About this series Simon-Kucher's Fleet Growth Playbook explores the commercial strategies reshaping today’s automotive fleet ecosystem, from OEMs and leasing providers to mobility platforms and service networks. As electrification, digitalization, and cost pressures escalate change, each article in this five-part series tackles the most critical levers of commercial performance: pricing, value delivery, customer retention, and integrated solutions. Based on insights from the Simon-Kucher Fleet Study 2025, the playbook turns real market data into practical guidance for decision-makers overseeing passenger cars and light commercial vehicles (LCVs). |

Flexible pricing models in a volatile fleet market

The rules of fleet pricing are being rewritten.

Inflation, volatile operating costs, and the rise of electric and flexible mobility are making traditional fixed-price lease increasingly unviable. Once predictable and secure, the model now feels rigid and risky for logistics operators, corporates, and public sector operators. Meanwhile, providers that fail to adapt risk margin erosion.

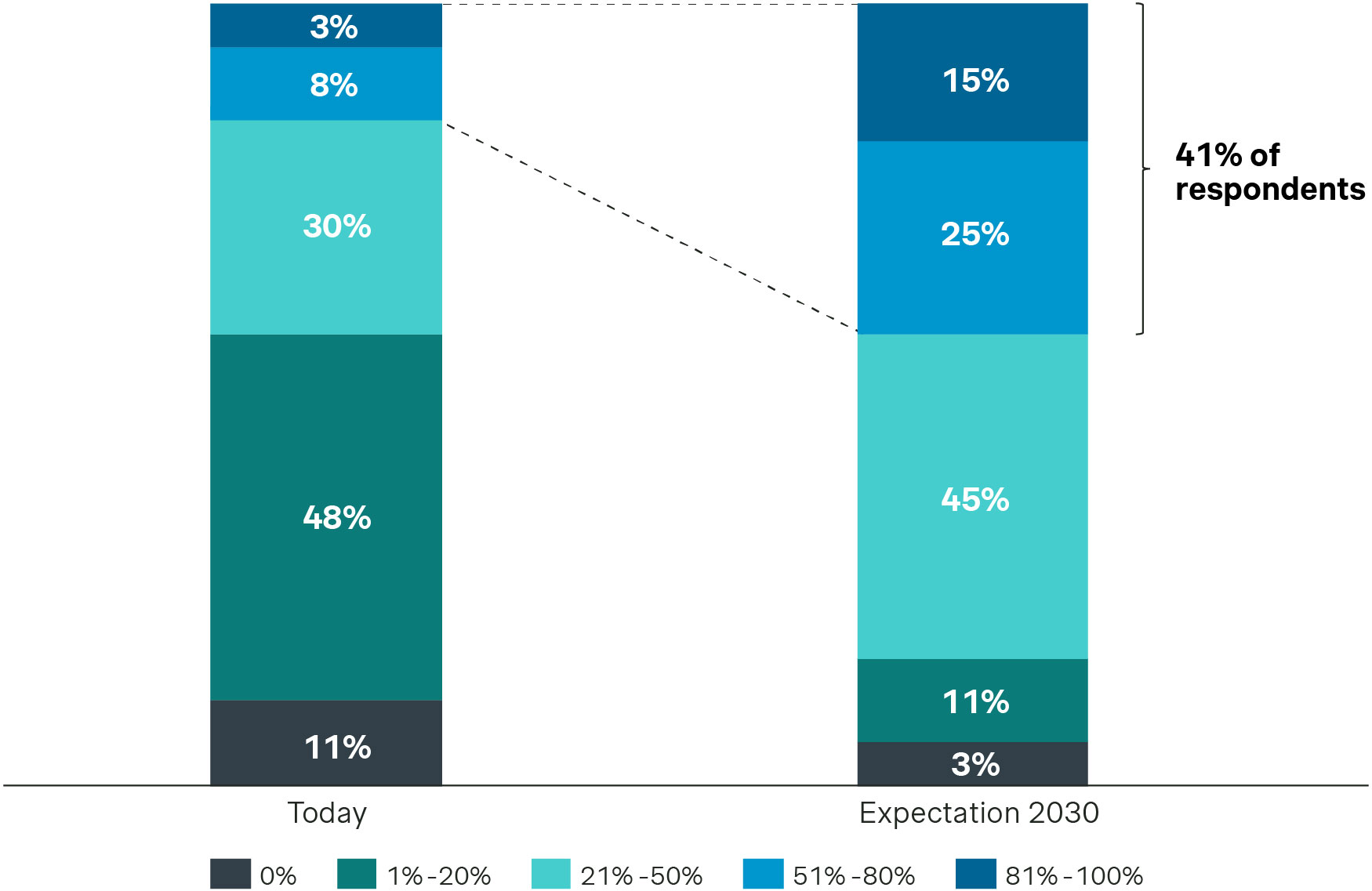

Our research shows that since 2020, fleet operating costs have jumped more than 20%, driven by spikes in energy prices, component shortages, and rising interest rates. EV adoption is accelerating, with over 40% of fleet managers expecting half their fleets to be electrified by 2030. At the same time, usage-based mobility models are scaling, with customers increasingly expecting pricing to reflect actual utilization, not just time or term.

EV adoption in fleet composition (in % today vs 2030E)

However, there is an opportunity. Fleet providers could benefit from embracing dynamic, value-based pricing, enabling them to better meet customer expectations, preserve profitability, and unlock new growth.

From fixed to flexible: Why fleet pricing needs to evolve

Fixed monthly payments, standard mileage assumptions, or annual contracts were designed for a more stable era. But these traditional fleet pricing models no longer accurately reflect market realities. Fleet buyers now operate in more complex, fluid environments:

Logistics operators face fluctuating delivery volumes and driver turnover.

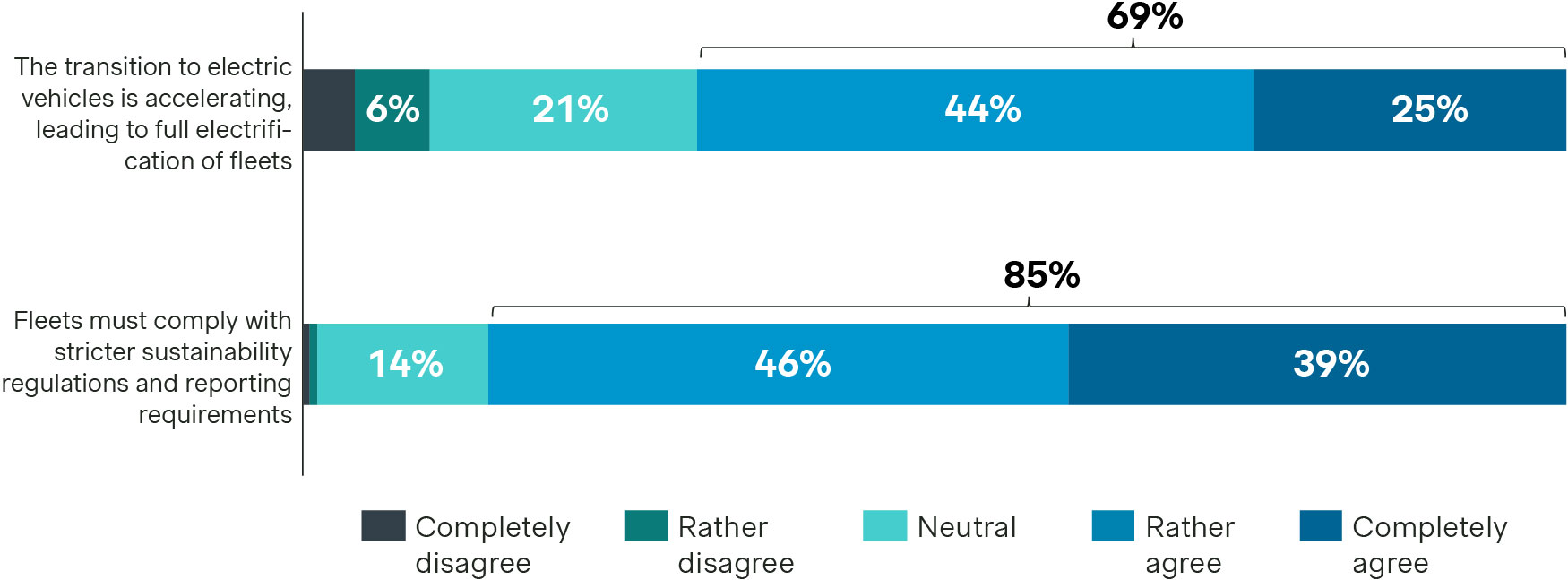

Corporate fleets optimize for hybrid work, flexible usage, and sustainability. 85% of fleet managers say compliance with stricter ESG regulations and reporting are increasingly important in sourcing decisions.

Public fleets are under pressure to decarbonize, digitize, and deliver more with less.

Identified trends that impact decisions on fleet composition according to fleet managers

These pressures are fueling demand for flexible pricing structures. Market trends show fleet buyers now favor usage-based or mileage-linked models over flat-rate leasing. Providers that implement dynamic pricing, adjusting fees based on utilization, service level, or vehicle type, are already reporting measurable gains in operational efficiency.

The most relevant pricing models today include:

Usage-based pricing: Billing per kilometer, vehicle hour, or delivery volume, popular with last-mile operators and gig fleets.

Tiered and modular pricing: Customizing offers by fleet segment (e.g., SME vs. enterprise) or vertical (e.g., pharma vs. construction).

Subscription bundles: Offering access to vehicles, services, and digital tools for a single monthly fee, ideal for predictable budgeting.

Performance-linked pricing: Linking fees to KPIs such as uptime, energy efficiency, or emissions reductions.

These models align price with value delivered, benefiting both the provider and the customer.

Smarter pricing for fleet electrification and new mobility

As electrification continues, pricing strategies must evolve beyond fuel cost savings. EVs come with different cost dynamics: lower maintenance but higher upfront costs and charging complexities.

To accelerate EV adoption, leading providers are testing new fleet electrification strategies, including:

EV-specific subscription tiers that bundle charging infrastructure, battery analytics, and priority support.

Energy-as-a-service add-ons with price-stable charging plans, grid optimization, and home charging reimbursement.

TCO-transparent pricing that factors in subsidies, tax benefits, and residual value uncertainty.

At the same time, new mobility models such as vehicle subscriptions, pay-per-use access, and fleet pooling are expanding, particularly in urban and shared-use contexts. Pricing must balance short-term flexibility with long-term asset optimization. Duration, utilization, geography, and fleet mix all become critical levers.

Common pitfalls: Where fleet pricing transformations go wrong

Many fleet providers understand the need for flexible pricing. Yet even as providers experiment with new electrification and fleet mobility pricing models, many struggle with execution. In practice, four common challenges undermine both profitability and customer trust:

Overly complex pricing structures confuse customers and even sales teams.

Much of the available data, particularly telematics and usage analytics, goes under-leveraged instead of driving sharper segmentation and performance-based pricing.

Rigid internal systems make it difficult to update prices or contract structures quickly.

Fear of margin dilution leads to cautious adoption or poor communication of the value exchange.

The key is balancing innovation with clarity. Fleet providers have an opportunity to simplify offers while using smart analytics to tailor pricing to customer priorities.

Our Fleet Study 2025 shows significant differences in how managers evaluate options. Price remains a critical decision factor, but premium OEMs command higher prices with superior service, reliability, and innovation. Meanwhile, mainstream brands compete on affordability and acceptable service quality. Utilizing all available data to understand the customer base is therefore crucial.

How Simon-Kucher powers fleet pricing excellence

At Simon-Kucher, we work with OEMs, leasing companies, and fleet tech providers to modernize pricing for current market realities. Our global automotive team brings deep expertise in commercial strategy, digital monetization, and go-to-market execution, delivering measurable over the past four decades.

We don’t apply one-size-fits-all solutions. Instead, we help you design and implement pricing models that reflect your specific customers, cost drivers, and growth ambitions. This often begins with segmented pricing models based on customer size, industry vertical, usage behavior, and value sensitivity. Subscription and hybrid pricing structures can then blend base fees with usage or performance metrics. Pricing is indexed to inflation, energy prices, or residual value shifts to safeguard margins in volatile times. And to ensure the value is clearly communicated, we equip you with ROI tools, fleet calculators, and tailored pitch decks.

Equally, we focus on aligning sales, finance, IT, and product teams behind the pricing transformation to ensure sustainable implementation.

Dynamic fleet pricing: Rethink your strategy today for big impact tomorrow

Fleet customers are clear: they want flexibility, transparency, and value for money. With electrification, usage-based services, and digital fleet management, pricing is now a core part of the customer experience. By embracing smarter pricing models today, you can position your business as a trusted partner and unlock new sources of profitable growth.

Ready to move from fixed to flexible pricing?

Let’s talk about how to build dynamic pricing strategies that win in tomorrow’s fleet market.

Next up in the Fleet Growth Playbook series:

Fleet sales and marketing 2.0 for the digital-savvy customer