About this series Simon-Kucher’s Fleet Growth Playbook is a five-part series that explores the commercial strategies reshaping the future of the automotive fleet ecosystem. From OEMs and leasing providers to mobility platforms and service networks, the series looks at how players can stay competitive as electrification, digitalization, and cost pressures accelerate change. Each article in this series draws on insights from Simon-Kucher's Fleet Study 2025 and examines a distinct commercial lever. This third installment focuses on fleet service contracts: how they are shifting from routine maintenance agreements to powerful tools for loyalty, retention, and recurring profitability. |

Rethinking service contracts for better fleet management in a cost-conscious, electrified world

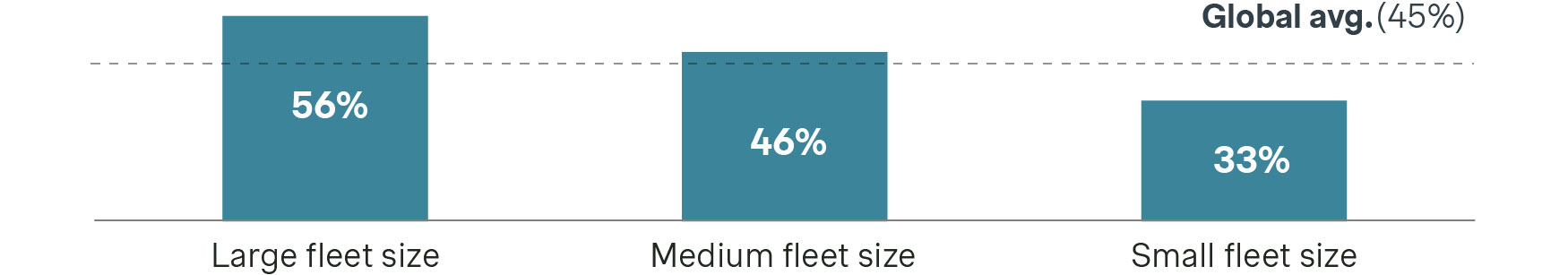

In the fleet industry, service used to be an afterthought. Today, it’s a loyalty engine. The quality of service often determines whether customers stay or leave. While 86% of fleet managers report satisfaction with their service providers, nearly half (45%) still say they are likely to switch, suggesting that even satisfied customers are open to alternatives. Among larger fleets, this number rises to 56%, highlighting just how fragile loyalty can be.

Fleet managers’ satisfaction with their service providers

Likelihood to switch their serviced providers

2025 Simon-Kucher Fleet Study (n=170)

Fleet customers are under more pressure than ever to control costs, maximize uptime, and simplify operations. Our Fleet Survey 2025 found that fleet managers spend about 68% of their time on operational and reactive tasks, such as budget and fleet size planning, procurement and leasing, fleet monitoring, maintenance and documentation.

At the same time, OEMs, leasing companies, and independent fleet maintenance networks face rising parts and labor costs, while traditional service revenue streams come under strain, especially during the transition to EVs.

Against this backdrop, forward-looking players are reinventing fleet service contracts. No longer just basic fleet maintenance agreements, they are becoming strategic tools to lock in loyalty, stabilize revenue, and deliver measurable value.

Why fleet service contracts are gaining strategic importance

The economics of fleet operations are quickly changing, and in ways that directly impact profitability:

Rising costs: Inflation is pushing up fleet maintenance costs, with parts, tires, and labor all seeing double-digit increases since 2020. For large fleets, this adds up to significant additional annual expense. Without structured service contracts, these cost swings are absorbed directly.

The EV challenge: EVs have different maintenance profiles: fewer moving parts, but new high-cost variables like battery performance, software updates, and charging access. An out-of-service battery pack can be a major financial liability, making risk-sharing through contracts far more valuable.

The buyer shift: Fleet buyers are moving away from purely price-driven decisions toward those that are more value-driven. They want predictability, uptime guarantees, and full-service simplicity in one integrated solution. These solutions guarantee stability and make transparent, value-based service contracts a key factor in fleet provider selection.

In this environment, reactive service models are no longer competitive. Ad hoc approaches erode customer loyalty and expose fleets to cost volatility. What customers need instead is proactive, outcome-focused support, delivered through clear, reliable service contracts. Well-structured agreements create stability for both fleet buyers and providers.

What next-gen fleet service contracts look like

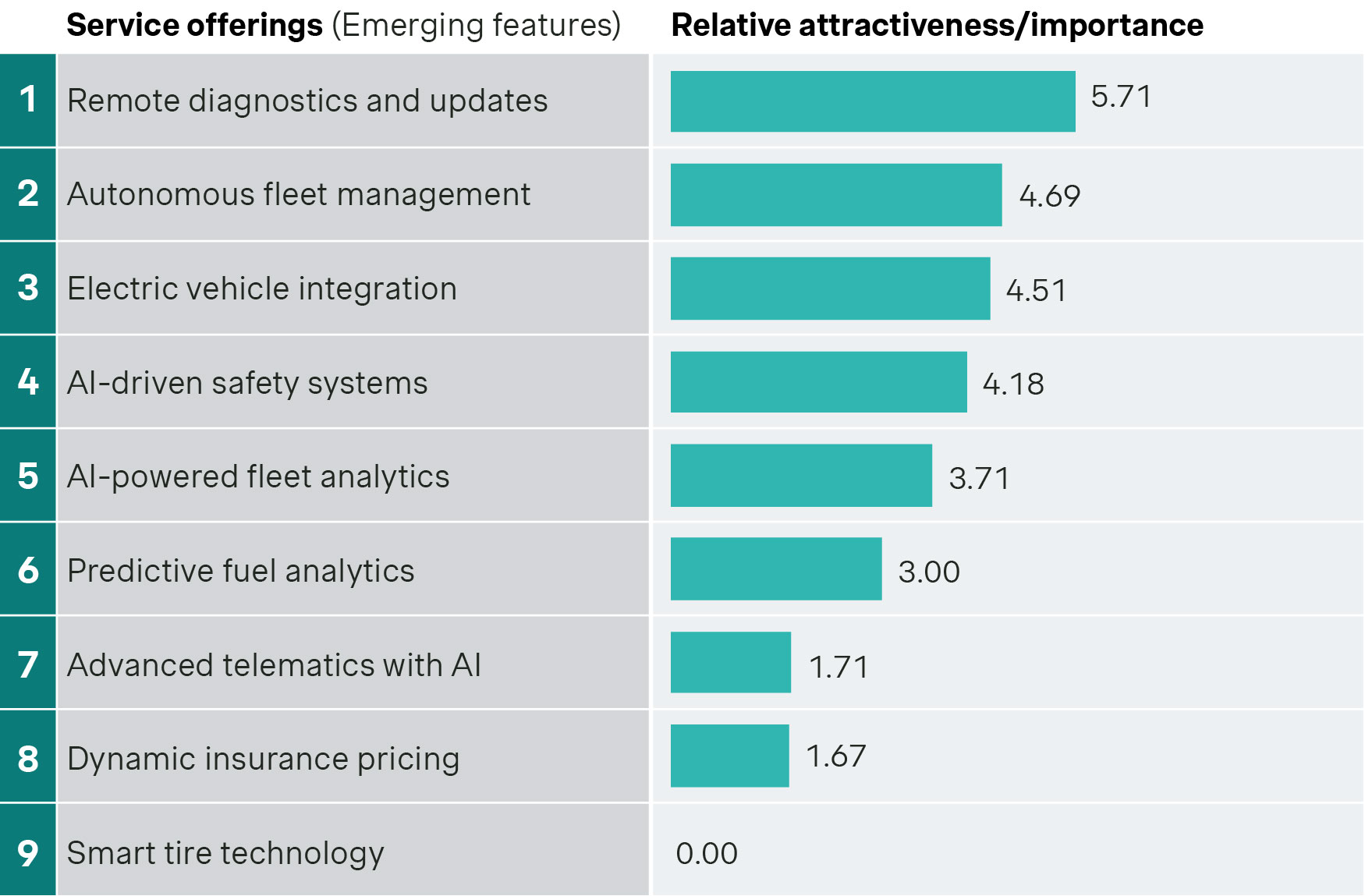

Our Fleet Study 2025 reinforces what forward-thinking providers are already experiencing: emerging technologies are moving to the core of fleet operations. This shift extends well beyond the vehicle itself.

Fleet managers are increasingly focused on smart services and digital add-ons that boost efficiency, performance, and compliance. To stay competitive, service contracts must evolve in lockstep. Basic maintenance is no longer enough. The next generation of agreements must integrate future-ready features that reflect how modern fleets actually operate and where they’re headed.

Relative importance of service offering components

2025 Simon-Kucher Fleet Study (n=170)

Leading providers are evolving their service models to offer greater transparency, flexibility, and performance assurance. Key features include:

Predictive maintenance powered by telematics and AI, identifying issues before they lead to downtime.

Flexible bundles covering maintenance, tires, roadside assistance, EV charging, and even software support.

Subscription-based models that spread costs across predictable monthly payments, appealing to CFOs managing tight budgets.

Tiered service levels aligned to fleet criticality, geography, or industry (e.g., 24/7 uptime support for logistics vs. basic coverage for low-mileage use cases).

Outcome-linked SLAs with uptime guarantees, penalty/reward mechanisms, or repair-time commitments.

A great example comes from Daimler Truck North America (DTNA). In partnership with Uptake, DTNA delivers predictive analytics as a service, using sensor and work-order data to anticipate maintenance needs before issues arise. This data-driven approach enables targeted servicing, minimizes unplanned downtime, and supports lower total cost of ownership for fleet operators.

Why this matters for customer retention and fleet profitability

Fleet operators often treat service as a commodity, switching providers over small price differences. But well-designed service contracts can reverse that trend by delivering:

Stickiness through integration offering one-stop solutions across maintenance, charging, software, and analytics.

Peace of mind via uptime guarantees and predictable costs.

Increased switching costs, especially when bundled with digital tools and personalized support.

For providers, service contracts deliver recurring, inflation-proof revenue, offsetting margin pressure on vehicle sales or lease rates. Moreover, digital service models generate rich customer data, which can inform upselling, segmentation, and pricing optimization.

Three common mistakes that hold back fleet service strategies

Despite the opportunity, many fleet providers underperform in service monetization due to:

Undifferentiated offers: Too many providers still rely on one-size-fits-all contracts that fail to align with customer segments or willingness to pay. This approach ignores differences in fleet size, usage intensity, and risk appetite. As a result, some customers are over-served, leading to margin erosion, while others feel underserved and switch to competitors that offer more tailored solutions.

Weak pricing logic: Bundles often include too much (lowering margins) or too little (reducing perceived value). Without a clear cost-to-serve analysis or customer willingness to pay insights, they undermine fleet profitability and weaken the provider’s credibility as a strategic partner.

Insufficient value communication: Even when premium packages deliver real ROI – through reduced downtime, guaranteed uptime, or predictable TCO – providers often fail to communicate this effectively. In turn, customers may not understand or trust the value of these packages. Instead, they focus on the higher sticker price rather than the savings or the reduced risk. Without clear business-case tools, premium offers struggle to scale.

This leaves providers with a strategic choice: these mistakes hurt margins, weaken long-term customer stickiness, and erode the ability to compete in an electrified, cost-conscious market. The solution lies in smart design and service contract pricing, grounded in customer insights, data analytics, and value-based selling.

Turn service contracts into strategic growth assets with Simon-Kucher

Industry leaders recognize that fleet service contracts are one of the most powerful levers of customer loyalty and recurring profitability today. When designed and priced correctly, they provide cost predictability and create inflation-resistant revenue streams.

It’s imperative to move beyond reactive service to offer smart, proactive, and integrated support that creates value for both sides.

At Simon-Kucher, we support fleet-focused businesses in transforming service contract portfolios from cost centers to commercial growth drivers. Over the past 40 years, we have helped fleet businesses worldwide:

Win with tailored offerings by designing tiered service portfolios based on usage, risk, and customer priorities.

Unlock new revenue models by implementing predictive and subscription-based pricing for maintenance, tires, software, and EV-specific services.

Communicate the value by equipping sales teams with business-case tools and benchmarks to demonstrate the ROI of premium support levels.

Boost retention and growth by designing upsell strategies linked to service contract milestones, vehicle performance, and customer behavior.

Protect margins over time by embedding indexation and inflation protection into long-term agreements.

Through this approach, you can turn service into a differentiator, not just an operational obligation.

Want to build service contracts that lock in loyalty and margin?

Connect with our experts to explore how our value-based approach can help you improve fleet management and design next-generation service offerings that boost retention and profitability.

Next up in the series:

Bundling for value: Partnerships and integrated fleet solutions