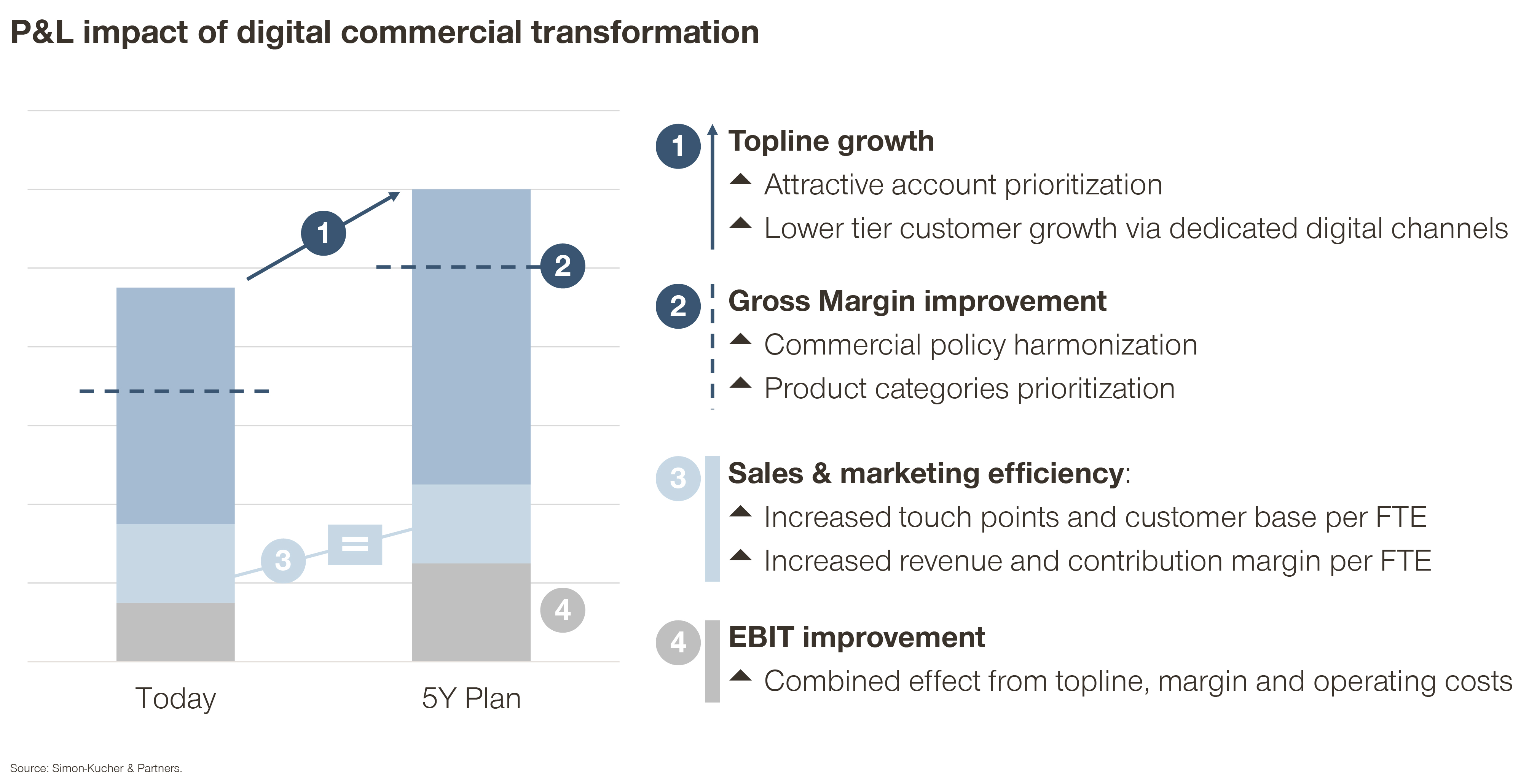

A clear alignment on strategy and benefits allows commercial digital transformation activities to impact the bottom line and address multiple P&L drivers:

Driving growth via

- growing business with the tail of the customer landscape

- increased prioritization of most attractive accounts

- portfolio-wide selling through digital channels

Improving gross margin via

- harmonized commercial policy per channel and segment

- increased prioritization toward profitable product categories

- optimized SLAs per customer segment

Improving (%) sales & marketing efficiency via

- increased touch points and customer base per FTE

- increased revenue and contribution margin per FTE

Improve net and % EBIT via

combined effect from topline, margin, and operating costs.

Whenever we refer to commercial digital transformation, we refer to three areas of applicability:

ENGAGE – Developing a strategy for digitally enabled customer engagement

SERVE - Digitizing of the operating model and channel mix

ENABLE– Enhancing sales and marketing initiatives through commercial data

ENGAGE

Digitally enabled customer engagement

Our recent study with more than 400 HCPs illustrates how digital interaction surged unprecedentedly in 2020 but is still perceived to be suboptimal in both approach and content. 46 percent of HCPs have a negative experience of being engaged by reps via remote calls, resulting in 71 percent wanting to go back to face-to-face interactions. 80 percent of medtech customers are not satisfied with the product, delivery, and price information provided online.

While it’s easy to claim that “HCPs prefer face to face interactions!”, the reality is that in most cases the analog approach and the physical content has been (inefficiently) retrofitted to digital channels.

Digitally enabled customer engagement means decrypting what matters for the different target groups, understanding their needs, pains, and wishes, and ultimately using systems to serve processes, and especially people. In the coming years, hybrid sales models will be a reality and lead to a shift in FTEs and competencies. Similarly, together with the due organizational adjustments, companies need to look into the following topics:

- Technology upgrade: A methodical, less centralized (beyond the boundaries of sales ops, sales, and IT) approach to selecting and evaluating sales technologies to reduce vendor selection and time to implementation.

- CRM improvement: Companies need to create a 360° customer view, upgrade consistently, and adopt AI and sophisticated analytics to improve their CRM systems for three functions: inform customer engagement strategies, formulate business goals, and predict customer needs.

- Incentive optimization: Maintaining incentive and compensation plans based on the “analog” model will likely undermine performance and miss out on sales opportunities. Criteria will need to look into lead identification and conversion, margin improvement, and/or customer satisfaction.

SERVE

Operating model and channel

The next evolutionary step following the shift from analog to digitally enabled customer engagement is digitizing the transaction itself. Outside the medtech world, digital sales are ubiquitous – as a reference point, e-commerce is expected to account for close to 20 percent of total retail sales worldwide in 2022. In medtech, so far, most players have a very modest e-commerce footprint with online stores often seen as “online product catalogues” or marketing gimmicks rather than true sales channels.

The status quo and anticipated adoption of e-commerce in medtech is changing though. First, a new generation of digitally native HCPs has brought a new set of expectations when it comes to a brand’s online presence and a much more favorable perception of online sales in the healthcare industry. Second, the COVID-19 pandemic has catalyzed the offline-to-online switch in healthcare purchasing. Practically forced to interact (and often transact) online due to external reasons, many medtech customers appreciate the benefits of digital procurement – from increased awareness of latest innovations to accelerated business cycles and efficiency gains. Finally, multiple upstarts in fields ranging from hearing aids and dental supplies to portable ultrasound systems are successfully challenging the incumbents by offering a superior online buying experience.

These trends are recognized by the industry: 78 percent of Simon-Kucher’s medtech clients surveyed in October 2022 expect more than five percent of their sales to come through digital in 2025. 22 percent have set an ambition to cross the 20 percent threshold – a significant shift for an industry that has been struggling to sell online at scale until now.

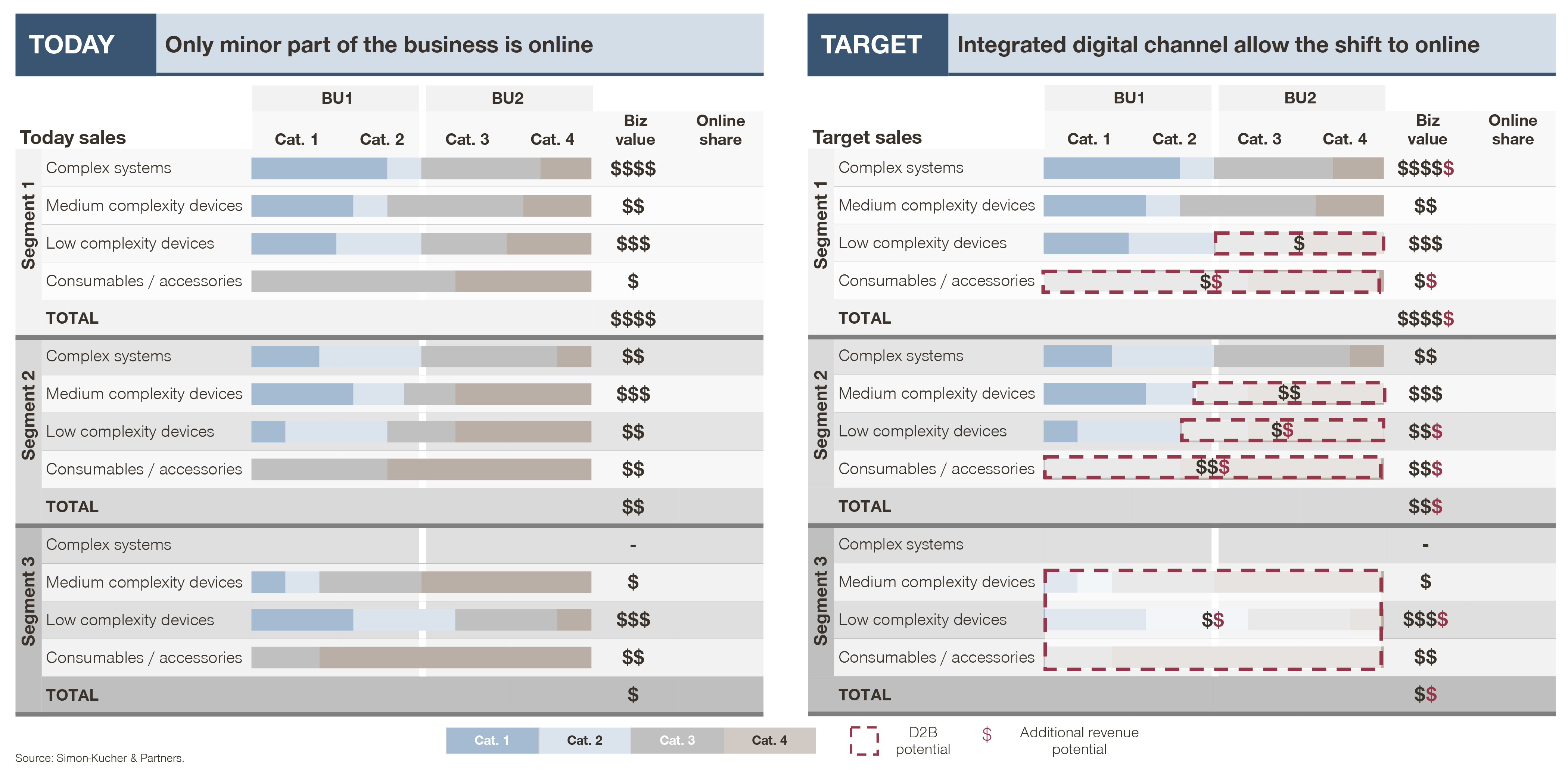

But where should medtech leaders start when it comes to building up a digital sales presence?

Prioritize the development of a robust e-commerce strategy and business plan, followed by fast operationalization on a small scale. Then monitor performance carefully and be ready to adjust quickly. Plotting your business on a simple 2:2 (product-customer) matrix is often a practical way to start developing an e-commerce plan. Which products and services do you want to sell online? And to which customer segments? Answers to these questions combined with a solid understanding of market dynamics as well as your own capabilities and readiness will help you to assess the opportunity size and define the ambition level.

Multiple other elements need to be detailed out as part of the strategy including (but not limited to):

- Marketing and sales strategy: value proposition and demand generation model, need for virtual sales support, implications for organizational sizing and performance measurement, …

- Pricing and offering: desired transparency levels, discounting models and promotions approach, dynamic pricing considerations, bundling and packaging decisions, …

- Platform and UX: customer journey mapping and pain point analysis, UX concepts development, testing and validation, …

Medtech digital pioneers should not forget about the e-commerce tech stack (often not present or underdeveloped given the industry’s legacy sales approach) as well as back-office functions and supply chain (often not designed for e-commerce and requiring a substantial transformation). These elements serve as critical enablers for your strategy.

ENABLE

Operationalization of commercial data for sales and marketing initiatives

Business intelligence is a key enabler for a successful commercial operating model and provides the opportunity for medtech companies to drive profitable growth by transforming raw data with the help of technology into actionable business decisions. The key benefits are:

- High-quality intelligence: Medtech companies sit on a large pool of data generated by internal ecommerce, ERP, or CRM systems, and external sources such as databases on competitive insights, payer environment, and patient data. Business intelligence is a key differentiator in using data from various sources in the most effective and efficient way.

This involves ETL (Extract, Transform, Load) processes which extract data from internal and external data source systems, then transform it and finally load it into the data warehouse system where the data is managed. Based on the data stored in the warehouse, analytics tools such as Power BI, Tableau or Qlik can be built.

Next level data utilization goes beyond analyzing trends and statistics based on historical data and provides real-time information to the organization. Such developed tools can be adapted to different decision-making levels in organizations – while the CMO only requires a dashboard with certain strategic KPIs, individual sales reps require much more detailed information on current evolving preferences and behavior of their specific customer mix. Besides historical and real-time data, Machine Learning and Artificial Intelligence can also be used to forecast customer behavior. - Effective sales and marketing: In marketing, business intelligence can be used to analyze and segment different customer groups to better understand preferences and behavior, enabling medtech companies to approach different customer segments with more targeted marketing campaigns.

It offers visibility on campaigns to the marketing team in real-time, making it possible to optimize budgets and to identify the best-performing promotional initiatives.

For sales, business intelligence will contribute to more accurate forecasts and can lead to increased order fulfillment, lower inventory costs, and higher profits. BI will support sales with visibility on customer touchpoints. It can inform reps which customers to focus on by providing the willingness to pay of different customer segments as well as insights into how to effectively operationalize different pricing strategies or marketing campaigns.

While designing solutions and preparing for operationalization, keep Arun and Lisa in mind and ensure that your efforts will facilitate their day-to-day business. The journey toward a digitally enabled commercial operating model in a conversative industry sector is challenging. Achieving success will support sustainable and more efficient business growth. Digital commercial transformation is around the corner, and that includes medtech.

Get ready!